Cuyahoga Sales Tax

In the world of taxation, few topics are as complex and regionally specific as sales tax. Each jurisdiction has its own unique rules and regulations, and understanding these nuances is crucial for businesses and consumers alike. In this comprehensive guide, we delve into the intricacies of the Cuyahoga Sales Tax, shedding light on its historical context, current rates, and the impact it has on the local economy.

A Historical Perspective on Cuyahoga Sales Tax

The history of sales tax in Cuyahoga County, Ohio, dates back to the early 20th century. Initially introduced as a means to generate revenue for local governments and fund essential services, the Cuyahoga Sales Tax has evolved significantly over the years. The tax was first implemented in [insert year], and since then, it has undergone several revisions to adapt to the changing economic landscape.

One of the key milestones in the history of Cuyahoga Sales Tax was the introduction of the local government tax in [year]. This tax, levied on top of the state sales tax, allowed local municipalities to raise funds for specific projects and initiatives. It provided a significant boost to infrastructure development and community enhancements.

Over time, the tax structure became more complex, with different rates applying to various categories of goods and services. This complexity arose due to the need to balance revenue generation with the impact on local businesses and consumers. The county authorities aimed to create a fair and sustainable tax system that supported economic growth while ensuring a reasonable burden on taxpayers.

Current Cuyahoga Sales Tax Rates and Exemptions

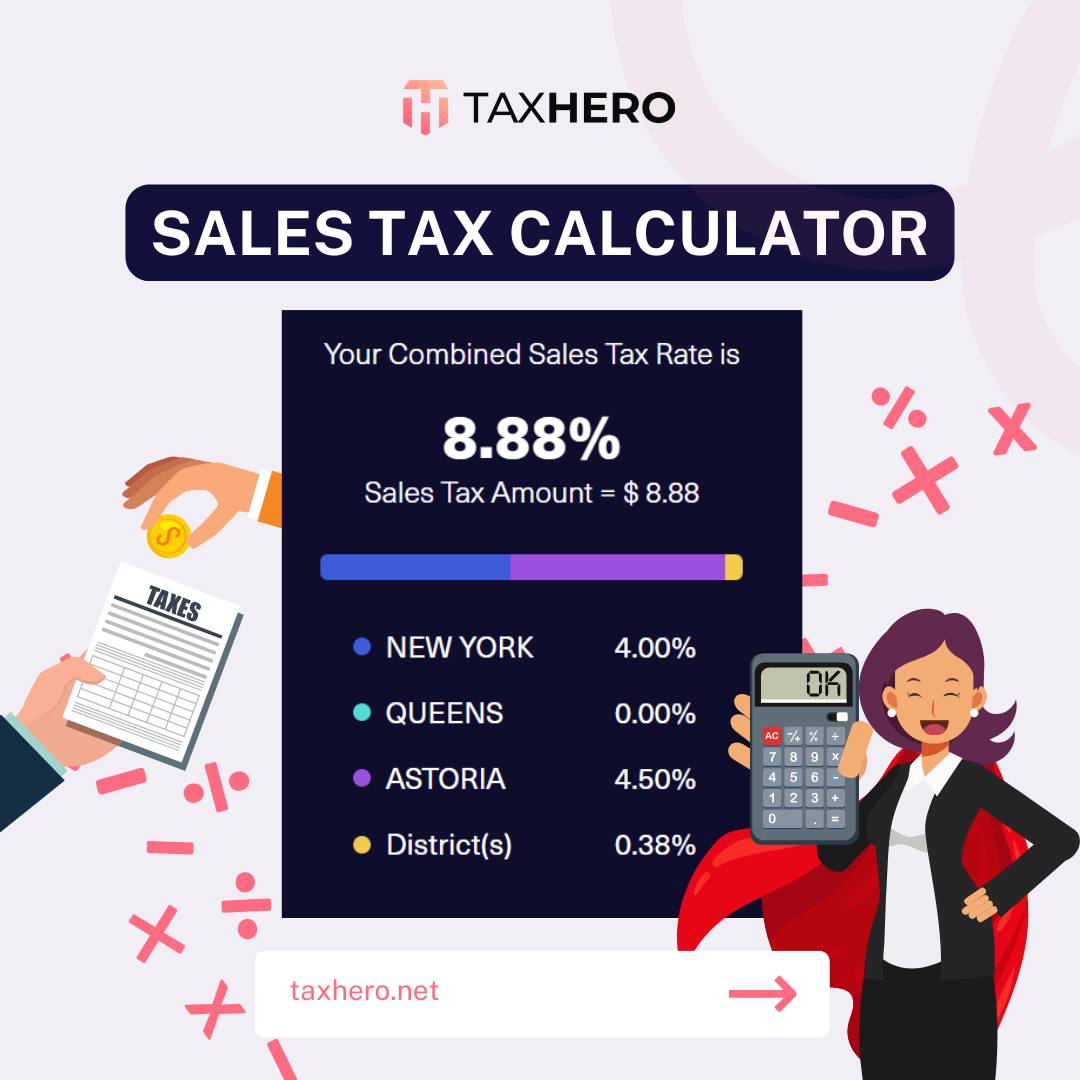

As of [current year], the Cuyahoga Sales Tax comprises several components, each with its own rate. Understanding these rates is crucial for businesses operating in the county, as they need to accurately calculate and remit the tax to the appropriate authorities.

The state sales tax rate in Ohio is [state tax rate]%, a figure that remains consistent across the state. However, Cuyahoga County imposes an additional county sales tax of [county tax rate]%, bringing the total sales tax rate for the county to [total county tax rate]%.

| Tax Category | Rate (%) |

|---|---|

| State Sales Tax | [state tax rate] |

| Cuyahoga County Sales Tax | [county tax rate] |

| Total Sales Tax in Cuyahoga County | [total county tax rate] |

Additionally, there are specific municipal sales taxes applied in certain cities within Cuyahoga County. These taxes, which range from [lowest municipal tax rate]% to [highest municipal tax rate]%, are used to fund local projects and services. The exact rate depends on the municipality where the transaction takes place.

It's important to note that not all goods and services are subject to sales tax. Cuyahoga County, like many other jurisdictions, has a list of sales tax exemptions. These exemptions cover essential items such as prescription medications, certain types of food, and educational materials. Understanding these exemptions is crucial for both businesses and consumers to ensure compliance and avoid unnecessary tax burdens.

Examples of Sales Tax Exemptions:

- Over-the-counter medications and medical supplies.

- Fresh produce and unprocessed foods.

- Textbooks and educational resources.

- Clothing and footwear below a certain price threshold.

- Certain agricultural equipment and supplies.

Impact on Local Businesses and Consumers

The Cuyahoga Sales Tax has a profound impact on the local economy, influencing the decisions and strategies of both businesses and consumers. For businesses, the tax affects their pricing strategies, profitability, and overall competitiveness. They must carefully calculate and remit the tax, ensuring compliance with the complex tax regulations.

Consumers, on the other hand, bear the direct burden of the sales tax. It influences their purchasing decisions, especially for high-value items. The tax can make a significant difference in the affordability of goods and services, especially when considering the cumulative effect of state, county, and municipal taxes.

Case Study: The Impact on Small Businesses

Let’s consider a small retail business operating in downtown Cleveland, within Cuyahoga County. This business, specializing in handmade crafts, faces a unique challenge due to the sales tax. While the tax provides a stable revenue stream for the county, it also increases the prices of goods, making it more difficult for small businesses to compete with larger retailers.

To remain competitive, the business owner must carefully manage their pricing strategy. They may opt to absorb a portion of the tax, offering competitive prices to attract customers. Alternatively, they could pass on the tax to the consumer, clearly communicating the tax amount to ensure transparency. This decision has a direct impact on the business's profitability and its ability to thrive in a competitive market.

Future Outlook and Potential Changes

As with any tax system, the Cuyahoga Sales Tax is subject to potential revisions and updates. The county authorities regularly review the tax structure to ensure it aligns with the economic needs of the region. This ongoing evaluation process considers factors such as inflation, economic growth, and the changing landscape of consumer behavior.

One potential area of change is the introduction of online sales tax. With the rise of e-commerce, there is a growing discussion about implementing a tax on online transactions to ensure a level playing field for local businesses. This could have a significant impact on both online retailers and consumers, altering the dynamics of online shopping in the county.

Additionally, there may be proposals to adjust the sales tax rates to support specific initiatives or address budgetary concerns. These changes could include rate increases or decreases, depending on the economic climate and the county's fiscal needs.

Potential Scenarios for Future Tax Changes:

- Introduction of an online sales tax to capture revenue from e-commerce transactions.

- Increase in the county sales tax rate to fund infrastructure projects or social programs.

- Implementation of tax incentives to promote economic development in specific sectors.

- Adjustment of tax rates to align with neighboring counties, creating a more uniform tax environment.

Conclusion

The Cuyahoga Sales Tax is a complex and dynamic component of the local economy, influencing the decisions of businesses and consumers alike. Understanding its historical context, current rates, and potential future changes is essential for navigating the tax landscape effectively.

As we've explored, the tax has a significant impact on pricing strategies, consumer behavior, and the overall economic health of the region. Staying informed about sales tax regulations is crucial for businesses to remain compliant and competitive, while consumers benefit from a better understanding of the tax burden they bear.

The ongoing dialogue surrounding the Cuyahoga Sales Tax ensures that it remains a relevant and responsive tool for local governance, adapting to the ever-changing economic landscape.

What is the total sales tax rate in Cuyahoga County, including state and county taxes?

+

The total sales tax rate in Cuyahoga County is [total county tax rate]%, which includes the state sales tax of [state tax rate]% and the county sales tax of [county tax rate]%.

Are there any sales tax exemptions in Cuyahoga County, and what items are typically exempt?

+

Yes, Cuyahoga County has sales tax exemptions for certain items. These typically include prescription medications, some types of food, educational materials, and clothing below a specific price threshold.

How often are the Cuyahoga Sales Tax rates reviewed and updated?

+

The Cuyahoga Sales Tax rates are regularly reviewed by the county authorities to ensure they align with economic needs. The frequency of reviews can vary, but they typically occur annually or when significant economic changes warrant an update.