Illinois State Tax Refund

The Illinois State Tax Refund is a crucial aspect of financial planning for residents of the Prairie State. As taxpayers navigate the complex world of state taxes, understanding the intricacies of refunds can be both rewarding and challenging. This comprehensive guide aims to demystify the process, providing an in-depth analysis of the Illinois State Tax Refund system, its benefits, and how taxpayers can maximize their returns.

Unraveling the Illinois State Tax Refund System

Illinois, like many other states, has a progressive tax system, meaning the tax rate increases as taxable income increases. This system ensures that higher-income earners contribute a larger portion of their income to state revenue. However, the state also recognizes the importance of providing tax relief to its residents through various refund mechanisms.

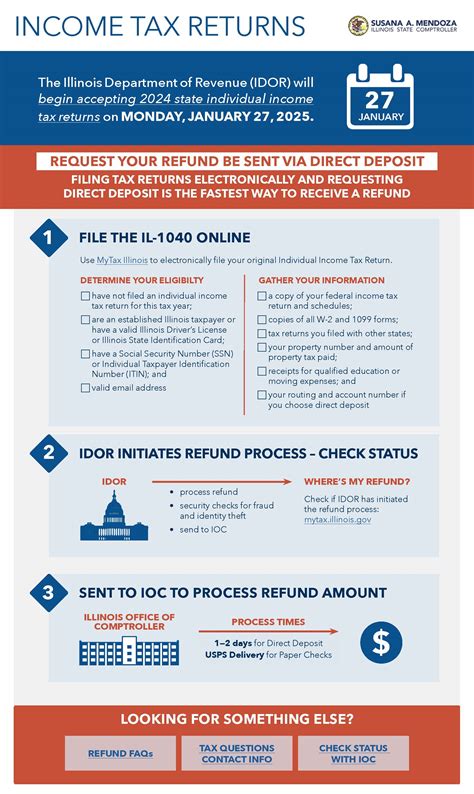

The Illinois Department of Revenue oversees the state's tax system, including the processing of tax returns and the issuance of refunds. Taxpayers are required to file their returns annually, typically by April 15th, to comply with federal and state tax laws.

One of the primary ways Illinois provides tax relief is through the Individual Income Tax Refund. This refund is designed to return excess tax payments to taxpayers, ensuring they are not overburdened by the state's tax system. The refund amount is calculated based on an individual's taxable income, deductions, and credits.

For instance, let's consider a hypothetical case of a single taxpayer, Ms. Smith, with an annual income of $50,000. If she has claimed all eligible deductions and credits, she might be eligible for a refund of approximately $1,200. This refund is a result of her tax liability being lower than the amount she has already paid through tax withholdings from her salary.

Eligibility and Calculation

To be eligible for an Illinois State Tax Refund, individuals must have earned income within the state during the tax year. This can include wages, salaries, tips, self-employment income, and certain other types of income. However, certain types of income, such as interest and dividends, are not taxed at the state level and therefore do not contribute to eligibility for a state tax refund.

The refund calculation takes into account various factors, including the taxpayer's filing status, number of dependents, and the amount of tax credits claimed. Illinois offers a range of tax credits, such as the Earned Income Tax Credit (EITC), which can significantly boost a taxpayer's refund. For instance, the EITC can provide a credit of up to $1,500 for eligible low- to moderate-income workers.

| Tax Credit | Description |

|---|---|

| Earned Income Tax Credit (EITC) | A refundable tax credit for low- to moderate-income workers, based on earned income and number of qualifying children. |

| Property Tax Credit | A non-refundable credit based on property taxes paid, available to homeowners and renters. |

| Senior Citizens Real Estate Tax Credit | A credit for individuals aged 65 or older with limited income, based on real estate taxes paid. |

The table above provides a glimpse into some of the tax credits available to Illinois taxpayers. These credits can substantially reduce a taxpayer's liability, potentially resulting in a larger refund.

Claiming Your Refund

To claim an Illinois State Tax Refund, taxpayers must file their state income tax return. This can be done online through the Illinois Department of Revenue's website or by using tax preparation software that integrates with the state's system. Alternatively, taxpayers can opt for paper filing by mailing their completed return to the appropriate processing center.

It is essential to ensure all information is accurate and complete to avoid processing delays or potential audits. This includes providing correct personal information, accurately reporting income, and substantiating all deductions and credits claimed.

Once the return is filed, the Department of Revenue processes the refund, which is typically issued within 4-6 weeks. However, during peak filing seasons, it may take longer. Taxpayers can track the status of their refund through the Department's website or by calling their toll-free number.

Maximizing Your Illinois State Tax Refund

While the Illinois State Tax Refund system provides a mechanism for taxpayers to reclaim excess tax payments, there are strategies taxpayers can employ to maximize their refunds.

Understanding Deductions and Credits

Illinois offers a range of deductions and credits that can significantly reduce a taxpayer's liability. Understanding these deductions and credits, and ensuring eligibility for them, is crucial to maximizing refunds.

For example, the Standard Deduction is a set amount that taxpayers can subtract from their income, reducing their taxable income. This deduction varies based on the taxpayer's filing status and is adjusted annually for inflation. By claiming the standard deduction, taxpayers can simplify their tax filing process and potentially reduce their taxable income significantly.

Additionally, Illinois provides various tax credits, such as the Property Tax Credit and the Senior Citizens Real Estate Tax Credit, which can provide substantial relief to eligible taxpayers. These credits are designed to assist specific groups, such as homeowners and senior citizens, by reducing their overall tax burden.

Optimizing Withholdings

Another strategy to maximize your Illinois State Tax Refund is to ensure your withholdings are optimized throughout the year. Taxpayers can adjust their withholdings by completing a new Form W-4 with their employer. By claiming the correct number of allowances, taxpayers can ensure they are not over-withholding and can potentially increase their take-home pay each pay period.

However, it's important to strike a balance. Under-withholding can lead to a tax liability at the end of the year, resulting in a reduced refund or even an additional tax payment. It's advisable to consult with a tax professional or use tax planning tools to ensure your withholdings are appropriately set.

Exploring Tax Preparation Options

Utilizing tax preparation software or engaging the services of a tax professional can also help maximize your refund. These tools and professionals can guide you through the complex world of deductions and credits, ensuring you don't miss out on any potential savings.

Tax preparation software often comes equipped with built-in calculators and guidelines that simplify the process of claiming deductions and credits. These tools can also help identify potential errors or oversights in your tax return, ensuring you receive the maximum refund you're entitled to.

Future Implications and Changes

As Illinois continues to evolve its tax system, it's important for taxpayers to stay informed about potential changes that may impact their refunds. While the state has historically maintained a progressive tax system, there have been discussions about potential reforms, including the introduction of a flat tax rate or the expansion of certain tax credits.

For instance, there have been proposals to increase the Earned Income Tax Credit, providing greater relief to low- and middle-income families. Such a change could significantly impact the refund amounts received by eligible taxpayers. It's crucial for taxpayers to stay updated on these discussions and potential changes to ensure they can adapt their tax planning strategies accordingly.

Furthermore, Illinois has also been exploring the use of technology to enhance its tax system. The state has implemented initiatives to streamline the tax filing process and improve refund processing times. These technological advancements can lead to more efficient tax administration, potentially reducing processing times and increasing the accuracy of refunds.

Frequently Asked Questions

When will I receive my Illinois State Tax Refund?

+The processing time for Illinois State Tax Refunds typically ranges from 4 to 6 weeks. However, during peak filing seasons, it may take longer. You can track the status of your refund through the Illinois Department of Revenue's website or by calling their toll-free number.

<div class="faq-item">

<div class="faq-question">

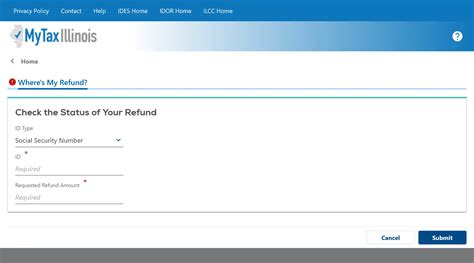

<h3>How can I check the status of my Illinois State Tax Refund?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can check the status of your refund by visiting the Illinois Department of Revenue's website and using their online refund status tool. You'll need to provide your Social Security Number and the amount of your expected refund. Alternatively, you can call their toll-free number and follow the instructions to check your refund status.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What if I haven't received my Illinois State Tax Refund after the expected processing time?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you haven't received your refund after the expected processing time, it's advisable to contact the Illinois Department of Revenue. They can help you track your refund and investigate any potential delays. Ensure you have your tax return information, including your Social Security Number and the amount of your expected refund, ready when you contact them.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any penalties for filing my Illinois State Tax Return late?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are penalties for filing your Illinois State Tax Return late. The state imposes a late filing penalty of 5% of the tax due per month, up to a maximum of 25%. Additionally, there is a late payment penalty of 1/2% per month, up to a maximum of 25%. However, if you are due a refund, there are no penalties for filing late.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I receive my Illinois State Tax Refund in a different form, such as a check or direct deposit?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you have the option to receive your Illinois State Tax Refund through various methods. When filing your tax return, you can choose to receive your refund via direct deposit, which is the fastest option. Alternatively, you can opt for a paper check to be mailed to your address. Ensure you provide accurate banking information or your mailing address to avoid any delays.</p>

</div>

</div>

</div>