California Income Tax Refund Status

California's income tax refund system is an essential aspect of the state's financial landscape, impacting millions of residents each year. The process of filing taxes and receiving refunds can be complex, and many Californians eagerly await the status updates on their refund checks. In this comprehensive guide, we will delve into the intricacies of the California Income Tax Refund process, providing valuable insights and information to help taxpayers navigate this critical financial journey.

Understanding California Income Tax Refunds

California, known for its vibrant economy and diverse population, has a progressive income tax system. The state’s tax authority, the Franchise Tax Board (FTB), administers the collection and distribution of income taxes. Understanding the tax refund process is crucial for taxpayers, as it involves several key steps and considerations.

When taxpayers file their income tax returns, they may be eligible for a refund if they have overpaid their taxes during the year. This overpayment can occur due to various reasons, such as tax deductions, credits, or changes in income. The FTB processes these returns and issues refunds accordingly.

The Role of the Franchise Tax Board

The Franchise Tax Board plays a central role in California’s tax system. It is responsible for enforcing tax laws, collecting income taxes, and administering various tax programs. The FTB’s primary goal is to ensure that taxpayers comply with state tax regulations and receive the refunds they are entitled to.

The FTB's website serves as a valuable resource for taxpayers, providing information on tax laws, forms, and refund status updates. Taxpayers can access their personal accounts, view their tax records, and track the progress of their refund checks.

Tax Filing Deadlines and Refunds

California’s tax filing deadlines are critical to understanding the refund process. The standard deadline for filing income tax returns is April 15th of each year. However, this deadline may be extended under certain circumstances, such as natural disasters or other emergencies.

It's important for taxpayers to file their returns on time to avoid penalties and interest charges. Late filing can also delay the processing of refunds, as the FTB prioritizes timely filed returns.

Once the FTB receives a tax return, it undergoes a thorough review process. This process includes verifying the taxpayer's identity, checking for errors or omissions, and ensuring compliance with state tax laws. The review process can take several weeks, and taxpayers often anxiously await updates on their refund status during this time.

Tracking Your California Income Tax Refund

Tracking the status of your income tax refund is a crucial step in the tax process. The FTB offers several methods for taxpayers to check the progress of their refunds, ensuring transparency and peace of mind.

Online Refund Status Check

The most convenient way to track your California income tax refund is through the FTB’s online portal. Taxpayers can access their personal accounts by visiting the FTB website and entering their login credentials. Once logged in, they can view their refund status, estimated refund amount, and any messages or updates from the FTB.

The online refund status check provides real-time information, allowing taxpayers to stay informed about the progress of their refund. It eliminates the need for phone calls or visits to FTB offices, making the process more efficient and convenient.

Phone and Mail Inquiries

For taxpayers who prefer traditional methods, the FTB offers phone and mail services for refund status inquiries. Taxpayers can call the FTB’s toll-free number and speak to a representative who can provide refund status updates and answer any questions.

Additionally, taxpayers can send a written request to the FTB by mail. The request should include the taxpayer's name, address, and Social Security number, along with a clear statement of the refund status inquiry. The FTB will respond to the taxpayer's address within a reasonable timeframe.

Refund Processing Times

The time it takes for the FTB to process income tax refunds can vary depending on several factors. Generally, taxpayers can expect their refunds within 60 days of filing their returns. However, there are instances where refunds may take longer to process.

Factors that can influence refund processing times include the complexity of the tax return, errors or discrepancies, and the volume of returns received by the FTB. During peak tax seasons, the FTB may experience a higher workload, leading to slightly longer processing times.

Common Issues and Troubleshooting

While the California income tax refund process is designed to be efficient, there may be instances where taxpayers encounter issues or delays. Understanding these common problems and knowing how to troubleshoot them can be beneficial.

Missing or Incorrect Information

One of the most common reasons for refund delays is missing or incorrect information on the tax return. The FTB requires accurate and complete information to process refunds. Taxpayers should double-check their returns for errors, ensuring that all personal and financial details are correct.

If the FTB identifies missing or incorrect information, it may send a notice to the taxpayer requesting additional documentation or corrections. Responding promptly to these notices is crucial to avoid further delays in the refund process.

Identity Verification and Fraud Prevention

The FTB takes measures to prevent tax fraud and identity theft. As part of its fraud prevention efforts, the FTB may require additional identity verification steps for certain taxpayers. This process ensures that refunds are issued to the rightful recipients.

Taxpayers who receive a notice requesting identity verification should follow the instructions provided. This may involve providing additional documentation or using secure online platforms to verify their identity. Cooperating with the FTB's fraud prevention measures is essential to protect taxpayers' rights and prevent unauthorized refund claims.

Address Changes and Refund Deposits

Another common issue that can arise during the refund process is an outdated address. Taxpayers who have recently moved should ensure that their current address is updated with the FTB. Failure to do so may result in refund checks being mailed to the wrong address, causing delays or the need for further action.

The FTB allows taxpayers to update their address online or by mail. Providing accurate and up-to-date contact information is crucial to receiving refunds promptly and avoiding the hassle of redirecting or resending checks.

Maximizing Your Refund

Maximizing your California income tax refund requires careful planning and knowledge of available tax credits and deductions. By understanding these opportunities, taxpayers can reduce their tax liabilities and increase their refund amounts.

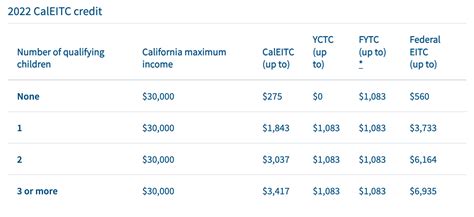

Tax Credits and Deductions

California offers various tax credits and deductions that can significantly impact a taxpayer’s refund. Some of the key tax credits available include the California Earned Income Tax Credit (CalEITC), the Child and Dependent Care Credit, and the Education Tax Credits. These credits can provide substantial benefits to eligible taxpayers.

Additionally, taxpayers can take advantage of deductions for expenses such as mortgage interest, charitable contributions, and medical costs. By carefully tracking and documenting these expenses, taxpayers can maximize their deductions and increase their refund potential.

Tax Preparation Services and Software

Navigating the complexities of tax filing and maximizing refunds can be simplified with the help of tax preparation services and software. These tools guide taxpayers through the filing process, ensuring that all relevant credits and deductions are considered.

Tax preparation services, such as H&R Block or TurboTax, offer expert assistance and customized solutions for taxpayers. These services can provide valuable advice, ensuring that taxpayers make the most of their tax returns and receive the maximum refund possible.

Tax Planning Strategies

Tax planning is a proactive approach to managing one’s financial affairs and optimizing tax refunds. By engaging in strategic tax planning, taxpayers can make informed decisions throughout the year to maximize their refunds.

Some tax planning strategies include contributing to retirement accounts, such as IRAs or 401(k)s, which offer tax advantages. Additionally, taxpayers can explore options for tax-efficient investing, such as using tax-advantaged investment vehicles like Roth IRAs or tax-free municipal bonds.

Future of California Income Tax Refunds

As technology advances and tax systems evolve, the future of California income tax refunds looks promising. The FTB is continuously improving its processes and adopting innovative solutions to enhance the taxpayer experience.

Digital Transformation and Online Services

The FTB is embracing digital transformation, aiming to provide more efficient and user-friendly online services. This includes enhancing its online portal, offering improved refund tracking features, and implementing secure digital identity verification methods.

By leveraging technology, the FTB aims to reduce processing times, improve accuracy, and provide taxpayers with a seamless experience when filing their returns and tracking their refunds.

Tax Reform and Policy Changes

California’s tax policies are subject to ongoing discussions and potential reforms. While it is challenging to predict specific changes, taxpayers can expect continued efforts to simplify the tax system and improve refund processes.

The FTB and state policymakers recognize the importance of a fair and efficient tax system. They aim to strike a balance between revenue generation and taxpayer convenience, ensuring that California's tax policies remain competitive and beneficial to its residents.

Community Engagement and Education

The FTB actively engages with taxpayers and community organizations to promote tax literacy and awareness. By educating taxpayers about their rights and responsibilities, the FTB aims to foster a culture of compliance and empower individuals to make informed financial decisions.

Community outreach programs, tax clinics, and educational resources play a vital role in ensuring that taxpayers understand the tax system and can navigate it successfully. The FTB's commitment to community engagement helps build trust and ensures that taxpayers receive the support they need.

How long does it typically take to receive a California income tax refund after filing my return?

+

On average, it takes approximately 60 days to receive your California income tax refund after filing your return. However, factors such as the complexity of your return, errors, or the volume of returns received by the FTB can influence processing times.

What should I do if I haven’t received my refund after the estimated processing time has passed?

+

If you haven’t received your refund after the estimated processing time, it’s recommended to check the status of your refund online or contact the FTB. They can provide updates and assist you in resolving any issues.

Can I track my refund status if I filed my taxes jointly with my spouse?

+

Yes, you can track the status of your refund even if you filed jointly with your spouse. Both taxpayers can access their individual accounts on the FTB website to view the refund status and estimated amount.

Are there any penalties for filing my California income tax return late?

+

Yes, filing your California income tax return late can result in penalties and interest charges. It’s important to file your return by the deadline to avoid these additional costs.

Can I check my refund status by phone if I don’t have access to the internet?

+

Absolutely! The FTB provides a toll-free number for refund status inquiries. You can call their customer service line and speak to a representative who can provide you with the latest updates on your refund.