Roll Over Myga Back To Ira Tax Free

Maximizing Retirement Funds: A Guide to Rolling Over MyGA to IRA Tax-Free

In the world of personal finance, making informed decisions about your retirement savings is crucial. One strategic move that can significantly impact your financial future is rolling over a MyGA (Money Guard Annuity) into an IRA (Individual Retirement Account). This process, when done right, offers tax advantages and provides you with more control over your retirement funds. Let's delve into the intricacies of this rollover, understanding the benefits, the steps involved, and the potential pitfalls to avoid.

A MyGA, or Money Guard Annuity, is a type of fixed indexed annuity that offers both income protection and the potential for growth. It is designed to provide a guaranteed income stream for life, making it an attractive option for those seeking financial security during their retirement years. However, the flexibility and tax advantages offered by an IRA can make it a more desirable option for many investors.

Understanding the MyGA-to-IRA Rollover

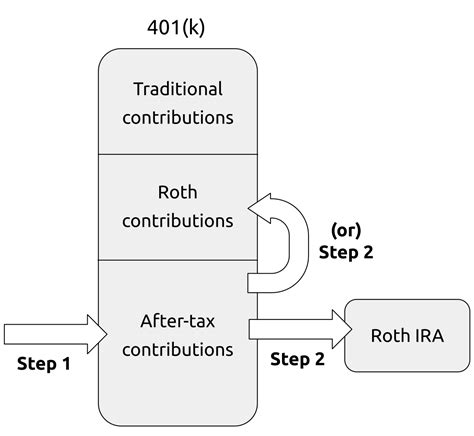

A rollover from a MyGA to an IRA is a strategic financial maneuver that allows individuals to transfer funds from a Money Guard Annuity to an Individual Retirement Account without incurring immediate tax liabilities. This process provides an opportunity to gain more control over retirement savings, potentially enhancing investment options and overall financial flexibility.

The appeal of this rollover lies in the ability to access a wider range of investment choices within the IRA, which can include stocks, bonds, mutual funds, and more. This diversification can lead to potentially higher returns and better alignment with an investor's risk tolerance and financial goals. Additionally, IRAs offer the advantage of tax-deferred growth, allowing earnings to compound over time without immediate tax implications.

However, it's important to approach this process with caution and a thorough understanding of the potential benefits and pitfalls. While a MyGA-to-IRA rollover can be advantageous, it requires careful planning and consideration to ensure that all the necessary steps are followed and that the benefits outweigh any potential drawbacks.

Benefits of the Rollover

The primary advantage of rolling over a MyGA to an IRA is the enhanced flexibility it offers. With an IRA, you gain the ability to invest in a broader range of assets, allowing for a more personalized and diversified investment strategy. This flexibility can be particularly beneficial if you wish to pursue a more aggressive investment approach or take advantage of specific market opportunities.

Another key benefit is the tax-deferred growth within an IRA. Unlike a MyGA, which typically offers a fixed or indexed rate of return, an IRA allows your investments to grow tax-free until you withdraw the funds. This means that your investments can compound over time without being reduced by immediate tax obligations, potentially leading to a larger retirement nest egg.

Additionally, an IRA provides the option of early withdrawal without the same penalties as a MyGA. While early withdrawals from an IRA may still be subject to certain fees, the flexibility to access your funds in case of an emergency or unexpected financial need can be a significant advantage.

| Benefit | Description |

|---|---|

| Flexibility | Broad investment choices and personalized strategies. |

| Tax-Deferred Growth | Compounding without immediate tax implications. |

| Early Withdrawal Option | Potential access to funds without MyGA penalties. |

Furthermore, rolling over a MyGA to an IRA can be a strategic move for those seeking to minimize tax liabilities in their retirement years. By transferring funds to an IRA, you can potentially reduce your overall tax burden by deferring taxes until withdrawal, which may occur when you are in a lower tax bracket.

The Rollover Process

The process of rolling over a MyGA to an IRA involves several key steps, each of which requires careful attention to detail to ensure a smooth and successful transition.

- Research and Planning: Before initiating the rollover, it's crucial to research and understand the potential benefits and drawbacks specific to your financial situation. Consult with a financial advisor or tax professional to ensure you're making an informed decision.

- Select an IRA Provider: Choose a reputable IRA provider that offers investment options aligned with your goals. Consider factors like fees, investment choices, and customer service when making your selection.

- Initiate the Rollover: Contact your MyGA provider and request a rollover kit or the necessary paperwork. Follow their instructions carefully to initiate the transfer process.

- Complete Required Forms: Fill out all necessary forms accurately and ensure they are submitted to the correct parties. This step is crucial to avoid delays or potential penalties.

- Choose Your Investment Strategy: Once the funds are in your IRA, decide on an investment strategy that aligns with your risk tolerance and financial goals. Consult with a financial advisor if needed.

Potential Pitfalls and Considerations

While a MyGA-to-IRA rollover can offer significant benefits, it's important to be aware of potential pitfalls and considerations to ensure a successful transition.

- Fees and Expenses: IRAs often come with various fees, including management fees, transaction fees, and administrative costs. Be sure to understand these fees and how they might impact your overall returns.

- Tax Implications: While the rollover itself is tax-free, there are potential tax implications when you withdraw funds from your IRA. Consult with a tax professional to understand how these withdrawals might affect your tax liability.

- Penalties for Early Withdrawal: While an IRA offers more flexibility than a MyGA, there are still penalties for early withdrawals before the age of 59½. Understand the rules and potential fees to avoid unexpected costs.

- Investment Risk: With the increased flexibility of an IRA, there is also an increased risk. Ensure that your investment strategy is well-thought-out and aligned with your risk tolerance to avoid potential losses.

Real-World Example

Let's consider the case of Sarah, a 55-year-old professional with a substantial MyGA balance. Sarah is looking to maximize her retirement savings and gain more control over her investment strategy. After careful consideration and consultation with a financial advisor, she decides to roll over her MyGA to an IRA.

Sarah selects a reputable IRA provider that offers a range of investment options, including stocks, bonds, and mutual funds. She initiates the rollover process, completing the necessary paperwork and transferring her funds. With the help of her advisor, she develops a personalized investment strategy that aligns with her risk tolerance and financial goals.

By rolling over her MyGA to an IRA, Sarah gains the flexibility to diversify her investments and potentially achieve higher returns. The tax-deferred growth within her IRA allows her savings to compound over time, and she appreciates the ability to access her funds early if needed without the same penalties as her MyGA.

Expert Insights

Conclusion

Rolling over a MyGA to an IRA can be a strategic move to enhance your retirement savings and financial flexibility. By understanding the benefits, the process, and the potential pitfalls, you can make an informed decision that aligns with your financial goals. Remember, it's always advisable to consult with a financial professional to ensure that your retirement planning is tailored to your unique circumstances.

Frequently Asked Questions

What is a MyGA (Money Guard Annuity)?

+A MyGA, or Money Guard Annuity, is a type of fixed indexed annuity that provides a guaranteed income stream for life. It offers income protection and the potential for growth, making it a popular choice for retirement planning.

What are the advantages of rolling over a MyGA to an IRA?

+The main advantages include increased flexibility in investment choices, tax-deferred growth within the IRA, and the potential for early withdrawal without the same penalties as a MyGA. This can lead to a more personalized retirement strategy and potentially higher returns.

What are the potential drawbacks of this rollover?

+Potential drawbacks include fees and expenses associated with IRAs, tax implications when withdrawing funds, penalties for early withdrawal, and the increased investment risk that comes with the flexibility of an IRA. It’s crucial to carefully consider these factors before making the decision to roll over.

Do I need a financial advisor for this process?

+While not mandatory, consulting a financial advisor can be highly beneficial. They can provide personalized advice based on your financial goals and risk tolerance, ensuring that the rollover aligns with your long-term financial plan.