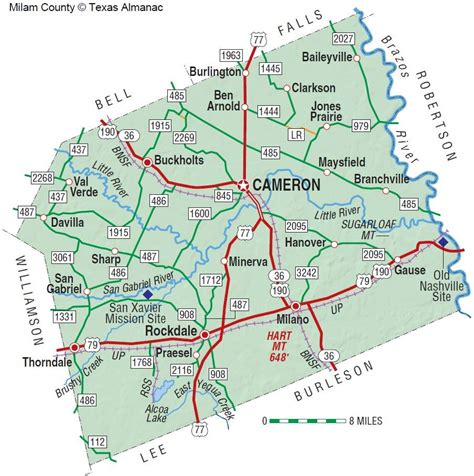

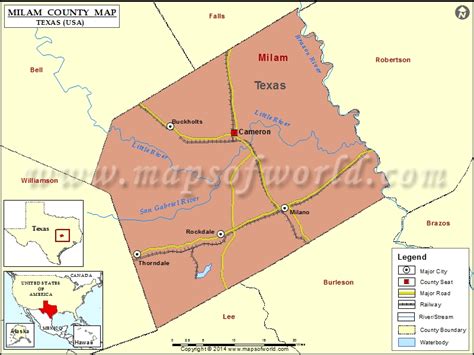

Milam County Tax Office

The Milam County Tax Office is an essential governmental entity that plays a pivotal role in the administrative and financial landscape of Milam County, Texas. This office is responsible for a wide array of tasks, from assessing and collecting property taxes to providing vital services and support to the county's residents and businesses. With a rich history and a dedicated team, the Milam County Tax Office has become an integral part of the local community, contributing to its growth and prosperity.

The Milam County Tax Office: A Comprehensive Guide

This article aims to delve into the various aspects of the Milam County Tax Office, offering an in-depth understanding of its functions, services, and significance within the county. From its historical evolution to its modern-day operations, we will explore how this office has adapted to meet the evolving needs of the community.

A Historical Perspective

The origins of the Milam County Tax Office can be traced back to the early 19th century when Milam County was established. As the county grew, so did the need for a centralized authority to manage financial affairs. The tax office was thus established to oversee the collection of taxes, a crucial revenue stream for the county’s development.

Over the years, the office has undergone significant transformations, adapting to changing tax laws, technological advancements, and the evolving needs of the community. Despite these changes, the core mission of the Milam County Tax Office has remained steadfast: to ensure fair and efficient tax collection while providing exceptional service to taxpayers.

Core Functions and Services

The Milam County Tax Office is responsible for a multitude of tasks, each integral to the financial health of the county and the well-being of its residents.

Property Tax Assessment and Collection

One of the primary functions of the tax office is the assessment and collection of property taxes. This process involves evaluating the value of properties within the county, determining the applicable tax rates, and issuing tax bills to property owners. The office also provides resources and assistance to taxpayers, helping them understand the assessment process and their tax obligations.

The tax office ensures a transparent and equitable assessment process, utilizing modern valuation techniques and maintaining a database of property records. This database serves as a valuable resource for taxpayers, providing them with detailed information about their properties and the associated taxes.

| Property Type | Tax Rate (%) |

|---|---|

| Residential | 1.85 |

| Commercial | 2.25 |

| Agricultural | 1.25 |

Vehicle Registration and Titling

The tax office also handles vehicle registration and titling, ensuring that vehicles operated within the county are properly documented and taxed. This service is crucial for maintaining road safety and accountability, as it enables the county to keep track of vehicle ownership and compliance with relevant laws.

Taxpayers can visit the office to register their vehicles, obtain titles, and renew their registrations. The tax office provides a streamlined process, offering online options for certain transactions, thus saving time and effort for taxpayers.

Other Tax-Related Services

In addition to property and vehicle-related taxes, the Milam County Tax Office provides a range of other tax-related services. These include:

- Assisting with tax exemptions and abatements for eligible individuals and businesses.

- Offering guidance on tax payment options, including online payments and payment plans.

- Providing resources for taxpayers to understand their rights and responsibilities.

- Maintaining a record of all tax-related transactions for transparency and accountability.

Community Engagement and Support

Beyond its core tax-related functions, the Milam County Tax Office actively engages with the community, offering support and resources to residents and businesses.

Community Outreach Programs

The tax office regularly organizes community outreach programs, aiming to educate residents about their tax obligations and rights. These programs often include workshops, seminars, and information sessions, covering topics such as tax preparation, tax relief programs, and changes in tax laws.

By fostering a culture of tax awareness and compliance, the office contributes to the financial literacy of the community, empowering residents to make informed decisions about their tax affairs.

Business Support Services

Recognizing the importance of businesses to the local economy, the Milam County Tax Office provides dedicated support services for businesses. This includes offering guidance on business tax obligations, providing resources for business registration and licensing, and assisting with tax planning and compliance.

The office's business support services help create a conducive environment for businesses to thrive, contributing to the economic growth and development of Milam County.

Modern Innovations and Technological Advancements

In line with its commitment to efficiency and accessibility, the Milam County Tax Office has embraced modern innovations and technological advancements.

Online Services and Digital Transformation

The office has developed an extensive online platform, offering a wide range of services digitally. Taxpayers can now access their property tax records, pay taxes online, and avail of various other services without having to visit the physical office. This digital transformation has significantly improved convenience and efficiency for taxpayers.

The online platform also provides a wealth of information, including tax rates, assessment details, and news updates, ensuring taxpayers stay informed and up-to-date.

Data Security and Privacy

With the transition to digital services, the Milam County Tax Office has implemented robust data security measures to protect taxpayer information. This includes encryption technologies, secure servers, and strict access controls, ensuring that taxpayer data remains confidential and secure.

The office also conducts regular security audits and stays abreast of the latest security threats and best practices, demonstrating its commitment to safeguarding taxpayer information.

Future Prospects and Challenges

As Milam County continues to grow and evolve, the Milam County Tax Office faces both opportunities and challenges. The office is committed to adapting to these changes, ensuring it remains an effective and efficient service provider.

Expanding Services and Outreach

The tax office plans to expand its services and outreach programs, aiming to reach more residents and businesses. This includes developing more targeted educational programs, enhancing its online services, and exploring partnerships with local organizations to increase awareness and accessibility.

Navigating Technological Advances

While technological advancements have brought numerous benefits, they also present challenges. The tax office must stay updated with the latest technologies and security measures to ensure it can provide efficient services and protect taxpayer data. This requires continuous investment in infrastructure, training, and expertise.

Addressing Community Needs

As the community’s needs evolve, the Milam County Tax Office must adapt its services to meet these changing demands. This involves staying connected with the community, understanding its needs, and tailoring services accordingly. The office is committed to being a responsive and proactive service provider, ensuring it remains a valuable asset to the community.

Conclusion: A Vital Community Resource

The Milam County Tax Office is more than just a governmental entity; it is a vital resource for the community, providing essential services and support. Through its commitment to transparency, efficiency, and community engagement, the office has earned the trust and respect of the residents and businesses it serves.

As Milam County continues to grow and prosper, the Milam County Tax Office will undoubtedly play a pivotal role, contributing to the county's financial health and the well-being of its community.

What is the role of the Milam County Tax Office in property tax assessments?

+The Milam County Tax Office is responsible for assessing the value of properties within the county, determining the applicable tax rates, and issuing tax bills to property owners. It provides resources and assistance to taxpayers, ensuring a transparent and equitable assessment process.

How does the Milam County Tax Office support local businesses?

+The tax office offers dedicated support services for businesses, including guidance on tax obligations, resources for business registration and licensing, and assistance with tax planning and compliance. This support contributes to the economic growth of Milam County.

What measures does the Milam County Tax Office take to protect taxpayer data?

+The office implements robust data security measures, including encryption technologies, secure servers, and strict access controls. It conducts regular security audits and stays updated with the latest security threats and best practices to ensure taxpayer data remains confidential and secure.