United States Exit Tax

The United States Exit Tax is a complex and often misunderstood aspect of the U.S. tax system, applicable to certain individuals who relinquish their U.S. citizenship or residency. This tax regime aims to prevent tax avoidance by individuals who would otherwise benefit from the American social and economic system without contributing to its maintenance. It's an important topic for anyone considering expatriation, as it can have significant financial implications.

Understanding the U.S. Exit Tax

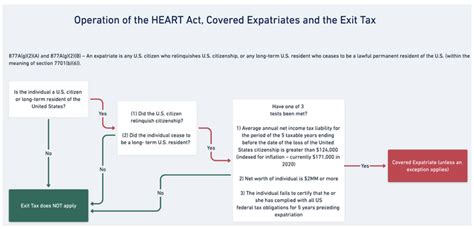

The U.S. Exit Tax is triggered when a Covered Expatriate relinquishes their U.S. citizenship or long-term residency. A Covered Expatriate is generally defined as a U.S. citizen who has a net worth of over 2 million or has a U.S. tax liability of over 160,000 for the five years preceding the expatriation. The Exit Tax is designed to treat such individuals as if they had sold all their assets and properties at fair market value on the day before the expatriation.

This tax mechanism aims to ensure that individuals do not avoid U.S. capital gains tax by moving their assets offshore before renouncing their citizenship or residency. The Exit Tax calculation can be complex, involving the determination of the fair market value of assets, potential gain recognition, and the application of various exclusions and exceptions.

Triggering Events and Exclusions

The Exit Tax is not applicable to all individuals who leave the U.S. It primarily targets those who are considered “Covered Expats” based on their wealth or tax liability. However, even if an individual doesn’t meet these criteria, they may still be subject to certain other tax obligations when leaving the U.S., such as filing a final tax return and settling any outstanding tax liabilities.

There are also specific exclusions and exceptions to the Exit Tax rules. For instance, individuals who have been U.S. citizens for fewer than eight years may be exempt, and those who can demonstrate that their expatriation was for reasons of health, work, or education may also be exempt. Additionally, certain types of assets, such as a primary residence, may be excluded from the Exit Tax calculation.

| Exclusion Category | Description |

|---|---|

| Low-Value Assets | Assets with a fair market value of less than $600,000 are generally excluded. |

| Retirement Accounts | Most retirement accounts are exempt, provided certain conditions are met. |

| Primary Residence | The primary residence may be excluded if it meets specific conditions, such as being owned and used as a residence for at least two of the five years preceding the expatriation. |

The Exit Tax Calculation

The calculation of the U.S. Exit Tax involves several steps. First, the fair market value of all the individual’s assets is determined as of the day before expatriation. This includes tangible assets like real estate and vehicles, as well as intangible assets like stocks, bonds, and other financial instruments. The total fair market value of these assets is then compared to the individual’s tax basis in these assets.

The tax basis is the original cost of the assets, adjusted for any improvements or depreciation. If the fair market value exceeds the tax basis, the difference is treated as a deemed sale, and the individual is considered to have realized a capital gain. This gain is then subject to U.S. capital gains tax rates, which can be significant.

For example, consider an individual with a $2 million portfolio of stocks and bonds. If the fair market value of these assets is determined to be $2.5 million on the day before expatriation, the individual is deemed to have realized a capital gain of $500,000. This gain would then be subject to capital gains tax, which could result in a substantial tax liability.

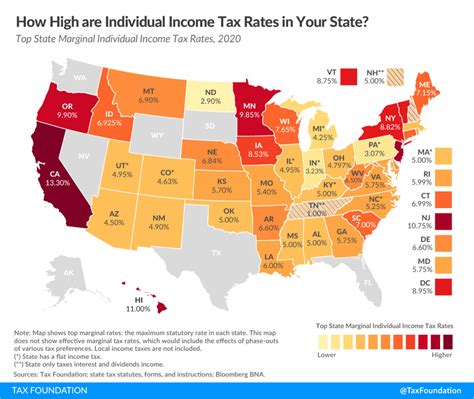

Capital Gains Tax Rates

The capital gains tax rates applicable to the Exit Tax are the same as those for regular capital gains. Short-term capital gains, those held for one year or less, are taxed at the individual’s ordinary income tax rate. Long-term capital gains, those held for more than one year, benefit from a lower tax rate, currently 20% for most individuals. However, this rate can be higher for certain types of assets or for individuals in higher tax brackets.

In addition to the capital gains tax, individuals may also be subject to the Net Investment Income Tax (NIIT) and the Additional Medicare Tax, which are both 3.8% and 0.9%, respectively. These additional taxes can significantly increase the overall tax liability.

| Capital Gains Type | Tax Rate |

|---|---|

| Short-Term | Ordinary Income Tax Rate |

| Long-Term | 20% (plus applicable surtaxes) |

Planning and Mitigating the Exit Tax

Given the complexity and potential financial impact of the Exit Tax, careful planning is essential for individuals considering expatriation. Several strategies can be employed to mitigate the Exit Tax liability, but these should be undertaken with the guidance of a qualified tax professional who specializes in international tax matters.

Timing and Asset Management

One strategy to consider is timing. The Exit Tax is calculated based on the fair market value of assets on the day before expatriation. Therefore, an individual may benefit from carefully timing their expatriation to coincide with a period when their assets have a lower fair market value, such as during a market downturn. This can reduce the deemed capital gain and, consequently, the Exit Tax liability.

Additionally, individuals can manage their asset portfolio to minimize the Exit Tax impact. This may involve selling assets that have a low tax basis and are likely to generate a large capital gain upon sale, or donating appreciated assets to charity to receive a tax deduction without triggering a capital gains tax event.

Expatriation with a Qualified Individual Retirement Account (QIRA)

Another strategy to consider is expatriating with a Qualified Individual Retirement Account (QIRA). A QIRA is a special type of Individual Retirement Account (IRA) that allows individuals to maintain their IRA benefits even after expatriation. This can be particularly beneficial for individuals with substantial retirement savings, as it allows them to avoid the Exit Tax on their retirement assets.

To establish a QIRA, the individual must transfer their IRA funds to a foreign financial institution that has entered into an agreement with the IRS to manage QIRAs. This institution must agree to withhold 30% of any distributions made to the individual to cover potential U.S. tax liabilities. The individual is then allowed to make withdrawals from the QIRA without triggering the Exit Tax, provided they pay the applicable U.S. tax on these withdrawals.

The Future of the U.S. Exit Tax

The U.S. Exit Tax regime has evolved significantly over the years, and it’s likely to continue to do so. While the current rules are already complex, there are ongoing discussions and proposals to further modify the Exit Tax regulations. These potential changes could have a significant impact on individuals considering expatriation, so it’s important to stay informed about any legislative developments.

Potential Reforms and Their Implications

One proposed reform is to lower the wealth threshold for Covered Expats. Currently, individuals with a net worth of over 2 million or a tax liability of over 160,000 for the five years preceding the expatriation are considered Covered Expats. Lowering this threshold would mean that more individuals would be subject to the Exit Tax, potentially impacting a wider range of expatriates.

Another proposed change is to modify the timing of the Exit Tax. Currently, the Exit Tax is calculated based on the fair market value of assets on the day before expatriation. Some proposals suggest changing this to the date of expatriation, which could have a significant impact on the tax liability, especially during volatile market conditions.

Furthermore, there have been discussions about expanding the scope of the Exit Tax to include certain types of trusts and entities. This could mean that individuals who hold assets through trusts or entities would be subject to the Exit Tax, even if they themselves do not meet the wealth or tax liability thresholds.

| Potential Reform | Implications |

|---|---|

| Lowering Wealth Threshold | More individuals would be considered Covered Expats, potentially increasing the number of people subject to the Exit Tax. |

| Changing Timing of Exit Tax | The tax liability could be significantly impacted by market conditions, making it more difficult to plan for and manage. |

| Expanding Scope to Trusts and Entities | Individuals who hold assets through trusts or entities may be subject to the Exit Tax, even if they themselves are not considered Covered Expats. |

Conclusion

The U.S. Exit Tax is a critical consideration for anyone contemplating expatriation. It’s a complex tax regime with significant financial implications, and careful planning is essential to mitigate its impact. Understanding the rules, exclusions, and potential strategies is the first step, but seeking professional advice from tax experts who specialize in international tax matters is crucial.

The Exit Tax landscape is dynamic, with ongoing discussions and proposed reforms. Staying informed about these developments is essential to make informed decisions about expatriation. While the Exit Tax may seem daunting, with the right guidance and strategies, individuals can effectively manage their tax obligations and plan for a successful expatriation.

Who is considered a Covered Expatriate under the U.S. Exit Tax rules?

+A Covered Expatriate is generally defined as a U.S. citizen who has a net worth of over 2 million or has a U.S. tax liability of over 160,000 for the five years preceding the expatriation.

What is the purpose of the U.S. Exit Tax?

+The U.S. Exit Tax is designed to prevent tax avoidance by individuals who would otherwise benefit from the American social and economic system without contributing to its maintenance. It ensures that individuals do not avoid U.S. capital gains tax by moving their assets offshore before renouncing their citizenship or residency.

How is the Exit Tax calculated?

+The Exit Tax is calculated by comparing the fair market value of an individual’s assets on the day before expatriation to their tax basis in these assets. If the fair market value exceeds the tax basis, the difference is treated as a deemed sale, and the individual is considered to have realized a capital gain, which is subject to U.S. capital gains tax rates.

What are some strategies to mitigate the Exit Tax liability?

+Strategies to mitigate the Exit Tax liability include carefully timing the expatriation to coincide with a period when assets have a lower fair market value, managing the asset portfolio to minimize capital gains, and considering expatriation with a Qualified Individual Retirement Account (QIRA) to avoid Exit Tax on retirement assets.

What potential reforms are being discussed for the U.S. Exit Tax?

+Potential reforms include lowering the wealth threshold for Covered Expats, changing the timing of the Exit Tax to the date of expatriation, and expanding the scope of the Exit Tax to include certain types of trusts and entities.