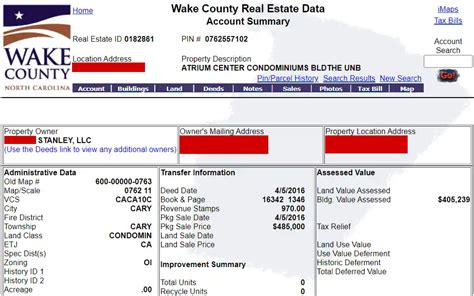

Wake Property Tax

Welcome to this in-depth exploration of the Wake Property Tax, a topic of significant interest for residents and investors alike in the vibrant county of Wake, North Carolina. This article aims to provide a comprehensive understanding of this tax, its implications, and its role in the local economy. With a focus on clarity and detail, we will delve into the specifics, shedding light on the intricate workings of property taxation in this region.

Understanding the Wake Property Tax Landscape

The Wake Property Tax, a fundamental component of the county’s revenue stream, plays a pivotal role in funding essential services and development initiatives. This tax is levied on real estate properties, including residential homes, commercial establishments, and land, with rates varying based on several key factors.

The assessment process for Wake Property Tax is meticulous, involving the evaluation of property values by the Wake County Tax Assessor's Office. This office employs a combination of market analysis, property inspections, and historical data to determine the fair market value of each property. The assessed value then forms the basis for calculating the tax liability.

The tax rate for Wake County is determined annually by the Board of Commissioners, taking into consideration the budget requirements for various county services such as schools, emergency services, and infrastructure development. The rate is expressed as a percentage of the assessed property value, with different rates applicable to residential and non-residential properties.

To illustrate, consider the following example: for the 2023 fiscal year, the Wake County Board of Commissioners approved a tax rate of 59.4 cents per $100 of assessed value for residential properties and 72.3 cents per $100 for non-residential properties. This means that a residential property with an assessed value of $200,000 would be subject to a tax liability of $1,188 ($200,000 x 0.594), while a non-residential property of the same value would incur a tax of $1,446 ($200,000 x 0.723). These rates are subject to change annually, so it's essential for property owners to stay informed about the current tax landscape.

Factors Influencing Wake Property Tax

Several factors contribute to the complexity of the Wake Property Tax system. These include:

- Property Type: As mentioned, residential and non-residential properties are subject to different tax rates, with the latter typically bearing a higher burden due to the services and amenities they utilize.

- Property Value: The higher the assessed value of a property, the greater the tax liability. This is a straightforward principle, ensuring that those with more valuable assets contribute proportionately more to the county's revenue.

- Location: The location of a property within Wake County can impact its tax assessment. Properties in areas with higher development costs or greater access to amenities may face slightly higher tax rates to reflect the additional services and infrastructure required.

- Special Assessments: In some cases, properties may be subject to special assessments for specific improvements or services. These assessments are typically levied to fund projects like road improvements, utility extensions, or environmental initiatives, and are in addition to the standard property tax.

It's worth noting that Wake County offers various exemptions and deductions to alleviate the tax burden for certain property owners. These include exemptions for senior citizens, veterans, and homeowners with disabilities, as well as deductions for energy-efficient improvements and historical properties. These incentives aim to promote sustainability, historic preservation, and affordability in the county.

| Property Type | Tax Rate per $100 Assessed Value |

|---|---|

| Residential | 0.594 |

| Non-Residential | 0.723 |

The Impact of Wake Property Tax on the Local Economy

The Wake Property Tax is a vital component of the county’s economic ecosystem, providing the financial backbone for a wide range of public services and infrastructure projects. This tax revenue not only sustains the day-to-day operations of essential services but also drives long-term development initiatives, shaping the future of the community.

A significant portion of the property tax revenue is allocated to the Wake County Public School System, ensuring that local schools receive the funding necessary for educational programs, teacher salaries, and facility maintenance. This investment in education fosters a skilled workforce, contributing to the county's economic growth and attracting businesses.

Furthermore, the tax revenue funds critical infrastructure projects, such as road improvements, bridge repairs, and the expansion of public transportation networks. These initiatives not only enhance the quality of life for residents but also improve access to employment opportunities and commercial hubs, further stimulating economic activity.

In addition to these core services, the property tax also supports public safety initiatives, including police, fire, and emergency medical services. A robust public safety system not only protects residents and businesses but also enhances the overall appeal of the county, attracting new businesses and residents.

The impact of the Wake Property Tax extends beyond the immediate services it funds. It plays a pivotal role in shaping the county's economic trajectory by influencing property values, development patterns, and investment decisions. A well-managed property tax system can encourage sustainable growth, promote economic diversity, and ensure a high quality of life for residents.

Economic Development and Property Tax

The relationship between economic development and property tax is intricate. On one hand, a thriving economy can drive up property values, leading to increased tax revenue. This, in turn, can fund further economic development initiatives, creating a positive feedback loop. However, it’s crucial to strike a balance, as excessively high property taxes can deter investment and hinder economic growth.

To navigate this delicate balance, Wake County employs a strategic approach to property taxation. The tax rates are carefully calibrated to generate sufficient revenue for essential services without placing an undue burden on property owners. This approach ensures that the county remains an attractive destination for businesses and residents, fostering a healthy and sustainable economy.

Moreover, the county actively promotes economic diversity by incentivizing the development of different sectors. For instance, it offers tax abatements and other incentives to attract and retain businesses in key industries such as technology, healthcare, and sustainable energy. These initiatives not only boost the county's economic resilience but also create a more dynamic and innovative business environment.

Case Study: The Impact of Property Tax on Wake County’s Economy

To illustrate the tangible impact of the Wake Property Tax on the local economy, let’s consider a hypothetical scenario. Imagine a thriving commercial district in Wake County, with a mix of office spaces, retail outlets, and entertainment venues. The property tax revenue generated from this district funds a range of initiatives that directly benefit the businesses and residents.

For instance, the tax revenue could be used to improve public transportation links to the district, making it more accessible for employees and customers. It could also fund infrastructure upgrades, such as the installation of broadband internet, which is essential for modern businesses. Additionally, the tax revenue could support local marketing initiatives, promoting the district as a vibrant business and leisure hub.

Furthermore, the property tax funds could be channeled into workforce development programs, ensuring that the county has a skilled and adaptable workforce to meet the needs of its diverse business community. This, in turn, enhances the county's competitiveness and attracts further investment.

The impact of the Wake Property Tax extends far beyond the collection of revenue. It is a critical tool for shaping the county's economic landscape, promoting sustainable growth, and enhancing the overall quality of life for its residents and businesses.

Future Implications and Considerations

As Wake County continues to evolve and grow, the landscape of property taxation is likely to undergo changes to adapt to emerging needs and challenges. Here are some key considerations and potential future implications to watch out for:

Sustainable Development and Green Initiatives

With a growing focus on environmental sustainability, Wake County may introduce incentives or adjustments to the property tax system to encourage green development and energy efficiency. This could include tax breaks for properties that meet certain sustainability criteria or for those that invest in renewable energy systems.

For instance, the county could implement a tax credit program for homeowners who install solar panels or implement other energy-saving measures. Similarly, commercial properties that adopt sustainable practices or achieve LEED (Leadership in Energy and Environmental Design) certification could benefit from reduced tax rates.

Technology and Automation

The advancement of technology and automation could significantly impact the property tax assessment process. Wake County might explore the use of advanced technologies, such as artificial intelligence and remote sensing, to streamline property assessments and ensure more accurate and efficient valuation processes.

Additionally, the county could leverage technology to enhance transparency and accessibility in the property tax system. Online platforms and digital tools could be utilized to provide property owners with real-time information about their tax obligations, assessment values, and payment options.

Demographic Shifts and Housing Affordability

As the population of Wake County continues to grow and diversify, the county may need to adapt its property tax policies to address issues of housing affordability and equity. This could involve implementing measures to prevent property tax burdens from disproportionately affecting lower-income households.

One potential strategy could be the introduction of a property tax cap, limiting the annual increase in property taxes to a predetermined percentage. This would help stabilize tax burdens and provide some predictability for homeowners, particularly those on fixed incomes.

Furthermore, the county could explore the expansion of property tax exemptions or deductions for specific groups, such as senior citizens or low-income homeowners, to alleviate their financial burdens and promote housing affordability.

Economic Fluctuations and Tax Revenues

Economic fluctuations, whether driven by market trends or external factors, can significantly impact property values and, consequently, property tax revenues. During periods of economic downturn, the county may need to carefully manage its budget and consider options for generating additional revenue or reducing expenditures.

Conversely, during periods of economic growth, the county might face the challenge of managing increased property tax revenues effectively. This could involve strategic investments in infrastructure, public services, and economic development initiatives to ensure that the county remains competitive and attractive to businesses and residents.

Intergovernmental Relations and Revenue Sharing

Wake County’s property tax revenue is not only crucial for the county’s operations but also for the funding of regional and state initiatives. As such, the county’s relationship with other local governments and the state government becomes increasingly important.

In the future, Wake County may need to engage in collaborative efforts with neighboring counties or the state to optimize revenue sharing and ensure that property tax revenues are allocated efficiently to meet regional needs. This could involve negotiating revenue-sharing agreements or exploring joint economic development initiatives that benefit multiple jurisdictions.

Conclusion: Navigating the Future of Property Taxation

The Wake Property Tax is a dynamic and evolving system, shaped by the county’s growth, economic trends, and changing needs. As Wake County continues to thrive and adapt, the property tax system will play a pivotal role in funding essential services, promoting economic development, and shaping the county’s future.

By staying informed about potential changes and future considerations, property owners, investors, and community members can actively engage in the process and contribute to the county's sustainable growth. The future of the Wake Property Tax system is a collaborative endeavor, requiring the participation and support of all stakeholders to ensure a bright and prosperous future for Wake County.

How often are property tax rates reviewed and adjusted in Wake County?

+The Wake County Board of Commissioners typically reviews and adjusts property tax rates annually as part of the budget-setting process. This ensures that the tax rates are aligned with the county’s financial needs and the changing economic landscape.

Are there any exemptions or deductions available for Wake Property Tax?

+Yes, Wake County offers various exemptions and deductions to alleviate the tax burden for certain property owners. These include exemptions for senior citizens, veterans, and homeowners with disabilities, as well as deductions for energy-efficient improvements and historical properties.

How can property owners stay informed about changes in tax rates and assessments?

+Property owners can stay informed by regularly checking the Wake County Tax Assessor’s website for updates and notifications. Additionally, subscribing to local news sources and following community forums can provide valuable insights into any changes or proposed adjustments to the property tax system.