Mn State Tax Refund Dates

For Minnesota residents, understanding the state tax refund process and the associated dates is crucial for financial planning and managing expectations. The Minnesota Department of Revenue plays a key role in this process, providing clear guidelines and timelines to taxpayers. This article aims to provide an in-depth analysis of the Minnesota state tax refund process, including important dates, procedures, and strategies to ensure a smooth and timely refund.

Understanding the Minnesota State Tax Refund Process

The state tax refund process in Minnesota involves several stages, each with its own timeline and requirements. The Department of Revenue offers a range of resources to assist taxpayers, from online tools for estimating refunds to detailed instructions for filing and payment.

One of the most critical aspects of the process is the deadline for filing tax returns, which is typically set at a specific date in April each year. This deadline is non-negotiable and applies to all individual taxpayers, including those who are expecting a refund.

For the 2023 tax year, the deadline for filing was April 18th, 2024. This date is important as it marks the last day individuals can file their state tax returns without incurring late fees or penalties. However, it's worth noting that the deadline can vary slightly from year to year, often influenced by federal tax deadlines and public holidays.

Key Stages of the Minnesota State Tax Refund Process

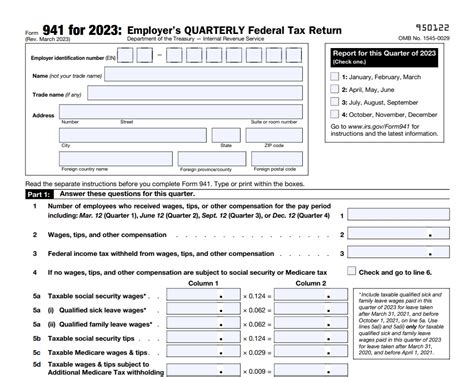

- Filing Tax Returns: Taxpayers must complete and submit their state tax returns by the deadline, typically in April. This process can be done electronically or through traditional mail methods. It's important to ensure all relevant information is included to avoid delays or errors.

- Processing of Returns: Once the Department of Revenue receives the tax returns, they initiate the processing stage. This involves a thorough review of the submitted information, including income details, deductions, and credits claimed. The processing time can vary based on the complexity of the return and the volume of submissions.

- Issuing Refunds: After successful processing, the Department of Revenue issues refunds to taxpayers who are eligible. The refund amount is calculated based on the taxpayer's income, deductions, and the applicable state tax rate. The refund can be issued via direct deposit or mailed as a check.

- Resolving Issues and Errors: In some cases, the Department of Revenue may identify errors or inconsistencies in the tax returns, which can delay the refund process. In such situations, taxpayers are contacted to resolve the issues. It's crucial to respond promptly to any such communications to avoid further delays.

Throughout the process, the Department of Revenue provides updates and notifications to taxpayers, keeping them informed about the status of their refund. These updates can be received via email, text messages, or through the taxpayer's online account.

| Tax Year | Filing Deadline | Expected Refund Issuance |

|---|---|---|

| 2023 | April 18, 2024 | Within 45 days of filing |

| 2022 | April 18, 2023 | Varies based on filing method |

| 2021 | April 15, 2022 | Within 60 days of filing |

Strategies for a Smooth State Tax Refund Process

To ensure a seamless experience during the state tax refund process, taxpayers can adopt several strategies. These include careful preparation of tax returns, timely filing, and staying informed about the latest tax regulations and deadlines.

Preparing Tax Returns Accurately

Accuracy is key when preparing tax returns. Taxpayers should gather all necessary documents, including W-2 forms, 1099 forms, and any relevant deductions or credits. Utilizing tax preparation software or seeking professional assistance can help ensure a precise and complete tax return.

Filing Early and Electronically

Filing tax returns early not only helps avoid last-minute rush but also ensures that the Department of Revenue can process the returns more efficiently. Electronic filing, which can be done through the Department's website or authorized e-file providers, offers a faster and more secure method compared to traditional mail.

Understanding Tax Credits and Deductions

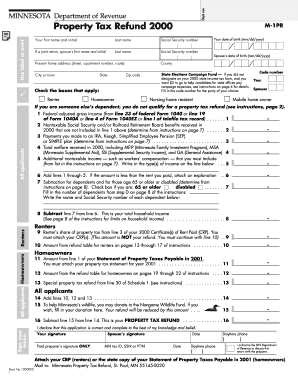

Minnesota offers various tax credits and deductions that can reduce the state tax liability. Taxpayers should familiarize themselves with these incentives, such as the Minnesota Working Family Credit, the Property Tax Refund, and education-related deductions. Understanding and claiming these credits can significantly impact the refund amount.

Staying Informed and Up-to-Date

The tax landscape can change frequently, with new regulations, laws, and deadlines introduced each year. Taxpayers should stay informed about these changes, especially those that may affect their tax liability or refund. The Department of Revenue's website is an excellent resource for the latest updates and announcements.

Minnesota Department of Revenue: Resources and Support

The Minnesota Department of Revenue offers a wealth of resources to assist taxpayers throughout the state tax refund process. These include:

- Online Tax Estimator: A tool to help taxpayers estimate their state tax refund or liability based on their income and deductions.

- Tax Preparation Assistance: Guidance and resources for preparing tax returns, including instructions, forms, and publications.

- E-File Options: Information on electronic filing, including authorized e-file providers and requirements.

- Refund Status Tracker: A service to check the status of a state tax refund online, providing real-time updates.

- Contact Information: Details on how to reach the Department of Revenue for assistance, including phone numbers, email addresses, and physical addresses.

For taxpayers facing complex tax situations or requiring specialized assistance, the Department of Revenue provides additional support, such as dedicated phone lines for specific issues and in-person help centers in various locations across the state.

FAQs

When can I expect my Minnesota state tax refund for the 2023 tax year?

+

For the 2023 tax year, Minnesota taxpayers can expect their state tax refund within 45 days of filing. However, this timeline can vary based on the method of filing and any issues or errors identified during the processing stage.

What happens if I miss the state tax filing deadline?

+

If you miss the state tax filing deadline, you may be subject to late filing penalties and interest charges. It’s advisable to file as soon as possible to minimize these additional fees and to avoid further complications with your state tax obligations.

How can I check the status of my Minnesota state tax refund?

+

You can check the status of your Minnesota state tax refund by using the online Refund Status Tracker available on the Department of Revenue’s website. This tool provides real-time updates on the processing and issuance of your refund.

Are there any special tax credits or deductions available in Minnesota?

+

Yes, Minnesota offers several tax credits and deductions that can reduce your state tax liability. These include the Minnesota Working Family Credit, the Property Tax Refund, and deductions for education-related expenses. It’s important to understand and claim these incentives to maximize your refund.

Where can I find more information and support for my state tax refund process in Minnesota?

+

The Minnesota Department of Revenue provides a range of resources and support options. You can visit their website for detailed information, tax forms, and publications. Additionally, you can contact their dedicated helplines or visit their in-person help centers for personalized assistance.