Pay Property Tax Broward County Fl

Paying property taxes is an essential aspect of homeownership, and understanding the process can be crucial for managing your finances effectively. In this comprehensive guide, we will delve into the specifics of paying property taxes in Broward County, Florida, providing you with all the information you need to navigate this important task with ease.

Understanding Property Taxes in Broward County

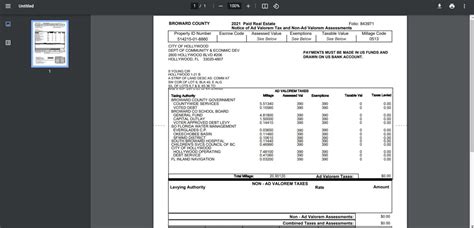

Property taxes are a significant source of revenue for local governments and are used to fund essential services like education, public safety, infrastructure, and more. In Broward County, property taxes are determined based on the assessed value of your property and the millage rate set by various taxing authorities within the county.

Assessed Value

The assessed value of your property is determined by the Broward County Property Appraiser’s Office. This value is typically lower than the market value and is used as the basis for calculating your property taxes. The appraiser’s office takes into account factors such as location, property type, size, improvements, and recent sales of similar properties to arrive at the assessed value.

| Assessment Type | Description |

|---|---|

| Full Market Value | The estimated amount your property would sell for on the open market. |

| Assessed Value | A percentage of the full market value, often set at 10% in Florida. |

Millage Rates

The millage rate, also known as the tax rate, is expressed in mills, where one mill is equal to one-tenth of a cent. In Broward County, different taxing authorities, such as the county government, school districts, and municipalities, set their own millage rates. These rates are then applied to the assessed value of your property to calculate your property tax liability.

For instance, if your property has an assessed value of $200,000 and the combined millage rate is 10 mills, your property tax would be calculated as follows:

Property Tax = Assessed Value x Millage Rate

Property Tax = $200,000 x 0.010 = $2,000

Payment Options and Deadlines

Broward County offers various payment options to cater to different preferences and needs. Understanding these options and adhering to the payment deadlines is crucial to avoid penalties and maintain a good standing with the county.

Online Payment

The most convenient and efficient way to pay your property taxes is through the Broward County Property Appraiser’s Office website. The online payment system allows you to make secure payments using your credit or debit card, e-check, or electronic funds transfer (EFT). You can also view your tax bill, check the status of your payments, and receive email notifications regarding your account.

Mail-In Payment

If you prefer a more traditional method, you can mail your payment to the Broward County Property Appraiser’s Office. Simply include your tax bill stub and a check or money order made payable to the “Broward County Tax Collector.” Ensure that you allow sufficient time for the payment to reach the office before the deadline to avoid any late fees.

In-Person Payment

You can also make your property tax payments in person at any of the Broward County Tax Collector’s offices. These offices are located throughout the county for your convenience. Bring your tax bill and the exact amount due, as cash payments are not accepted. You can also pay with a check, money order, or credit/debit card.

Payment Deadlines

Property taxes in Broward County are due annually, and there are two payment periods to consider:

- First Payment Period: From November 1 to March 31

- Second Payment Period: From April 1 to September 30

It's important to note that if you do not pay your taxes by the end of the second payment period, you may incur additional fees and penalties. Late payments are subject to a 3% penalty, and if taxes remain unpaid after September 30, the county may initiate collection actions, including a tax certificate sale.

Discounts and Exemptions

Broward County offers various discounts and exemptions to eligible homeowners, which can significantly reduce their property tax burden. Understanding these benefits and applying for them can save you a substantial amount of money.

Homestead Exemption

The Homestead Exemption is one of the most significant tax benefits available to Florida residents. If you own and reside in your property as your primary residence, you may qualify for this exemption. The Homestead Exemption reduces the assessed value of your property by $50,000, which, in turn, lowers your property taxes.

To apply for the Homestead Exemption, you must complete and submit the appropriate application form to the Broward County Property Appraiser's Office before March 1 of the tax year for which you are seeking the exemption. You will need to provide documentation, such as a driver's license, voter registration card, and a copy of your mortgage or lease agreement.

Other Exemptions and Discounts

In addition to the Homestead Exemption, Broward County offers various other exemptions and discounts, including:

- Senior Exemption: Residents aged 65 or older may qualify for an additional exemption of up to $50,000 on their assessed property value.

- Widow/Widower Exemption: Surviving spouses of military personnel killed in action or law enforcement officers killed in the line of duty may be eligible for an exemption.

- Veterans' Exemption: Qualified veterans may receive an exemption of up to $25,000 on their assessed property value.

- Low-Income Senior Discount: Senior citizens with limited income may qualify for a discount on their property taxes.

It's important to review the eligibility criteria and application process for each exemption or discount to determine if you qualify. You can find detailed information and application forms on the Broward County Property Appraiser's Office website.

Appealing Your Property Assessment

If you believe that the assessed value of your property is inaccurate or higher than it should be, you have the right to appeal the assessment. The process of appealing your property assessment involves several steps and requires careful preparation.

Steps to Appeal

- Obtain a copy of your property’s assessment record from the Broward County Property Appraiser’s Office.

- Review the record and gather evidence to support your case, such as recent sales of similar properties or appraisals.

- File an appeal with the Property Appraisal Adjustment Board (PAAB) by the deadline, which is typically around late February.

- Prepare and submit your evidence and arguments to support your case.

- Attend a hearing before the PAAB, where you can present your case and respond to any questions or challenges.

- Wait for the PAAB’s decision, which will be sent to you in writing.

It's crucial to note that appealing your property assessment is a formal process, and it's advisable to seek professional advice or assistance, especially if you are unsure about the process or have a complex case.

Conclusion

Paying property taxes in Broward County, Florida, is an important responsibility for homeowners. By understanding the assessment process, payment options, deadlines, and available discounts and exemptions, you can navigate this process with confidence. Remember to stay organized, keep track of important dates, and take advantage of the resources provided by the Broward County Property Appraiser’s Office and Tax Collector’s Office to ensure a smooth and timely payment experience.

When is the deadline for paying property taxes in Broward County, Florida?

+The deadlines for paying property taxes in Broward County are as follows: First Payment Period: November 1 to March 31; Second Payment Period: April 1 to September 30. It’s crucial to pay your taxes by September 30 to avoid late fees and potential collection actions.

Can I receive a discount if I pay my property taxes early?

+Yes, Broward County offers a 1% discount if you pay your taxes during the first payment period, from November 1 to March 31. This early payment discount can help you save a small amount on your property taxes.

How can I check my property’s assessed value in Broward County?

+You can access your property’s assessed value by visiting the Broward County Property Appraiser’s Office website and searching for your property. You’ll need to enter your property’s address or parcel number to view the assessment details.

What happens if I don’t pay my property taxes on time in Broward County?

+If you fail to pay your property taxes by the end of the second payment period, you may incur a 3% penalty. Additionally, the county may initiate collection actions, including a tax certificate sale, to recover the unpaid taxes.

Are there any resources available to help me understand the property tax process in Broward County?

+Yes, the Broward County Property Appraiser’s Office and Tax Collector’s Office provide comprehensive resources and guides to help homeowners understand the property tax process. You can find detailed information, FAQs, and contact details on their respective websites.