Property Tax South Carolina Vehicle

Welcome to our comprehensive guide on property tax for vehicles in the state of South Carolina. This article aims to provide you with all the essential information and insights you need to navigate the process of registering and maintaining your vehicle in South Carolina, while also understanding the property tax implications. Whether you're a resident or a newcomer to the state, we'll break down the steps, requirements, and potential costs associated with vehicle property taxes in SC.

Understanding Vehicle Property Taxes in South Carolina

Vehicle property taxes are an essential component of vehicle ownership in South Carolina. These taxes are assessed annually and are based on the value of your vehicle. The South Carolina Department of Revenue is responsible for administering and collecting these taxes, which contribute to the state's revenue and fund various public services.

It's important to note that vehicle property taxes are distinct from other vehicle-related fees and taxes, such as registration fees, title transfer fees, and sales tax. While these other charges are typically paid once when you purchase or register your vehicle, property taxes are an ongoing obligation that must be fulfilled annually.

Taxable Vehicle Types

In South Carolina, a wide range of vehicles are subject to property taxes. This includes:

- Cars

- Trucks

- Motorcycles

- Recreational vehicles (RVs)

- Travel trailers

- Boat trailers

- Certain types of farm equipment

It's crucial to understand that not all vehicles are taxed equally. The specific tax rate and calculation method can vary based on the type of vehicle and its intended use. For instance, vehicles used for commercial purposes may be subject to different tax rates compared to personal vehicles.

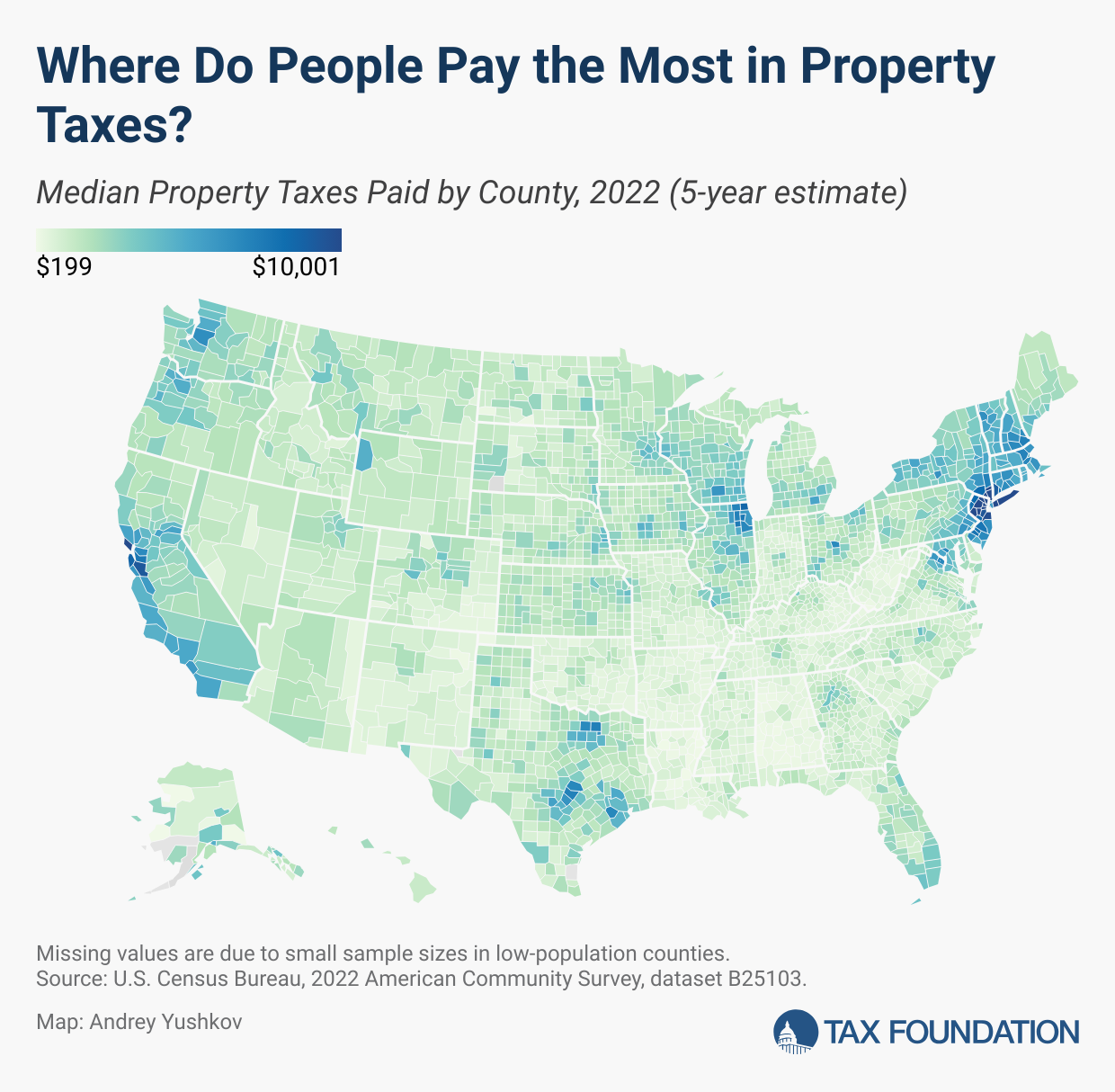

Tax Rate and Assessment

The tax rate for vehicle property taxes in South Carolina is set by individual counties. This means that the tax rate can vary significantly from one county to another. The South Carolina Department of Revenue provides a comprehensive list of county tax rates, which can be accessed here. It's essential to check the specific tax rate for your county to accurately calculate your vehicle property tax liability.

The tax assessment is based on the vehicle's fair market value, which is determined by the South Carolina Department of Motor Vehicles (DMV). The DMV utilizes a depletion schedule to calculate the value of vehicles, taking into account factors such as the vehicle's age, make, model, and condition. This schedule is updated annually to reflect changes in the vehicle market.

| Vehicle Type | Tax Rate Example (County) |

|---|---|

| Passenger Car | 1.5% of assessed value |

| Light Truck | 1.25% of assessed value |

| Motorcycle | 0.75% of assessed value |

| RV/Trailer | 1% of assessed value |

Due Dates and Payment Options

Vehicle property taxes in South Carolina are due annually, typically by a specified deadline in January. However, the exact due date can vary based on the county. It's crucial to check the due date for your county to ensure timely payment and avoid penalties.

South Carolina offers various payment options for vehicle property taxes, including:

- Online Payment: You can pay your vehicle property taxes conveniently through the South Carolina Treasurer's Office website. This option allows you to make payments securely using a credit or debit card.

- Mail-In Payment: You can also choose to pay by mail. Simply complete the necessary forms and include a check or money order made payable to the Treasurer of [Your County]. Mail the payment to the designated address provided by your county's tax office.

- In-Person Payment: Visit your county's tax office to make a payment in person. Bring the required documentation and the exact amount due to complete the transaction.

Registration and Property Tax: A Comprehensive Process

Registering your vehicle in South Carolina involves several steps, and property tax is an integral part of this process. Here's a detailed breakdown of what you need to know:

Vehicle Registration

To register your vehicle in South Carolina, you must first ensure that it meets all the necessary requirements. This includes having a valid title, proof of insurance, and passing an inspection if required. The registration process typically involves the following steps:

- Obtain a Title: If you're a new resident or purchasing a vehicle, you'll need to obtain a title from the South Carolina DMV. This involves completing the necessary paperwork and providing proof of ownership.

- Complete Registration Application: Fill out the South Carolina Vehicle Registration Application form, which can be found here. Provide accurate and complete information about your vehicle and yourself.

- Submit Required Documents: Along with the application, you'll need to submit additional documents, such as proof of insurance, your driver's license, and the vehicle's title.

- Pay Registration Fees: Registration fees are based on the type of vehicle and its intended use. You can find the current fee schedule here. These fees are separate from property taxes and are typically paid once during the initial registration.

- Vehicle Inspection (if required): Some vehicles, such as commercial vehicles or those over a certain age, may require an inspection. Check the SC DMV guidelines to determine if your vehicle needs an inspection.

- Receive Registration Certificate and Plates: Once your registration application is approved, you'll receive your registration certificate and license plates. These documents must be kept up-to-date and displayed on your vehicle as required by law.

Property Tax During Registration

During the vehicle registration process, you will also be required to pay the property tax for your vehicle. This tax is typically due at the time of registration, and the amount is calculated based on the vehicle's assessed value and the county's tax rate.

It's important to note that the property tax payment is a separate transaction from the registration fees. You will need to provide the necessary documentation and make the payment to the appropriate tax office, which may be different from the DMV.

Renewal and Property Tax

Vehicle registration in South Carolina must be renewed annually. The renewal process involves:

- Completing the South Carolina Vehicle Registration Renewal Application, which can be found here.

- Submitting proof of insurance and any other required documents.

- Paying the registration renewal fees, which are typically based on the type of vehicle and its intended use.

- Additionally, property taxes must be paid during the renewal process. The tax amount will be calculated based on the vehicle's assessed value and the current tax rate for your county.

Exemptions and Discounts: Understanding Your Options

South Carolina offers certain exemptions and discounts for vehicle property taxes, which can help reduce the financial burden on vehicle owners. It's important to understand these options and determine if you're eligible.

Vehicle Property Tax Exemptions

South Carolina provides several exemptions from vehicle property taxes. These exemptions are typically based on specific circumstances or vehicle types. Here are some common exemptions:

- Disabled Veteran Exemption: Veterans with a service-connected disability may be eligible for a full or partial exemption from vehicle property taxes. The South Carolina Department of Revenue provides more information on this exemption here.

- Disabled Persons Exemption: Individuals with a disability may be eligible for a vehicle property tax exemption if their disability meets certain criteria. More details can be found on the SC Department of Revenue website.

- Active Duty Military Exemption: Active-duty military personnel stationed in South Carolina may be eligible for a vehicle property tax exemption. This exemption applies to one vehicle owned by the military member.

- Veteran-Owned Businesses Exemption: Certain veteran-owned businesses may qualify for a vehicle property tax exemption. This exemption is designed to support veteran entrepreneurship.

Discounts and Reduced Rates

In addition to exemptions, South Carolina offers discounts and reduced tax rates for specific vehicle types or circumstances. These discounts can help lower the financial impact of vehicle property taxes.

- Low-Value Vehicle Discount: Vehicles with an assessed value below a certain threshold may qualify for a reduced tax rate. This discount is designed to provide relief for owners of older or less valuable vehicles.

- Farm Equipment Discount: Certain types of farm equipment may be eligible for a reduced tax rate. This discount recognizes the unique needs and challenges of the agricultural community.

- Senior Citizen Discount: Senior citizens may be eligible for a vehicle property tax discount. The eligibility criteria and application process can be found on the SC Department of Revenue website.

Stay Informed, Save Time, and Avoid Penalties

Understanding the ins and outs of vehicle property taxes in South Carolina is crucial for maintaining compliance and avoiding unnecessary penalties. Here are some key takeaways and tips to keep in mind:

- Stay Informed: Vehicle property tax laws and rates can change periodically. It's essential to stay updated on any changes or new regulations that may impact your tax liability. Regularly check the South Carolina Department of Revenue website for the latest information.

- Plan Ahead: Mark your calendar with the due dates for both your vehicle registration renewal and property tax payment. Planning ahead ensures you don't miss any deadlines and helps you budget for these expenses effectively.

- Utilize Online Resources: South Carolina offers various online tools and resources to assist vehicle owners. From checking your registration status to paying taxes online, these resources can save you time and make the process more convenient.

- Keep Records: Maintain accurate records of your vehicle's registration, property tax payments, and any relevant documentation. This helps in case of audits or if you need to prove compliance.

- Penalties and Late Fees: Failing to pay your vehicle property taxes on time can result in penalties and late fees. These additional charges can add up quickly, so it's crucial to stay on top of your payment obligations.

Conclusion: A Comprehensive Guide to Vehicle Property Taxes in SC

Vehicle ownership in South Carolina comes with certain responsibilities, including the payment of property taxes. By understanding the process, staying informed, and taking advantage of available exemptions and discounts, you can navigate the vehicle property tax system effectively. Remember, timely payment and compliance with the law are essential to avoid penalties and ensure a smooth vehicle ownership experience in South Carolina.

FAQs

What happens if I don’t pay my vehicle property taxes in South Carolina?

+

Failing to pay your vehicle property taxes in South Carolina can result in penalties, late fees, and potential legal consequences. The state may place a hold on your vehicle registration, preventing you from renewing it until the taxes are paid. Additionally, the county tax office may place a lien on your vehicle, which could impact your ability to sell or transfer ownership. It’s crucial to stay compliant and pay your taxes on time to avoid these issues.

How can I estimate my vehicle property tax in South Carolina before registering my vehicle?

+

You can estimate your vehicle property tax in South Carolina by following these steps: First, determine the assessed value of your vehicle using the South Carolina Vehicle Registration Application or by contacting the SC DMV. Then, check the tax rate for your county, which is available on the South Carolina Department of Revenue website. Multiply the assessed value of your vehicle by the tax rate to get an estimated tax amount. Keep in mind that this is an estimate, and the actual tax may vary slightly.

Are there any online resources to help me calculate my vehicle property tax in South Carolina?

+

Yes, the South Carolina Department of Revenue provides an online calculator to help estimate your vehicle property tax. You can access this calculator here. Simply input the assessed value of your vehicle and your county’s tax rate, and the calculator will provide an estimate of your tax liability. This tool can be a convenient way to get a quick estimate before registering your vehicle.