Where Do You Send Pa Tax Returns

Tax season is upon us, and for Pennsylvania residents, understanding the process and procedures for filing tax returns is essential. The state of Pennsylvania, known as the Keystone State, has its own set of tax regulations and requirements, which can sometimes be a bit complex. In this comprehensive guide, we will delve into the specifics of where and how to send your Pennsylvania tax returns, ensuring you navigate the process with ease and confidence.

Understanding Pennsylvania’s Tax Landscape

Pennsylvania’s tax system encompasses various types of taxes, including income tax, sales and use tax, corporate net income tax, and more. For individual taxpayers, the focus is primarily on personal income tax and understanding the state’s unique tax brackets and rates. It’s crucial to grasp the differences between federal and state tax systems to ensure accurate filing.

The Pennsylvania Department of Revenue plays a pivotal role in overseeing tax collection and enforcement. Their website serves as a valuable resource, providing detailed information on tax forms, deadlines, and payment options. For instance, the Department of Revenue offers online filing platforms, such as e-file PA, which streamline the tax filing process and ensure compliance with state regulations.

Key Considerations for Pennsylvania Tax Filers

Before delving into the specifics of where to send your tax returns, here are some crucial considerations for Pennsylvania taxpayers:

- Pennsylvania operates on a fiscal year that runs from July 1 to June 30. Taxpayers must file their returns based on this fiscal year cycle.

- The state offers various tax credits and deductions, including the Property Tax/Rent Rebate Program, which provides relief for eligible residents. Understanding these incentives can significantly impact your tax liability.

- For businesses, Pennsylvania's corporate net income tax structure varies based on entity type and income sources. Familiarity with these regulations is essential for accurate business tax filing.

Sending Your Pennsylvania Tax Returns

Now, let’s explore the different methods and options available for sending your Pennsylvania tax returns:

Electronic Filing (e-file PA)

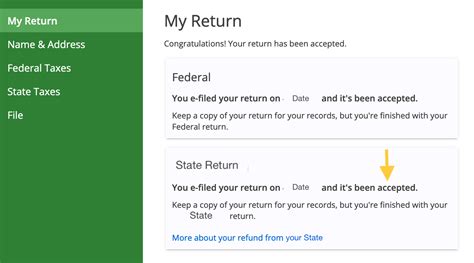

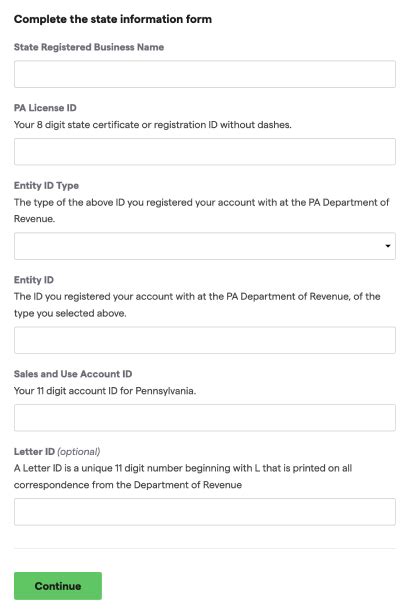

The most efficient and recommended way to file your Pennsylvania tax return is through the state’s official e-filing platform, e-file PA. This online system offers a secure and convenient way to transmit your tax information directly to the Pennsylvania Department of Revenue. Here’s how it works:

- Visit the e-file PA website and create an account. This process requires personal information, including your Social Security Number, date of birth, and contact details.

- Select the appropriate tax form based on your income type and filing status. The website provides clear guidance on which form to use.

- Enter your tax information accurately, including income details, deductions, and credits. The platform guides you through the process, ensuring you don't miss any crucial details.

- Review your return for accuracy before submitting. Once satisfied, electronically sign and transmit your return to the Department of Revenue.

- You will receive an email confirmation acknowledging the receipt of your tax return. This confirmation serves as proof of filing.

Electronic filing offers several advantages, including faster processing times, reduced errors, and the ability to track the status of your return online. Additionally, the Department of Revenue provides helpful resources and support throughout the e-filing process.

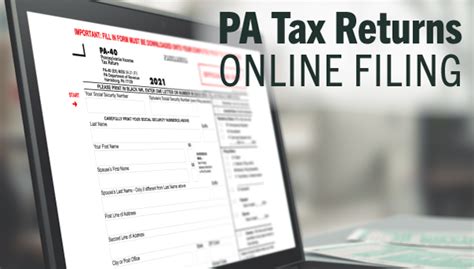

Paper Filing

While electronic filing is preferred, Pennsylvania also accepts paper tax returns. If you choose this method, here’s what you need to know:

- Obtain the appropriate tax form for your income type and filing status. You can download these forms from the Department of Revenue's website or request them by mail.

- Fill out the tax form accurately, providing all necessary information, including income details, deductions, and credits.

- Calculate your tax liability based on the instructions provided with the tax form.

- Enclose a check or money order for the full amount of tax due, making it payable to the Pennsylvania Department of Revenue.

- Mail your completed tax return, along with the payment, to the following address:

Pennsylvania Department of Revenue

Department of Revenue Building

P.O. Box 280946

Harrisburg, PA 17128-0946

Ensure that you meet the filing deadline, which is typically April 15th, to avoid penalties and interest charges. Late filing can result in additional fees and complications.

Tax Payment Options

Pennsylvania offers various methods for taxpayers to pay their tax liabilities. Here are some common payment options:

- Electronic Payment: You can make an electronic payment directly from your bank account using the Department of Revenue's online payment portal. This method is secure and convenient, allowing for real-time payment processing.

- Credit or Debit Card: Taxpayers can also pay their taxes using a credit or debit card. The Department of Revenue partners with authorized payment processors to facilitate this option.

- Check or Money Order: As mentioned earlier, you can enclose a check or money order with your paper tax return. Ensure that the payment method is payable to the Pennsylvania Department of Revenue and includes your Social Security Number or taxpayer identification number.

Tax Preparation Services

For those who prefer professional assistance, Pennsylvania offers a range of tax preparation services. These services can help individuals and businesses navigate the complexities of tax filing, ensuring compliance and optimizing tax benefits.

Professional Tax Preparers

Engaging a professional tax preparer can provide peace of mind and ensure your tax return is accurate and complete. These professionals have extensive knowledge of Pennsylvania’s tax laws and can guide you through the filing process. They can also assist with complex tax situations, such as business taxes, investments, and rental properties.

Tax Preparation Software

Tax preparation software has become increasingly popular due to its convenience and affordability. These software programs guide users through the tax filing process, providing step-by-step instructions and ensuring compliance with state regulations. Some popular options include TurboTax, H&R Block, and TaxAct. These platforms often offer free versions for simple tax returns, making them accessible to a wide range of taxpayers.

Free Tax Preparation Services

For eligible individuals with low to moderate income, Pennsylvania offers free tax preparation services through the Volunteer Income Tax Assistance (VITA) program. This program provides free tax help to individuals who earn $58,000 or less and need assistance in preparing their own tax returns. VITA volunteers are trained and IRS-certified, ensuring accurate and reliable tax preparation.

Conclusion

Understanding where and how to send your Pennsylvania tax returns is a crucial step in fulfilling your tax obligations. Whether you choose electronic filing, paper filing, or seek professional assistance, the process can be streamlined and efficient with the right knowledge and resources. Remember to stay informed about tax deadlines, take advantage of available tax credits and deductions, and seek help when needed.

Frequently Asked Questions

What happens if I miss the tax filing deadline in Pennsylvania?

+

Missing the tax filing deadline can result in penalties and interest charges. Pennsylvania imposes a late filing penalty of 5% of the unpaid tax amount for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 6% per year. To avoid these consequences, it’s crucial to file your tax return on time or request an extension if needed.

Can I file my Pennsylvania tax return early?

+

Yes, you can file your Pennsylvania tax return early if you have all the necessary information and documentation ready. However, keep in mind that the state’s tax deadline aligns with the federal deadline, which is typically April 15th. If you choose to file early, ensure that you have accurate income and deduction details to avoid any discrepancies.

How long does it take to receive a refund after filing my Pennsylvania tax return?

+

The processing time for tax refunds in Pennsylvania can vary. On average, it takes approximately 4 to 6 weeks to receive a refund after filing electronically. However, certain factors, such as the complexity of your return or errors in filing, can impact the processing time. The Department of Revenue provides an online tool to track the status of your refund, which can help you estimate the timeline.

Are there any tax credits or deductions available for Pennsylvania residents?

+

Absolutely! Pennsylvania offers various tax credits and deductions to help residents reduce their tax liability. Some common credits include the Property Tax/Rent Rebate Program, the School Income Tax Relief (SITR) Credit, and the Retirement Income Tax Exclusion. Additionally, standard deductions and itemized deductions are available to lower your taxable income. It’s essential to explore these options to maximize your tax benefits.

What should I do if I need to amend my Pennsylvania tax return?

+

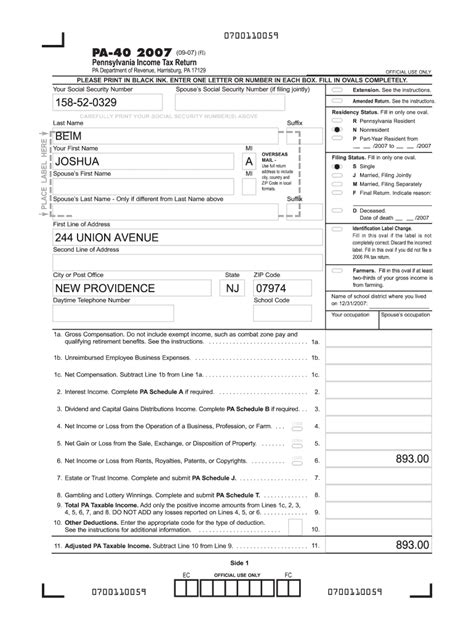

If you need to amend your Pennsylvania tax return, you must file a revised return using Form PA-40X, the Amended Personal Income Tax Return. This form is available on the Department of Revenue’s website. It’s important to review your original return carefully, identify the errors or omissions, and make the necessary corrections. Be sure to include any additional documentation or supporting information with your amended return.