Property Taxes Sacramento County

Property taxes are a significant aspect of homeownership, and in Sacramento County, California, understanding the ins and outs of this financial obligation is crucial for residents and prospective buyers alike. The tax system in Sacramento County is structured to support local government services, including schools, public safety, and infrastructure maintenance. This article delves into the intricacies of property taxes in Sacramento County, providing an in-depth analysis to help you navigate this essential aspect of homeownership.

Understanding Property Taxes in Sacramento County

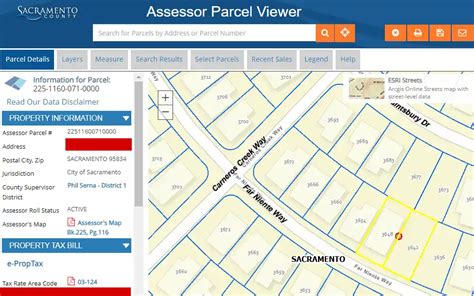

Property taxes in Sacramento County are levied on real estate property, which includes land, buildings, and any permanent fixtures. These taxes are a primary source of revenue for local governments, and their calculation is based on the assessed value of the property. The assessment process is conducted by the Sacramento County Assessor’s Office, which determines the taxable value of each property.

The taxable value of a property is not necessarily its market value. Instead, it is determined by a complex process that considers various factors. The Assessor's Office uses a combination of methods, including physical inspections, sales analysis, and cost approaches, to arrive at an accurate assessment. This assessed value is then used as the basis for calculating property taxes.

Sacramento County, like many other jurisdictions, follows a system where property taxes are calculated based on a fixed percentage of the assessed value. This percentage, known as the tax rate, is set annually by the county's Board of Supervisors and other local taxing agencies. The tax rate includes not only the county's share but also the rates set by local districts, such as school districts and special assessment districts.

The Impact of Proposition 13

California’s Proposition 13, passed in 1978, has had a significant influence on property taxes across the state, including Sacramento County. This landmark legislation limits the tax rate to 1% of the assessed value and restricts the annual increase in assessed value to a maximum of 2% or the inflation rate, whichever is lower.

Proposition 13's restrictions provide stability for property owners, as it prevents drastic increases in their tax liabilities. However, it also means that the assessed value of a property may not reflect its current market value, especially in a rapidly appreciating real estate market. When a property changes ownership, the assessed value is reset to the purchase price, ensuring that new buyers are not penalized for the appreciation that occurred under the previous owner.

Property Tax Rates and Assessments in Sacramento County

The actual tax rate in Sacramento County varies from year to year, as it is determined by the county’s fiscal needs and the requirements of local districts. For the fiscal year 2023-2024, the average tax rate is set at approximately 1.25% of the assessed value. This rate includes the county’s share, as well as the rates for various special districts and the city, if applicable.

To illustrate, let's consider a hypothetical property in Sacramento County with an assessed value of $500,000. Using the average tax rate for the current fiscal year, the property owner would owe approximately $6,250 in property taxes. This amount is typically divided into two installments, due in the fall and the spring, to make the payment more manageable for property owners.

| Property Tax Components | Percentage |

|---|---|

| Sacramento County | 0.26% |

| Sacramento County Flood Control | 0.04% |

| City of Sacramento (if applicable) | 0.36% |

| Sacramento County Office of Education | 0.09% |

| Various Special Districts | Varies |

| Total Tax Rate | Approximately 1.25% |

Property Tax Payment and Due Dates

Property tax payments in Sacramento County are typically due twice a year, with installment dates falling on December 10th and April 10th. These due dates are set by the county and are consistent for all property owners. Late payments may incur penalties and interest, so it’s essential to stay informed and plan your payments accordingly.

Property owners have several payment options, including online payment through the Treasurer-Tax Collector's website, by phone, or by mail. In-person payments can also be made at the Treasurer-Tax Collector's office. It's worth noting that if a property is under escrow at the time of the installment due date, the responsibility for payment typically falls on the escrow company.

Escrow and Property Tax Payments

When a property is under escrow, the escrow company often handles the property tax payments as part of the transaction. The buyer and seller will typically contribute their respective shares of the property taxes based on the date of the escrow closing. This ensures that the property taxes are up to date and that the new owner is not responsible for any outstanding liabilities from the previous owner.

For example, if a property with an annual tax bill of $6,250 is sold in the middle of the tax year, the seller will pay the taxes up to the date of escrow, and the buyer will pay the remaining balance. This ensures a fair distribution of the tax liability and simplifies the process for both parties.

Appealing Property Tax Assessments

Property owners in Sacramento County have the right to appeal their property tax assessments if they believe the assessed value is inaccurate. The appeal process is managed by the Sacramento County Assessment Appeals Board, an independent board that reviews and decides on assessment appeals.

There are several grounds for an appeal, including a decrease in property value due to damage or a decline in the market, an increase in value that exceeds the 2% annual limit set by Proposition 13, or if the property was not properly assessed according to its current use. The appeal process involves submitting an application, providing supporting evidence, and potentially attending a hearing before the Appeals Board.

It's important to note that the Appeals Board's decision is final and cannot be appealed further within the county. However, if an owner disagrees with the Board's decision, they can file an action with the Sacramento County Superior Court.

The Assessment Appeals Process

- Filing an Appeal: Property owners must file an application for changed assessment with the Assessment Appeals Board within specific timeframes. These timeframes vary depending on the type of change and the reason for the appeal.

- Evidence Submission: Along with the application, owners must provide supporting evidence to substantiate their claim. This may include recent sales data, appraisals, or other relevant documentation.

- Hearing: If the Board determines that an appeal warrants a hearing, owners will be notified and given the opportunity to present their case. Hearings are typically informal and may involve presentations from both the property owner and the Assessor’s Office.

- Decision: The Assessment Appeals Board will issue a written decision, which will include the new assessed value if the appeal is successful. If the appeal is denied, the original assessment stands.

Property Tax Relief Programs

Sacramento County offers several programs to assist eligible property owners with their tax obligations. These programs aim to provide relief to seniors, disabled individuals, and low-income homeowners, ensuring that financial constraints do not lead to property loss.

The Senior Citizen Exemption

The Senior Citizen Exemption program provides a partial property tax exemption to homeowners who are 62 years of age or older and meet specific income criteria. This exemption reduces the assessed value of the property for tax purposes, resulting in lower tax bills. To qualify, homeowners must meet income limits set by the state and occupy the property as their primary residence.

For instance, if a senior homeowner with an assessed value of $500,000 qualifies for the Senior Citizen Exemption, their assessed value for tax purposes might be reduced to $400,000. This reduction would result in a lower tax bill, potentially saving the homeowner several hundred dollars each year.

Disabled Veteran Exemption

Sacramento County also offers an exemption for disabled veterans who have a service-connected disability of at least 10%. This exemption reduces the assessed value of the veteran’s property by $100,000, which can significantly lower their annual property tax liability.

Low-Income Homeowner Program

The Low-Income Homeowner Program provides a partial property tax exemption to low-income homeowners who meet certain income and asset limits. This program aims to help struggling homeowners keep their properties and reduce their tax burden. To qualify, homeowners must occupy the property as their primary residence and meet specific income and asset guidelines set by the state.

Future Implications and Trends

As Sacramento County continues to grow and evolve, the property tax landscape is likely to see changes and adaptations. While Proposition 13 provides stability for property owners, it also presents challenges for local governments, as it limits their ability to increase revenue through property taxes. As a result, local authorities may explore alternative revenue streams or seek changes to the tax system to address these challenges.

One potential trend is the increased use of special assessment districts. These districts are formed to fund specific services or infrastructure projects and are funded through additional property taxes. While they provide a dedicated revenue stream for specific purposes, they can also increase the overall tax burden for property owners.

Another trend to watch is the potential impact of new construction and development on the tax base. As Sacramento County continues to attract new residents and businesses, the demand for housing and commercial space may drive up property values, leading to higher assessments and potentially higher taxes. This could be especially significant for new homeowners, as they may face higher tax bills than their predecessors.

Prospects for Tax Reform

While Proposition 13 has been a cornerstone of California’s property tax system for over four decades, there have been ongoing discussions about potential reforms. Some proposals suggest modifying the assessment process to more closely align with market values, while others advocate for changes to the tax rate structure. These reforms aim to address concerns about fairness and revenue adequacy while maintaining the stability that Proposition 13 provides.

Regardless of the future direction of property taxes in Sacramento County, staying informed and engaged is crucial for property owners. Understanding the current system, monitoring changes, and seeking professional advice when needed can help homeowners navigate the complexities of property taxes and make informed decisions about their financial obligations.

How can I estimate my property tax bill in Sacramento County?

+You can estimate your property tax bill by multiplying your property’s assessed value by the current tax rate. For example, if your property’s assessed value is 500,000 and the current tax rate is 1.25%, your estimated tax bill would be 6,250.

What happens if I miss a property tax payment deadline in Sacramento County?

+If you miss a property tax payment deadline, you may incur penalties and interest. It’s important to stay informed about the payment due dates and make timely payments to avoid these additional costs.

How do I apply for a property tax relief program in Sacramento County?

+To apply for a property tax relief program, you should contact the Sacramento County Assessor’s Office or visit their website for detailed instructions and application forms. Each program has specific eligibility criteria and application processes, so it’s important to review the requirements carefully.

Can I appeal my property tax assessment if I disagree with the value assigned to my property?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. You must file an application for changed assessment with the Sacramento County Assessment Appeals Board within the specified timeframes. It’s advisable to seek professional advice to ensure a successful appeal.

How often are property tax rates updated in Sacramento County?

+Property tax rates in Sacramento County are updated annually. The county’s Board of Supervisors and other local taxing agencies set the rates based on their fiscal needs and the requirements of various special districts.