City Of La Sales Tax

In the bustling metropolis of Los Angeles, California, sales tax plays a crucial role in shaping the city's economic landscape and contributing to its vibrant urban fabric. The City of Los Angeles, often referred to as the City of Angels, is renowned for its diverse culture, thriving entertainment industry, and iconic landmarks. However, beneath the glitz and glamour lies a complex system of taxation that impacts residents, businesses, and visitors alike. This article delves into the intricacies of the City of LA's sales tax, exploring its historical context, current regulations, and the economic implications it holds for the city's prosperity.

A Historical Perspective on LA’s Sales Tax

The history of sales tax in Los Angeles is deeply intertwined with the city’s economic evolution. In the early 20th century, as Los Angeles emerged as a major urban center, the need for stable revenue streams to fund public services and infrastructure became increasingly apparent. The city’s leadership recognized the potential of a sales tax as a means to generate revenue while encouraging economic growth.

The first sales tax ordinance was introduced in Los Angeles in 1943, marking a significant milestone in the city's fiscal policy. Initially, the tax was implemented as a temporary measure to support the war effort during World War II. However, as the city's population continued to grow and its economic significance expanded, the sales tax became a permanent fixture in the city's fiscal landscape.

Over the decades, the City of LA has witnessed a series of amendments and adjustments to its sales tax regulations. These changes were driven by various factors, including shifts in the local economy, inflation, and the evolving needs of the city's infrastructure and public services. The city has aimed to strike a delicate balance between generating sufficient revenue and maintaining a competitive business environment.

Understanding the Current Sales Tax Structure

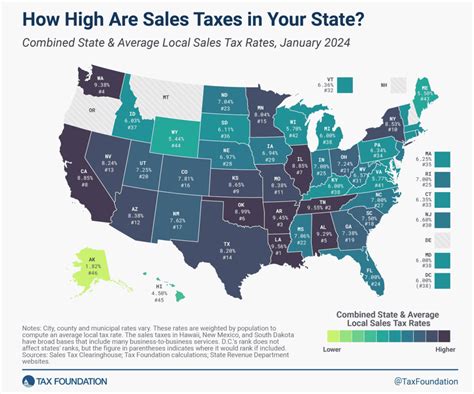

As of the latest updates, the City of Los Angeles imposes a sales tax rate of 9.50% on most retail transactions. This rate is comprised of several components, including the state sales tax, county sales tax, and city sales tax. Understanding the breakdown of these components is essential for businesses and consumers alike.

The state of California applies a 7.25% sales tax rate across the state. This base rate is uniform and applies to all counties, including Los Angeles County. Additionally, Los Angeles County imposes a 0.25% county sales tax, bringing the total county-level tax to 7.50%. The City of Los Angeles then adds its own 2.00% sales tax, resulting in the combined rate of 9.50% within the city limits.

It's important to note that sales tax rates can vary within the county. Certain cities and unincorporated areas may have additional local sales taxes, leading to slightly higher rates. For instance, neighboring cities like Beverly Hills and Santa Monica have slightly different sales tax structures due to their independent tax jurisdictions.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Los Angeles County | 7.50% (including 0.25% county tax) |

| City of Los Angeles | 9.50% (including 2.00% city tax) |

Businesses operating within the City of LA are responsible for collecting and remitting the appropriate sales taxes to the California Department of Tax and Fee Administration (CDTFA). This process involves accurate record-keeping, timely tax filings, and compliance with the state's regulations to avoid penalties and ensure smooth operations.

Economic Impact and Revenue Generation

The sales tax system in Los Angeles serves as a vital revenue stream for the city, contributing significantly to its fiscal health and the funding of essential public services. The revenue generated from sales taxes is allocated to various sectors, including education, infrastructure development, public safety, and social services.

Education, in particular, benefits greatly from sales tax revenue. The city's public schools, colleges, and universities receive funding that supports improved facilities, enhanced curriculum, and expanded programs. This investment in education plays a pivotal role in shaping the city's future workforce and ensuring a skilled talent pool for local businesses.

Infrastructure development is another key area where sales tax revenue makes a substantial impact. Los Angeles, known for its extensive road network and public transportation systems, relies on sales tax funds to maintain and upgrade its infrastructure. This includes road repairs, bridge maintenance, and the expansion of public transit options, all of which contribute to a more efficient and sustainable urban environment.

Furthermore, sales tax revenue supports the city's public safety initiatives. The funding helps maintain a robust police force, fire department, and emergency response teams, ensuring the safety and well-being of residents and visitors alike. Additionally, social services, such as healthcare, housing assistance, and community development programs, receive critical funding, addressing the needs of vulnerable populations and fostering social equity.

The Role of Tourism

Los Angeles is a global tourist destination, attracting millions of visitors each year. The tourism industry plays a significant role in the city’s economy, and sales tax revenue generated from tourist spending is a substantial contributor to the city’s fiscal stability. From iconic landmarks like the Hollywood Sign and the Griffith Observatory to world-class museums and vibrant entertainment districts, tourists inject significant revenue into the local economy through their retail purchases and other expenditures.

Impact on Businesses

While the sales tax system provides essential revenue for the city, it also presents challenges and considerations for businesses operating within the City of LA. Businesses must navigate the complexities of tax compliance, ensuring accurate tax collection and remittance to avoid penalties. Additionally, the sales tax can impact pricing strategies and affect consumer behavior, as higher tax rates may influence purchasing decisions.

Compliance and Tax Administration

Compliance with sales tax regulations is a critical aspect of doing business in Los Angeles. The California Department of Tax and Fee Administration (CDTFA) oversees the administration and enforcement of sales tax laws. Businesses are required to obtain a seller’s permit, collect the appropriate taxes, and file regular tax returns.

The CDTFA provides resources and guidance to help businesses navigate the sales tax landscape. This includes access to tax rate tables, sales tax rate calculators, and educational materials. By ensuring compliance, businesses not only avoid penalties but also contribute to the city's fiscal stability and the funding of essential public services.

Future Considerations and Potential Changes

As Los Angeles continues to evolve and adapt to changing economic landscapes, the sales tax system is likely to undergo further scrutiny and potential adjustments. Economic shifts, technological advancements, and changing consumer behaviors may influence the effectiveness and fairness of the current tax structure.

One potential area of focus is the impact of e-commerce and online sales. With the rise of online retail, ensuring that sales taxes are accurately collected and remitted for these transactions becomes increasingly complex. The city may explore ways to adapt its tax regulations to keep pace with the evolving nature of commerce.

Additionally, discussions surrounding tax equity and the distribution of sales tax revenue may gain prominence. As the city strives to address social and economic disparities, ensuring that sales tax revenue benefits all communities equally becomes a priority. This may involve reevaluating tax rates, exploring new tax initiatives, or implementing targeted programs to support underserved areas.

Conclusion

The City of Los Angeles’ sales tax system is a dynamic and integral component of its economic framework. It serves as a critical revenue source, funding essential public services and infrastructure while shaping the city’s fiscal landscape. As Los Angeles continues to thrive and adapt, the sales tax will remain a key consideration for businesses, consumers, and policymakers alike.

What is the purpose of the sales tax in Los Angeles?

+The sales tax in Los Angeles is primarily aimed at generating revenue to fund essential public services, infrastructure development, and social programs. It plays a crucial role in maintaining the city’s fiscal health and contributing to its overall prosperity.

How does the sales tax rate vary across different cities in Los Angeles County?

+Sales tax rates can vary within Los Angeles County. While the state sales tax rate is uniform at 7.25%, cities and unincorporated areas may have additional local sales taxes. For example, Beverly Hills has a higher sales tax rate compared to the City of Los Angeles.

What are the consequences of non-compliance with sales tax regulations in Los Angeles?

+Non-compliance with sales tax regulations can result in penalties, fines, and legal consequences. Businesses that fail to collect and remit sales taxes accurately may face audits, assessments, and even criminal charges in severe cases. Compliance is crucial to avoid these negative repercussions.

How often do sales tax rates change in Los Angeles?

+Sales tax rates in Los Angeles can change periodically, often in response to economic factors, infrastructure needs, or changes in state or local legislation. While the rates are generally stable, it’s essential to stay informed about any potential changes to ensure compliance and accurate tax collection.

Are there any tax incentives or exemptions for certain industries or businesses in Los Angeles?

+Yes, there may be tax incentives or exemptions available for specific industries or businesses in Los Angeles. These incentives aim to promote economic growth, support certain sectors, or encourage job creation. It’s advisable to consult with tax professionals or refer to official resources to explore potential tax benefits.