Sales Tax In Irvine Ca

Sales tax is an essential component of the revenue system for many states and local governments, including California. Understanding the sales tax landscape is crucial for businesses and consumers alike, especially in a bustling city like Irvine, California. This comprehensive guide will delve into the specifics of sales tax in Irvine, exploring the rates, applicable goods and services, and the potential implications for local businesses and residents.

Sales Tax Rates in Irvine, California

The sales tax structure in California is a combination of state, county, and city taxes, with additional district taxes in some cases. Irvine, like other cities in the state, follows a specific tax rate formula.

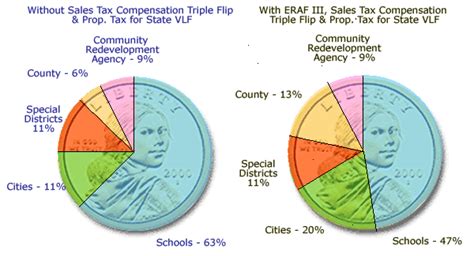

State Sales Tax

The state of California imposes a base sales tax rate of 7.25%, which is applied to most retail transactions. This rate is mandated by the California State Board of Equalization and serves as the foundation for local tax rates.

County Sales Tax

In addition to the state sales tax, Orange County, where Irvine is located, adds a countywide tax of 0.25%. This rate is consistent across the county and is used to fund various local services and infrastructure projects.

City Sales Tax

Irvine imposes its own city sales tax, which currently stands at 1.00%. This rate is dedicated to specific city initiatives and projects, contributing to the overall development and maintenance of the city.

| Sales Tax Category | Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| County Sales Tax | 0.25 |

| City Sales Tax (Irvine) | 1.00 |

| Total Sales Tax | 8.50 |

As a result, the combined sales tax rate in Irvine, California, is 8.50%. This rate is applicable to most tangible personal property sold at retail, including goods purchased online or through mail-order catalogs.

Goods and Services Subject to Sales Tax

In California, a wide range of goods and services are subject to sales tax. This includes, but is not limited to:

- Clothing and footwear.

- Electronics and appliances.

- Groceries (with certain exemptions for unprepared food items).

- Vehicles and vehicle parts.

- Restaurant meals and prepared food.

- Admission to entertainment events (e.g., concerts, movies, sporting events).

- Hotel and lodging services.

- Certain professional services, such as legal and accounting services.

It's important to note that there are specific exemptions and special tax rules for certain items and services. For instance, prescription medications, most medical devices, and certain agricultural equipment are exempt from sales tax in California.

Online Sales and Sales Tax

With the rise of e-commerce, online retailers must also comply with sales tax regulations. In California, online retailers are responsible for collecting and remitting sales tax if they have a physical presence or a substantial economic nexus in the state. This includes having employees, warehouses, or even affiliates located in California.

Sales Tax Compliance and Registration

Businesses operating in Irvine, California, must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a Seller’s Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments.

The registration process involves providing detailed information about the business, including its legal name, physical address, and the types of goods and services it offers. Once registered, businesses are required to collect the appropriate sales tax rate from customers and remit these funds to the CDTFA on a regular basis, typically quarterly or monthly.

Sales Tax Filing and Remittance

Sales tax returns must be filed with the CDTFA by the designated due dates. These returns detail the total sales, taxable sales, and the corresponding sales tax collected during the reporting period. Businesses are required to pay the collected sales tax to the state, along with any additional taxes due based on their sales.

Failure to comply with sales tax regulations can result in penalties and interest charges. It's crucial for businesses to maintain accurate records and file their sales tax returns promptly to avoid any legal repercussions.

Impact on Local Businesses and Residents

The sales tax rate in Irvine, California, can have both positive and negative implications for local businesses and residents.

Benefits for Local Businesses

- Revenue Generation: The sales tax collected provides a significant source of revenue for the city of Irvine, which can be used for various local projects and improvements.

- Competitive Advantage: A consistent sales tax rate can create a level playing field for businesses in Irvine, preventing unfair competition from businesses in neighboring cities with potentially lower tax rates.

- Support for Local Economy: Sales tax revenues can be invested back into the local economy, supporting job creation and economic growth.

Challenges for Local Businesses

- Increased Operating Costs: For businesses, especially those with narrow profit margins, the sales tax rate can add to their operating costs, potentially impacting their profitability.

- Customer Resistance: Some customers may be hesitant to make purchases in areas with higher sales tax rates, preferring to shop in neighboring cities or online to avoid the additional tax.

Impact on Residents

For residents of Irvine, the sales tax rate can affect their purchasing power and overall cost of living. While sales tax revenues support local services and infrastructure, residents may need to budget carefully to account for the additional tax on their purchases.

Future Outlook and Potential Changes

Sales tax rates and regulations can evolve over time due to various economic and political factors. In California, there have been discussions about potential changes to the sales tax system, including proposals for a simplified sales tax formula or the introduction of new tax brackets.

Additionally, with the continued growth of e-commerce, the state and local governments may need to adapt their sales tax regulations to ensure fair taxation of online sales. This could include the implementation of new rules or the adoption of existing laws, such as the Marketplace Fairness Act, which aims to require online retailers to collect sales tax based on the destination of the sale rather than their physical presence.

Potential Benefits of Sales Tax Reform

- Fairness: A simplified sales tax system could make it easier for businesses to comply with tax regulations and reduce the administrative burden associated with collecting and remitting sales tax.

- Increased Revenue: Depending on the proposed changes, a reformed sales tax system could lead to increased revenue for the state and local governments, allowing for further investment in public services and infrastructure.

- Economic Growth: Fair and efficient tax systems can encourage economic growth by promoting business investment and consumer spending.

Conclusion: Navigating Sales Tax in Irvine

Understanding the sales tax landscape in Irvine, California, is essential for both businesses and residents. The current sales tax rate of 8.50% is a combination of state, county, and city taxes, with each component contributing to the overall development and maintenance of the city and state. While sales tax can present challenges, it also offers benefits, such as revenue generation and support for local businesses and the economy.

As sales tax regulations continue to evolve, especially in the digital age, staying informed about potential changes is crucial for businesses and consumers alike. By staying up-to-date with tax laws and regulations, individuals and businesses can ensure compliance, avoid penalties, and contribute to the vibrant economy of Irvine, California.

What happens if a business fails to collect or remit sales tax in Irvine, CA?

+Businesses that fail to collect or remit sales tax as required may face significant penalties and interest charges. In addition to financial repercussions, businesses may also be subject to legal action, including potential suspension of their business license or Seller’s Permit.

Are there any sales tax holidays in California, and if so, when are they?

+California does not currently have sales tax holidays. However, the state may introduce them in the future to stimulate consumer spending during specific periods, such as back-to-school or holiday shopping seasons.

How often do sales tax rates change in Irvine, and who decides these changes?

+Sales tax rates can change based on various factors, including legislative decisions, economic conditions, and local initiatives. In Irvine, changes to the city sales tax rate are typically proposed by the city council and require approval from the state government. The state sales tax rate is set by the California State Legislature, while county sales tax rates are determined by the respective county boards of supervisors.