What Is A Tax District

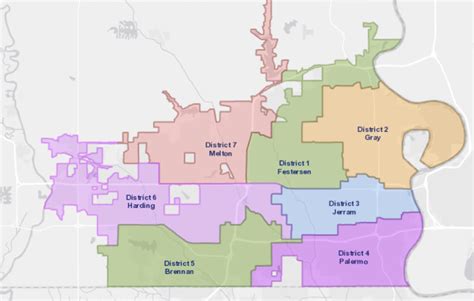

Understanding tax districts is crucial for both individuals and businesses, as they play a significant role in shaping the financial landscape of a region. A tax district, often referred to as a taxing district or a special assessment district, is a legally defined geographic area within which specific taxes are levied to fund various public services and infrastructure projects.

These districts are created to address the unique needs and priorities of a particular community or region, ensuring that the tax burden is allocated fairly and efficiently. By establishing tax districts, governments can allocate resources more effectively, tailor services to specific areas, and promote economic development and community well-being.

The Purpose and Structure of Tax Districts

Tax districts serve as a fundamental tool for local governments to raise revenue for essential services and initiatives. These districts are established through legal processes, often requiring public hearings and approvals by governing bodies such as city councils or county boards.

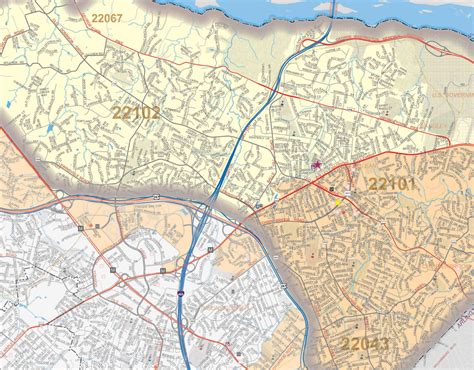

The structure of a tax district is designed to align with the specific needs and characteristics of the area it serves. It can encompass various types of jurisdictions, including cities, towns, villages, or even specific areas within a larger municipality. The boundaries of a tax district are carefully defined to ensure fairness and to avoid overlapping with other taxing entities.

The creation of a tax district typically involves a comprehensive assessment of the community's needs, including infrastructure requirements, public safety needs, and economic development goals. This assessment helps determine the type and level of taxation needed to support these initiatives. Tax districts can be established for a wide range of purposes, such as funding public schools, maintaining roads and utilities, providing fire and police services, or even supporting special projects like parks and cultural centers.

Types of Taxes within Tax Districts

Tax districts can employ various types of taxes to generate revenue. The most common tax levied within these districts is the property tax, which is based on the assessed value of real estate within the district's boundaries. Property taxes are a significant source of funding for local governments and are often used to support public education, maintain infrastructure, and provide essential services.

In addition to property taxes, tax districts may also implement other types of taxes, such as sales taxes, income taxes, or special assessment fees. Sales taxes are applied to the purchase of goods and services within the district, while income taxes are levied on the earnings of individuals or businesses operating within the district's jurisdiction. Special assessment fees, on the other hand, are targeted charges imposed on specific properties or businesses to fund improvements or services that directly benefit those entities.

| Tax Type | Description |

|---|---|

| Property Tax | Based on real estate value, funds public services and infrastructure. |

| Sales Tax | Applied to goods and services purchased within the district. |

| Income Tax | Levied on individual and business earnings. |

| Special Assessment Fees | Charges for specific improvements or services. |

The choice of taxes within a tax district is carefully considered to ensure fairness and to align with the district's goals. Some tax districts may rely primarily on property taxes, while others may utilize a mix of taxes to generate revenue. The specific tax structure is often tailored to the district's unique needs and the prevailing economic conditions.

The Impact of Tax Districts on Communities

Tax districts have a profound impact on the communities they serve, influencing economic development, infrastructure, and the overall quality of life. By allocating tax revenues to specific projects and services, these districts play a pivotal role in shaping the growth and prosperity of a region.

Economic Development and Job Creation

One of the key benefits of tax districts is their ability to stimulate economic growth and create job opportunities. Tax revenues generated within these districts can be directed towards initiatives that attract businesses, foster entrepreneurship, and promote industrial or commercial development. This, in turn, leads to increased employment prospects and a thriving local economy.

For example, a tax district may invest in developing a business park or industrial zone, offering incentives and infrastructure to attract new businesses. These initiatives can create a positive feedback loop, as the influx of businesses generates additional tax revenue, allowing for further investment in economic development and community enhancement.

Infrastructure and Community Enhancements

Tax districts are instrumental in funding and maintaining essential infrastructure and public amenities. Revenues generated within these districts are often allocated to projects such as road construction and maintenance, water and sewage systems, and public transportation networks. These investments ensure that communities have the necessary infrastructure to support growth and development.

Furthermore, tax districts can also support the development of recreational facilities, parks, and cultural centers. By investing in these amenities, tax districts enhance the quality of life for residents and create gathering spaces that foster community engagement and social cohesion. These investments not only benefit the present but also leave a lasting legacy for future generations.

Tailored Services and Community Priorities

A significant advantage of tax districts is their ability to provide tailored services and address the unique needs of a community. Through the allocation of tax revenues, these districts can prioritize specific initiatives that align with the community's vision and goals. This may include funding for specialized education programs, healthcare facilities, or targeted social services.

For instance, a tax district with a high concentration of elderly residents may allocate resources towards improving senior care facilities and programs. Similarly, a district with a growing population of young families may prioritize funding for childcare centers and after-school programs. This tailored approach ensures that tax revenues are directed towards initiatives that have the most significant impact on the community's well-being and development.

Challenges and Considerations in Tax District Management

While tax districts offer numerous benefits, their effective management and administration present several challenges and considerations. Local governments and tax district authorities must navigate complex legal and financial frameworks to ensure fair and efficient tax collection and allocation.

Fairness and Equity in Taxation

Ensuring fairness and equity in taxation is a critical aspect of tax district management. Authorities must establish tax rates and assessment methodologies that are transparent, consistent, and free from bias. This involves careful consideration of property values, income levels, and the ability of taxpayers to bear the tax burden.

To maintain fairness, tax districts often employ professional assessment firms or departments to conduct impartial evaluations of property values. These assessments ensure that tax rates are based on accurate and up-to-date information, preventing disproportionate tax burdens on certain individuals or businesses.

Financial Transparency and Accountability

Financial transparency and accountability are essential for maintaining public trust and ensuring that tax revenues are used efficiently and effectively. Tax district authorities must provide clear and accessible information about tax rates, budgets, and how tax revenues are allocated.

Regular financial audits, public meetings, and transparent reporting mechanisms help foster accountability and trust among taxpayers. By openly communicating the financial health and performance of the tax district, authorities can demonstrate their commitment to responsible fiscal management and community well-being.

Balancing Community Needs and Fiscal Constraints

Tax districts must carefully balance the community's needs and priorities with the constraints of available tax revenues. While it is essential to address community aspirations and provide essential services, tax district authorities must also ensure fiscal sustainability and avoid excessive taxation that could hinder economic growth.

To achieve this balance, tax districts often engage in comprehensive planning processes that involve community input and collaboration. By involving residents, businesses, and stakeholders in decision-making, tax district authorities can identify priorities, allocate resources efficiently, and ensure that tax revenues are directed towards initiatives that have the most significant impact on the community's development and well-being.

Future Implications and Innovations in Tax District Governance

As society and technology evolve, the governance and administration of tax districts are also undergoing transformations to meet emerging challenges and opportunities. Forward-thinking approaches and innovations are shaping the future of tax district management, aiming to enhance efficiency, fairness, and community engagement.

Technological Innovations for Efficient Administration

The integration of technology is revolutionizing the way tax districts operate. Advanced digital platforms and software solutions are streamlining tax assessment, collection, and administration processes. Online portals and mobile applications enable taxpayers to access information, pay taxes, and interact with tax district authorities conveniently and securely.

Additionally, technology facilitates data-driven decision-making, allowing tax district authorities to analyze trends, forecast revenue, and optimize resource allocation. By leveraging data analytics and machine learning, tax districts can identify inefficiencies, improve tax compliance, and enhance the overall efficiency of tax administration.

Community Engagement and Participatory Governance

Tax districts are increasingly recognizing the importance of community engagement and participatory governance. Involving residents and stakeholders in decision-making processes fosters a sense of ownership and ensures that tax revenues are aligned with community priorities.

To facilitate community engagement, tax districts are adopting innovative approaches such as online platforms for public consultations, town hall meetings, and participatory budgeting initiatives. These mechanisms empower residents to voice their opinions, suggest improvements, and actively contribute to the development and allocation of tax revenues. By incorporating community feedback, tax districts can make more informed decisions that reflect the diverse needs and aspirations of the community.

Sustainable and Innovative Revenue Sources

In response to changing economic landscapes and community needs, tax districts are exploring sustainable and innovative revenue sources to fund essential services and infrastructure projects. Beyond traditional property and sales taxes, tax districts are considering alternative revenue streams such as green taxes, tourism taxes, or digital service taxes.

Green taxes, for instance, can be levied on activities that have a negative environmental impact, such as carbon emissions or pollution. These taxes not only generate revenue but also incentivize sustainable practices and support environmental initiatives. Similarly, tourism taxes can be implemented to fund the development and maintenance of tourist attractions, ensuring that the benefits of tourism are shared with the local community.

Collaborative Partnerships for Shared Services

Tax districts are also exploring collaborative partnerships with neighboring jurisdictions to share services and resources, thereby optimizing efficiency and cost-effectiveness. By collaborating on shared services such as emergency response, transportation infrastructure, or waste management, tax districts can reduce duplication of efforts and leverage economies of scale.

These collaborative partnerships not only enhance service delivery but also foster regional cooperation and a sense of shared responsibility. By working together, tax districts can pool resources, expertise, and best practices, ultimately improving the quality and accessibility of services for their residents.

How are tax districts created and established?

+Tax districts are typically created through a legal process that involves public hearings and approvals by governing bodies such as city councils or county boards. The process may vary depending on the jurisdiction, but it generally requires a proposal, public notice, and a vote or approval by the relevant governing body.

What are the key considerations when determining tax rates within a tax district?

+When setting tax rates, tax district authorities consider factors such as property values, income levels, and the ability of taxpayers to bear the tax burden. They aim to establish fair and equitable tax rates that generate sufficient revenue to fund the district’s initiatives while avoiding excessive taxation that could hinder economic growth.

How do tax districts contribute to economic development and job creation?

+Tax districts play a vital role in economic development by allocating tax revenues to initiatives that attract businesses, foster entrepreneurship, and promote industrial or commercial growth. This can lead to increased employment opportunities and a thriving local economy.

What are some challenges faced by tax district authorities in managing tax revenues and community needs?

+Tax district authorities must balance community needs with fiscal constraints. They need to ensure fair taxation, maintain financial transparency, and prioritize initiatives that have the most significant impact on community well-being while avoiding excessive taxation that could hinder economic growth.

How can tax districts adapt to changing economic landscapes and community needs?

+Tax districts are exploring innovative approaches such as sustainable revenue sources, community engagement, and collaborative partnerships. By embracing technology, participatory governance, and alternative funding models, tax districts can remain resilient and responsive to the evolving needs of their communities.