California Sales Tax Rate 2025

The sales tax system in California is a crucial component of the state's revenue generation, with a significant impact on both businesses and consumers. As we look ahead to 2025, understanding the projected sales tax rates and their implications becomes essential for financial planning and business strategy. This article aims to provide an in-depth analysis of the California sales tax rate for 2025, exploring its historical context, current trends, and potential future developments.

Historical Perspective: California Sales Tax Evolution

California’s sales tax system has undergone several transformations since its inception. The state first implemented a general sales and use tax in 1933, with a rate of 2.5%. Over the years, this rate has fluctuated, influenced by various economic factors and legislative decisions. A notable increase occurred in 2009, when the state raised the sales tax rate to 7.25% to bolster its revenue during the Great Recession. Since then, the rate has remained relatively stable, providing a foundation for the upcoming 2025 projection.

The Current Sales Tax Landscape in California

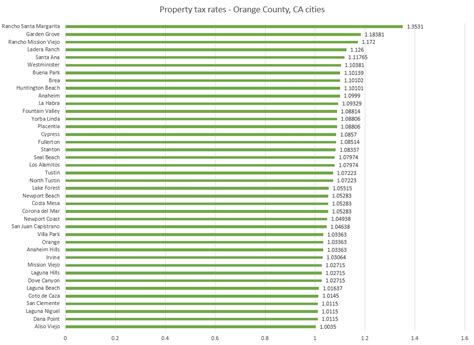

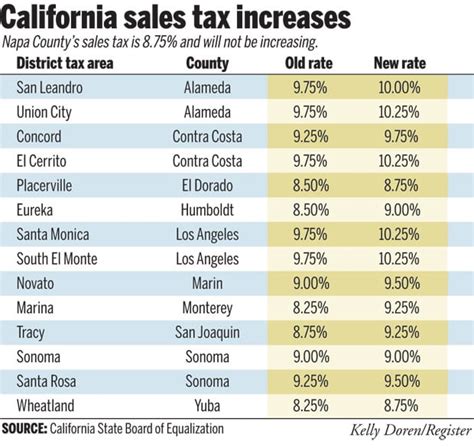

As of my last update in January 2023, California’s state-wide sales and use tax rate stands at 7.25%. However, it’s important to note that California allows local jurisdictions, including counties and cities, to levy additional sales taxes. These local add-on taxes can vary significantly, leading to a wide range of sales tax rates across the state.

For instance, in San Francisco, the total sales tax rate is 8.50%, comprising the state base rate of 7.25% and a local add-on tax of 1.25%. On the other hand, Los Angeles County has a total sales tax rate of 9.50%, with a local add-on tax of 2.25% on top of the state rate. These variations in local taxes contribute to a complex sales tax landscape, making it essential for businesses and consumers to be aware of the specific rates in their areas.

Projecting California Sales Tax Rates for 2025

When considering the sales tax rates for 2025, it’s important to analyze both historical trends and current economic conditions. While the state-wide sales tax rate has remained relatively stable, local jurisdictions have shown a propensity for adjusting their add-on taxes to meet budgetary needs or address specific community concerns.

Based on the historical data and the current economic climate, it is reasonable to project that the state-wide sales tax rate will remain at 7.25% in 2025. This stability is supported by the state's commitment to maintaining a competitive business environment and its focus on long-term economic growth. However, it's crucial to acknowledge that local add-on taxes could undergo changes, impacting the total sales tax rates in specific regions.

Potential Scenarios for Local Add-On Taxes

Local governments in California often consider sales tax adjustments to fund infrastructure projects, support public services, or address budgetary shortfalls. Here are a few potential scenarios for local add-on taxes in 2025:

- Stable Rates: Some cities and counties may opt to maintain their current local add-on tax rates, especially if they have recently made adjustments or if their financial needs are met by existing tax structures.

- Incremental Increases: Certain jurisdictions might consider small, incremental increases in their local add-on taxes. These adjustments could be used to fund specific initiatives or address long-term financial planning goals.

- Significant Changes: In areas where significant infrastructure projects or major budgetary concerns are present, local governments may propose more substantial changes to their sales tax rates. These changes could impact the total sales tax rate significantly, particularly in regions where the state-wide rate remains stable.

It's important to note that local tax decisions are influenced by a range of factors, including community input, economic development goals, and the need to maintain a competitive business environment. As such, the potential scenarios outlined above are just projections, and actual decisions will depend on the unique circumstances of each local jurisdiction.

Impact on Businesses and Consumers

The sales tax rate has a direct impact on both businesses and consumers in California. For businesses, particularly those engaged in e-commerce or with a physical presence in multiple locations, managing varying sales tax rates can be complex. They must ensure compliance with local regulations and accurately calculate and remit taxes, which can affect their operational costs and pricing strategies.

For consumers, the sales tax rate influences their purchasing decisions and overall cost of living. Higher sales taxes can impact the affordability of goods and services, particularly for lower-income households. Additionally, the variability in sales tax rates across the state can create complexities for consumers when making purchases, especially when comparing prices between different regions.

Strategies for Businesses and Consumers

In the face of potential sales tax changes, businesses and consumers can employ various strategies to navigate the complexities.

- Businesses:

- Tax Compliance Software: Utilizing advanced tax compliance software can help businesses automate the calculation and remittance of sales taxes, ensuring accuracy and compliance with local regulations.

- Price Adjustments: Businesses may need to adjust their pricing strategies to account for changes in sales tax rates, especially if they operate in multiple jurisdictions with varying tax structures.

- Local Engagement: Staying informed about local tax initiatives and engaging with community leaders can provide businesses with insights into potential tax changes, allowing them to plan and adapt accordingly.

- Consumers:

- Price Comparison: When making significant purchases, consumers should consider the total cost, including sales tax, and compare prices across different regions to make informed decisions.

- Budget Planning: Understanding the impact of sales taxes on their cost of living can help consumers plan their budgets effectively, especially when considering large purchases or long-term financial goals.

- Community Involvement: Engaging with local government and expressing opinions on tax initiatives can influence the decision-making process, ensuring that consumer needs and interests are considered.

Conclusion: Navigating California’s Sales Tax Landscape

California’s sales tax system is a dynamic component of the state’s economy, with a complex interplay of state and local tax rates. As we look ahead to 2025, businesses and consumers should anticipate a stable state-wide sales tax rate but remain vigilant about potential changes in local add-on taxes. By staying informed and employing strategic approaches, they can effectively navigate the sales tax landscape, ensuring compliance and making informed financial decisions.

FAQ

How often does California update its sales tax rates?

+California typically adjusts its sales tax rates through legislative actions. While the state-wide rate has remained stable for several years, local jurisdictions can propose changes more frequently to address their budgetary needs. These local adjustments can occur annually or at irregular intervals, depending on the specific circumstances of each jurisdiction.

Are there any industries or goods exempt from sales tax in California?

+Yes, California offers exemptions for certain industries and goods. These exemptions can vary and are often based on specific criteria such as the type of business, the nature of the goods or services provided, or the intended use of the purchase. It’s important for businesses and consumers to stay informed about these exemptions to ensure compliance and take advantage of any applicable tax savings.

How do sales tax rates impact online businesses in California?

+Online businesses in California face unique challenges when it comes to sales tax. They must navigate the complexities of different tax rates across the state, especially if they have a physical presence in multiple locations or ship products to various regions. Additionally, online businesses must comply with the state’s marketplace facilitator laws, which require them to collect and remit sales tax on behalf of certain third-party sellers. These factors can significantly impact the operational costs and pricing strategies of online businesses.