How To Add Tax Onto A Price

In the world of business and commerce, understanding how to accurately calculate and apply taxes to prices is essential for compliance and transparency. This guide will provide a comprehensive overview of the process, offering a step-by-step breakdown and insights into the various tax considerations that businesses must navigate.

Understanding Tax Calculation

Tax calculation is a fundamental aspect of pricing strategies, and it varies depending on the nature of the business, its location, and the products or services offered. Here’s a detailed look at the process:

Step 1: Identify Applicable Taxes

The first step is to identify all the taxes that apply to your business and its offerings. This could include:

- Sales Tax: A tax levied on the sale of goods and services, often varying by jurisdiction.

- Value Added Tax (VAT): A consumption tax added to the price of a product or service at each production stage, with the final consumer bearing the total VAT cost.

- Excise Tax: A tax on specific goods, often based on quantity, such as a tax per liter of fuel or per pack of cigarettes.

- Import Duties: Taxes imposed on imported goods, calculated as a percentage of the product’s value, freight, and insurance.

Step 2: Determine Tax Rates

Once you’ve identified the applicable taxes, the next step is to find out the specific tax rates. These rates can vary significantly, depending on factors like the type of product, the location of the sale, and the consumer’s residency status. For instance, the sales tax rate in the United States can vary from state to state and even city to city.

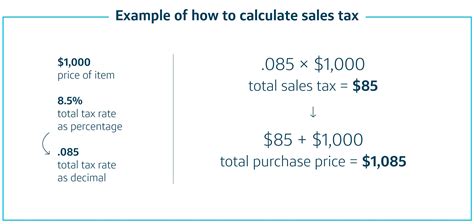

Step 3: Calculate Tax Amount

With the applicable taxes and their rates identified, you can now calculate the tax amount. This is typically done by multiplying the pre-tax price by the tax rate and rounding the result to the nearest cent or other smallest currency unit.

For example, if you’re selling a product for 100 and the applicable tax rate is 15%, the tax amount would be calculated as follows:</p> <p>100 x 0.15 = $15

Step 4: Add Tax to the Price

Once you’ve calculated the tax amount, simply add it to the pre-tax price to arrive at the final, tax-inclusive price. In our example, the final price would be:

100 + 15 = $115

Real-World Example: Tax Calculation for an Online Store

Let’s consider an online store, TechShop, that sells electronic gadgets. TechShop is based in California, where the sales tax rate varies by county. The store ships its products nationwide, so it needs to account for different tax rates depending on the shipping destination.

For a product priced at 500, the tax calculation would depend on the shipping address. If the product is shipped to San Francisco, with a sales tax rate of 8.75%, the tax amount would be:</p> <p>500 x 0.0875 = 43.75</p> <p>So, the final price for a customer in San Francisco would be:</p> <p>500 + 43.75 = 543.75

However, if the product is shipped to a different county with a different sales tax rate, say 7.5%, the tax amount and final price would change accordingly.

Advanced Tax Considerations

While the basic process of adding tax to a price is straightforward, there are several advanced considerations that businesses, especially those operating on a larger scale or across multiple jurisdictions, need to take into account.

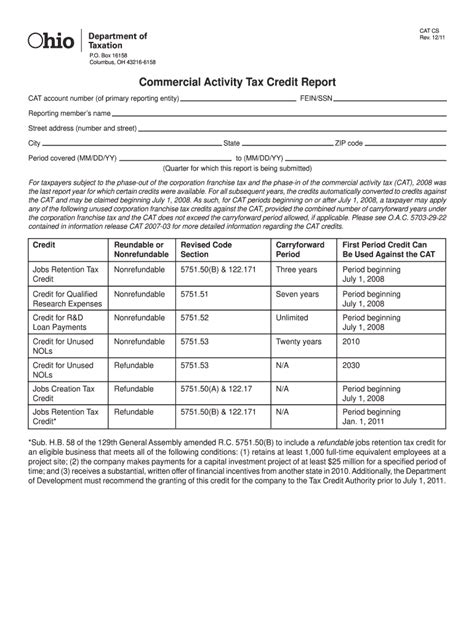

Tax Exemptions and Discounts

Certain products or services may be exempt from certain taxes or eligible for tax discounts. For example, some jurisdictions offer tax exemptions for essential goods like food or for specific types of businesses, such as non-profits. Understanding and correctly applying these exemptions is crucial to avoid overcharging customers and potential legal issues.

Rounding and Precision

Tax calculations often involve precise calculations to the nearest cent or other smallest currency unit. However, the process of rounding can lead to slight variations in the final price. For instance, a tax rate of 7.25% on a product priced at 99.99 would result in a tax amount of 7.247425. To simplify calculations and ensure consistency, many businesses round tax amounts to the nearest cent.

Tax Calculation Software

For businesses dealing with complex tax structures or a large volume of transactions, using tax calculation software can be a game-changer. These tools automate the tax calculation process, ensuring accuracy and efficiency. They can also handle variations in tax rates based on product type, customer location, and other factors, streamlining the pricing process.

International Tax Considerations

If your business operates internationally, you’ll need to navigate a complex web of tax regulations. Different countries have different tax systems and rates, and some may require specific documentation or compliance measures. For instance, in the European Union, businesses must comply with VAT regulations, which involve registering for a VAT number and charging VAT based on the destination country (known as the “VAT MOSS” system for digital services).

Performance Analysis

Understanding how tax affects your business performance is crucial. This involves analyzing the impact of tax on your pricing strategy, profitability, and customer behavior. For instance, you might consider offering tax-exclusive pricing to highlight the value of your products, or you might analyze the impact of tax changes on your sales trends to inform future business decisions.

Future Implications

Staying abreast of tax changes and trends is essential for long-term business success. Tax rates and regulations can change frequently, influenced by economic conditions, political decisions, and other factors. By staying informed and adaptable, you can ensure your business remains compliant and competitive.

Frequently Asked Questions

How do I calculate tax for a product with a discount?

+To calculate tax for a discounted product, first apply the discount to the pre-tax price. Then, calculate the tax based on the discounted price. For example, if a product originally priced at 100 has a 20% discount, the discounted price would be 80. The tax amount would then be calculated as $80 x the applicable tax rate.

Can I round off tax amounts to the nearest cent?

+Yes, rounding tax amounts to the nearest cent is a common practice to simplify calculations and ensure consistency. However, it’s important to ensure that rounding doesn’t significantly impact the final price, especially for high-value transactions.

Are there any tax exemptions for certain types of businesses or products?

+Yes, many jurisdictions offer tax exemptions or discounts for specific types of businesses or products. For example, some countries offer VAT exemptions for certain services or products, while others provide tax incentives for eco-friendly products or businesses operating in specific sectors.

How can I ensure my business stays compliant with changing tax regulations?

+To ensure compliance, it’s crucial to stay updated on tax regulations and changes. This can be done by subscribing to tax-related newsletters or alerts, consulting with tax professionals, and using tax calculation software that automatically updates with the latest regulations. Regular audits and reviews of your tax practices can also help identify any potential issues.