Colorado State Tax Rate

Colorado's tax system is a crucial component of its fiscal landscape, playing a pivotal role in funding essential public services and infrastructure. The state's tax structure, comprising various taxes, significantly impacts businesses and individuals alike. One of the key elements of this structure is the state income tax, which forms a substantial portion of Colorado's revenue.

Understanding Colorado’s State Tax Rate

Colorado operates on a flat income tax rate, applying a single rate to all taxable income without regard to an individual’s or business’s income bracket. This flat tax system simplifies the tax calculation process and provides a consistent rate for all taxpayers.

The current state income tax rate in Colorado is 4.55%, effective from January 1, 2023. This rate is applied to the taxable income of individuals, corporations, estates, and trusts. It's important to note that this is a statewide flat rate, and there are no additional local income taxes levied by counties or municipalities.

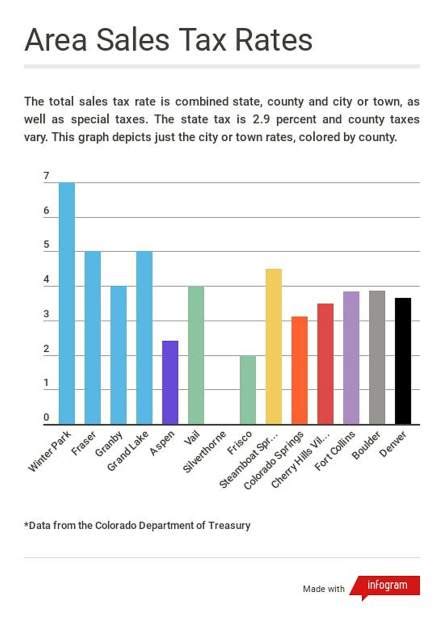

However, it's crucial to understand that Colorado's tax system extends beyond income tax. The state also imposes a sales and use tax, which is applied to the retail sale, lease, rental, and consumption of tangible personal property and some services. The sales tax rate varies depending on the location of the sale, as it is levied by both the state and local governments. On average, the combined state and local sales tax rate in Colorado is approximately 7.46%, but it can range from around 6.8% to over 10% depending on the jurisdiction.

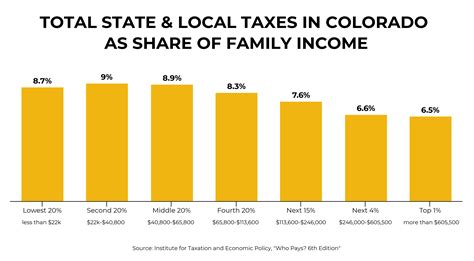

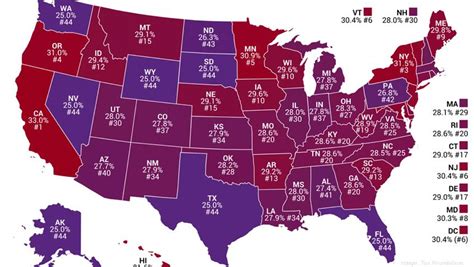

How Colorado’s State Tax Rate Compares

When compared to other states, Colorado’s flat tax rate of 4.55% is relatively competitive. Many states have higher income tax rates, especially those with progressive tax systems. For instance, California has one of the highest state income tax rates, with a top rate of 13.3% for high-income earners. In contrast, some states like Florida and Texas have no income tax at all, instead relying heavily on other taxes such as sales tax.

Colorado's approach of a flat income tax rate combined with a relatively moderate sales tax rate offers a balanced approach to taxation. This structure aims to provide a stable and predictable tax environment for businesses and individuals, which can foster economic growth and investment.

The Impact on Businesses and Individuals

For businesses, Colorado’s state tax rate can influence investment decisions and operational costs. A flat tax rate can be beneficial as it provides certainty in tax obligations, making it easier to plan and budget. Additionally, a moderate tax rate can make Colorado an attractive location for businesses, especially when compared to states with higher tax burdens.

Individuals also feel the impact of the state tax rate through their taxable income. Colorado's 4.55% flat rate means that regardless of income level, the state tax obligation remains consistent. This can provide a sense of fairness and simplicity for taxpayers. However, it's important to note that the state tax is just one component of an individual's overall tax liability, as federal taxes and local taxes can also significantly affect their financial obligations.

| Tax Type | Colorado Tax Rate |

|---|---|

| State Income Tax | 4.55% |

| Average Combined State and Local Sales Tax | 7.46% |

Future Outlook and Considerations

As with any tax system, Colorado’s state tax rate is subject to change and evolution. The state’s tax policy is influenced by various factors, including economic conditions, political landscape, and the need to fund public services and infrastructure. Regular reviews and adjustments are made to ensure the tax system remains equitable and effective.

Looking ahead, there may be discussions and proposals to modify the flat tax rate or introduce additional taxes to address specific needs or challenges. For instance, there have been debates around introducing a progressive income tax system to generate more revenue from high-income earners. However, any significant changes to the tax structure would likely require careful consideration and planning to ensure they align with the state's economic goals and the interests of its citizens.

Conclusion

Colorado’s state tax rate, particularly its flat income tax rate of 4.55%, plays a vital role in shaping the state’s economic landscape. This rate, combined with the sales and use tax, forms the backbone of Colorado’s tax system, funding essential services and contributing to the state’s fiscal health. As the state continues to evolve, its tax policy will remain a key area of focus, balancing the need for revenue with the desire for a competitive and fair tax environment.

What is the state income tax rate in Colorado for 2023?

+

The state income tax rate in Colorado for 2023 is 4.55%.

Does Colorado have a progressive tax system for income tax?

+

No, Colorado has a flat tax system, meaning all taxable income is taxed at the same rate.

How does Colorado’s state tax rate compare to other states?

+

Colorado’s flat tax rate of 4.55% is relatively competitive compared to states with progressive tax systems. However, it is important to consider the combined impact of state and local taxes when comparing tax burdens across states.