File Nys Sales Tax Online

In today's digital age, businesses are increasingly turning to online platforms to streamline their operations and stay competitive. One crucial aspect of running a business is managing sales taxes, especially in a state as diverse and populous as New York. For businesses operating in New York State, understanding the process of filing sales tax online is essential for compliance and efficient tax management. This comprehensive guide aims to provide an expert-level overview of the steps involved in filing New York sales tax online, offering valuable insights and practical tips for businesses.

Understanding New York Sales Tax: A Comprehensive Overview

New York State imposes a sales and use tax on the sale of tangible personal property, certain services, and taxes on the rental of real property. The tax is collected by the seller from the purchaser and remitted to the New York State Department of Taxation and Finance (NYS DTF). Understanding the intricacies of sales tax in New York is crucial for businesses to ensure compliance and avoid penalties.

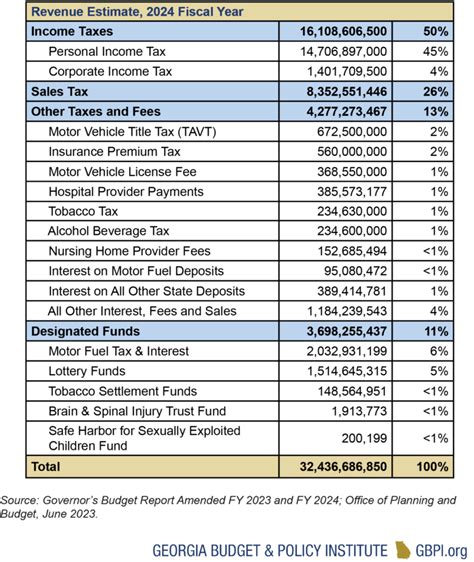

Sales tax in New York is applicable to a wide range of goods and services, with certain exemptions and special considerations for specific industries. The tax rate varies depending on the location of the sale, with a statewide base rate of 4% and additional local and municipal rates that can increase the total tax rate. This complexity makes it essential for businesses to have a clear understanding of their tax obligations and the processes involved in filing sales tax returns.

One key aspect of New York sales tax is the concept of nexus, which determines whether a business has a sufficient connection to the state to be liable for collecting and remitting sales tax. Nexus can be established through various factors, including physical presence, economic presence, or certain activities conducted within the state. Businesses that have nexus in New York are required to register with the NYS DTF and collect sales tax from customers.

The Importance of Online Filing for Sales Tax in New York

Filing sales tax online offers numerous benefits to businesses operating in New York. It provides a convenient and efficient way to manage tax obligations, especially for businesses with multiple locations or those selling goods and services across the state. Online filing eliminates the need for manual paperwork and reduces the risk of errors associated with traditional filing methods.

Furthermore, online filing allows businesses to access real-time information and tools to help them stay compliant with New York's sales tax regulations. The NYS DTF provides an online platform that offers features such as tax rate lookup, registration and filing services, payment options, and access to tax forms and instructions. This platform ensures that businesses have the necessary resources to understand their tax obligations and file their returns accurately.

By filing sales tax online, businesses can also take advantage of automation features that streamline the tax calculation and reporting process. This includes the ability to import sales data from various sources, such as e-commerce platforms or point-of-sale systems, and automatically calculate the applicable tax amounts. This level of automation not only saves time but also reduces the risk of errors and ensures that businesses are accurately reporting their sales tax liabilities.

| Key Benefits of Online Filing |

|---|

| Convenience and Efficiency |

| Reduced Risk of Errors |

| Real-time Access to Information |

| Automation of Tax Calculations |

| Compliance Support and Resources |

Step-by-Step Guide to Filing New York Sales Tax Online

Filing New York sales tax online involves a series of well-defined steps that ensure accuracy and compliance. Here is a comprehensive guide to help businesses navigate the process seamlessly.

Step 1: Determine Sales Tax Nexus and Registration

Before filing sales tax online, businesses must first determine whether they have established a nexus with New York State. As mentioned earlier, nexus refers to the connection or presence a business has within the state that triggers its obligation to collect and remit sales tax. This can be established through physical presence, economic presence, or specific activities conducted within the state.

Once a business determines it has nexus in New York, the next step is to register with the NYS DTF. This registration process involves providing relevant business information, such as the business name, address, and taxpayer identification number. The registration process can be completed online through the NYS DTF's website, making it a convenient and efficient process for businesses.

Step 2: Understand Sales Tax Rates and Exemptions

New York State has a complex sales tax structure with varying rates across different jurisdictions. It is crucial for businesses to understand the applicable sales tax rates for their specific location(s) and the goods and services they sell. The statewide base rate is 4%, but additional local and municipal rates can increase the total tax rate.

In addition to understanding the tax rates, businesses must also be aware of the exemptions and special considerations applicable to their industry or specific transactions. These exemptions can significantly impact the sales tax liability and should be carefully considered when filing returns. The NYS DTF provides resources and guidelines to help businesses navigate the complex landscape of sales tax rates and exemptions.

Step 3: Collect and Record Sales Data

Accurate sales data is essential for filing sales tax returns. Businesses should have robust systems in place to track and record all sales transactions, including the date, location, and amount of each sale. This data should be collected and organized in a way that allows for easy retrieval and analysis when it comes time to file sales tax returns.

For businesses with online sales or multiple sales channels, it is particularly important to have integrated systems that can automatically capture and record sales data. This ensures that all sales, regardless of the channel, are included in the sales tax calculation and reporting process. By maintaining accurate and up-to-date sales records, businesses can streamline the filing process and reduce the risk of errors.

Step 4: Calculate Sales Tax Liability

Once the sales data has been collected and organized, the next step is to calculate the sales tax liability. This involves applying the applicable sales tax rates to the total sales amount for each jurisdiction where the business has nexus. It is crucial to ensure accuracy in this step, as any errors in calculation can lead to penalties and interest charges.

Businesses can utilize various tools and software to assist in the calculation process. These tools can automate the application of tax rates, taking into account the specific exemptions and special considerations applicable to the business. By leveraging technology, businesses can save time and reduce the risk of human error in calculating their sales tax liability.

Step 5: File Sales Tax Returns Online

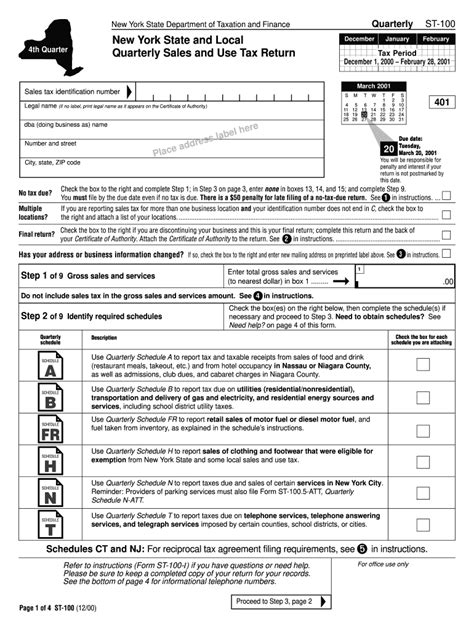

The NYS DTF provides an online platform for businesses to file their sales tax returns. This platform offers a user-friendly interface that guides businesses through the filing process. Businesses will need to log in to their account, select the appropriate filing period, and enter the calculated sales tax liability along with any supporting documentation.

The online filing platform offers a range of features to assist businesses in the filing process. These include the ability to import sales data from external systems, such as accounting software, to automatically populate the necessary fields. The platform also provides real-time error checking to help businesses identify and correct any issues before submitting their returns.

Once the returns are filed, businesses can track their submission status and receive notifications regarding any required actions or additional information needed from the NYS DTF. The online filing platform ensures a transparent and efficient process, providing businesses with the tools they need to manage their sales tax obligations effectively.

Step 6: Make Timely Sales Tax Payments

In addition to filing sales tax returns, businesses must also make timely payments to the NYS DTF. The payment due date typically coincides with the filing due date, and businesses should ensure they have sufficient funds to cover their sales tax liabilities. The NYS DTF offers various payment options, including electronic funds transfer, credit card payments, and check or money order payments.

Businesses should carefully review the payment instructions provided by the NYS DTF to ensure they are using the correct payment method and providing the necessary information. Late payments can result in penalties and interest charges, so it is crucial for businesses to stay on top of their payment obligations and maintain good records of their sales tax payments.

Step 7: Maintain Records and Documentation

Maintaining accurate and organized records is essential for sales tax compliance and audit preparedness. Businesses should retain all sales records, tax returns, payment receipts, and any other relevant documentation for a minimum of three years. These records can be crucial in the event of an audit or if there are any discrepancies in the sales tax filings.

It is recommended for businesses to establish a robust record-keeping system that allows for easy access and retrieval of sales tax-related information. This can include electronic filing systems, cloud-based storage, or physical filing systems that are well-organized and easily searchable. By maintaining thorough records, businesses can demonstrate their compliance with sales tax regulations and provide evidence of their tax obligations if needed.

Advanced Strategies for Efficient Sales Tax Management

For businesses looking to optimize their sales tax management processes, there are several advanced strategies that can be implemented. These strategies can help businesses streamline their operations, reduce costs, and ensure ongoing compliance with New York’s sales tax regulations.

Integrating Sales Tax Automation Tools

One of the most effective ways to improve sales tax management is by integrating automation tools into the business’s systems. These tools can automate various aspects of the sales tax process, from calculating tax liabilities to generating tax returns and making payments. By leveraging automation, businesses can reduce the risk of errors, save time, and improve overall efficiency.

Sales tax automation tools can be integrated with existing accounting software, e-commerce platforms, or point-of-sale systems. These tools can automatically calculate sales tax based on the applicable rates and exemptions, ensuring accurate tax calculations for each transaction. They can also generate tax returns and provide real-time reporting on sales tax liabilities, making it easier for businesses to stay on top of their tax obligations.

Utilizing Sales Tax Exemptions and Incentives

New York State offers various sales tax exemptions and incentives that can help businesses reduce their tax liabilities. These exemptions and incentives are designed to support specific industries, promote economic development, or encourage certain behaviors. By understanding and leveraging these exemptions and incentives, businesses can optimize their sales tax obligations and potentially save significant amounts of money.

For example, New York offers exemptions for certain types of sales, such as sales to government entities, nonprofit organizations, or religious institutions. There are also exemptions for specific products, such as prescription medications, certain types of food, or educational materials. By researching and taking advantage of these exemptions, businesses can ensure they are not overpaying on their sales tax obligations.

Implementing Sales Tax Compliance Training

Sales tax compliance is an ongoing process that requires a deep understanding of the regulations and best practices. To ensure that all employees involved in sales tax management are well-versed in the intricacies of New York’s sales tax laws, businesses should implement comprehensive compliance training programs. These programs can help employees stay up-to-date with the latest changes in regulations, understand their roles and responsibilities, and avoid common pitfalls.

Compliance training should cover a range of topics, including nexus determination, sales tax registration, rate calculations, and filing requirements. It should also address common errors and misconceptions to help employees develop a strong foundation in sales tax compliance. By investing in compliance training, businesses can foster a culture of accuracy and accountability, reducing the risk of errors and potential penalties.

Common Challenges and Solutions in Sales Tax Filing

While filing sales tax online offers numerous benefits, businesses may still encounter challenges and obstacles along the way. Understanding these challenges and implementing effective solutions can help businesses overcome these hurdles and ensure a smooth filing process.

Dealing with Complex Tax Rates and Jurisdictions

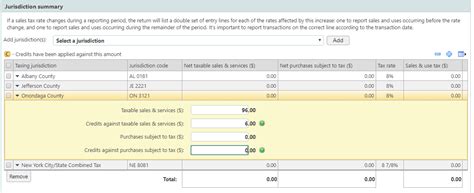

New York’s complex sales tax structure, with varying rates across different jurisdictions, can be a significant challenge for businesses. Keeping track of the applicable tax rates and ensuring accurate calculations can be a time-consuming and error-prone process. To address this challenge, businesses can utilize tax rate lookup tools provided by the NYS DTF or third-party providers.

These tools provide real-time information on sales tax rates, including any local and municipal surcharges, ensuring that businesses have the most up-to-date and accurate data. By leveraging these tools, businesses can reduce the risk of errors and save valuable time in the tax calculation process. Additionally, businesses can consider implementing automation solutions that automatically apply the correct tax rates based on the location of the sale, further streamlining the process.

Navigating Exemptions and Special Considerations

New York’s sales tax regulations include a range of exemptions and special considerations that can be challenging to navigate. Businesses must stay updated on these exemptions and ensure they are accurately applying them to their sales transactions. To address this challenge, businesses should establish a comprehensive understanding of the exemptions and special considerations that apply to their industry and specific transactions.

Regularly reviewing and updating this knowledge base is essential, as sales tax regulations can change frequently. Businesses can leverage resources provided by the NYS DTF, such as guides and newsletters, to stay informed about any updates or changes in the sales tax landscape. Additionally, seeking guidance from tax professionals or consulting firms with expertise in New York sales tax can provide valuable insights and ensure compliance with the latest regulations.

Managing Sales Tax in Multiple Jurisdictions

For businesses operating in multiple jurisdictions within New York State or across different states, managing sales tax obligations can become complex. Each jurisdiction may have its own sales tax rates, filing requirements, and due dates, making it challenging to stay organized and compliant. To address this challenge, businesses can implement centralized sales tax management systems that can track and manage sales tax obligations across multiple jurisdictions.

These systems can automate the calculation of tax liabilities, generate tax returns, and make payments for each jurisdiction, ensuring accuracy and timely compliance. Additionally, businesses can consider outsourcing their sales tax management to specialized firms or utilizing cloud-based sales tax management platforms that can handle the complexities of multi-jurisdictional sales tax obligations. By leveraging these solutions, businesses can streamline their operations and reduce the administrative burden of managing sales tax in multiple jurisdictions.

The Future of Sales Tax Filing: Technological Innovations

The world of sales tax is constantly evolving, and technological innovations are playing a significant role in shaping the future of sales tax filing. These innovations are aimed at making the filing process more efficient, accurate, and accessible for businesses of all sizes.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the way sales tax is managed and filed. These technologies can analyze vast amounts of data, identify patterns, and make accurate predictions, which can greatly benefit businesses in their sales tax management. AI and ML algorithms can automate various tasks, such as tax rate determination, exemption application, and tax return generation, reducing the risk of errors and saving significant time and resources.

Additionally, AI-powered systems can provide real-time insights and recommendations to businesses, helping them optimize their sales tax strategies and identify areas for improvement. By leveraging AI and ML, businesses can stay ahead of the curve and ensure they are always compliant with the latest sales tax regulations and best practices.

Blockchain Technology for Secure Transactions

Blockchain technology is revolutionizing the way transactions are recorded and verified, and its potential applications in sales tax management are significant. Blockchain provides a secure and transparent ledger system that can track sales transactions, ensuring accuracy and reducing the risk of fraud or manipulation. By utilizing blockchain technology, businesses can establish a reliable and tamper-proof record of their sales transactions, which can be invaluable in the event of an audit or dispute.

Additionally, blockchain can facilitate seamless and secure payments, reducing the administrative burden associated with sales tax obligations. By leveraging blockchain technology, businesses can enhance their sales tax management processes, improve transparency, and build trust with their customers and stakeholders.

Mobile Applications for On-the-Go Filing

The increasing popularity of mobile devices and applications has led to the development of mobile sales tax filing solutions. These applications provide businesses with the ability to file sales tax returns and manage their tax obligations on the go, from anywhere and at any time. Mobile sales tax filing applications offer a user-friendly interface, real-time data synchronization, and secure payment options, making the filing process more accessible and convenient.

With mobile sales tax filing applications, businesses can stay on top of their tax obligations even while traveling or working remotely. These applications can provide push notifications and reminders, ensuring businesses never miss a filing deadline. By embracing mobile sales tax filing solutions, businesses can streamline their operations, improve efficiency, and enhance their overall tax management experience.

Conclusion: Embracing Efficiency and Compliance in Sales Tax Filing

Filing New York sales tax online offers businesses a range of benefits, including convenience, efficiency, and compliance support. By following the step-by-step guide outlined in this article and implementing advanced strategies, businesses can streamline their sales tax management processes and ensure ongoing compliance with New York’s sales tax regulations.

As the world of sales tax continues to evolve, technological innovations will play a crucial role in shaping the future of sales tax filing. Embracing these innovations, such as AI, blockchain, and mobile applications, will enable businesses to stay ahead of the curve, optimize their tax strategies, and provide a seamless experience for their customers and stakeholders. By staying informed and adapting to the changing landscape, businesses can navigate the complexities of sales tax filing with confidence and success.