County Of Hawaii Real Property Tax

The County of Hawaii, often referred to as the Big Island, has a unique real property tax system that plays a crucial role in the local economy and the overall development of the island. This article delves into the intricacies of the County of Hawaii Real Property Tax, exploring its history, current practices, and its impact on homeowners, investors, and the community at large.

A Historical Perspective

The origins of the real property tax system in Hawaii can be traced back to the early 20th century when the territory was under the jurisdiction of the United States. The first real property tax laws were enacted to provide a stable source of revenue for the territorial government, primarily for infrastructure development and public services. Over the decades, the tax system evolved to accommodate the diverse needs of the growing population and the unique challenges posed by Hawaii’s geographic location.

One of the key milestones in the history of Hawaii's real property tax was the establishment of the County of Hawaii in 1905. This event marked the beginning of a more localized approach to taxation, allowing the county to set its own tax rates and policies. This autonomy has been instrumental in shaping the real property tax landscape, enabling the county to respond effectively to the specific needs and challenges of the Big Island.

Understanding the Current System

The real property tax in the County of Hawaii is an annual assessment levied on the value of real estate properties, including land, buildings, and improvements. The tax is a significant source of revenue for the county, funding vital services such as education, healthcare, public safety, and infrastructure development. The revenue generated from real property taxes also contributes to the preservation of Hawaii’s unique natural and cultural resources.

Assessment Process

The assessment process begins with the County’s Department of Finance, which is responsible for evaluating the value of each property within the county. This evaluation considers various factors, including the property’s size, location, improvements, and market conditions. The assessed value is then used as the basis for calculating the real property tax.

Property owners receive a notice of assessment, which outlines the assessed value and the corresponding tax liability. Property owners have the right to appeal the assessed value if they believe it is inaccurate or unfair. The appeals process provides an opportunity for property owners to present evidence and argue their case before an independent review board.

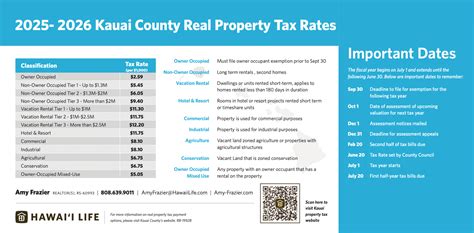

Tax Rates and Exemptions

The County of Hawaii sets its real property tax rates annually, with the tax rate varying across different zones and property types. The tax rate is typically expressed as a percentage of the assessed value. For instance, the tax rate for residential properties in a particular zone might be 0.35%, while commercial properties in the same zone could be taxed at a higher rate of 0.45%.

The county also offers various exemptions and credits to certain property owners. These exemptions are designed to support specific groups, such as senior citizens, disabled individuals, and veterans. Additionally, the county provides incentives for renewable energy systems and conservation initiatives, encouraging property owners to adopt sustainable practices.

Impact on Homeowners and Investors

The real property tax has a significant impact on homeowners and investors in the County of Hawaii. For homeowners, the tax is an essential consideration when budgeting for their annual expenses. The tax liability can vary widely depending on the location and characteristics of the property. Understanding the real property tax landscape is crucial for homeowners to make informed decisions about their financial planning and property ownership.

Investors, on the other hand, view the real property tax as a key factor in their investment strategies. The tax rate and exemptions can influence investment decisions, particularly for large-scale developments and commercial properties. Investors often analyze the tax implications alongside other financial considerations to determine the feasibility and profitability of their projects.

Case Study: Real Property Tax and Residential Investment

Consider the case of Mr. Anderson, a retired individual who recently purchased a condominium in the heart of Hilo. Mr. Anderson was attracted to the area for its vibrant culture and proximity to natural attractions. However, he soon realized that the real property tax would be a significant expense, particularly given the high assessed value of his property due to its desirable location.

Mr. Anderson's annual real property tax liability amounted to $2,500, which was a substantial portion of his monthly expenses. To manage this liability, he explored various options, including applying for the senior citizen exemption, which could potentially reduce his tax burden. Mr. Anderson's experience highlights the importance of understanding the real property tax system for homeowners like him, ensuring they can plan their finances effectively.

Community Benefits and Challenges

The revenue generated from real property taxes has a profound impact on the community, funding essential services and infrastructure. For instance, the tax revenue supports the county’s efforts to maintain and improve its road network, which is crucial for the island’s transportation and tourism industries. Additionally, the tax revenue contributes to the development and maintenance of public spaces, such as parks and recreational facilities, enhancing the quality of life for residents and visitors alike.

However, the real property tax system also presents challenges, particularly in terms of equity and affordability. Some critics argue that the current tax structure disproportionately affects low-income homeowners and small businesses, making it difficult for them to bear the tax burden. Addressing these concerns is essential to ensuring that the tax system remains fair and sustainable.

Proposed Reforms and Community Engagement

Recognizing the need for reform, the County of Hawaii has initiated several discussions and public consultations to gather feedback and ideas for improving the real property tax system. One proposed reform is the introduction of a graduated tax rate structure, where the tax rate increases with the property’s value, ensuring that high-value properties contribute a larger share of the tax revenue.

Additionally, the county is exploring the idea of offering tax incentives for affordable housing developments, encouraging the construction of housing units that are accessible to a wider range of income levels. These reforms aim to address the challenges of equity and affordability while maintaining a stable source of revenue for the county's vital services.

Future Outlook and Implications

The future of the County of Hawaii’s real property tax system is closely tied to the island’s economic and demographic trends. As the population continues to grow and the economy diversifies, the tax system will need to adapt to meet the changing needs of the community. One key area of focus is ensuring that the tax system remains competitive and attractive to investors, particularly in the tourism and renewable energy sectors, which are vital to the island’s economy.

Furthermore, the county must balance the need for revenue generation with the principles of equity and fairness. As the island continues to develop and attract new residents and businesses, finding the right balance between taxation and community development will be crucial for the long-term sustainability of the County of Hawaii.

Frequently Asked Questions

When is the real property tax due in the County of Hawaii?

+The real property tax is due twice a year, with payments typically required by August 20 and January 20. Property owners receive a tax bill with the due dates and payment instructions.

How can I appeal my real property tax assessment?

+To appeal your assessment, you need to submit a written request to the County’s Board of Review within 60 days of receiving your assessment notice. The request should include specific reasons for the appeal and any supporting evidence.

Are there any exemptions or credits available for real property taxes in Hawaii?

+Yes, the County of Hawaii offers several exemptions and credits, including those for senior citizens, disabled individuals, veterans, and renewable energy systems. These exemptions and credits can reduce your tax liability, so it’s worth exploring if you qualify.

How does the real property tax affect investment opportunities in Hawaii?

+The real property tax is a key consideration for investors, as it can impact the profitability of their ventures. Investors often analyze the tax implications alongside other financial factors to determine the feasibility of their projects.