Douglas County Ga Property Tax

Property taxes are an essential aspect of local government finances, providing a significant revenue stream for essential services and infrastructure development. In Douglas County, Georgia, property taxes play a crucial role in funding various community initiatives and maintaining the county's infrastructure and services. This article delves into the intricacies of Douglas County Ga Property Tax, exploring its calculation, assessment, payment, and impact on the local community.

Understanding the Douglas County Ga Property Tax Landscape

Douglas County, located in the northern part of Georgia, is known for its vibrant communities, thriving businesses, and natural beauty. The property tax system in Douglas County is a critical component of the local economy, contributing to the overall prosperity and development of the region. Let’s explore the key aspects of property taxation in this county.

Property Tax Assessment in Douglas County

The process of property tax assessment in Douglas County begins with the determination of the property’s value. The Douglas County Board of Tax Assessors is responsible for evaluating residential, commercial, and industrial properties annually. They utilize various methods, including market value analysis, income capitalization, and cost approaches, to determine the fair market value of each property.

Once the value is assessed, the Board applies the applicable tax rate, which is determined by the Douglas County Board of Commissioners and approved by the Douglas County Board of Education. This rate is expressed as millage, where one mill represents 1 of tax liability for every 1,000 of assessed value.

For instance, if a residential property is valued at 250,000 and the tax rate is set at 20 mills, the property owner would owe 5,000 in property taxes annually.

Factors Influencing Property Tax Assessments

Several factors influence the assessment of property taxes in Douglas County. These include:

- Property Type: Different types of properties, such as residential, commercial, and agricultural, may have varying tax rates and assessment methods.

- Location: Properties located in prime areas or with desirable amenities may be assessed at higher values, impacting their tax liability.

- Market Conditions: The real estate market’s overall health and fluctuations can influence property values and, consequently, tax assessments.

- Improvements: Any improvements made to a property, such as renovations or additions, can increase its assessed value and tax liability.

Property Tax Rates and Revenues

The tax rate in Douglas County is determined by the local government and is used to calculate the tax liability for each property. The revenue generated from property taxes is allocated to various services and initiatives, including:

- Education: A significant portion of property tax revenue is dedicated to funding the Douglas County School System, ensuring quality education for local students.

- Public Safety: Property taxes contribute to the county’s law enforcement, fire protection, and emergency response services, maintaining a safe community.

- Infrastructure: Revenues are utilized for road maintenance, bridge repairs, and other infrastructure development projects, enhancing the county’s overall connectivity and accessibility.

- Community Services: Property taxes support a range of community services, such as parks, libraries, recreational facilities, and social programs, enriching the quality of life for residents.

| Service Category | Allocated Revenue (%) |

|---|---|

| Education | 40% |

| Public Safety | 25% |

| Infrastructure | 15% |

| Community Services | 20% |

Property Tax Payment and Appeals

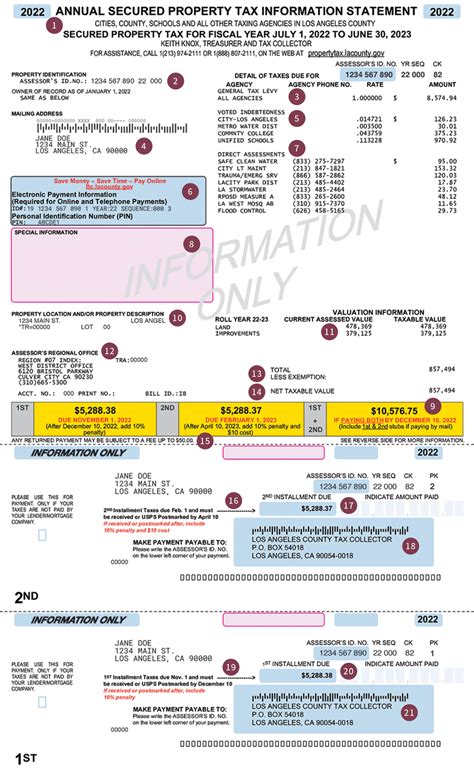

Property owners in Douglas County receive their tax bills annually, typically in the fall. The bills outline the assessed value of the property, the applicable tax rate, and the total tax liability. Property taxes are due by a specified deadline, usually in December.

If a property owner disagrees with the assessed value or believes an error has been made, they have the right to appeal the assessment. The Douglas County Board of Equalization hears and adjudicates such appeals, providing a fair and transparent process for property owners to address their concerns.

Impact on the Local Economy and Community

The property tax system in Douglas County has a profound impact on the local economy and community development. The revenue generated from property taxes is a significant source of funding for essential services, ensuring the county’s continued growth and prosperity.

Additionally, property taxes play a crucial role in maintaining the county’s infrastructure, from roads and bridges to public facilities. Well-maintained infrastructure attracts businesses and residents, fostering economic growth and a high quality of life.

Douglas County’s Approach to Tax Equity

Douglas County strives to maintain a fair and equitable property tax system. The county regularly conducts revaluations to ensure that property values are up-to-date and reflect the current market conditions. This practice helps prevent discrepancies and ensures that all property owners contribute their fair share.

Furthermore, the county offers various exemptions and relief programs to eligible taxpayers, such as the Homestead Exemption, which reduces the assessed value of primary residences, benefiting homeowners.

Community Engagement and Transparency

Douglas County actively engages with its residents regarding property taxes. The county conducts public meetings and provides transparent information on tax rates, assessments, and revenue allocation. This approach fosters trust and understanding between the local government and the community.

Conclusion

The Douglas County Ga Property Tax system is a vital component of the local economy and community development. By understanding the assessment process, tax rates, and the impact of property taxes, residents can actively contribute to the county’s growth and well-being. With a fair and transparent approach, Douglas County ensures that property taxes are not just a financial obligation but a means to enhance the quality of life for its residents.

Frequently Asked Questions

When are property taxes due in Douglas County, GA?

+Property taxes in Douglas County are typically due by December 20th of each year. However, it’s essential to check the official tax calendar or contact the Douglas County Tax Commissioner’s office for the most accurate and up-to-date information.

How can I appeal my property tax assessment in Douglas County?

+If you wish to appeal your property tax assessment in Douglas County, you must file an appeal with the Douglas County Board of Equalization within a specified timeframe, usually before the end of the appeal period. The board will review your case and make a determination based on the evidence provided.

What are the property tax rates in Douglas County for 2023?

+The property tax rates in Douglas County for 2023 are set at 20 mills for the county and 18 mills for the Douglas County Board of Education. These rates may vary slightly based on the specific jurisdiction within the county.

Are there any exemptions or relief programs for property taxes in Douglas County?

+Yes, Douglas County offers several exemptions and relief programs to eligible taxpayers. These include the Homestead Exemption, which reduces the assessed value of primary residences, and the Senior Citizen Exemption, which provides tax relief to qualified seniors.

How can I stay informed about property tax-related updates and changes in Douglas County?

+Douglas County provides various resources to keep residents informed about property tax-related matters. These include the official county website, local news outlets, and social media platforms. Additionally, attending public meetings and staying in touch with the Douglas County Tax Commissioner’s office can ensure you receive the latest updates.