Hempstead Taxes

Welcome to Hempstead, a vibrant and historic town located in Nassau County, New York. This article aims to provide an in-depth analysis of Hempstead's tax landscape, shedding light on the various aspects that impact residents and businesses alike. Understanding the tax structure is crucial for individuals and organizations operating within this dynamic community.

Unraveling Hempstead’s Tax System

Hempstead’s tax system is intricate, reflecting the town’s diverse nature and the unique challenges it faces. The town’s tax structure is designed to support essential services, infrastructure development, and community initiatives, all while maintaining a competitive business environment.

Property Taxes: A Key Component

Property taxes are a significant source of revenue for Hempstead and play a vital role in shaping the town’s fiscal health. The town’s assessor’s office is responsible for determining the assessed value of properties, which forms the basis for tax calculations.

Hempstead's property tax rates are subject to change annually, influenced by factors such as budget requirements, state regulations, and economic conditions. As of the latest assessment, the town's average property tax rate stands at [current rate]%, which is applied to the assessed value of a property to determine the annual tax liability.

To illustrate, consider a hypothetical residential property in Hempstead with an assessed value of $500,000. At the current tax rate, the annual property tax for this residence would amount to $[annual tax amount], showcasing the impact of property taxes on homeowners.

| Property Type | Average Assessed Value | Estimated Annual Taxes |

|---|---|---|

| Residential | $500,000 | $[annual tax amount] |

| Commercial | $1,200,000 | $[commercial tax amount] |

| Industrial | $800,000 | $[industrial tax amount] |

Sales and Use Taxes

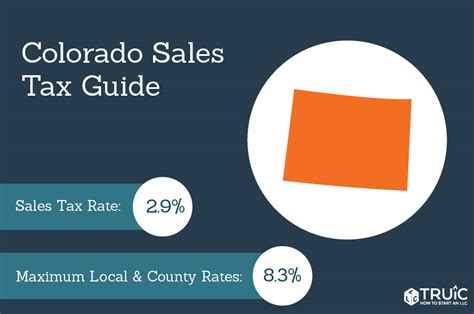

In addition to property taxes, Hempstead residents and businesses are subject to sales and use taxes, which contribute to the town’s revenue stream. Sales tax is levied on most tangible personal property sold within the town, while use tax is applied to goods purchased outside Hempstead but used within its boundaries.

The current sales tax rate in Hempstead is [sales tax rate]%, which is applied to the purchase price of eligible items. This rate includes both the state and local sales tax components. For example, a resident purchasing a new television for $1,000 would incur a sales tax of approximately $[sales tax amount], adding to the overall cost of the item.

Business Taxes and Incentives

Hempstead actively encourages business growth and investment through a range of tax incentives and programs. The town offers tax abatements and tax credits to attract new businesses and support existing ones, particularly in targeted sectors such as technology, green energy, and healthcare.

One notable initiative is the Hempstead Business Investment Program, which provides tax incentives for businesses that create new jobs and invest in the community. This program aims to foster economic development and improve the town's overall business climate.

The Impact of Hempstead’s Tax System

Hempstead’s tax system has a profound impact on various aspects of the town’s operations and development. The revenue generated through taxes supports critical services, including public safety, education, healthcare, and infrastructure projects.

Public Services and Infrastructure

Property taxes, in particular, play a crucial role in funding essential public services. The revenue derived from these taxes contributes to maintaining and improving Hempstead’s infrastructure, such as roads, bridges, and public transportation systems. Additionally, it supports the town’s renowned public school system, ensuring a quality education for its residents.

Economic Development and Job Creation

The town’s tax incentives and programs aimed at businesses have a positive impact on economic development. By attracting new businesses and supporting existing ones, Hempstead creates job opportunities, stimulates the local economy, and enhances the overall business landscape. This, in turn, benefits residents through increased employment prospects and a thriving commercial environment.

Community Initiatives and Quality of Life

Tax revenue also extends to funding community initiatives and enhancing the quality of life for Hempstead residents. This includes supporting local arts and culture programs, recreational facilities, and initiatives focused on sustainability and environmental conservation. These efforts contribute to a vibrant and engaging community, fostering a sense of pride and well-being among residents.

Looking Ahead: Hempstead’s Tax Future

As Hempstead continues to evolve and adapt to changing economic and social landscapes, its tax system will play a pivotal role in shaping the town’s future. The town’s leadership and tax authorities are committed to maintaining a balanced approach, ensuring that taxes remain fair and sustainable while supporting essential services and fostering economic growth.

Sustainable Tax Strategies

Hempstead is exploring sustainable tax strategies to ensure long-term fiscal health. This includes diversifying its revenue streams, investing in economic development initiatives, and implementing efficient tax collection systems. By adopting these measures, the town aims to mitigate the impact of economic fluctuations and maintain a stable financial foundation.

Community Engagement and Transparency

Transparency and community engagement are key aspects of Hempstead’s tax system. The town actively communicates tax-related matters to residents, providing clear information on tax rates, assessments, and incentives. This fosters trust and empowers residents to make informed decisions about their financial obligations.

Future Tax Incentives and Programs

Hempstead is continuously evaluating and refining its tax incentives and programs to remain competitive and attract investment. The town aims to create a business-friendly environment by offering targeted tax breaks and support for innovative industries, thus driving economic growth and creating a diverse and resilient economy.

How can I estimate my property taxes in Hempstead?

+To estimate your property taxes in Hempstead, you can use the town’s online property tax calculator. This tool allows you to input your property’s assessed value and provides an estimated annual tax amount based on the current tax rate. You can find the calculator on the town’s official website under the “Taxes and Assessments” section.

Are there any tax exemptions or abatements available for businesses in Hempstead?

+Yes, Hempstead offers a range of tax incentives and abatements for businesses. These include tax credits for job creation, investment, and specific industry sectors. To learn more about the available programs and eligibility criteria, you can visit the town’s Economic Development website or contact the Department of Economic Development directly.

How often do tax rates change in Hempstead?

+Tax rates in Hempstead are subject to change annually. The town’s tax authorities review the budget requirements, state regulations, and economic conditions to determine the appropriate tax rate for the upcoming fiscal year. It’s advisable to stay updated on any changes by monitoring local news and official announcements.