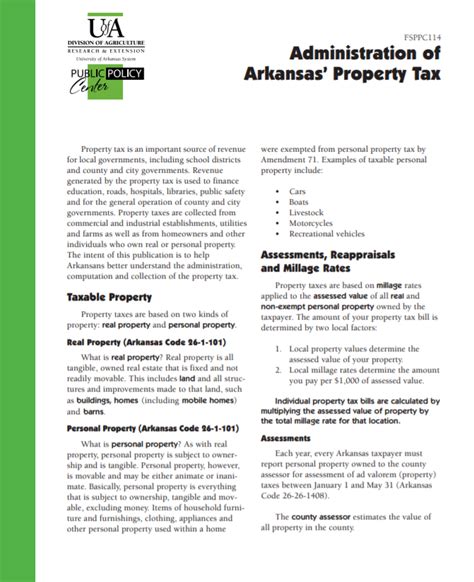

Personal Property Tax Arkansas

Arkansas is one of the states in the United States that imposes a personal property tax, a levy on the value of personal property owned by individuals or entities. Personal property in this context refers to tangible assets other than real estate, such as vehicles, boats, jewelry, furniture, and other valuables. This tax contributes to the state's revenue and helps fund essential public services, including education, infrastructure, and public safety.

Understanding Personal Property Tax in Arkansas

The personal property tax in Arkansas is an ad valorem tax, meaning it is based on the assessed value of the property. The tax is calculated as a percentage of the property’s assessed value, and this rate may vary depending on the county and the type of property. The assessed value is typically determined by local assessors, who evaluate the property’s worth based on factors such as market value, condition, and depreciation.

Arkansas has a unique approach to personal property taxation, as it exempts certain types of personal property from taxation. These exemptions are designed to provide relief to specific groups of taxpayers and to encourage certain activities or investments. Understanding these exemptions is crucial for individuals and businesses in Arkansas to ensure they are not overpaying their taxes.

Exemptions and Relief

One notable exemption in Arkansas is for household goods and personal effects. This means that items such as furniture, clothing, appliances, and other personal belongings used for everyday living are generally exempt from personal property tax. This exemption provides a significant relief for homeowners and renters alike, as it removes the burden of taxing everyday items that are essential for daily life.

Additionally, Arkansas offers an exemption for certain business-related personal property. This exemption applies to tangible personal property used in the production of income, such as machinery, equipment, and inventory. This provision aims to encourage business investment and economic growth in the state by reducing the tax burden on businesses. However, it is important to note that there are specific criteria and limitations for this exemption, and businesses should consult with tax professionals to ensure compliance.

Another important exemption in Arkansas is for personal vehicles. While vehicle ownership is generally subject to personal property tax, Arkansas provides a cap on the assessed value of vehicles for taxation purposes. This means that once a vehicle reaches a certain age or value threshold, it becomes exempt from further personal property taxation. This exemption recognizes the depreciation of vehicles over time and provides relief to vehicle owners.

| Exemption Category | Description |

|---|---|

| Household Goods | Personal belongings and furniture used for daily living are exempt. |

| Business Property | Tangible assets used in income-generating activities are exempt with certain criteria. |

| Vehicles | Vehicles are exempt once they reach a certain age or value threshold. |

Assessing Personal Property

In Arkansas, the assessment of personal property for tax purposes is typically conducted by county assessors. These assessors are responsible for determining the fair market value of personal property within their jurisdiction. They consider various factors, including purchase price, age, condition, and comparable sales data, to arrive at an accurate assessment.

Taxpayers are generally required to report their personal property holdings to the local assessor's office. This reporting process often involves completing a personal property tax return, providing details about the type and value of personal property owned. The assessor then reviews these returns and may conduct further assessments or audits to ensure accurate valuation.

Valuation Methods

Arkansas employs several valuation methods to assess personal property. The most common method is the market value approach, where the assessor determines the fair market value of the property based on its sale price in an open market. This method considers factors such as the property’s location, condition, and recent sales of similar properties.

Another method used in Arkansas is the cost approach, which estimates the property's value based on its replacement cost. This approach considers the cost of acquiring or constructing similar property, minus any depreciation. The depreciation calculation takes into account factors such as age, condition, and obsolescence.

Additionally, Arkansas may use the income approach for certain types of personal property, particularly income-generating assets like rental properties or commercial equipment. This method assesses the property's value based on its potential to generate income, taking into account factors like rental rates, occupancy rates, and expenses.

| Valuation Method | Description |

|---|---|

| Market Value Approach | Determines value based on open market sales. |

| Cost Approach | Estimates value based on replacement cost minus depreciation. |

| Income Approach | Assesses value based on income-generating potential. |

Tax Rates and Calculations

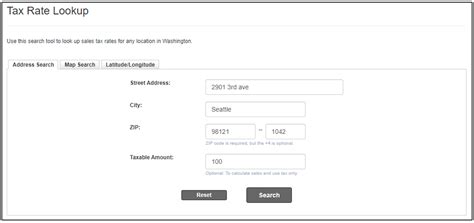

The personal property tax rate in Arkansas varies depending on the county and the type of property. County tax rates are established by local governments and may differ significantly from one county to another. These rates are typically expressed as a percentage of the assessed value of the property.

For example, in County A, the personal property tax rate for residential property might be 0.5%, while in County B, the rate could be 0.75%. These rates are applied to the assessed value of the property to calculate the tax liability. It's important for taxpayers to be aware of the specific tax rates applicable to their county and property type.

The tax calculation process involves multiplying the assessed value of the property by the applicable tax rate. This calculation provides the tax liability for the property. It's worth noting that Arkansas may also impose additional taxes or surcharges on certain types of personal property, such as luxury vehicles or high-value assets.

Tax Due Dates and Payment Options

The due dates for personal property tax payments in Arkansas are typically established by the local tax authority. These due dates may vary from county to county, and it’s crucial for taxpayers to be aware of the specific deadlines to avoid penalties and interest charges.

Arkansas offers various payment options for personal property taxes. Taxpayers can typically pay their taxes online through the county's website or by mailing a check to the appropriate tax office. Some counties may also accept payments in person at designated tax collection centers. It's advisable to check with the local tax authority for the most up-to-date payment options and instructions.

Challenging Assessments and Appeals

Taxpayers in Arkansas have the right to challenge their personal property tax assessments if they believe the assessed value is inaccurate or unfair. The appeal process allows taxpayers to dispute the valuation or classification of their property and seek a reduction in their tax liability.

To initiate an appeal, taxpayers must generally file a formal written request with the county assessor's office within a specified timeframe. The assessor's office will then review the appeal and may request additional information or documentation to support the taxpayer's claim. If the assessor upholds the original assessment, taxpayers have the option to appeal further to a higher authority, such as a county board of equalization or a state tax commission.

Appeal Procedures and Outcomes

The appeal process in Arkansas typically involves several stages. First, the taxpayer presents their case to the county assessor, providing evidence and arguments to support their claim. If the assessor agrees with the taxpayer’s appeal, the assessment may be adjusted, and the taxpayer’s tax liability will be recalculated accordingly.

If the assessor does not agree with the appeal, the taxpayer can proceed to the next level of appeal, which may involve a hearing before a board of equalization or a similar administrative body. During this hearing, the taxpayer has the opportunity to present their case and provide additional evidence. The board will then make a decision based on the presented information.

In some cases, the taxpayer may not be satisfied with the outcome of the administrative appeal and may choose to take their case to court. This option is typically reserved for complex cases or when significant tax savings are at stake. Court proceedings can be lengthy and require extensive preparation, so it's advisable to consult with a tax attorney or legal professional before pursuing this route.

| Appeal Stage | Description |

|---|---|

| County Assessor Review | Taxpayer presents case to the county assessor. |

| Board of Equalization Hearing | Hearing before an administrative body to review the assessment. |

| Court Appeal | Taxpayer can take the case to court for further review. |

Conclusion

Personal property tax in Arkansas is an essential component of the state’s revenue system, contributing to the funding of vital public services. While the tax can be a burden for some taxpayers, Arkansas provides exemptions and relief measures to ease the tax burden on individuals and businesses. Understanding the assessment process, tax rates, and appeal procedures is crucial for taxpayers to navigate the personal property tax system effectively.

By staying informed about their tax obligations and taking advantage of available exemptions, taxpayers in Arkansas can ensure they are paying their fair share while also maximizing their tax relief opportunities. Consulting with tax professionals and staying updated with the latest tax guidelines and regulations is highly recommended to navigate the complexities of personal property taxation in Arkansas.

How often do I need to report my personal property holdings to the assessor’s office in Arkansas?

+

In Arkansas, personal property tax returns are typically due annually. Taxpayers are required to report their personal property holdings each year to ensure accurate assessment and taxation. The due date for filing these returns may vary by county, so it’s important to check with the local assessor’s office for specific deadlines.

Are there any penalties for late payment of personal property taxes in Arkansas?

+

Yes, Arkansas imposes penalties for late payment of personal property taxes. The specific penalties may vary by county, but they typically include interest charges and potential additional fees. It’s important to pay your taxes on time to avoid these penalties and maintain a good standing with the local tax authority.

Can I deduct my personal property tax payments from my federal income tax return in Arkansas?

+

The deductibility of personal property taxes from federal income tax returns depends on various factors, including your income level, filing status, and other deductions claimed. Generally, personal property taxes are considered a state and local tax (SALT) deduction, but there are limitations. It’s advisable to consult with a tax professional or refer to IRS guidelines for specific information on deducting state and local taxes.