Estate Tax Id

The Estate Tax Identification Number (EIN), often referred to as the "Federal Tax Identification Number" or simply "Tax ID," is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to business entities and certain individuals. It serves as a critical tool for tax administration, enabling the IRS to track financial activities and ensure compliance with tax laws. This number plays a pivotal role in various business operations, including filing tax returns, opening business bank accounts, and managing payroll.

In this comprehensive guide, we delve into the intricacies of the Estate Tax ID, exploring its purpose, acquisition process, and the diverse scenarios in which it is essential. We aim to provide a thorough understanding of this vital identifier, offering practical insights and guidance for businesses and individuals navigating the complex landscape of tax administration.

Understanding the Estate Tax ID

The Estate Tax ID, or EIN, is more than just a random sequence of digits. It is a cornerstone of tax administration, functioning as a unique identifier for entities and individuals in the eyes of the IRS. This number is instrumental in tracking financial transactions, ensuring proper tax filing, and maintaining compliance with federal regulations.

Here's a closer look at the key aspects of the Estate Tax ID:

- Purpose: The primary objective of the EIN is to facilitate tax administration. It allows the IRS to accurately identify and track the financial activities of businesses and individuals, ensuring that tax obligations are met.

- Structure: An EIN comprises nine digits, typically arranged in a format such as XX-XXXXXXX. This structured format ensures easy recognition and efficient data processing.

- Issuing Authority: The IRS is the sole authority responsible for assigning EINs. The process of obtaining an EIN is straightforward and can be completed online, by mail, or through a specialized service.

- Applicability: While the EIN is primarily associated with businesses, certain individuals may also require one. This includes individuals involved in specific business activities, trustees of estates or trusts, and other designated parties.

Acquiring an Estate Tax ID

Obtaining an Estate Tax ID is a straightforward process, offering multiple methods to cater to diverse business needs and preferences. The IRS provides an online application, known as the EIN Online Application, which offers a convenient and efficient way to acquire an EIN. This application is accessible to most business entities and individuals eligible for an EIN.

For those unable to apply online, the IRS offers an alternative method through the EIN Assistance Center. This center provides support for businesses and individuals to apply for an EIN by phone or mail. Additionally, specialized services are available to assist with the EIN application process, offering guidance and support tailored to specific business needs.

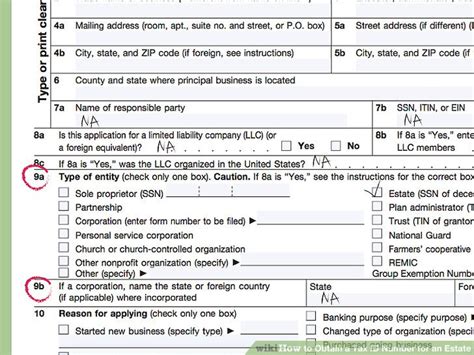

The application process involves providing essential details about the business or individual, including legal name, address, and type of entity. It is important to ensure the accuracy of the information provided to avoid delays in the issuance of the EIN.

Online Application

The EIN Online Application is a user-friendly platform designed to streamline the process of acquiring an EIN. It offers a secure and efficient way to apply, typically resulting in immediate issuance of the EIN. The online application is accessible 24⁄7, allowing businesses and individuals to apply at their convenience.

To complete the online application, applicants must provide personal information, such as name, date of birth, and social security number (or individual taxpayer identification number). Additionally, they must furnish details about the business, including the legal name, principal business activity, and tax classification.

Upon successful completion of the application, the IRS assigns an EIN, which is immediately available for use. The EIN is displayed on the confirmation page and is also sent to the applicant's email address.

EIN Assistance Center

The EIN Assistance Center provides an alternative method for businesses and individuals to obtain an EIN. This center offers assistance by phone or mail, catering to those who prefer a more traditional application process or encounter challenges with the online application.

To apply by phone, applicants can call the IRS toll-free number and provide the necessary information to a customer service representative. The representative will guide them through the application process and assign an EIN, which is typically available within a few business days.

For mail applications, the IRS provides a paper form, known as the SS-4 form, which can be downloaded from their website. Applicants must complete the form and mail it to the appropriate IRS office. The processing time for mail applications is generally longer, taking up to four weeks or more.

Specialized Services

For businesses and individuals seeking additional support or specialized guidance, various services are available to assist with the EIN application process. These services offer expertise in navigating the complexities of tax administration, ensuring a smooth and efficient application experience.

Specialized services can provide personalized assistance, helping applicants choose the most suitable tax classification and navigate any unique requirements associated with their business or individual circumstances. They can also offer ongoing support, ensuring compliance with tax regulations and providing guidance on tax obligations.

When Do You Need an Estate Tax ID?

Understanding when an Estate Tax ID is necessary is crucial for businesses and individuals to ensure compliance with tax regulations. While the primary purpose of the EIN is to facilitate tax administration, there are specific scenarios in which an EIN is mandatory, as well as situations where it is strongly recommended.

Mandatory Requirements

There are several circumstances in which an EIN is legally required. These include:

- Business Entities: Most business entities, such as corporations, partnerships, and limited liability companies (LLCs), are mandated to obtain an EIN. This requirement applies regardless of the size or nature of the business.

- Payroll Management: If a business has employees, it is mandatory to have an EIN to manage payroll and file employment tax returns. The EIN is used to report and pay taxes related to employee compensation, including federal income tax withholding, Social Security, and Medicare taxes.

- Trusts and Estates: Trustees of estates or trusts are required to obtain an EIN to manage the financial affairs of the trust or estate. This includes filing tax returns and managing any associated tax obligations.

- Certain Individuals: Specific individuals, such as sole proprietors with employees, may also be required to obtain an EIN. Additionally, non-resident aliens engaged in a U.S. trade or business, and individuals with control or significant ownership in a foreign disregard entity, may need an EIN.

Recommended Scenarios

While not mandatory, there are situations in which obtaining an EIN is strongly recommended. These include:

- Opening a Business Bank Account: Many financial institutions require an EIN when opening a business bank account. This is particularly true for larger banks and institutions, as it helps them comply with know-your-customer (KYC) regulations and prevent financial crimes.

- Filing Tax Returns: While sole proprietors can use their Social Security Number (SSN) for tax purposes, obtaining an EIN is recommended for better privacy and security. Using an EIN can help protect personal information and provide a layer of separation between business and personal finances.

- Applying for Licenses and Permits: Some local, state, and federal agencies may require an EIN as part of the licensing or permitting process. Obtaining an EIN can streamline these applications and demonstrate compliance with tax regulations.

Using Your Estate Tax ID

Once you have obtained your Estate Tax ID, it becomes a critical tool for managing your business or individual tax obligations. The EIN is used in various tax-related activities, ensuring compliance and facilitating efficient financial management.

Filing Tax Returns

The primary use of the EIN is for filing tax returns. Businesses and individuals use their EIN to report income, expenses, and other financial information to the IRS. The EIN is included on tax forms, such as the Form 1040 for individuals and the Form 1120 for corporations, to identify the taxpayer and ensure proper processing of the return.

By using an EIN, businesses and individuals can protect their personal information and maintain a clear separation between business and personal finances. This is particularly important for sole proprietors, who may otherwise be required to use their Social Security Number on tax forms, exposing their personal information to potential risks.

Opening Business Bank Accounts

The Estate Tax ID is often required when opening a business bank account. Financial institutions use the EIN to verify the identity of the business and ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Providing an EIN demonstrates the legitimacy of the business and helps prevent financial crimes.

Additionally, using an EIN when opening a business bank account provides a clear distinction between business and personal finances. This separation is essential for accurate financial reporting, tax compliance, and personal liability protection.

Managing Payroll

For businesses with employees, the Estate Tax ID is crucial for managing payroll and complying with employment tax regulations. The EIN is used to report and pay taxes related to employee compensation, including federal income tax withholding, Social Security, and Medicare taxes.

By using the EIN, businesses can accurately track and report payroll taxes, ensuring compliance with federal and state regulations. This includes filing employment tax returns, such as the Form 941 for federal income tax withholding, Social Security, and Medicare taxes, and the Form W-2 for employee wage and tax statements.

Applying for Loans and Financing

When applying for business loans or financing, lenders often require an EIN as part of the application process. The EIN provides a unique identifier for the business, allowing lenders to conduct credit checks and assess the financial health of the business.

Additionally, using an EIN can demonstrate the legitimacy and stability of the business, increasing the chances of securing favorable loan terms. It also helps protect personal information, as the EIN can be used instead of a Social Security Number, reducing the risk of identity theft and maintaining privacy.

Maintaining and Updating Your Estate Tax ID

While obtaining an Estate Tax ID is a critical step, maintaining and updating the information associated with the EIN is equally important. The IRS requires businesses and individuals to keep their EIN information current to ensure accurate tax administration and compliance.

Updating Business Information

Businesses are responsible for updating any changes to their information with the IRS. This includes changes to the legal name, address, responsible party, or tax classification of the business. The IRS provides an online tool, known as the Business Update Portal, to facilitate the update process.

The Business Update Portal allows businesses to submit changes to their EIN information securely and efficiently. It is accessible 24/7, enabling businesses to update their information at their convenience. Upon successful submission, the IRS processes the changes, ensuring accurate tax administration.

Addressing Changes in Responsible Parties

When there is a change in the responsible party, such as a change in ownership or management, it is crucial to update the EIN information with the IRS. This ensures that tax obligations are properly assigned and met.

The responsible party is typically the individual or entity responsible for managing the financial affairs of the business. Changes in responsible parties can occur due to various reasons, including ownership transfers, mergers, or the appointment of new officers or directors.

Handling Lost or Misplaced EINs

In the event that an EIN is lost or misplaced, the IRS provides assistance to retrieve the number. Businesses and individuals can contact the IRS and provide identifying information, such as the business name, address, and tax classification. The IRS will then locate the EIN and provide the necessary details.

It is important to note that the IRS does not provide EINs over the phone or by email. They will verify the identity of the caller or email sender and provide the EIN through secure channels, such as mail or secure online platforms.

Future Implications and Trends

As the landscape of tax administration continues to evolve, the role of the Estate Tax ID is likely to adapt and expand. The IRS is continuously working to enhance its systems and processes, incorporating advancements in technology and data analytics to improve tax compliance and efficiency.

Digital Transformation

The IRS is embracing digital transformation, leveraging technology to streamline its operations and enhance taxpayer services. This includes the development of online platforms and mobile applications, offering taxpayers a more convenient and efficient way to interact with the IRS.

The EIN Online Application is a prime example of this digital transformation, providing a user-friendly and secure platform for businesses and individuals to obtain an EIN. As the IRS continues to invest in digital solutions, taxpayers can expect further improvements in the application and management of EINs.

Data Analytics and Compliance

The IRS is leveraging data analytics to identify patterns and trends in tax administration, enhancing its ability to detect and prevent tax evasion and fraud. By analyzing large datasets, the IRS can identify potential risks and take proactive measures to ensure compliance.

The use of data analytics also enables the IRS to provide more targeted assistance to taxpayers, offering personalized guidance and support based on their unique circumstances. This can help businesses and individuals navigate the complexities of tax administration more effectively, ensuring compliance and minimizing risks.

International Tax Cooperation

With the increasing global nature of business, the IRS is collaborating with international tax authorities to enhance cross-border tax compliance. This includes sharing information and best practices, as well as developing common standards and frameworks for tax administration.

The Estate Tax ID plays a crucial role in international tax cooperation, serving as a unique identifier for businesses and individuals across borders. As the IRS continues to strengthen its international partnerships, the EIN is likely to become an even more vital tool for ensuring compliance and facilitating global tax administration.

Conclusion

The Estate Tax ID, or EIN, is a fundamental tool for tax administration, enabling the IRS to track financial activities and ensure compliance. Obtaining an EIN is a straightforward process, offering multiple methods to cater to diverse business and individual needs. Once obtained, the EIN becomes a critical identifier, used in various tax-related activities, such as filing tax returns, opening business bank accounts, and managing payroll.

As the landscape of tax administration evolves, the role of the Estate Tax ID is likely to expand and adapt. The IRS is embracing digital transformation, leveraging technology to enhance taxpayer services and improve compliance. Additionally, the IRS is utilizing data analytics to detect and prevent tax evasion, and collaborating with international tax authorities to strengthen cross-border tax administration.

Understanding the importance of the Estate Tax ID and staying updated with the latest trends and developments is essential for businesses and individuals to navigate the complex world of tax administration. By obtaining and effectively using an EIN, taxpayers can ensure compliance, protect their personal information, and streamline their financial management processes.

Can I use my Social Security Number instead of an EIN for business purposes?

+While you can use your Social Security Number (SSN) for certain business activities, such as filing tax returns as a sole proprietor, obtaining an EIN is generally recommended. Using an EIN provides better privacy and security, protecting your personal information and ensuring a clear separation between business and personal finances.

How long does it take to receive an EIN after applying online?

+When applying for an EIN online, the process is typically immediate. Once you complete the EIN Online Application and submit the required information, the IRS will assign an EIN, which is displayed on the confirmation page and sent to your email address. This ensures a quick and efficient process for obtaining an EIN.

What happens if I need to change the responsible party associated with my EIN?

+If there is a change in the responsible party, such as a change in ownership or management, it is crucial to update the EIN information with the IRS. You can use the Business Update Portal to securely submit changes to your EIN details, including the responsible party. This ensures that tax obligations are properly assigned and met.