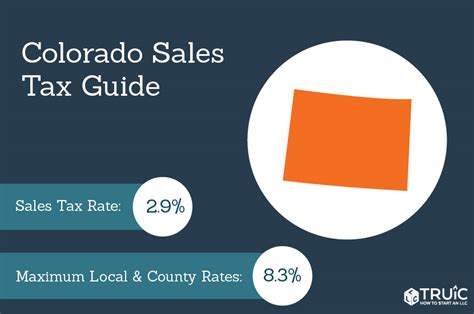

Colorado State Sales Tax

Colorado's sales tax is an important revenue stream for the state, impacting various industries and consumer behavior. Understanding the nuances of this tax is crucial for businesses and individuals alike, especially given the unique features of Colorado's tax landscape. This comprehensive guide aims to demystify the Colorado State Sales Tax, offering an in-depth analysis of its rates, applicability, exemptions, and the impact it has on the state's economy.

Understanding Colorado’s Sales Tax Landscape

Colorado, known for its stunning natural landscapes, also boasts a complex sales tax system. The state’s sales tax is not a flat rate across the board but rather a combination of state and local taxes, creating a dynamic and varied tax environment. This section will delve into the fundamental aspects of Colorado’s sales tax, setting the stage for a detailed exploration.

State and Local Sales Tax Rates

The Colorado State Sales Tax is currently set at 2.9%, a rate that has remained consistent for several years. However, this is just the tip of the iceberg. Colorado’s unique tax structure allows for local sales taxes to be levied on top of the state rate, resulting in varying total sales tax rates across different jurisdictions within the state.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Denver County | 4.62% | 7.52% |

| El Paso County | 3.10% | 6.0% |

| Larimer County | 3.5% | 6.4% |

As seen above, the total sales tax rate can vary significantly, with rates as high as 7.52% in Denver County and as low as 6.0% in El Paso County. These variations are primarily due to the different local taxes levied by city and county governments, adding an extra layer of complexity to Colorado's sales tax structure.

Exemptions and Special Considerations

While the sales tax is applicable to most goods and services, Colorado does offer a range of exemptions and special considerations that can significantly impact the tax liability of businesses and consumers. These exemptions are designed to encourage certain economic activities or support specific industries, making them a crucial aspect of Colorado’s tax strategy.

- Food and Grocery Exemptions: Most unprepared food items, including produce, dairy, and meat, are exempt from sales tax. However, prepared foods and meals are taxable.

- Manufacturing and Production Exemptions: Many raw materials and equipment used in manufacturing and production processes are exempt from sales tax, encouraging industrial growth in the state.

- Agricultural Sales Tax Exemption: Agricultural equipment, supplies, and inputs are generally exempt from sales tax, supporting Colorado's robust agricultural sector.

- Medical and Pharmaceutical Exemptions: Most medical services and prescription drugs are exempt from sales tax, providing relief to individuals and businesses in the healthcare sector.

Impact on Colorado’s Economy

The Colorado State Sales Tax plays a pivotal role in shaping the state’s economic landscape. From influencing consumer behavior to driving investment decisions, the tax has wide-ranging effects that are both positive and negative. This section will analyze these impacts in detail, providing a comprehensive understanding of the tax’s economic implications.

Consumer Behavior and Spending Patterns

The sales tax directly affects consumer spending habits. Higher tax rates can discourage spending, while lower rates can stimulate economic activity. In Colorado, the varying sales tax rates across different regions can lead to consumer migration, with individuals choosing to shop in areas with lower tax rates. This phenomenon, often referred to as “tax-driven shopping”, can significantly impact local businesses and revenue streams.

Additionally, the tax can influence consumer choice between taxable and exempt items. For instance, the exemption on unprepared food items can encourage consumers to opt for home-cooked meals over dining out, impacting the restaurant industry.

Business Operations and Investment Decisions

The sales tax is a critical consideration for businesses operating in Colorado. Companies must navigate the complex tax landscape, ensuring compliance with both state and local regulations. This complexity can impact investment decisions, with businesses potentially choosing to locate in areas with more favorable tax rates or structures.

Moreover, the sales tax can affect pricing strategies and profit margins. Businesses may absorb the tax or pass it on to consumers, which can influence their competitive positioning in the market. The tax can also impact the cash flow of businesses, especially those operating on thin margins.

Revenue Generation and Allocation

The revenue generated from the Colorado State Sales Tax is a significant contributor to the state’s budget. This revenue is used to fund various public services and infrastructure projects, playing a crucial role in the state’s development. The distribution of this revenue is also an important consideration, with funds allocated to different areas based on need and priority.

The sales tax revenue is allocated to various sectors, including education, healthcare, transportation, and public safety. The state budget for these sectors is heavily influenced by the tax revenue, with any fluctuations impacting the availability of resources and the quality of services provided.

Future Implications and Potential Reforms

As Colorado’s economy continues to evolve, so too will the role and structure of its sales tax. This section will explore the potential future implications of the current sales tax system and discuss possible reforms that could shape the tax landscape in the years to come.

Potential Impact of Economic Shifts

Economic shifts, such as changes in consumer spending habits or shifts in industry focus, can significantly impact the effectiveness and fairness of the current sales tax system. For instance, the growth of online shopping and the shift towards service-based economies can reduce the tax base for sales tax, potentially leading to revenue shortfalls.

Additionally, changes in population demographics and regional economic development can lead to imbalances in the distribution of tax revenue, impacting the equity of the system.

Exploring Alternative Tax Structures

Colorado’s unique sales tax structure has its advantages and disadvantages. As the state looks to the future, there may be opportunities to explore alternative tax structures that could better align with the state’s economic goals and needs. These could include:

- Simplification of the Tax Structure: Streamlining the tax rates and reducing the complexity of the current system could make it easier for businesses and consumers to understand and comply with.

- Introduction of a State-Wide Flat Tax: Implementing a uniform sales tax rate across the state could bring fairness and consistency, although it may face opposition from local governments reliant on local sales taxes.

- Expanding the Tax Base: Exploring additional tax sources, such as a state-wide income tax or a value-added tax (VAT), could provide a more stable and diverse revenue stream for the state.

Conclusion: Navigating Colorado’s Sales Tax Landscape

Colorado’s sales tax is a complex yet vital component of the state’s economy. Understanding its intricacies is essential for businesses and individuals looking to navigate this dynamic tax environment. As Colorado continues to grow and evolve, the sales tax will remain a key consideration, shaping the state’s economic future.

What is the primary purpose of Colorado’s sales tax?

+Colorado’s sales tax is a primary source of revenue for the state, used to fund public services, infrastructure projects, and other government initiatives.

How often are sales tax rates reviewed and updated in Colorado?

+Sales tax rates are typically reviewed annually by the Colorado Department of Revenue, with any changes implemented through legislative processes.

Are there any online resources available for businesses to stay updated on sales tax regulations in Colorado?

+Yes, the Colorado Department of Revenue provides an online portal with up-to-date information on sales tax regulations, including rates, exemptions, and filing requirements.

How does Colorado’s sales tax compare to other states in terms of rate and complexity?

+Colorado’s sales tax rate is relatively low compared to many other states, but its complexity, particularly with the addition of local sales taxes, makes it one of the more intricate tax systems in the country.