Anderson County Sc Tax

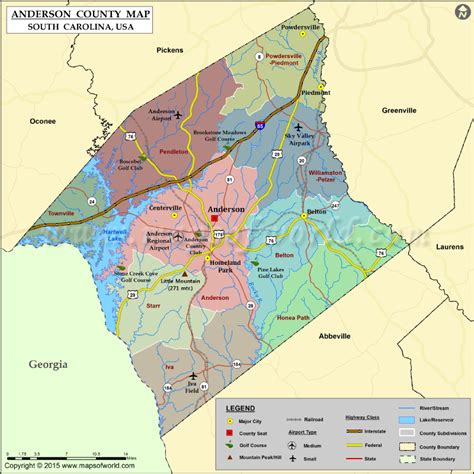

Welcome to our comprehensive guide on Anderson County SC Tax, designed to provide you with an in-depth understanding of the tax landscape in this vibrant county. As we delve into the intricacies of Anderson County's tax system, we will explore the various types of taxes, rates, and regulations that affect individuals and businesses within this region. Whether you're a resident, a business owner, or simply interested in the fiscal dynamics of this area, this article will offer valuable insights and practical information.

Unraveling the Anderson County Tax System

Anderson County, nestled in the heart of South Carolina, boasts a diverse economy and a thriving community. The tax system here plays a crucial role in supporting the county’s infrastructure, services, and overall development. Understanding the intricacies of this system is essential for making informed financial decisions and ensuring compliance with local regulations.

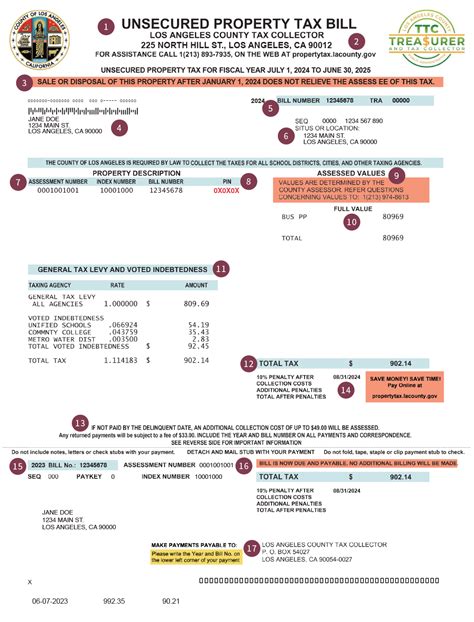

Property Taxes: A Key Revenue Source

Property taxes are a significant component of Anderson County’s tax revenue. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The county’s property tax rate is determined by the assessed value of the property and is subject to regular reassessments to ensure fairness and accuracy.

For instance, let’s consider a residential property in Anderson County with an assessed value of 250,000. The property tax rate for such a property might be around 0.65%, resulting in an annual property tax bill of 1,625. This rate is subject to change based on budgetary needs and other factors determined by the county government.

| Property Type | Assessed Value | Estimated Tax Rate | Annual Property Tax |

|---|---|---|---|

| Residential | 250,000</td> <td>0.65%</td> <td>1,625 | ||

| Commercial | 500,000</td> <td>0.7%</td> <td>3,500 | ||

| Agricultural | 150,000</td> <td>0.55%</td> <td>825 |

Sales and Use Taxes: Impact on Daily Transactions

Anderson County, like many other areas, imposes sales and use taxes on various goods and services. These taxes are an essential revenue stream for the county and are applicable to most retail purchases. The sales tax rate in Anderson County is comprised of both state and county taxes, resulting in a combined rate that affects consumers directly.

As of the latest information available, the total sales tax rate in Anderson County is approximately 8.5%. This rate includes the state sales tax of 6% and an additional 2.5% in local taxes. For example, if you purchase an item priced at 100 in Anderson County, you will pay a total of 108.50, with $8.50 going towards sales taxes.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Anderson County Sales Tax | 2.5% |

| Total Sales Tax | 8.5% |

Business Taxes: Navigating the Entrepreneurial Landscape

Anderson County is a popular destination for businesses, and understanding the local tax obligations is crucial for entrepreneurs and business owners. The county imposes various taxes on businesses, including income taxes, payroll taxes, and business license fees. These taxes contribute to the county’s revenue and help fund essential services and infrastructure projects.

For instance, businesses in Anderson County are required to obtain a business license, which incurs a fee based on the type and nature of the business. Additionally, businesses with employees must comply with payroll tax regulations, including the withholding and remittance of federal, state, and local taxes.

| Business Tax | Rate/Fee |

|---|---|

| Business License Fee | Varies based on business type |

| Income Tax | Varies based on business income |

| Payroll Taxes | Federal, State, and Local Rates |

Special Taxes and Exemptions: A Complex Landscape

Anderson County, like many other jurisdictions, has a range of special taxes and exemptions that apply to specific situations. These can include taxes on accommodations, rentals, and certain services, as well as exemptions for non-profit organizations and government entities.

For instance, Anderson County imposes a 3% accommodations tax on rentals of less than 90 days, which is commonly referred to as a “tourist tax.” This tax is applied to hotels, motels, and other short-term rental accommodations. Additionally, certain purchases made by non-profit organizations may be exempt from sales tax, provided they meet specific criteria and follow the necessary procedures.

Conclusion: Navigating Anderson County’s Fiscal Landscape

Anderson County’s tax system is a complex yet crucial aspect of the local economy. Understanding the various taxes, rates, and regulations is essential for individuals and businesses alike to ensure compliance and make informed financial decisions. From property taxes to sales taxes and business obligations, each component plays a vital role in supporting the county’s infrastructure and services.

As you navigate the fiscal landscape of Anderson County, stay informed about the latest tax rates, incentives, and regulations. This knowledge will not only help you manage your financial obligations but also contribute to the continued growth and development of this vibrant community.

What is the average property tax rate in Anderson County, SC?

+The average property tax rate in Anderson County can vary depending on the assessed value of the property. As of recent data, the average effective property tax rate is around 0.65%.

Are there any tax incentives for businesses in Anderson County?

+Yes, Anderson County offers various tax incentives for businesses, including tax credits for job creation, research and development, and investment in certain industries. These incentives are designed to attract and support businesses in the county.

How often are property assessments conducted in Anderson County?

+Property assessments in Anderson County are typically conducted every five years. However, certain circumstances, such as significant property improvements or changes in value, may trigger an earlier reassessment.

Are there any sales tax holidays in Anderson County?

+Yes, Anderson County, along with the state of South Carolina, participates in sales tax holidays. These are designated periods where certain items, such as school supplies or energy-efficient appliances, are exempt from sales tax. The dates and eligible items can vary each year.

How can I stay updated on tax rates and regulations in Anderson County?

+You can stay informed by regularly checking the official website of Anderson County, which provides the latest tax rates and regulations. Additionally, subscribing to local news sources and following relevant social media accounts can keep you updated on any changes or developments.