What Is Ohio Sales Tax

Welcome to a comprehensive guide on the Ohio Sales Tax, a crucial aspect of doing business in the Buckeye State. Ohio's sales tax system is an essential part of the state's revenue generation and economic framework. This article will delve into the specifics of Ohio sales tax, providing valuable insights for businesses and consumers alike. We'll cover the fundamentals, rates, exemptions, and best practices to ensure compliance and avoid penalties.

Understanding Ohio Sales Tax

Ohio’s sales tax is a consumption tax imposed on the sale of tangible personal property and certain services within the state. It is a key source of revenue for the state, local governments, and special districts. The tax is collected by businesses and remitted to the appropriate tax authorities. The Ohio Department of Taxation administers and enforces the sales tax regulations.

Ohio's sales tax is a cumulative tax, meaning that both state and local sales taxes are charged on the same transaction. This is different from some other states where the state tax is excluded from the local tax calculation. The cumulative nature of Ohio's sales tax can result in higher overall tax rates in certain areas.

Sales tax is an important consideration for businesses operating in Ohio. It impacts pricing strategies, competitive positioning, and overall financial planning. Understanding the intricacies of Ohio's sales tax system is vital for compliance and successful business operations.

Sales Tax Rates in Ohio

Ohio’s sales tax is composed of a state tax rate and local tax rates. The state sales tax rate is a flat 5.75% as of 2023. This rate is applicable across the state and is set by the Ohio General Assembly. However, local jurisdictions, such as cities and counties, have the authority to levy additional sales taxes on top of the state rate.

Local sales tax rates in Ohio vary depending on the jurisdiction. These rates can range from 0% to 2.5%, with some areas having multiple local taxes. For instance, a business operating in a city with a 1.5% local tax rate and a county with a 1% local tax rate would need to collect a total sales tax of 8.25% (5.75% state rate + 1.5% city rate + 1% county rate) on applicable transactions.

| Ohio Sales Tax Rates | Rate |

|---|---|

| State Sales Tax | 5.75% |

| Average Combined Rate (State + Local) | 7.25% |

| Highest Combined Rate | 8.5% |

It's crucial for businesses to stay updated on the sales tax rates in their specific locations. The Ohio Department of Taxation provides resources to help businesses determine the applicable tax rates based on their physical presence and transaction details.

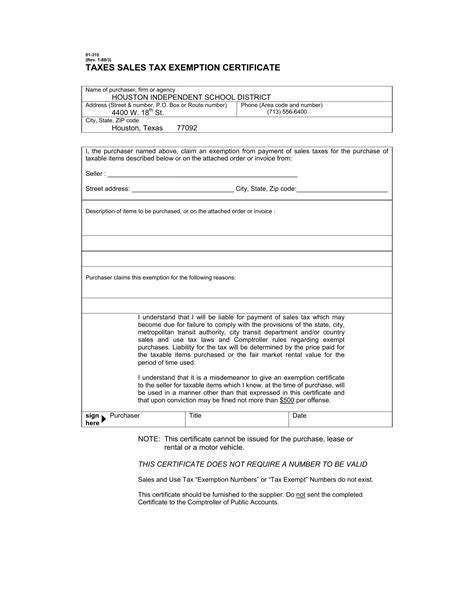

Sales Tax Exemptions in Ohio

Ohio offers various sales tax exemptions to specific goods and services. These exemptions are designed to reduce the tax burden on certain sectors and promote economic growth. Understanding these exemptions is vital for businesses to ensure they are compliant and taking advantage of any applicable tax breaks.

Some common sales tax exemptions in Ohio include:

- Food for Home Consumption: Most unprepared food items, including groceries, are exempt from sales tax in Ohio. However, prepared foods and beverages sold in restaurants or similar establishments are taxable.

- Prescription Drugs: Sales of prescription drugs and certain medical devices are exempt from sales tax.

- Manufacturing Equipment: Machinery and equipment used directly in manufacturing processes are often exempt from sales tax.

- Agricultural Products: Sales of agricultural products, including seeds, feed, and certain farm equipment, are exempt.

- Residential Rentals: Renting residential properties is generally exempt from sales tax in Ohio.

It's important to note that these exemptions have specific criteria and limitations. Businesses should consult the Ohio Department of Taxation's guidelines and seek professional advice to ensure they are applying the exemptions correctly.

Compliance and Reporting for Ohio Sales Tax

Ensuring compliance with Ohio’s sales tax regulations is crucial for businesses to avoid penalties and maintain a positive relationship with tax authorities. Here are some key considerations for sales tax compliance in Ohio:

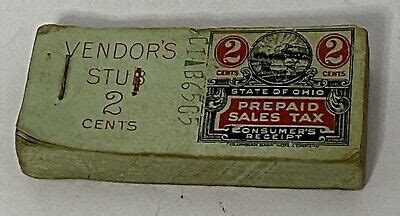

Registration and Permits

Businesses that make taxable sales in Ohio must register with the Ohio Department of Taxation to obtain a Vendor’s License. This license authorizes the business to collect and remit sales tax. The registration process involves providing detailed information about the business, its activities, and its physical presence in Ohio.

Businesses with multiple physical locations or significant online sales may need to register in multiple jurisdictions within Ohio. It's important to understand the registration requirements and ensure compliance to avoid penalties.

Sales Tax Collection

Once registered, businesses must collect sales tax from customers on taxable transactions. The tax is typically calculated as a percentage of the total sale, including any applicable discounts or promotions. It’s important to accurately calculate the tax and ensure it is clearly displayed to customers.

Businesses should also be aware of any special tax considerations, such as tax holidays or specific tax rates for certain items. Staying informed about these special circumstances is crucial for accurate tax collection.

Sales Tax Remittance

After collecting sales tax from customers, businesses must remit the tax to the Ohio Department of Taxation on a regular basis. The frequency of remittance depends on the business’s sales volume and tax liability. Most businesses are required to remit sales tax monthly or quarterly.

Sales tax returns must be filed accurately and on time. Late or incorrect filings can result in penalties and interest charges. Businesses should keep detailed records of sales transactions and tax calculations to facilitate accurate reporting.

Record Keeping and Audits

Maintaining accurate records is a critical aspect of sales tax compliance. Businesses should keep records of sales transactions, including the date, amount, and applicable tax rate. These records are essential for preparing sales tax returns and responding to audits.

The Ohio Department of Taxation has the authority to conduct sales tax audits to ensure compliance. During an audit, businesses must provide detailed records and demonstrate their sales tax calculations. Failure to provide accurate records or comply with audit requests can result in penalties.

Best Practices for Ohio Sales Tax Compliance

To ensure smooth compliance with Ohio’s sales tax regulations, businesses should consider the following best practices:

- Stay Informed: Keep up-to-date with sales tax rate changes, new regulations, and tax law amendments. The Ohio Department of Taxation provides resources and updates on its website.

- Accurate Calculation: Use reliable sales tax calculation tools or software to ensure accurate tax computations. These tools can help avoid errors and simplify the tax collection process.

- Separate Taxable and Exempt Sales: Clearly differentiate between taxable and exempt sales to avoid overcharging or undercharging sales tax. Proper segregation can simplify record keeping and tax reporting.

- Implement Sales Tax Automation: Consider using sales tax automation solutions that integrate with your accounting and e-commerce systems. These tools can automate tax calculations, reporting, and remittance, reducing the risk of errors and streamlining compliance.

- Seek Professional Advice: Consult with tax professionals or accountants who specialize in sales tax compliance. They can provide tailored guidance based on your business's specific circumstances and help navigate complex tax scenarios.

Conclusion

Ohio’s sales tax system is a critical component of the state’s revenue generation and economic framework. Understanding the sales tax rates, exemptions, and compliance requirements is essential for businesses operating in Ohio. By staying informed, implementing best practices, and seeking professional advice when needed, businesses can ensure compliance, avoid penalties, and contribute to the state’s fiscal health.

For more information on Ohio sales tax and other business tax obligations, visit the Ohio Department of Taxation website. The department provides comprehensive resources, guidelines, and support to help businesses navigate the complexities of Ohio's tax landscape.

What is the average sales tax rate in Ohio?

+

The average combined sales tax rate in Ohio, including state and local taxes, is around 7.25% as of 2023. However, rates can vary depending on the specific location within the state.

Are there any sales tax holidays in Ohio?

+

Yes, Ohio has designated sales tax holidays for specific items or occasions. These holidays typically offer temporary tax exemptions on certain purchases. Check the Ohio Department of Taxation website for the latest information on sales tax holidays.

How often do I need to remit sales tax in Ohio?

+

The frequency of sales tax remittance depends on your business’s sales volume and tax liability. Most businesses in Ohio are required to remit sales tax monthly or quarterly. However, businesses with higher sales may need to remit more frequently.

What happens if I don’t register for a Vendor’s License in Ohio?

+

Failing to register for a Vendor’s License in Ohio can result in penalties and interest charges. Additionally, unregistered businesses may be subject to audits and face legal consequences for non-compliance.

Can I claim sales tax refunds in Ohio?

+

Yes, businesses and individuals may be eligible for sales tax refunds in certain circumstances. Common scenarios include overpayment of tax, tax paid on exempt purchases, or tax paid in error. Consult the Ohio Department of Taxation for guidelines on claiming refunds.