Ge Tax Hawaii

Hawaii, the picturesque archipelago in the Pacific Ocean, is renowned for its stunning natural beauty and unique culture. However, when it comes to taxation, the state has its own set of rules and regulations that can be complex and often confusing for both residents and visitors. In this comprehensive guide, we will delve into the world of Hawaii's General Excise Tax (GET), also known as the Ge Tax, and explore its impact on the state's economy and the lives of its residents.

Understanding Hawaii’s Ge Tax

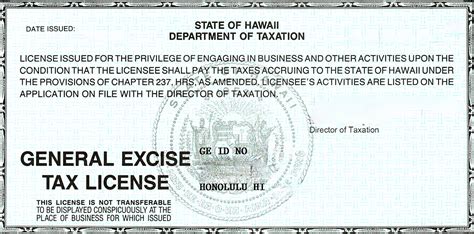

The Ge Tax, or General Excise Tax, is a broad-based consumption tax imposed by the state of Hawaii on the privilege of doing business in the state. It is similar to a sales tax but with a broader scope, as it applies to nearly all transactions, including services, rather than just tangible goods. The Ge Tax is a critical revenue source for Hawaii, funding essential government services and infrastructure projects.

What sets Hawaii's Ge Tax apart from many other state taxes is its base rate of 4%, which is applied to the gross income of businesses. This base rate is then subject to various surcharges and exemptions, making the effective tax rate variable across different industries and activities.

Key Features of Hawaii’s Ge Tax

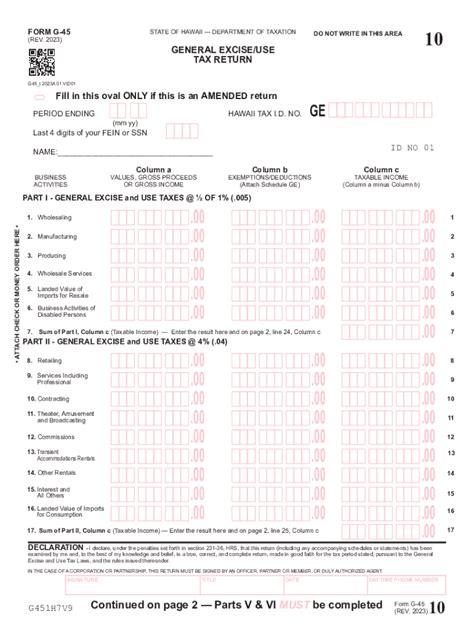

- Broad Coverage: The Ge Tax applies to most business activities, including retail sales, wholesale trade, and even certain services like legal and medical services.

- Multi-Level Taxation: Hawaii allows counties to impose their own County Surcharges on the Ge Tax base, resulting in a higher effective tax rate in certain areas.

- Exemptions and Credits: Certain transactions and industries are exempt from the Ge Tax, and there are also Ge Tax Credits available for specific activities, encouraging investment and development in targeted areas.

- Pass-Through Mechanism: The Ge Tax is often passed on to consumers, meaning that residents and visitors may encounter the tax indirectly when purchasing goods and services.

Let's take a closer look at how this tax affects different aspects of life and business in Hawaii.

Impact on Residents and Businesses

The Ge Tax plays a significant role in shaping the economic landscape of Hawaii. While it provides a stable revenue stream for the state, it also influences consumer behavior and business operations.

Resident Experience

For Hawaii residents, the Ge Tax is an ever-present factor in their daily lives. It affects the cost of living, as it is embedded in the prices of goods and services they purchase. From grocery shopping to dining out, the Ge Tax adds a consistent percentage to their expenses.

Additionally, residents who own businesses or are employed by businesses must navigate the complexities of collecting and remitting the Ge Tax. This responsibility falls on the business owners, adding an administrative burden to their operations.

Business Operations

Businesses operating in Hawaii must carefully manage their tax obligations to ensure compliance with the Ge Tax regulations. This involves calculating the tax accurately, collecting it from customers, and remitting it to the state on a regular basis.

The Ge Tax can impact pricing strategies and profit margins for businesses. To maintain competitiveness, businesses may need to absorb some of the tax burden, leading to reduced profit margins or increased prices for consumers.

Furthermore, the variable tax rates due to county surcharges can create challenges for businesses operating across multiple counties, requiring careful tax planning and management.

Analysis of Ge Tax Rates and Surcharges

The Ge Tax is not a one-size-fits-all tax. It has a base rate of 4%, but this can be modified by county surcharges and other factors. Here’s a breakdown of the effective tax rates in different counties:

| County | Base Rate | County Surcharge | Effective Rate |

|---|---|---|---|

| Kauai County | 4% | 0.5% | 4.5% |

| Maui County | 4% | 0.5% | 4.5% |

| Hawaii County | 4% | 0.5% | 4.5% |

| City and County of Honolulu | 4% | 0.5% | 4.5% |

It's worth noting that while the effective rate is consistent across the state at 4.5%, there are additional exemptions and credits that can further modify the tax burden for specific industries and activities.

Comparison with Other States

Hawaii’s Ge Tax differs significantly from the sales taxes implemented in many other states. While sales taxes are typically applied only to tangible goods, Hawaii’s Ge Tax applies to a much broader range of transactions, including services.

The 4% base rate is higher than the average sales tax rate in the U.S., which is approximately 6%. However, when considering the effective rate of 4.5% with county surcharges, Hawaii's tax rate is on par with or slightly higher than many other states.

The broader scope of Hawaii's Ge Tax can make it a more significant factor in the cost of doing business and living in the state compared to states with more limited sales taxes.

Future Implications and Reforms

The Ge Tax has been a subject of debate and potential reform in Hawaii. While it provides a stable revenue stream for the state, it also faces criticism for its impact on the cost of living and doing business.

Proposed Reforms

- Revenue Neutral Reform: Some proposals suggest restructuring the Ge Tax to a more traditional sales tax model, with a lower base rate and fewer exemptions, while ensuring the overall revenue remains unchanged.

- Simplification: Efforts to simplify the tax code and reduce the administrative burden on businesses have been discussed, aiming to make tax compliance less complex.

- Targeted Incentives: The state could explore providing targeted tax incentives to encourage investment in specific industries or regions, similar to the Ge Tax credits already in place.

The future of Hawaii's Ge Tax will depend on the state's economic needs, political climate, and the ongoing dialogue between policymakers, businesses, and residents.

Conclusion

Hawaii’s General Excise Tax, or Ge Tax, is a unique and critical component of the state’s economy. While it provides a stable revenue source for essential services, it also presents challenges and considerations for residents and businesses alike. Understanding the intricacies of the Ge Tax is essential for navigating life and commerce in the Aloha State.

How does the Ge Tax affect tourism in Hawaii?

+The Ge Tax is often passed on to tourists in the form of higher prices for goods and services. This can impact the affordability of travel to Hawaii, potentially affecting the state’s tourism industry.

Are there any exemptions for certain industries under the Ge Tax?

+Yes, certain industries like agriculture and certain financial services are exempt from the Ge Tax. Additionally, there are Ge Tax credits available for specific activities, providing tax incentives for targeted industries.

How does Hawaii’s Ge Tax compare to other states’ sales taxes in terms of revenue generation?

+Hawaii’s Ge Tax generates a significant portion of the state’s revenue, ranking among the top states in terms of tax revenue as a percentage of total state revenue. This is due to its broad scope and higher base rate compared to many other states.