How Much Does Tax Preparation Cost

Tax preparation is an essential financial service that assists individuals and businesses in accurately filing their tax returns and navigating the complex world of taxation. The cost of tax preparation can vary significantly based on several factors, including the complexity of the tax situation, the services provided, and the expertise of the tax preparer. Understanding the range of costs and the factors influencing them is crucial for anyone seeking tax preparation services.

Factors Influencing Tax Preparation Costs

Several key elements contribute to the overall cost of tax preparation:

Complexity of Tax Returns

The complexity of your tax situation is a primary factor in determining the cost of preparation. Simple tax returns, such as those for individuals with straightforward employment income and minimal deductions, typically cost less to prepare. On the other hand, complex returns involving multiple sources of income, business ownership, investments, or rental properties can significantly increase the preparation fees.

| Tax Scenario | Estimated Cost |

|---|---|

| Basic Employment Income | $50 - $200 |

| Self-Employment or Small Business | $300 - $600 |

| High-Income Individuals or Complex Investments | $600+ per return |

Type of Tax Preparer

The choice of tax preparer can also impact the overall cost. Certified Public Accountants (CPAs), Enrolled Agents (EAs), and attorneys specializing in tax law often charge higher rates due to their advanced qualifications and expertise. On the other hand, tax professionals with less experience or those working for large tax preparation firms may offer more affordable rates, especially for simpler tax situations.

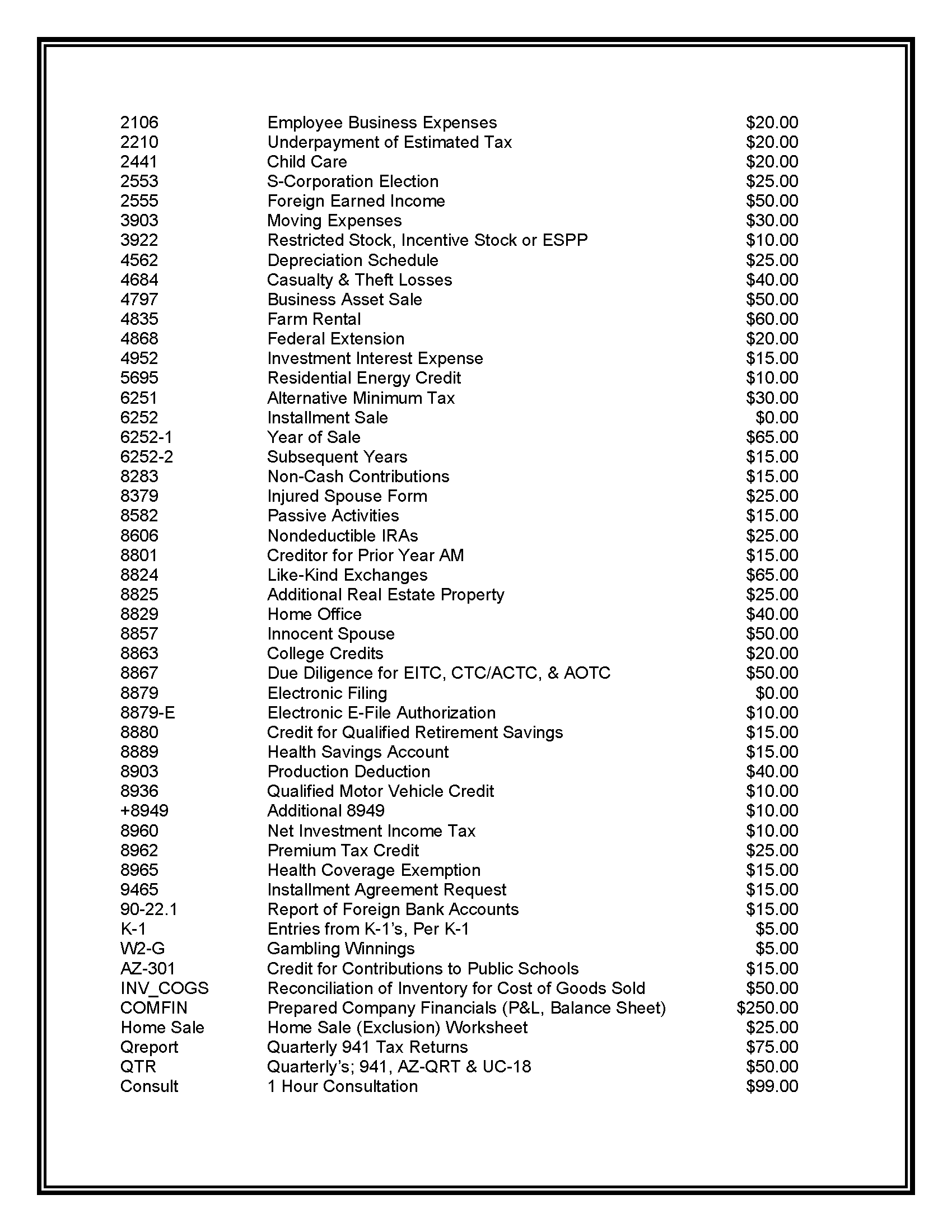

Additional Services and Expertise

Tax preparation fees can vary based on the services you require. If you need assistance with tax planning, estate planning, or auditing, the cost may increase. Additionally, if your tax situation involves international elements or requires specialized knowledge, such as cryptocurrency taxation, the fees could be higher.

Online vs. In-Person Preparation

The method of tax preparation can also affect the cost. Online tax preparation software and self-filing options are generally more affordable, with prices ranging from free to a few hundred dollars, depending on the complexity of the software and the number of returns filed. In-person tax preparation services, provided by tax professionals or accounting firms, typically cost more but offer the benefit of personalized advice and guidance.

Average Costs for Different Tax Scenarios

The cost of tax preparation can vary widely based on individual circumstances. Here’s a breakdown of average costs for various tax scenarios:

Simple Individual Tax Returns

For individuals with straightforward tax situations, such as those with W-2 income, minimal deductions, and no complex investments, the cost of tax preparation can range from 50 to 200. This includes basic services like filing federal and state income tax returns, calculating deductions, and preparing schedules for itemized deductions.

Small Business and Self-Employment

Small business owners and self-employed individuals often face more complex tax situations. The cost of tax preparation for this group can range from 300 to 600. This covers services like preparing Schedule C for business income and expenses, handling payroll taxes, and advising on business deductions and tax strategies.

High-Income Individuals and Complex Investments

Individuals with high incomes, multiple sources of income, or complex investment portfolios often require specialized tax preparation services. The cost for these scenarios can exceed $600 per return. This category may include services like handling capital gains and losses, navigating tax strategies for high-net-worth individuals, and dealing with complex international tax issues.

Tips for Choosing a Tax Preparer and Managing Costs

When selecting a tax preparer, it’s essential to consider your specific needs and budget. Here are some tips to help you make an informed decision and manage the costs effectively:

- Assess Your Tax Needs: Evaluate your tax situation and the level of complexity involved. This will help you determine the type of preparer and services you require.

- Research and Compare Rates: Shop around and compare prices from different tax preparers or firms. Ensure you understand the services included in the quoted price.

- Consider Your Comfort Level: Some individuals prefer the personal touch of in-person preparation, while others find online services more convenient and cost-effective. Choose the method that aligns with your preferences.

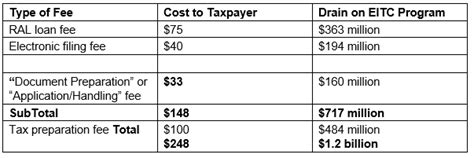

- Ask About Additional Fees: Inquire about any potential additional fees, such as charges for amendments, e-filing, or consultations beyond the initial preparation.

- Explore Tax Software: For simple tax situations, tax software can be a cost-effective option. Many software providers offer free or low-cost versions for basic returns.

Future Trends in Tax Preparation Costs

The tax preparation industry is evolving, and several trends may impact future costs. The increasing adoption of technology and automation could lead to more efficient processes, potentially reducing costs over time. Additionally, the rise of online tax preparation services and the growing popularity of self-filing options may drive competition and further lower prices.

Conclusion

Understanding the factors influencing tax preparation costs is crucial for individuals and businesses seeking these services. By considering the complexity of their tax situation, the type of preparer, and the additional services required, they can make informed decisions about tax preparation and manage their finances effectively. As the industry continues to evolve, staying informed about emerging trends and options can help taxpayers optimize their tax strategies and minimize costs.

Can I Negotiate Tax Preparation Fees?

+

Yes, it’s possible to negotiate tax preparation fees, especially if you’re a returning client or have a long-term relationship with the preparer. Discuss your budget and needs openly to find a mutually beneficial arrangement.

Are There Any Free Tax Preparation Services Available?

+

Absolutely! Many organizations offer free tax preparation services for eligible individuals, such as seniors, low-income earners, and military members. These services are often provided by volunteers or community programs.

How Can I Reduce the Cost of Tax Preparation?

+

To reduce costs, consider using tax software for simple returns, explore free filing options if eligible, or seek advice from a tax professional to understand how to streamline your tax situation.