Indiana 529 Tax Credit

The Indiana 529 Tax Credit is a valuable financial tool designed to encourage families to save for their children's education. This credit, available through the state's CollegeChoice 529 Direct Savings Plan, offers a unique opportunity for residents to invest in their future while enjoying substantial tax benefits. In this comprehensive guide, we will delve into the intricacies of the Indiana 529 Tax Credit, exploring its advantages, eligibility criteria, and the steps required to maximize its potential.

Understanding the Indiana 529 Tax Credit

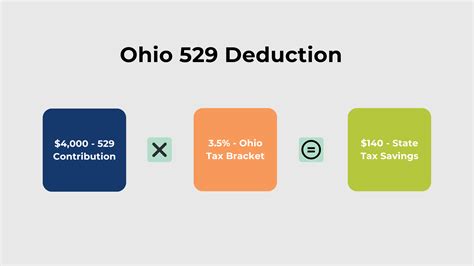

The Indiana 529 Tax Credit is a state-sponsored initiative aimed at making college savings more accessible and affordable for Hoosiers. It provides a credit against state income tax, offering a significant incentive for families to contribute to their 529 college savings plans.

The credit is available to Indiana residents who contribute to the CollegeChoice 529 Direct Savings Plan, a tax-advantaged savings program specifically designed for education expenses. This plan allows families to save for qualified higher education costs, including tuition, fees, books, and other related expenses, without incurring federal or state taxes on the growth of their investments.

Key Features of the Indiana 529 Tax Credit

The Indiana 529 Tax Credit stands out for its generous provisions and flexibility:

- Credit Amount: Account owners are eligible for a credit of 20% of their annual contributions, up to a maximum of 1,000 per beneficiary per year. This means that a family can save up to 5,000 per year for each child’s education and still receive the full tax credit.

- Qualified Contributions: The credit applies to contributions made to the CollegeChoice 529 Direct Savings Plan. These contributions can be made by the account owner, other family members, or even friends, making it a collaborative effort to fund a child’s education.

- Eligibility: Any Indiana resident with a valid state income tax filing requirement can claim the credit. This includes individuals, couples, and even those who are not the biological parents of the beneficiary, as long as they meet the state’s residency criteria.

Maximizing the Benefits of the Indiana 529 Tax Credit

To make the most of the Indiana 529 Tax Credit, careful planning and understanding of the program’s rules are essential. Here are some strategies to optimize your savings and tax benefits:

Strategic Contributions

To maximize the tax credit, it’s crucial to make contributions that align with the credit’s limits. Consider the following:

- If you’re planning to save a substantial amount, contribute 5,000 per beneficiary to claim the full 1,000 credit. This strategy ensures you don’t exceed the annual contribution limit and lose out on potential benefits.

- For those with multiple children or beneficiaries, spread your contributions evenly across accounts to ensure each child receives the maximum credit.

- Remember, the credit is based on the account owner’s contributions, so ensure you’re making the majority of the contributions to maximize your tax benefits.

Long-Term Planning

The Indiana 529 Tax Credit is designed to encourage long-term savings. Consider these aspects when planning:

- Start early: The sooner you begin saving, the more time your investments have to grow. This can significantly impact the overall value of your savings by the time your child reaches college age.

- Use the credit annually: Claiming the credit each year helps maintain consistent savings and allows you to take full advantage of the program’s benefits over time.

- Review your investment options: The CollegeChoice 529 Direct Savings Plan offers various investment options. Regularly assess your portfolio to ensure it aligns with your financial goals and risk tolerance.

Understanding Qualified Expenses

The Indiana 529 Tax Credit is designed to cover a wide range of qualified higher education expenses. Here are some key points to consider:

- Tuition and fees: The credit covers a broad range of tuition and mandatory fees, including those for undergraduate, graduate, and professional degree programs.

- Books and supplies: Textbooks, computers, and other educational materials necessary for a student’s academic pursuits are eligible expenses.

- Room and board: The credit can be applied to on-campus housing and meal plans, providing flexibility for students living away from home.

- Other qualified expenses: The plan also covers certain K-12 expenses, making it a versatile savings tool for families with children at various educational stages.

Performance and Real-World Examples

The Indiana 529 Tax Credit has proven to be a valuable asset for families across the state. Here’s a glimpse at its impact:

| Family Type | Annual Savings | Tax Credit Received |

|---|---|---|

| Single Parent with 1 Child | $4,000 | $800 |

| Couple with 2 Children | $8,000 (split evenly) | $1,600 for each parent |

| Grandparents Saving for Grandchild | $6,000 | $1,200 |

Future Implications and Considerations

As education costs continue to rise, the Indiana 529 Tax Credit plays a crucial role in helping families prepare for the future. By encouraging early and consistent savings, the program empowers families to take control of their financial destiny.

Looking ahead, it's essential to stay informed about any potential changes to the program. While the credit has been a stable feature of Indiana's financial landscape, keeping an eye on legislative updates is prudent. Additionally, exploring the broader benefits of 529 plans, such as their portability and potential federal tax advantages, can further enhance your financial strategy.

In conclusion, the Indiana 529 Tax Credit is a powerful tool for families looking to invest in their children's education. By understanding the program's nuances and maximizing its benefits, families can navigate the often-challenging landscape of higher education expenses with greater financial confidence.

Can I claim the Indiana 529 Tax Credit if I’m not the biological parent of the beneficiary?

+Yes, the credit is available to any Indiana resident with a valid state income tax filing requirement. This includes grandparents, aunts, uncles, and even friends who wish to contribute to a child’s education fund.

Are there any income limits for claiming the Indiana 529 Tax Credit?

+No, there are no income restrictions for claiming the credit. All Indiana residents who contribute to the CollegeChoice 529 Direct Savings Plan are eligible, regardless of their income level.

Can I roll over unused credits from one year to the next?

+Unfortunately, the credit is non-refundable and cannot be carried forward to future years. It’s important to plan your contributions strategically to make the most of the annual credit limit.

Are there any restrictions on the type of educational institution the credit can be used for?

+The credit can be applied to qualified expenses at any accredited college, university, or technical school, both within and outside Indiana. This flexibility allows families to choose the educational path that best suits their needs.