State Of Ri Tax

In the world of taxes, each state in the United States has its own set of regulations and laws, making the process of understanding and complying with tax obligations a complex journey. The State of Rhode Island is no exception, with a unique tax system that impacts both residents and businesses. This comprehensive guide aims to shed light on the intricacies of Rhode Island's tax landscape, offering an expert analysis of its various aspects and providing valuable insights for those navigating this crucial financial territory.

Understanding the State of Ri Tax: An Overview

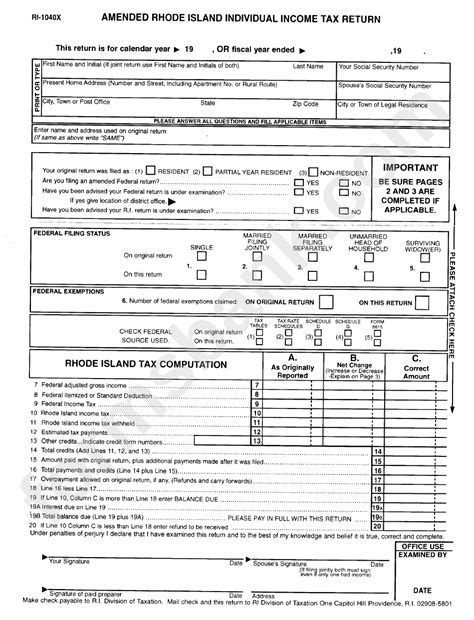

The tax system in Rhode Island, often referred to as Ri Tax, encompasses a range of levies and duties that residents and businesses must fulfill. It serves as a crucial source of revenue for the state government, funding essential public services and infrastructure projects. The system is governed by the Rhode Island Division of Taxation, which enforces tax laws and ensures compliance across the state.

One of the key components of the Ri Tax system is the income tax, applicable to both individuals and corporations. Rhode Island operates a progressive tax structure, meaning tax rates increase as income levels rise. This approach aims to ensure that higher-income earners contribute a larger proportion of their earnings towards state revenue.

In addition to income tax, Rhode Island imposes a sales and use tax, applicable to the purchase of goods and services within the state. This tax, often referred to as the "Sales Tax," is levied at the point of sale and is typically paid by the consumer. The rate varies depending on the type of item purchased and the location of the transaction.

Furthermore, the Ri Tax system includes property taxes, which are levied on real estate and personal property owned within the state. These taxes are a significant source of revenue for local governments and school districts, contributing to the maintenance and improvement of public facilities and educational institutions.

Income Tax: A Detailed Look

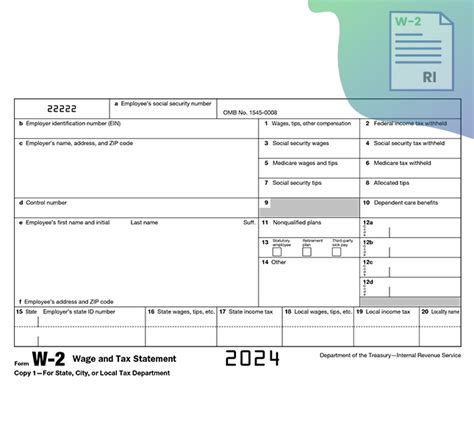

The income tax in Rhode Island is structured into brackets, with each bracket carrying a specific tax rate. As of the latest tax year, these brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $8,950 | 3.75% |

| $8,951 - $45,000 | 4.75% |

| $45,001 - $113,700 | 5.99% |

| Over $113,700 | 5.99% |

It's important to note that these rates are subject to change annually, and taxpayers should refer to the most recent tax guidelines for accurate information. The state also offers various deductions and credits to help reduce the tax burden for eligible individuals and families.

Tax Credits and Deductions

Rhode Island provides several tax credits and deductions to encourage savings, investment, and charitable contributions. Some of the notable deductions include the Rhode Island Earned Income Tax Credit (EITC), which provides a refundable credit for low- and moderate-income working individuals and families. This credit helps offset the cost of living and can provide a significant boost to those struggling financially.

Additionally, the state offers deductions for contributions to certain retirement plans, educational expenses, and medical costs. These deductions can help reduce taxable income, resulting in a lower tax liability for eligible taxpayers.

Sales and Use Tax: Unraveling the Details

The sales and use tax in Rhode Island is a consumption tax, applicable to the purchase or lease of tangible personal property and certain services. The tax is imposed on the seller or lessor, who is responsible for collecting the tax from the purchaser or lessee. The current standard sales tax rate in Rhode Island is 7%, which is applied to most goods and services.

However, it's important to note that certain items are exempt from sales tax, such as most food items, prescription drugs, and certain clothing items. Additionally, there are specific locations within the state, often referred to as "tax-free zones," where the sales tax rate is lower or even non-existent. These zones are typically designated to promote economic development and attract businesses and residents.

Sales Tax Exemptions and Special Zones

Rhode Island has a few notable sales tax exemptions and special zones. For instance, the state offers a Sales Tax Holiday, usually occurring over a weekend in August, during which certain items are exempt from sales tax. This holiday encourages consumer spending and provides a boost to local businesses.

Furthermore, Rhode Island has designated several Enterprise Zones throughout the state. These zones offer reduced sales tax rates and other incentives to attract new businesses and promote economic growth. Businesses operating within these zones may be eligible for reduced tax rates or even complete exemption from certain taxes.

Property Tax: A Localized Approach

Property taxes in Rhode Island are primarily levied and collected by local governments, with the revenue used to fund local services and infrastructure. The assessment and collection process varies across municipalities, but generally, property taxes are based on the assessed value of the property.

The assessed value is determined by the local tax assessor, who considers various factors such as the property's size, location, and condition. This value is then multiplied by the tax rate, which is set by the local government. The resulting amount is the property tax bill that the owner is responsible for paying.

Assessed Value and Tax Rates

The assessed value of a property can change over time, typically increasing with improvements or renovations. However, some municipalities offer tax exemptions or deferrals for certain types of properties, such as owner-occupied residences or properties owned by non-profit organizations.

Tax rates vary significantly across Rhode Island, with some municipalities having higher rates to fund more extensive services or infrastructure projects. These rates can be influenced by factors such as the local economy, population growth, and the overall budget of the municipality.

Compliance and Enforcement: Ensuring Tax Integrity

The Rhode Island Division of Taxation takes tax compliance seriously, implementing various measures to ensure taxpayers meet their obligations. The division conducts regular audits to verify the accuracy of tax returns and ensure taxpayers are paying the correct amount of tax. Penalties and interest may be imposed on taxpayers who fail to comply with their tax obligations.

To assist taxpayers in understanding their responsibilities, the division provides a range of resources, including online tax guides, workshops, and webinars. Taxpayers can also access support through the division's website or by contacting their local tax office.

Online Resources and Support

The official website of the Rhode Island Division of Taxation, https://tax.ri.gov, is a valuable resource for taxpayers. It offers a wealth of information, including tax forms, instructions, and publications. Taxpayers can also use the website to file their tax returns electronically, pay their taxes online, and access their tax account information.

Additionally, the division provides a dedicated helpline for taxpayers who need assistance with their tax matters. Taxpayers can call or email the helpline to seek guidance on tax laws, regulations, and compliance requirements.

Future Implications and Trends

The tax landscape in Rhode Island is subject to change, influenced by economic conditions, political decisions, and societal needs. As the state continues to evolve, it’s likely that the tax system will undergo modifications to meet these changing circumstances.

One potential trend is the movement towards a more simplified tax system. While the current system is effective, there have been calls for a more streamlined approach to make tax compliance easier for both taxpayers and tax administrators. This could involve reducing the number of tax brackets, simplifying tax forms, and improving the efficiency of the tax collection process.

Potential Reforms and Simplification

Another area of potential reform is the sales tax. With the increasing popularity of online shopping, there have been discussions about expanding the sales tax to include online purchases, ensuring that all retail transactions, regardless of their origin, are subject to the same tax rates. This would help level the playing field for local businesses and ensure a more equitable distribution of tax revenue.

Furthermore, as the state continues to invest in its infrastructure and public services, there may be a need to increase revenue through tax adjustments. This could involve raising tax rates, introducing new taxes, or modifying existing tax laws to generate additional funds. However, any such changes would need to be carefully considered to ensure they do not unduly burden taxpayers or negatively impact the state's economic growth.

Frequently Asked Questions

What is the current sales tax rate in Rhode Island?

+

The current standard sales tax rate in Rhode Island is 7%.

Are there any tax credits available for Rhode Island residents?

+

Yes, Rhode Island offers various tax credits, including the Earned Income Tax Credit (EITC) for low- and moderate-income working individuals and families.

How often do tax rates change in Rhode Island?

+

Tax rates can change annually, typically based on budgetary needs and economic conditions. It’s important to refer to the most recent tax guidelines for accurate information.

What happens if I don’t pay my taxes in Rhode Island?

+

Failure to pay taxes in Rhode Island can result in penalties, interest, and potential legal consequences. The state takes tax compliance seriously and enforces tax laws rigorously.

Are there any resources available to help me understand my tax obligations in Rhode Island?

+

Yes, the Rhode Island Division of Taxation provides a wealth of resources, including online guides, workshops, and a dedicated helpline. You can access these resources through the official website, https://tax.ri.gov.