Riverside County Tax

Taxation is an essential aspect of any functioning society, and understanding the tax system in your jurisdiction is crucial for both individuals and businesses. In this comprehensive guide, we will delve into the intricacies of Riverside County's tax system, exploring the various types of taxes, their rates, and how they impact residents and businesses alike. With a focus on Riverside County, California, we aim to provide an expert-level analysis of the tax landscape, offering valuable insights and clarity to those navigating this complex yet critical financial landscape.

Unraveling the Riverside County Tax System: A Comprehensive Overview

Riverside County, nestled in the heart of Southern California, boasts a vibrant economy and a diverse population. With its thriving industries, picturesque landscapes, and growing communities, the county’s tax system plays a pivotal role in its development and prosperity. In this section, we will dissect the various taxes imposed by Riverside County, shedding light on their purpose, rates, and implications.

Property Taxes: The Backbone of Local Revenue

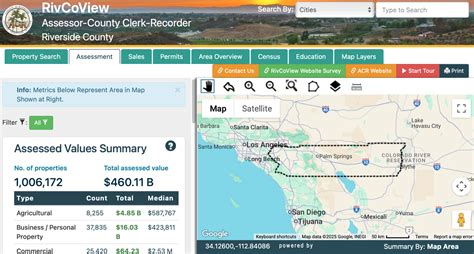

One of the primary sources of revenue for Riverside County is property tax. Property taxes are levied on both real estate and personal property within the county. The assessment process is intricate, taking into account factors such as property value, improvements, and exemptions. The tax rate for property taxes in Riverside County is set at a standard rate of 1% of the assessed value, with additional rates varying based on special districts and bond measures.

For instance, let’s consider a residential property in the city of Riverside. A homeowner with a property valued at 500,000 can expect to pay approximately 5,000 in annual property taxes, assuming there are no additional assessments or exemptions. This tax contributes to the funding of essential services such as education, public safety, and infrastructure development.

| Property Type | Assessment Rate | Tax Rate |

|---|---|---|

| Residential | 1% of Assessed Value | 1.0% + District Rates |

| Commercial | Same as Residential | 1.25% - 1.5% (Varies) |

| Agricultural | Special Assessment | Varies based on Use |

Sales and Use Taxes: Funding Essential Services

Sales and use taxes are another vital component of Riverside County’s tax system. These taxes are imposed on the sale or use of goods and services within the county. The sales tax rate in Riverside County stands at 7.75%, which includes both state and local taxes. This rate is applied to most retail transactions, including clothing, electronics, and groceries. However, certain exemptions and special tax rates apply to specific items, such as prescription drugs and food products.

For businesses operating in Riverside County, understanding the sales tax obligations is crucial. Let’s take the example of a local retailer, Riverside Electronics. When a customer purchases a new laptop for 1,000, the business is responsible for collecting and remitting the applicable sales tax, which amounts to 77.50 in this case. This tax revenue is then distributed to various local agencies, contributing to essential services such as transportation, public health, and social programs.

| Tax Type | Rate | Description |

|---|---|---|

| State Sales Tax | 7.25% | Imposed by the State of California |

| Local Sales Tax | 0.5% | Additional tax for Riverside County |

| District Sales Tax | Varies | Specific rates for special districts |

Income Taxes: Individual and Business Contributions

Income taxes play a significant role in funding state and local governments, and Riverside County is no exception. Residents and businesses alike are subject to income taxes, with rates varying based on individual circumstances. The state of California imposes a progressive income tax system, with rates ranging from 1% to 12.3% for individuals and 1.5% to 8.84% for corporations.

Let’s illustrate this with an example. A resident of Riverside County, Jane, has an annual income of 60,000. Based on California's tax brackets, Jane would fall into the <strong>6%</strong> tax rate for the first 9,835 of her income and the 8.84% tax rate for the remaining amount. This calculation results in an estimated state income tax liability of approximately $4,264 for Jane.

For businesses, the income tax landscape is equally intricate. Corporations and limited liability companies (LLCs) are subject to the aforementioned corporate tax rates, while sole proprietorships and partnerships are taxed at individual rates. It is essential for businesses to understand their tax obligations and seek professional guidance to ensure compliance and optimize their tax strategies.

Special Taxes and Assessments: Targeted Funding for Specific Purposes

In addition to the aforementioned taxes, Riverside County also levies special taxes and assessments to fund specific projects and services. These taxes are often approved by voters through ballot measures and are targeted towards addressing unique community needs.

For instance, the Riverside County Transportation Commission (RCTC) imposes a half-cent sales tax dedicated to improving the county’s transportation infrastructure. This tax, approved by voters, provides funding for projects such as highway improvements, public transit expansion, and pedestrian and bicycle infrastructure.

Furthermore, special assessments are imposed on certain properties within specific districts to fund services such as mosquito and vector control, fire protection, and flood control. These assessments are typically based on the benefits received by the property owners and are an essential component of the county’s financial landscape.

Navigating the Tax Landscape: Strategies and Considerations

Understanding the Riverside County tax system is just the first step towards effective tax planning and compliance. In this section, we will explore some strategies and considerations that individuals and businesses can employ to navigate the tax landscape successfully.

Maximizing Deductions and Exemptions

Both individuals and businesses have the opportunity to reduce their tax liability by taking advantage of various deductions and exemptions. For individuals, common deductions include mortgage interest, property taxes, charitable contributions, and retirement plan contributions. Businesses, on the other hand, can benefit from deductions such as advertising expenses, employee benefits, and certain types of property depreciation.

Let’s consider a small business owner, John, who operates a local coffee shop in Riverside County. By keeping detailed records of his expenses, John can claim deductions for items such as coffee beans, cups, and marketing costs. Additionally, if John has hired employees, he can deduct their salaries and benefits as business expenses. These deductions can significantly reduce his tax liability and improve his bottom line.

Utilizing Tax Credits and Incentives

Riverside County, like many other jurisdictions, offers various tax credits and incentives to encourage economic growth and development. These incentives can take the form of tax credits for hiring local residents, investing in renewable energy, or engaging in research and development activities. Businesses should stay informed about these opportunities and work with tax professionals to maximize their eligibility for such credits.

For instance, a manufacturing company planning to expand its operations in Riverside County may be eligible for tax credits based on the number of jobs created and the investment made in the local community. By leveraging these incentives, businesses can not only reduce their tax burden but also contribute to the economic vitality of the region.

Efficient Record-Keeping and Tax Preparation

Accurate record-keeping is crucial for both individuals and businesses to ensure compliance and optimize their tax strategies. Maintaining detailed records of income, expenses, and transactions is essential for preparing tax returns and supporting any deductions or credits claimed. Additionally, working with qualified tax professionals can provide valuable guidance and ensure that all applicable tax laws and regulations are followed.

For individuals, utilizing tax preparation software or seeking the assistance of a tax accountant can simplify the process and ensure accuracy. Businesses, on the other hand, often benefit from employing dedicated accounting teams or outsourcing their financial management to experts who can handle complex tax matters efficiently.

Understanding Tax Deadlines and Payment Options

Tax deadlines are critical to avoid penalties and interest charges. Both individuals and businesses must be aware of the specific dates for filing tax returns and making payments. Riverside County, like most jurisdictions, typically follows the federal tax deadlines, with the standard tax year ending on December 31st. However, it is essential to verify the specific deadlines for different tax types and ensure timely compliance.

Furthermore, understanding the available payment options is crucial. Riverside County offers various methods for tax payment, including online portals, direct bank transfers, credit/debit card payments, and traditional mail-in payments. Being aware of these options and their associated fees and processing times can help individuals and businesses manage their cash flow effectively during tax season.

The Future of Riverside County Taxation: Trends and Implications

As Riverside County continues to evolve and grow, its tax system will also undergo changes and adaptations. In this section, we will explore some emerging trends and potential future developments that may shape the tax landscape in the years to come.

Digital Taxation and E-Commerce

With the rise of e-commerce and digital transactions, the taxation of online sales has become a complex issue. Riverside County, like many other jurisdictions, is exploring ways to ensure fair taxation of online businesses and remote sellers. This may involve implementing new tax collection mechanisms, such as marketplace facilitator laws, to capture tax revenue from out-of-state sellers.

As the digital economy continues to grow, Riverside County will need to stay agile and adapt its tax system to keep pace with evolving business models. This may include revisions to sales tax laws, expanded definitions of nexus, and enhanced tax enforcement strategies to ensure compliance among online businesses.

Sustainable Taxation and Green Initiatives

In recent years, there has been a growing focus on sustainability and environmental initiatives. Riverside County, with its commitment to green energy and conservation, may explore the implementation of taxes or fees targeted at reducing carbon emissions and promoting sustainable practices.

For instance, the county could introduce a carbon tax on certain industries or a fee for single-use plastics. These measures would not only generate revenue for environmental initiatives but also incentivize businesses and residents to adopt more sustainable practices, contributing to the county’s overall sustainability goals.

Taxation and Social Equity

Social equity and fairness in taxation are critical considerations for any jurisdiction. Riverside County may explore ways to ensure that its tax system promotes economic development while also addressing social disparities. This could involve implementing tax incentives or grants targeted at underserved communities or businesses owned by minorities and women.

Additionally, the county may consider adjusting tax rates or providing tax relief for low-income individuals and families. By making the tax system more equitable, Riverside County can foster economic growth while ensuring that the benefits are distributed fairly across its diverse population.

Conclusion: A Complex but Crucial Landscape

The tax system in Riverside County is intricate and multifaceted, encompassing various taxes and assessments that fund essential services and contribute to the county’s prosperity. From property taxes to sales and use taxes, income taxes, and special assessments, understanding this landscape is vital for both individuals and businesses.

By exploring the different types of taxes, their rates, and their implications, we have gained a comprehensive understanding of Riverside County’s tax system. Additionally, we have delved into strategies and considerations for effective tax planning, maximizing deductions, utilizing incentives, and ensuring compliance. As the county continues to evolve, staying informed about emerging trends and potential future developments will be crucial for navigating the tax landscape successfully.

Whether you are a resident, a business owner, or simply interested in the workings of local governments, this guide aims to provide valuable insights and a deeper understanding of the vital role that taxation plays in shaping our communities. As we continue to navigate the complex world of taxation, staying informed and seeking professional guidance will be essential to ensure compliance and optimize our financial strategies.

What is the property tax rate in Riverside County?

+The standard property tax rate in Riverside County is 1% of the assessed value. However, additional rates may apply based on special districts and bond measures.

How are sales taxes calculated in Riverside County?

+Sales taxes in Riverside County are calculated by adding the state sales tax rate (7.25%) and the local sales tax rate (0.5%), resulting in a total sales tax rate of 7.75%. Additional district sales tax rates may also apply.

What are some common tax deductions for individuals in Riverside County?

+Common tax deductions for individuals in Riverside County include mortgage interest, property taxes, charitable contributions, and retirement plan contributions. It is important to consult a tax professional to maximize deductions.

How can businesses take advantage of tax incentives in Riverside County?

+Businesses can take advantage of tax incentives in Riverside County by staying informed about local and state programs. This may include tax credits for hiring local residents, investing in renewable energy, or engaging in research and development activities.

What are the key tax deadlines for individuals and businesses in Riverside County?

+The key tax deadlines for individuals and businesses in Riverside County typically follow the federal tax deadlines. However, it is essential to verify specific deadlines for different tax types. The standard tax year ends on December 31st.