Does Tennessee Have Property Tax

When it comes to property ownership, one of the key considerations for residents and investors alike is the impact of property taxes. Tennessee, known for its diverse landscapes and vibrant cities, has a unique approach to property taxation that is worth exploring. This article delves into the intricacies of Tennessee's property tax system, shedding light on how it works and what it means for property owners across the state.

Understanding Tennessee’s Property Tax Structure

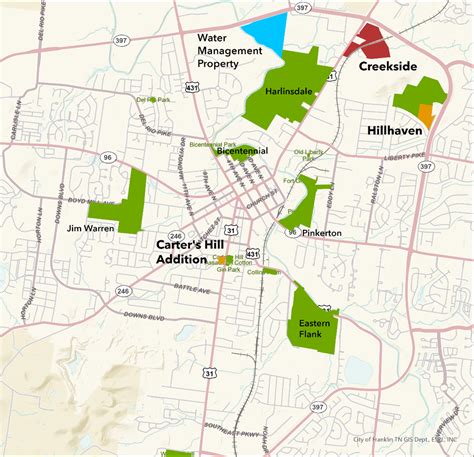

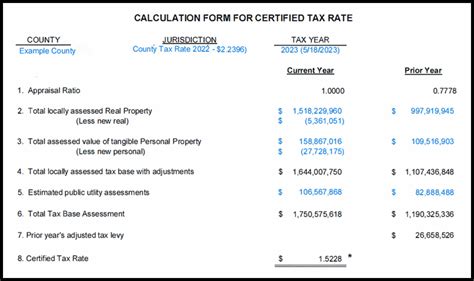

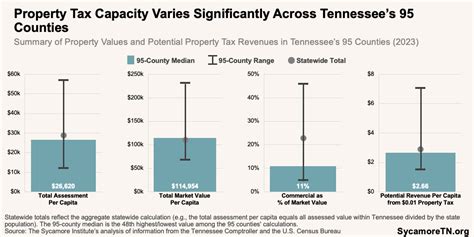

Tennessee’s property tax system is a vital component of the state’s revenue generation, contributing significantly to the funding of local governments, schools, and essential services. The property tax rate in Tennessee is determined by the jurisdiction in which the property is located, primarily at the county level. This decentralized approach allows for local control and the ability to tailor tax rates to meet specific community needs.

The property tax assessment process in Tennessee involves two key components: the assessment of the property's value and the application of the tax rate. The appraised value of a property is determined by the local assessor's office, which considers factors such as location, size, improvements, and recent sales data of comparable properties. This appraised value serves as the basis for calculating the property tax liability.

The Role of Assessment Ratios

Tennessee utilizes assessment ratios, often referred to as assessment rates, to determine the taxable value of a property. These ratios vary depending on the type of property and its use. For instance, residential properties typically have a lower assessment ratio compared to commercial or industrial properties. The taxable value is calculated by multiplying the appraised value by the applicable assessment ratio.

Here's an example to illustrate this process: Let's consider a residential property in Davidson County, Tennessee, with an appraised value of $300,000. If the assessment ratio for residential properties in this county is 25%, the taxable value would be $75,000 (appraised value x assessment ratio). This taxable value is then used to calculate the property tax liability.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 25% |

| Commercial | 40% |

| Industrial | 50% |

Property Tax Rates and Calculations

Once the taxable value of a property is determined, the property tax rate comes into play. As mentioned earlier, property tax rates are set by local governments, primarily at the county level, and can vary significantly across Tennessee. These rates are expressed in mills, where one mill represents one-tenth of a cent.

To calculate the property tax liability, the taxable value is multiplied by the applicable tax rate in mills. For instance, if the tax rate in a particular county is set at 250 mills, a property with a taxable value of $75,000 would incur a property tax liability of $1,875 (taxable value x tax rate in mills). This calculation provides a straightforward way to determine the annual property tax obligation.

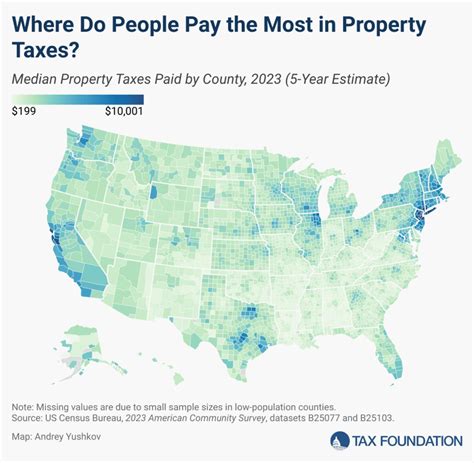

Tax Rate Variations Across Tennessee

Tennessee’s decentralized approach to property taxation results in a wide range of tax rates across the state. While some counties may have relatively low tax rates, others may impose higher rates to fund specific local initiatives or infrastructure projects. This variability allows local governments to align tax revenue with community needs and priorities.

For example, consider two counties in Tennessee: Shelby County and Williamson County. Shelby County, which includes the city of Memphis, might have a tax rate of 200 mills, while Williamson County, a suburban area outside Nashville, might have a higher rate of 275 mills. These differences in tax rates reflect the diverse needs and priorities of these communities.

| County | Tax Rate (Mills) |

|---|---|

| Shelby County | 200 |

| Williamson County | 275 |

Property Tax Exemptions and Credits

Tennessee offers a range of property tax exemptions and credits to eligible property owners, providing relief and incentives. These exemptions and credits are designed to support specific groups, such as senior citizens, veterans, and those with disabilities, as well as promote certain types of property use, such as agricultural or historic properties.

Senior Citizen Property Tax Freeze

One notable exemption in Tennessee is the Senior Citizen Property Tax Freeze program. This program allows eligible senior citizens to freeze their property taxes at a base year’s assessed value, protecting them from future increases in property taxes due to rising property values. This exemption provides much-needed financial stability for senior homeowners.

To qualify for the Senior Citizen Property Tax Freeze, individuals must be at least 65 years old, meet certain income requirements, and have owned and resided in their property for at least five consecutive years. The program applies to both residential and agricultural properties, offering a significant benefit to Tennessee's senior population.

Other Exemptions and Credits

Tennessee also offers various other exemptions and credits, including those for:

- Veterans with service-connected disabilities

- Disabled individuals

- Homestead exemptions for primary residences

- Agricultural and forest land use

- Historic properties

These exemptions and credits aim to support specific segments of the population and encourage the preservation of certain types of properties, contributing to the overall well-being and character of Tennessee's communities.

Appealing Property Tax Assessments

Property owners in Tennessee have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. The appeal process typically involves a review by the local board of equalization, which is responsible for ensuring the fairness and accuracy of property assessments.

Steps to Appeal

To initiate an appeal, property owners should follow these general steps:

- Review the assessment notice and identify any discrepancies or concerns.

- Gather relevant documentation, such as recent appraisals, sales data, or comparative property information.

- Contact the local assessor's office to discuss the assessment and understand the basis for the valuation.

- If the issue cannot be resolved informally, file a formal appeal with the board of equalization within the specified timeframe.

- Prepare and present a case during the appeal hearing, providing evidence to support the requested change in assessment.

It's important for property owners to thoroughly understand the appeal process and gather strong evidence to support their case. The board of equalization's decision is final, but there may be opportunities for further review or legal action if necessary.

The Impact of Property Taxes on Tennessee’s Economy

Property taxes play a crucial role in Tennessee’s economy, funding vital services and infrastructure that support the state’s growth and development. The revenue generated from property taxes contributes to local governments’ budgets, enabling them to invest in schools, public safety, transportation, and other essential services.

Funding Education and Infrastructure

A significant portion of property tax revenue in Tennessee is allocated to education. Local property taxes are a primary source of funding for public schools, ensuring that Tennessee’s youth receive the resources and support they need for a quality education. Additionally, property taxes contribute to the maintenance and improvement of local infrastructure, including roads, bridges, and public facilities.

For instance, in Davidson County, property taxes account for a substantial portion of the county's budget, with a significant allocation dedicated to the Nashville Metropolitan School District. This funding supports the education of thousands of students, providing resources for teachers, classroom technology, and extracurricular activities.

Economic Development and Community Initiatives

Property taxes also drive economic development initiatives in Tennessee. Local governments use property tax revenue to attract businesses, create job opportunities, and stimulate economic growth. This can include investing in business-friendly infrastructure, offering incentives to new businesses, and supporting local entrepreneurship.

Moreover, property taxes fund community initiatives that enhance the quality of life for Tennessee residents. These initiatives may include parks and recreation programs, cultural events, and social services that promote the well-being and engagement of community members.

Conclusion: Navigating Tennessee’s Property Tax Landscape

Tennessee’s property tax system is a complex yet vital component of the state’s fiscal landscape. From the assessment process to tax rate variations and exemptions, property owners have a range of factors to consider when managing their property tax obligations. Understanding the intricacies of Tennessee’s property tax system empowers property owners to make informed decisions, engage in the appeal process if necessary, and actively contribute to the vibrant communities across the state.

As Tennessee continues to grow and evolve, its property tax system will remain a critical pillar of local governance, ensuring that essential services are funded and communities thrive. By navigating this landscape with knowledge and awareness, property owners can actively participate in shaping the future of Tennessee's vibrant cities and diverse landscapes.

What is the average property tax rate in Tennessee?

+The average property tax rate in Tennessee varies across counties, with some counties having rates as low as 200 mills and others with rates up to 300 mills or more. It’s important to check with the specific county’s assessor’s office for the most accurate and up-to-date tax rate information.

Are there any property tax breaks for homeowners in Tennessee?

+Yes, Tennessee offers various property tax exemptions and credits to eligible homeowners. These include the Senior Citizen Property Tax Freeze program, veteran and disability exemptions, homestead exemptions, and more. Each exemption has specific eligibility criteria, so it’s important to review the requirements to determine eligibility.

How often are property tax assessments conducted in Tennessee?

+Property tax assessments in Tennessee are typically conducted on a regular basis, often every few years. However, the frequency can vary by county. It’s recommended to check with the local assessor’s office to understand the assessment schedule and any specific procedures in place.

Can I appeal my property tax assessment if I disagree with the value assigned to my property?

+Absolutely! Property owners in Tennessee have the right to appeal their property tax assessments if they believe the value is inaccurate or unfair. The appeal process involves presenting evidence and making a case to the local board of equalization. It’s important to follow the appeal procedures and timelines to ensure a successful appeal.

How does Tennessee’s property tax system compare to other states in terms of rates and exemptions?

+Tennessee’s property tax rates and exemptions vary significantly from other states. While some states have higher average rates, others may offer more generous exemptions or have different assessment methodologies. It’s essential to compare Tennessee’s system with other states on a case-by-case basis to understand the specific advantages and considerations.