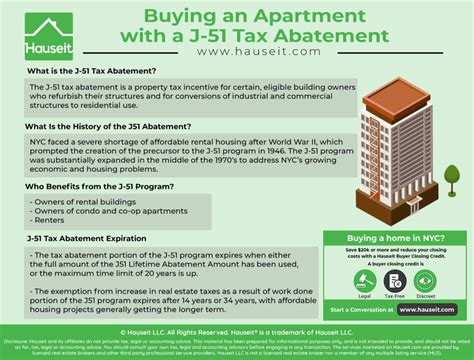

What Is Tax Abatement

Tax abatement is a strategic financial tool utilized by governments and local authorities to encourage economic growth and development within their jurisdictions. It is a temporary reduction or elimination of taxes for businesses and individuals, often offered as an incentive to attract new investments, create jobs, and stimulate economic activity. This practice is particularly common in regions seeking to revitalize their economies or promote specific industries. Understanding tax abatement is crucial for businesses, investors, and policymakers as it can significantly impact the financial landscape and business opportunities in a given area.

The Mechanics of Tax Abatement

Tax abatement can be applied to various types of taxes, including property taxes, income taxes, sales taxes, and even specific fees. The scope and duration of the abatement are typically defined by local ordinances or agreements between the government and the recipient of the abatement. These abatements are often tailored to specific projects or initiatives, such as the construction of a new manufacturing facility, the development of affordable housing, or the expansion of a technology hub.

Types of Tax Abatement

There are several common types of tax abatement strategies employed by governments:

- Property Tax Abatement: This involves reducing or waiving property taxes for a defined period, often as an incentive for businesses to establish or expand their operations in a particular area. Property tax abatements can be especially beneficial for industries that require substantial infrastructure investments.

- Income Tax Incentives: Governments may offer reduced income tax rates or tax credits to businesses or individuals meeting certain criteria. These incentives are designed to attract new businesses or encourage the growth of existing ones, thereby increasing employment opportunities and economic output.

- Sales Tax Holidays: During designated periods, governments may waive sales taxes on specific goods or services. This strategy is often used to boost consumer spending and support local businesses, particularly during slower economic periods.

- Targeted Tax Credits: Certain jurisdictions provide tax credits for businesses operating in specific sectors or those that meet certain sustainability or social responsibility standards. These credits can offset a portion of the business’s tax liability, making them an attractive option for environmentally conscious or socially responsible companies.

The Process and Eligibility

The process of applying for and receiving tax abatement varies depending on the jurisdiction and the type of abatement. Typically, businesses or individuals must submit an application detailing their project, its economic impact, and how it aligns with the local development goals. The application is then reviewed by a designated committee or government body, which decides on the eligibility and terms of the abatement.

| Abatement Type | Eligibility Criteria |

|---|---|

| Property Tax Abatement | Often requires a minimum investment amount and job creation goals. |

| Income Tax Incentives | May be based on industry sector, employment creation, or economic development impact. |

| Sales Tax Holidays | Typically open to all businesses within the designated industry or sector. |

| Targeted Tax Credits | Usually tied to specific sustainability or social responsibility standards. |

The Impact and Considerations of Tax Abatement

Tax abatement programs can have significant economic benefits, including job creation, increased tax revenues over the long term, and the revitalization of underdeveloped areas. They can also stimulate competition among businesses, leading to improved services and products. However, these programs also come with potential drawbacks and challenges.

Pros of Tax Abatement

- Economic Growth: Tax abatements can spur significant economic growth by attracting new businesses and encouraging expansion. This leads to increased employment opportunities and a boost in the local economy.

- Community Development: Abatement programs often focus on underdeveloped areas, helping to revitalize these communities and improve the overall quality of life for residents.

- Competitive Advantage: Businesses benefiting from tax abatements may have a competitive edge, allowing them to invest more in research, development, and innovation.

Cons of Tax Abatement

- Revenue Loss: Governments forego tax revenues during the abatement period, which can impact their ability to fund public services and infrastructure.

- Inequality Concerns: If not designed and implemented carefully, tax abatement programs can exacerbate economic inequalities, particularly if they benefit primarily larger corporations or wealthier individuals.

- Administrative Burden: The process of administering tax abatement programs can be complex and time-consuming, requiring significant resources from government agencies.

Real-World Examples of Tax Abatement

Tax abatement strategies have been implemented across the globe, with varying degrees of success and impact. Here are a few notable examples:

- Amazon’s Second Headquarters: In 2018, Amazon announced plans to establish its second headquarters in two locations: Arlington, Virginia, and New York City. Both locations offered significant tax incentives, including property tax abatements and sales tax exemptions, to attract the tech giant.

- Detroit’s Renaissance Zone: The city of Detroit designated a large area as a Renaissance Zone, offering businesses within the zone substantial tax abatements for up to 15 years. This strategy was aimed at revitalizing the city’s economy post-bankruptcy and encouraging new investments.

- Singapore’s Tax Incentives for Green Tech: Singapore has implemented tax incentives for companies operating in the green technology sector, offering reduced tax rates and credits for businesses that meet certain sustainability criteria. This strategy is part of the country’s broader push towards a greener economy.

Future Implications and Conclusion

Tax abatement programs will likely continue to play a significant role in economic development strategies, particularly as governments seek to recover from the economic impacts of the COVID-19 pandemic. These programs can be a powerful tool for stimulating economic growth, but they must be carefully designed and implemented to ensure they achieve their intended goals without causing unintended consequences. As such, ongoing research and analysis are essential to understand the full impact of these programs and to guide their future development.

How long do tax abatement programs typically last?

+

The duration of tax abatement programs can vary widely, ranging from a few years to over a decade. It often depends on the specific goals and objectives of the program and the needs of the recipient.

Are there any restrictions on how the tax savings can be used by the recipient?

+

Yes, tax abatement programs often come with specific requirements and conditions. For instance, a business receiving a property tax abatement may be required to use the savings for further investment in the business, such as expanding operations or hiring more employees.

What are some common challenges faced when implementing tax abatement programs?

+

Challenges can include ensuring the program aligns with the community’s long-term goals, managing the administrative burden, and addressing concerns about revenue loss and potential inequality issues. Effective planning, community engagement, and rigorous evaluation are crucial for successful implementation.

Can individuals benefit from tax abatement programs, or are they primarily for businesses?

+

While tax abatement programs are often designed for businesses, some jurisdictions offer tax incentives for individuals as well. For instance, first-time home buyer programs may include tax abatements or credits to encourage homeownership.

How do tax abatement programs contribute to a region’s overall economic development strategy?

+

Tax abatement programs are a critical component of a region’s economic development strategy. They can attract new businesses, encourage investment, and create jobs, all of which contribute to economic growth and community revitalization. These programs are often tailored to align with a region’s unique strengths and development goals.