Personal Property Tax Va Loudoun

Welcome to an in-depth exploration of the personal property tax system in Loudoun County, Virginia. This article aims to shed light on the ins and outs of this taxation process, providing valuable insights for residents and property owners in the area. As one of the wealthiest counties in the United States, Loudoun County's unique economic landscape and robust real estate market make understanding personal property taxes essential for both long-term residents and newcomers.

Understanding Personal Property Taxes in Loudoun County, VA

Personal property taxes are a significant source of revenue for local governments in Virginia, including Loudoun County. These taxes are levied on tangible personal property owned by individuals and businesses within the county. The revenue generated from personal property taxes is vital for funding various public services, infrastructure development, and educational initiatives.

In Loudoun County, the assessment and collection of personal property taxes are managed by the Commissioner of the Revenue's Office, which plays a crucial role in ensuring the fair and efficient administration of this tax system.

The Assessment Process: How Personal Property is Valued

The valuation process for personal property taxes in Loudoun County is comprehensive and follows a well-defined methodology. The Commissioner of the Revenue’s Office conducts annual assessments to determine the value of taxable personal property.

Here's a breakdown of the key steps in the assessment process:

- Data Collection: The Commissioner's Office gathers information on personal property owned by residents and businesses. This includes vehicles, boats, aircraft, recreational vehicles, and business equipment. Information is sourced from various channels, including registration data and self-reporting.

- Appraisal: Trained assessors use industry standards and market values to appraise the personal property. They consider factors such as age, condition, and depreciation to determine an accurate value. For vehicles, the assessed value is typically based on the National Automobile Dealers Association (NADA) guidelines.

- Notice of Assessment: After the appraisal, the Commissioner's Office issues a Notice of Assessment to the property owner. This notice details the assessed value of the personal property and the corresponding tax liability. Property owners have the right to appeal the assessment if they believe it is inaccurate.

- Appeal Process: Loudoun County offers a fair and transparent appeal process for property owners. Appeals are heard by the Board of Equalization, an independent body that reviews assessment disputes. Property owners can present evidence and arguments to support their case, ensuring a thorough review of their assessment.

The assessment process is designed to be fair and accurate, reflecting the current market value of personal property. This ensures that the tax burden is distributed equitably among property owners in the county.

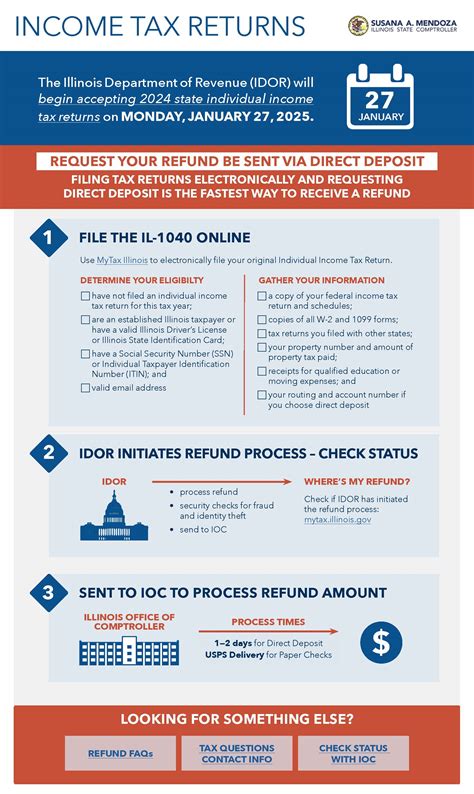

Tax Rates and Revenue Distribution

The personal property tax rate in Loudoun County is set annually by the Board of Supervisors. The tax rate is expressed in cents per 100 of assessed value. For example, a tax rate of 30 cents per 100 means that for every $100 of assessed value, the property owner pays 30 cents in taxes.

The revenue generated from personal property taxes is distributed to various county funds and local government entities. A significant portion goes towards funding public schools, which are highly regarded in Loudoun County. Other allocations include support for emergency services, road maintenance, and other essential public services.

| Personal Property Tax Revenue Distribution (Estimated) | |

|---|---|

| Public Schools | 45% |

| County Operations | 30% |

| Emergency Services | 15% |

| Road Maintenance and Infrastructure | 10% |

It's important to note that personal property tax rates can vary depending on the type of property and its use. For instance, vehicles and recreational equipment may have different tax rates compared to business equipment.

Tax Relief Programs: Supporting Loudoun County Residents

Loudoun County recognizes the importance of supporting its residents and offers various tax relief programs to alleviate the financial burden of personal property taxes. These programs are designed to assist specific groups, including seniors, disabled individuals, and low-income families.

- Senior Citizen Real Estate Tax Relief: Loudoun County provides real estate tax relief for senior citizens who meet certain age and income requirements. This program aims to help seniors maintain their independence and stay in their homes.

- Disabled Veterans Exemption: Disabled veterans are entitled to an exemption from personal property taxes on one vehicle. This exemption recognizes the sacrifices made by veterans and aims to provide financial support.

- Low-Income Tax Relief: The county offers tax relief for low-income individuals and families. This program helps ensure that personal property taxes do not disproportionately impact those with limited financial means.

These tax relief programs demonstrate Loudoun County's commitment to supporting its diverse community and ensuring that personal property taxes are manageable for all residents.

Online Services: Convenience and Efficiency

In an effort to provide convenient and efficient services, Loudoun County offers online platforms for personal property tax-related transactions. Residents and businesses can access these services through the county’s official website.

- Online Tax Payment: Property owners can make secure online payments for their personal property taxes. This option is not only convenient but also offers a faster and more efficient way to fulfill tax obligations.

- Personal Property Tax Records: Online access to personal property tax records allows property owners to review their assessment details, tax bills, and payment history. This transparency enhances accountability and provides valuable information for financial planning.

- Electronic Vehicle Registration: Loudoun County provides an electronic vehicle registration system, streamlining the process for vehicle owners. This online service saves time and reduces the need for in-person visits to government offices.

By embracing digital technologies, Loudoun County enhances the overall experience for residents and businesses, making personal property tax management more accessible and user-friendly.

Future Implications and Trends

As Loudoun County continues to experience rapid growth and economic development, the personal property tax system will play a crucial role in shaping the future of the county. Here are some key implications and trends to consider:

Economic Growth and Tax Revenue

Loudoun County’s robust economy, fueled by its proximity to Washington, D.C., and its thriving technology sector, has led to significant increases in personal property values. This trend is expected to continue, resulting in higher tax revenue for the county. As the economy expands, the personal property tax base will likely broaden, providing additional resources for public services and infrastructure projects.

Equitable Tax Distribution

With the county’s growing diversity and changing demographics, ensuring equitable tax distribution becomes increasingly important. Loudoun County recognizes the need to strike a balance between funding essential services and keeping tax rates manageable for all residents. The county’s commitment to fair assessments and tax relief programs will remain crucial in maintaining a sense of financial fairness.

Technology and Innovation

Loudoun County’s embrace of technology for personal property tax management is expected to continue and evolve. As digital transformation takes hold, the county may explore further innovations, such as blockchain-based record-keeping and smart contract technologies, to enhance security, efficiency, and transparency in the tax system.

Community Engagement and Transparency

Loudoun County values community engagement and transparency in its governance. The personal property tax system will likely continue to be a focus of public dialogue, with residents actively participating in discussions on tax rates, assessments, and the allocation of tax revenue. Open communication and citizen involvement will be essential in shaping a tax system that aligns with the values and needs of the community.

When is the personal property tax due in Loudoun County, VA?

+

Personal property taxes in Loudoun County are due by February 28th each year. However, it’s important to note that payments made after January 5th are subject to interest and penalties. Late payments can result in additional fees and potential enforcement actions.

How can I appeal my personal property tax assessment in Loudoun County?

+

To appeal your personal property tax assessment, you must file a written appeal with the Board of Equalization within 30 days of receiving your Notice of Assessment. The appeal process involves providing evidence and arguments to support your case. It’s recommended to consult the Commissioner of the Revenue’s Office for specific guidelines and requirements.

Are there any tax relief programs for seniors in Loudoun County?

+

Yes, Loudoun County offers a Senior Citizen Real Estate Tax Relief program. This program provides tax relief for senior citizens who meet certain age and income requirements. It’s designed to help seniors maintain their independence and stay in their homes. Contact the Commissioner of the Revenue’s Office for more information and eligibility criteria.

How can I pay my personal property taxes online in Loudoun County?

+

To pay your personal property taxes online, visit the Loudoun County government website and navigate to the online payment portal. You will need your account number and payment information to complete the transaction securely. Online payments are processed promptly, offering a convenient and efficient way to fulfill your tax obligations.