Maximize Your Savings with a Property Tax Refund Strategy

Developing an effective property tax refund strategy can significantly enhance your overall financial management, particularly when navigating the complexities of local taxation systems. For property owners eager to optimize refunds, understanding the intricacies of tax assessments, exemptions, appeals, and strategic planning is essential. This guide provides a step-by-step approach rooted in expert analysis and practical application, equipping you with the knowledge needed to maximize your property tax refunds systematically.

Understanding Property Taxation: The Foundation of Refund Optimization

Property taxes are fundamental to municipal revenue streams, funding local services such as schools, infrastructure, and public safety. However, many property owners overpay due to misassessed values or missed exemptions. Recognizing the valuation process—the method by which taxing authorities determine your property’s worth—is crucial. Typically, assessments are carried out via mass appraisal techniques, which can sometimes result in inaccuracies owing to outdated data or clerical errors. These inaccuracies often serve as the foundation for successful refund claims. Consequently, a sophisticated understanding of assessment methodology, along with thorough documentation, is vital for formulating an effective refund strategy.

Step 1: Conduct a Precise Property Valuation Review

Start by obtaining a detailed copy of your property’s assessment report from the local assessor’s office. Review this report meticulously for discrepancies in size, condition, or classified use that could inflate your valuation unnecessarily. Employ independent appraisals or comparative market analyses (CMA) from licensed appraisers to benchmark assessed values against current market conditions. The discrepancy between assessed and actual market value often forms the basis for appeal or rebate requests, especially when assessments are up to 15-20% higher than market prices.

| Key Metric | Typical Assessment Discrepancy |

|---|---|

| Assessment accuracy | Up to 20% overestimated in some cases |

| Appeal success rate | Approximately 50-60% for well-documented appeals |

Leveraging Tax Exemptions and Deductions

An oft-overlooked element in maximizing property tax refunds is the exploitation of available exemptions, credits, and deductions. Local jurisdictions typically provide allowances for senior citizens, veterans, primary residence exemptions, disability status, or conservation easements. These concessions can lower your taxable property value or directly reduce your tax bill, sometimes by thousands annually. A comprehensive review of eligibility criteria, combined with thorough application submission, can result in meaningful savings.

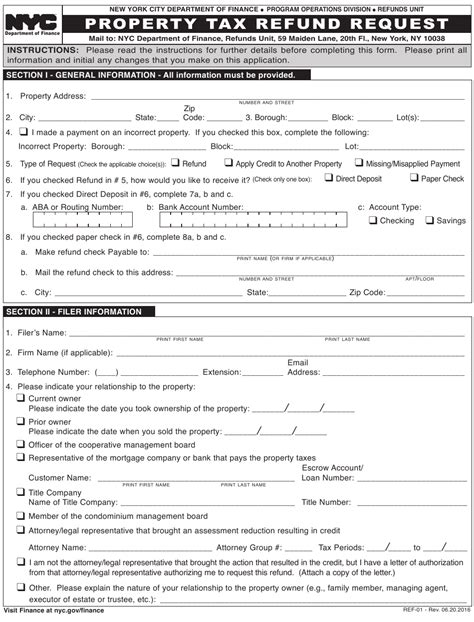

Step 2: Identify and Apply Relevant Tax Reliefs

Begin by examining local tax codes, which are frequently updated and may include new relief programs. Engage with a tax professional or legal advisor specializing in local property laws to interpret these codes. Document eligibility with supporting evidence such as age, veteran status, or conservation documentation. Submit applications within the stipulated deadlines—failure to do so forfeits potential refunds or credits—and confirm receipt and processing status regularly.

| Tax Relief Category | Average Annual Benefit |

|---|---|

| Senior exemptions | Up to 10% reduction in assessed value |

| Veterans’ benefits | Varies by jurisdiction, up to 100% exemption in some cases |

| Primary residence exemption | Excludes a portion of property value from taxation |

Appealing Unfavorable Assessments or Tax Bills

When discrepancies or overlooked exemptions are identified, pursuing an appeal becomes a pivotal component of your refund strategy. The appeal process involves submitting documented evidence, such as independent appraisals, market data, and exemption eligibility, to the local assessors or tax tribunal. Successful appeals typically rely on strategic legal or appraisal expertise, making the choice of advocates a key factor.

Step 3: Prepare a Robust Appeal Case

Gather comprehensive supporting data, including recent sales of comparable properties, independent appraisals, and records of prior assessments. Focus your appeal on quantifiable errors—overvaluation, misclassification, or missed exemptions. When a formal hearing is scheduled, present your case concisely, focusing on factual inaccuracies supported by solid evidence. Consider alternative dispute resolution methods like mediation if available, which can often expedite refunds without protracted litigation.

| Success Rate Factors | Estimated Outcome |

|---|---|

| Quality of evidence | Higher quality increases success likelihood |

| Market conditions | Declining markets often strengthen appeal position |

| Legal expertise | Specialized representation improves odds |

Implementing a Proactive Refund Strategy

Long-term property tax savings are optimized through proactive and recurring review cycles. Establish a schedule for evaluating assessment reports annually or bi-annually, especially after significant market shifts or property improvements. Automate reminders for filing deadlines and regularly survey available exemptions. Keep meticulous records of all correspondence, submissions, and supporting documentation to streamline future appeals and claims.

Step 4: Build a Data-Driven Tax Management System

Utilize property management software or bespoke spreadsheets to track valuation assessments, exemption applications, appeal statuses, and refund amounts. Integrate local market data feeds and assessors’ updates to stay current. Engage with local tax authorities via forums or community groups to understand emerging relief programs or changes in assessment procedures.

| Key Tool | Benefit |

|---|---|

| Property management software | Streamlines data organization and alerts |

| Regular market analysis | Informs timely appeals and exemption applications |

| Legal or tax advisor consultations | Enhances claim quality and success rates |

Maximizing Returns with Strategic Investment in Property Improvements

While reducing assessed value through appeal and exemptions is fundamental, investments in property enhancements can itself be part of a refund strategy. Capital improvements may qualify for additional exemptions or reductions if they significantly increase property value or qualify under conservation or historic designation programs. However, it’s critical to balance the cost of improvements against potential tax benefits, ensuring the return on investment aligns with your refund objectives.

Step 5: Evaluate Cost-Benefit of Capital Improvements

Analyze the potential impact of planned improvements through cost estimates and projected assessment increases. If improvements qualify for special exemptions or accelerated depreciation, incorporate these benefits into your financial planning. Engage professional appraisers to anticipate the post-improvement valuation, helping you decide whether the increase justifies the investment—and if it might trigger higher tax assessments, counteracting your refund gains.

| Investment Metric | Expected Impact |

|---|---|

| Home upgrades | Potential increase in assessed value, offset by exemptions |

| Historic or conservation projects | Eligibility for special relief programs |

Harnessing Data and Technology for Continuous Optimization

Modern property tax management leverages data analytics, AI tools, and cloud-based platforms to anticipate assessment trends, automate documentation, and streamline appeals. Utilizing decline-in-value reports, market forecast models, and GIS mapping can help anticipate assessment shifts, prepare appeals preemptively, and identify new exemption opportunities.

Step 6: Integrate Modern Tech Tools

Select platforms with capabilities like predictive analytics, document automation, and real-time alerts. These tools enable you to act swiftly in response to market or assessment changes. Regular training or consultations with data science experts can maximize the potential of these systems, ensuring your refund strategy remains current and effective.

| Technology | Benefit |

|---|---|

| Predictive analytics | Forecasts assessment shifts |

| Document automation | Simplifies filings and appeals |

| GIS mapping | Visualizes property and assessment data spatially |

Key Points

- Thorough review of assessment data and market conditions lays the foundation for effective refunds.

- Exploiting exemptions and relief programs can lead to substantial reductions or refunds.

- Robust appeal processes backed by expert testimony amplify success probabilities.

- Proactive, systematized management ensures ongoing optimization over time.

- Leveraging technology transforms property tax management into a strategic, dynamic discipline.

What is the most effective way to identify property assessment errors?

+Start by reviewing your assessment report thoroughly, compare assessed values with recent market sales, and consider hiring an independent appraiser. Discrepancies such as overvaluation, incorrect property classification, or outdated information are prime targets for appeal.

How often should I review my property’s tax assessments and exemptions?

+Ideally, conduct a review annually or after significant market shifts or property improvements. Regular reviews help catch errors early and adapt to changing tax relief opportunities.

What resources are available for complex property tax appeals?

+Consult local tax professionals, legal experts specializing in property law, or utilize specialized software and data analytics tools. Many jurisdictions also offer free appeal guidance or mediation services.