Tax Form For Independent Contractor

Welcome to this comprehensive guide on one of the most crucial aspects of an independent contractor's life: tax obligations. Whether you're a freelancer, consultant, or self-employed professional, understanding the tax landscape is essential to ensure compliance, manage finances effectively, and maximize deductions. In this expert-level article, we will delve into the world of tax forms for independent contractors, providing you with valuable insights and actionable advice to navigate this complex but vital process.

The Tax Landscape for Independent Contractors

As an independent contractor, your tax obligations differ from those of traditional employees. While employees typically have taxes automatically deducted from their paychecks, independent contractors are responsible for calculating and paying their taxes directly to the Internal Revenue Service (IRS) or other applicable tax authorities. This means you need to be well-versed in tax laws, forms, and deadlines to avoid penalties and ensure a smooth financial journey.

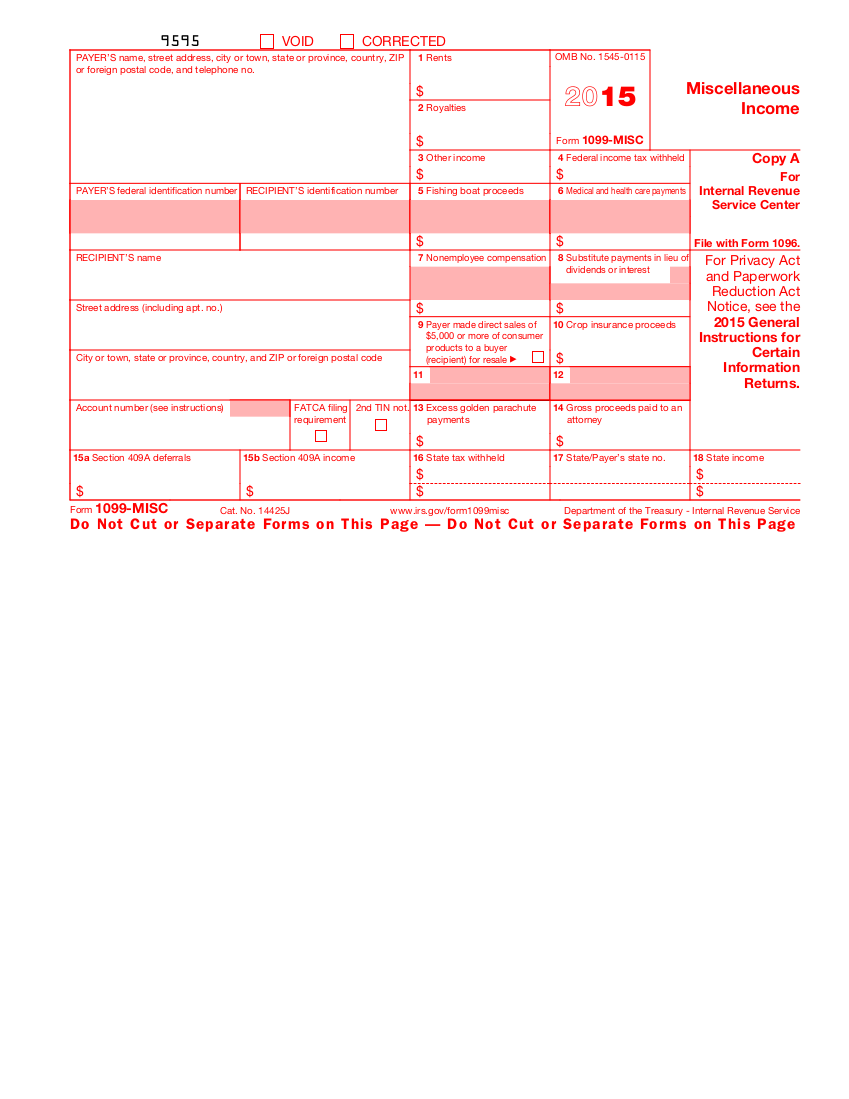

One of the key tax forms you'll encounter as an independent contractor is the 1099-MISC. This form is used to report various types of income, such as rental income, royalties, prizes, awards, and, most importantly for contractors, non-employee compensation. The 1099-MISC form is typically issued by clients or businesses that have paid you for services rendered. It serves as a record of your earnings and is crucial for accurately reporting your income to the tax authorities.

However, the 1099-MISC is not the only tax form you should be familiar with. Depending on your specific circumstances and income sources, you may need to consider other forms such as the 1099-NEC (Non-Employee Compensation), 1099-K (Payment Card and Third Party Network Transactions), or even the Schedule C (Profit or Loss From Business) if you operate a sole proprietorship.

Understanding the 1099-MISC: A Key Tax Form for Contractors

The 1099-MISC form is a critical document for independent contractors as it reports non-employee compensation. It is issued by businesses or clients who have paid you a certain threshold amount during the tax year. This form helps the IRS track income and ensure that contractors are properly reporting their earnings.

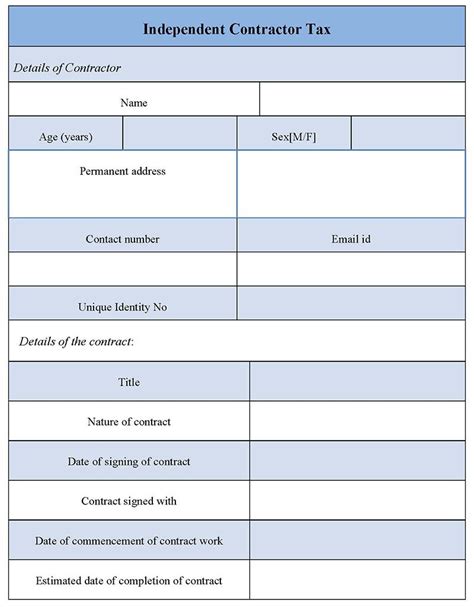

Here's a breakdown of the key sections of the 1099-MISC form:

Box 7: Non-employee Compensation

This box is where your client or business will report the total amount of payments made to you for services rendered. It includes all compensation for work performed as an independent contractor, such as consulting fees, commissions, or other types of earnings. It’s crucial to ensure that this amount matches your records to avoid any discrepancies during tax filing.

Other Boxes and Their Significance

- Box 3: Federal Income Tax Withheld: This box indicates any federal income tax withheld from your payments. While independent contractors are generally responsible for their own tax payments, some clients may choose to withhold taxes on a voluntary basis. This amount will be reflected here.

- Box 4: State/Local Income Tax Withheld: Similar to Box 3, this box shows any state or local income tax withheld from your payments. The presence of this amount depends on the client’s withholding practices and the tax laws in your jurisdiction.

- Box 8: Direct Sales: This box is relevant if you are involved in direct sales or similar businesses. It reports the total amount of direct sales made to your customers.

- Box 10: Fishing Boat Proceeds: Reserved for fishing boat operators, this box reports the total proceeds from fishing boat operations.

- Box 14: Gross Proceeds Paid to an Attorney: If you are an attorney, this box reports the gross proceeds paid to you by clients for legal services.

It's important to carefully review each box on the 1099-MISC form to ensure accuracy and to understand the implications for your tax filing. If there are any discrepancies or errors, it's crucial to address them with your client or the issuer of the form.

Navigating Tax Obligations as an Independent Contractor

Being an independent contractor comes with a unique set of tax responsibilities. Here are some key considerations to help you navigate this landscape:

Record-Keeping

Maintaining accurate and organized records is essential for independent contractors. Keep track of all income and expenses related to your business. This includes invoices, receipts, bank statements, and any other documents that support your financial transactions. Proper record-keeping not only ensures compliance but also simplifies the process of calculating deductions and filing taxes.

Estimating and Paying Taxes

As an independent contractor, you are responsible for estimating and paying your taxes throughout the year. This typically involves making quarterly estimated tax payments to the IRS. These payments cover both your income tax and self-employment tax obligations. Failing to make these payments on time can result in penalties and interest, so it’s crucial to stay on top of your tax liabilities.

Maximizing Deductions

Independent contractors have the opportunity to claim various deductions to reduce their taxable income. These deductions can significantly impact your tax liability and help you keep more of your hard-earned money. Common deductions for contractors include business expenses such as office rent, equipment, internet and phone bills, professional development costs, and even a portion of your home office expenses. Understanding which deductions you are eligible for and keeping proper documentation is key to maximizing your tax savings.

Seeking Professional Guidance

Tax laws can be complex, and the specific requirements for independent contractors can vary based on factors like your business structure, income sources, and industry. Consider consulting with a tax professional or accountant who specializes in working with contractors. They can provide personalized advice, help you navigate the intricacies of tax forms, and ensure you are taking advantage of all the deductions and credits available to you.

The Future of Tax Forms for Independent Contractors

The world of tax forms is constantly evolving, and independent contractors should stay informed about any changes that may impact their tax obligations. Here are some future trends and developments to watch:

Digital Tax Forms and Filing

The IRS and other tax authorities are increasingly embracing digital technologies to streamline the tax filing process. Electronic filing of tax forms is becoming more common, and contractors can expect to see continued improvements in online platforms and mobile apps for tax-related tasks. Staying up-to-date with these digital tools can simplify the tax preparation and filing process, making it more efficient and convenient.

Simplification of Tax Forms

Efforts to simplify tax forms and reduce the complexity of tax codes are ongoing. While the process is gradual, contractors may benefit from future changes that aim to make tax forms more user-friendly and easier to understand. Keep an eye on any proposed reforms or updates to tax legislation that could impact the forms you need to file.

Expanding Use of Data Analytics

Tax authorities are leveraging data analytics to enhance compliance and detect potential errors or fraud. As data-driven technologies advance, contractors may see more automated processes for data collection and analysis, which could impact how tax forms are prepared and filed. Being proactive in adopting digital tools and keeping accurate records will be essential to navigate these potential changes.

Conclusion: Empowering Independent Contractors with Tax Knowledge

Understanding tax forms and obligations is a critical aspect of being an independent contractor. By staying informed about the tax landscape, maintaining meticulous records, and seeking professional guidance when needed, you can ensure compliance, manage your finances effectively, and make the most of the deductions available to you. Remember, knowledge is power when it comes to taxes, and being proactive in your tax management can pay dividends in the long run.

What is the difference between a 1099-MISC and a 1099-NEC form?

+

The 1099-MISC form was previously used to report non-employee compensation, but as of 2020, the IRS introduced the 1099-NEC form specifically for this purpose. The 1099-NEC now serves as the primary form for reporting payments made to independent contractors for services performed. The 1099-MISC is still used for other types of income, such as rental income and prizes.

When do I need to file my tax return as an independent contractor?

+

The tax filing deadline for independent contractors is typically the same as for other taxpayers: April 15th of the year following the tax year. However, if you are unable to meet this deadline, you can request an extension. It’s important to note that requesting an extension only extends the time to file, not the time to pay any taxes owed.

How can I stay updated on changes to tax laws and forms?

+

Staying informed about tax law changes is crucial for independent contractors. Subscribe to newsletters or alerts from reputable tax organizations or professional bodies. Additionally, follow trusted news sources that cover tax-related topics. Regularly checking the IRS website for updates and announcements is also recommended.