Broward County Property Tax Payment

Property taxes are an essential component of local government revenue, playing a crucial role in funding essential public services and infrastructure development. In Broward County, Florida, property owners are required to pay these taxes annually, contributing to the county's overall financial stability and growth. This article aims to provide a comprehensive guide to understanding and navigating the process of Broward County Property Tax Payment, offering valuable insights for both seasoned homeowners and new property owners alike.

Understanding Broward County Property Taxes

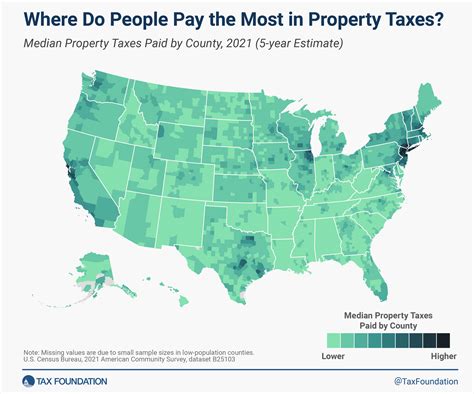

Broward County, known for its vibrant communities and thriving economy, relies on property taxes to support its diverse range of services and initiatives. These taxes are calculated based on the assessed value of properties, which is determined by the Broward County Property Appraiser’s Office. The appraiser’s office assesses the value of all real property within the county annually, considering factors such as location, size, improvements, and market trends.

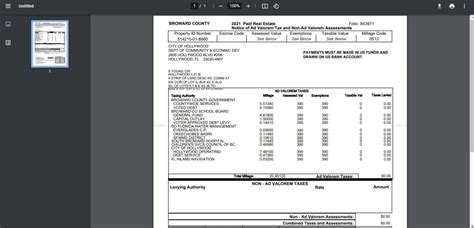

The property tax rate in Broward County is set by various taxing authorities, including the county itself, municipalities, school districts, and special districts. These rates are expressed as millage rates, where one mill represents $1 of tax for every $1,000 of the property's assessed value. The total millage rate is the sum of the rates set by all the taxing authorities, and it is this rate that determines the property tax liability for each individual property owner.

Property owners in Broward County receive a Truth in Millage (TRIM) notice annually, which provides detailed information about their property's assessed value, the millage rates, and the estimated taxes due. This notice is typically mailed out in late August or early September, offering property owners a chance to review and understand their tax liability before the payment deadline.

The Payment Process

Broward County offers a convenient and user-friendly system for property tax payment, providing multiple options to accommodate different preferences and needs.

Online Payment

The Broward County Property Appraiser’s Office provides an online payment portal, accessible through their official website. This portal allows property owners to make secure payments using major credit cards or electronic checks. Online payment offers the advantage of immediate confirmation and receipt, ensuring a quick and efficient transaction. Additionally, the portal provides a detailed payment history, allowing property owners to keep track of their tax payments easily.

In-Person Payment

For those who prefer a more traditional approach, in-person payment is an option. The Broward County Tax Collector’s Office has multiple branch locations throughout the county, where property owners can pay their taxes in person. Acceptable forms of payment include cash, check, money order, and credit card (subject to a convenience fee). Payment can be made during regular business hours, and receipts are provided on-site.

Mail-In Payment

Property owners who wish to pay by mail can do so by sending a check or money order, along with the payment coupon from their TRIM notice, to the Broward County Tax Collector’s Office. It is important to ensure that the payment is received before the deadline to avoid late fees and penalties. When mailing in a payment, it is advisable to use a trackable service to ensure its timely arrival.

Electronic Funds Transfer (EFT)

For those who prefer an automated payment method, Broward County offers the option of Electronic Funds Transfer. Property owners can set up an EFT arrangement, authorizing the county to withdraw the tax amount directly from their bank account on the due date. This method ensures timely payment and eliminates the need for manual checks or visits to the tax collector’s office.

Payment Deadlines and Penalties

Timely payment of property taxes is crucial to avoid late fees and penalties. In Broward County, the payment deadline is typically November 1st of each year. However, it is essential to note that this deadline may vary slightly depending on the specific taxing authority and the property’s location within the county.

If the property tax payment is not received by the deadline, a 3% late fee is applied, calculated based on the total tax amount due. Additionally, interest accrues on the unpaid tax balance at a rate of 1.5% per month (or fraction thereof) from the payment due date until the balance is paid in full. It is important to note that these penalties can quickly add up, so prompt payment is advisable to avoid unnecessary financial burdens.

Payment Discounts and Exemptions

Broward County offers various discounts and exemptions to certain property owners, helping to reduce their tax liability. These include:

- Early Payment Discount: Property owners who pay their taxes before the official due date may be eligible for an early payment discount. This discount typically ranges from 1% to 3% of the total tax amount, depending on the timing of the payment. It is a great incentive for property owners to pay their taxes promptly and save on their overall liability.

- Homestead Exemption: Florida offers a homestead exemption to property owners who use their property as their primary residence. This exemption reduces the assessed value of the property, resulting in lower property taxes. To qualify, the property must be the owner's permanent residence, and the application must be filed with the Property Appraiser's Office by March 1st of the tax year.

- Senior Exemption: Broward County provides an additional exemption for senior citizens aged 65 and above. This exemption reduces the assessed value of the property by up to $50,000, resulting in lower property taxes. To qualify, seniors must meet certain income and residency requirements and file an application with the Property Appraiser's Office.

- Military Exemption: Active-duty military personnel and their spouses are eligible for a partial exemption from property taxes. This exemption is applicable to their primary residence and can significantly reduce their tax liability. The application for this exemption must be filed with the Property Appraiser's Office.

Challenging Property Assessments

Property owners who believe that their property’s assessed value is inaccurate or unfair have the right to challenge the assessment. The first step is to contact the Broward County Property Appraiser’s Office to discuss the issue and request a review. If the issue cannot be resolved informally, property owners can file a formal petition with the Value Adjustment Board (VAB). The VAB is an independent board that hears and decides on property tax disputes, providing a fair and impartial process for property owners to seek relief.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure projects within Broward County. These taxes support vital areas such as:

- Education: A significant portion of property taxes goes towards funding public schools, ensuring that students receive a quality education and that school facilities are well-maintained.

- Public Safety: Property taxes contribute to funding law enforcement, fire protection, and emergency response services, keeping our communities safe and secure.

- Road Maintenance: Property taxes help maintain and improve the county's road network, ensuring smooth and efficient transportation for residents and visitors alike.

- Recreational Facilities: Property taxes support the development and upkeep of parks, sports fields, and recreational centers, promoting a healthy and active lifestyle for residents.

- Social Services: These taxes also fund crucial social services, including healthcare, senior services, and support for individuals with disabilities, ensuring a strong and compassionate community.

By paying their property taxes, residents of Broward County contribute to the overall well-being and prosperity of their community. These taxes are a vital investment in the future of the county, ensuring that essential services are maintained and improved for the benefit of all residents.

Conclusion

Understanding and managing Broward County property taxes is an essential part of responsible homeownership. By being aware of the assessment process, payment options, deadlines, and available discounts and exemptions, property owners can navigate the property tax system with confidence. The revenue generated from these taxes is a vital investment in the community, supporting essential services and infrastructure that enhance the quality of life for all residents.

What happens if I miss the property tax payment deadline in Broward County?

+If you miss the property tax payment deadline, a 3% late fee is applied to the total tax amount. Additionally, interest accrues on the unpaid balance at a rate of 1.5% per month. It is important to pay your taxes promptly to avoid these additional costs.

Can I pay my property taxes in installments in Broward County?

+Unfortunately, Broward County does not offer an official installment payment plan for property taxes. However, property owners can explore alternative options, such as refinancing their mortgage or seeking assistance from financial institutions to manage their tax payments.

How can I check the status of my property tax payment in Broward County?

+You can check the status of your property tax payment by visiting the Broward County Tax Collector’s Office website and accessing the online payment portal. Here, you can view your payment history, including any pending or processed payments.

Are there any discounts available for early payment of property taxes in Broward County?

+Yes, Broward County offers an early payment discount to property owners who pay their taxes before the official due date. The discount typically ranges from 1% to 3% of the total tax amount, depending on the timing of the payment. It is a great incentive to pay your taxes promptly and save on your overall liability.

Can I appeal my property’s assessed value in Broward County?

+Yes, property owners have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The first step is to contact the Broward County Property Appraiser’s Office to discuss the issue and request a review. If the issue cannot be resolved informally, a formal petition can be filed with the Value Adjustment Board (VAB) for a fair and impartial decision.