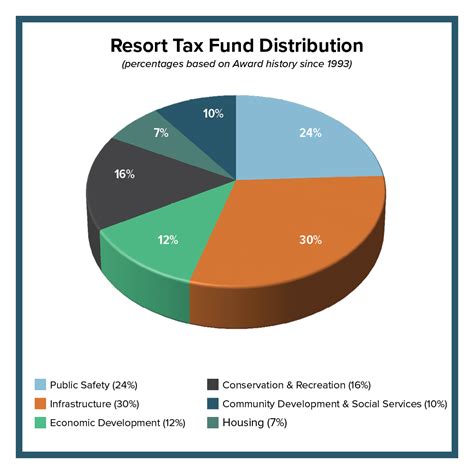

Resort Tax

Resort tax, also known as resort fee, is a common practice in the hospitality industry, particularly in certain regions and types of accommodations. It is an additional fee charged to guests, separate from the room rate, for various services and amenities offered by the resort or hotel. This practice has sparked debates and discussions among travelers, industry experts, and regulatory bodies, leading to a complex landscape of opinions and varying experiences. In this comprehensive guide, we will delve into the world of resort taxes, exploring their origins, impact, and the considerations travelers must make when encountering them.

The Rise of Resort Taxes: Origins and Implementation

The concept of resort taxes can be traced back to the early 2000s, with its emergence largely attributed to the growing demand for all-inclusive experiences and the desire of resort owners to enhance their revenue streams. Initially, these fees were introduced as a means to cover the costs of amenities such as fitness centers, swimming pools, and other recreational facilities, often marketed as a way to provide guests with a more comprehensive and convenient stay.

However, over time, the implementation of resort taxes has evolved, and they are now often applied to a wide range of services, including internet access, local phone calls, and even basic housekeeping. In some cases, resort taxes have become a significant portion of the overall cost of a stay, leading to concerns among travelers and advocacy groups.

The adoption of resort taxes varies across regions and even within different properties in the same area. Some destinations, particularly those known for their luxurious resorts and high-end amenities, have embraced this practice as a standard. For instance, in certain popular vacation spots like Las Vegas, Nevada, and parts of Florida, resort taxes are almost universally applied, often reaching double-digit percentages of the room rate.

Understanding the Impact: Advantages and Disadvantages

Resort taxes have both positive and negative implications for travelers and the hospitality industry as a whole. On the one hand, these fees can provide a more transparent pricing structure, allowing guests to understand the breakdown of costs and the value they receive for their money. Additionally, resort taxes can incentivize properties to invest in and maintain high-quality amenities, leading to improved guest experiences.

However, the drawbacks of resort taxes are substantial. For travelers, the sudden addition of these fees can be a significant surprise, especially when they are not adequately disclosed during the booking process. This lack of transparency can lead to feelings of being misled or overcharged, damaging the trust between guests and the industry. Furthermore, resort taxes can disproportionately affect budget-conscious travelers, potentially pricing them out of certain destinations or properties.

From an industry perspective, the implementation of resort taxes can be a double-edged sword. While they can indeed generate additional revenue, they also carry the risk of alienating guests and damaging a property's reputation. Additionally, the administrative burden of managing and collecting these fees can be significant, requiring dedicated staff and systems.

Transparency and Disclosure: A Critical Consideration

One of the key issues surrounding resort taxes is the transparency with which they are presented to guests. In an ideal scenario, travelers should have a clear understanding of the fees they will incur before making a booking. Unfortunately, this is not always the case, with some properties employing tactics to downplay or hide the existence of resort taxes until the final stages of the booking process.

Travelers should be vigilant when researching accommodations and take the time to thoroughly review the fine print of booking websites and hotel descriptions. Look for mentions of "resort fees," "amenity fees," or similar terms, and ensure that you understand what these fees cover and how they are calculated. Websites and travel agents should be held accountable for providing accurate and up-front information about these charges.

The Future of Resort Taxes: Regulatory and Industry Responses

The growing concern over resort taxes has not gone unnoticed by regulatory bodies and industry associations. In recent years, there have been efforts to address the issue and ensure a more balanced approach to their implementation.

Some destinations have taken steps to regulate resort taxes, with local governments imposing caps or guidelines on their usage and disclosure. For example, in certain cities, resort taxes must be displayed prominently during the booking process, and properties are required to provide a detailed breakdown of the services covered by these fees.

Additionally, industry associations have begun to address the issue through initiatives aimed at promoting transparency and fairness. The American Hotel & Lodging Association (AHLA), for instance, has developed guidelines encouraging hotels to disclose resort fees clearly and provide value-added services in return.

Navigating Resort Taxes: Strategies for Travelers

For travelers, encountering resort taxes can be a frustrating experience, but there are strategies to mitigate their impact and ensure a more enjoyable journey.

Research and Compare

Before finalizing your travel plans, take the time to research and compare different accommodations. Look beyond the room rates and consider the potential addition of resort taxes. Some properties may advertise lower base rates but have higher resort fees, while others may include a range of amenities in their base rate, making them a more cost-effective choice.

Consider All-Inclusive Options

If you are particularly concerned about unexpected fees, consider opting for all-inclusive resorts. These properties typically bundle a wide range of amenities and services into the room rate, providing a more predictable and transparent pricing structure. While all-inclusive resorts may have higher base rates, they can offer excellent value for travelers seeking a hassle-free experience.

Negotiate and Advocate

In certain situations, it may be possible to negotiate resort fees or even waive them altogether. This is more likely to occur during off-peak seasons or when booking directly with the property. By demonstrating your loyalty or willingness to stay for an extended period, you may be able to persuade the hotel to reduce or eliminate the resort tax.

Explore Alternative Accommodations

If resort taxes are a significant concern, consider exploring alternative types of accommodations. For example, vacation rentals, such as those offered by Airbnb, often do not charge resort fees, providing a more straightforward pricing structure. Additionally, boutique hotels and bed and breakfasts may offer a more personalized experience without the added costs of resort taxes.

The Bottom Line: Making Informed Choices

Resort taxes are an integral part of the hospitality landscape, and their presence is likely to continue. As a traveler, it is essential to approach these fees with knowledge and awareness, ensuring that you make informed choices that align with your budget and preferences.

By staying vigilant, researching thoroughly, and advocating for transparency, you can navigate the world of resort taxes and find accommodations that provide the best value for your travel needs. Remember, your experience as a traveler is valuable, and your choices can influence the industry's approach to pricing and disclosure.

Conclusion: A Call for Continued Dialogue

The debate surrounding resort taxes highlights the complex relationship between travelers, the hospitality industry, and regulatory bodies. While these fees may provide certain benefits, their implementation must be fair, transparent, and aligned with the expectations of guests.

As the industry continues to evolve, it is crucial for all stakeholders to engage in an open dialogue, seeking solutions that balance the needs of businesses and travelers alike. By fostering an environment of trust and clarity, we can ensure that resort taxes remain a tool for improvement rather than a source of confusion and dissatisfaction.

Are resort taxes mandatory, or can I opt out of paying them?

+Resort taxes are generally mandatory and are considered a standard charge for using the amenities and services provided by the resort. While you cannot opt out of paying these taxes, you can choose accommodations that do not charge resort fees or have lower fees compared to others in the area.

How can I identify if a resort charges a resort tax before booking?

+When researching accommodations, pay close attention to the fine print and look for mentions of “resort fees,” “amenity fees,” or similar terms. Some booking websites and travel agents also provide a breakdown of fees during the booking process. Additionally, you can contact the resort directly to inquire about their fee structure.

Can I negotiate resort taxes with the hotel or resort?

+Negotiating resort taxes can be challenging, but it is not impossible. During off-peak seasons or when booking directly with the property, you may have more leverage to negotiate. However, it is important to note that resort taxes are often considered a standard charge, and properties may be less flexible in waiving them.

What happens if I refuse to pay the resort tax during my stay?

+Refusing to pay the resort tax during your stay can lead to various consequences, including additional fees, administrative penalties, or even the cancellation of your reservation. It is important to understand that resort taxes are a legal requirement, and refusing to pay them can result in significant issues during your stay.