Sales Tax In Maryland

In the state of Maryland, sales tax is an essential component of the tax system, contributing significantly to the state's revenue and impacting consumers and businesses alike. Understanding the intricacies of sales tax in Maryland is crucial for both residents and businesses operating within the state.

The Basics of Sales Tax in Maryland

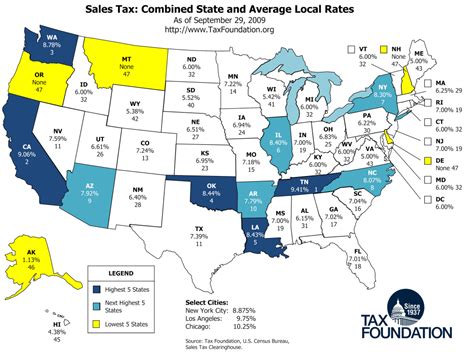

Maryland imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain selected services. The state sales tax rate in Maryland is currently set at 6%, which is applicable across the state. However, it’s important to note that this is not the only tax rate that consumers may encounter.

Maryland has a unique feature in its sales tax system known as local jurisdiction taxes. These are additional taxes imposed by counties and municipalities, creating a variable tax rate depending on the location of the purchase. Local jurisdiction taxes can range from 0% to 3%, with some areas having no additional tax and others adding a significant percentage to the state rate. This variability makes the sales tax landscape in Maryland quite complex.

For instance, consider the city of Baltimore, which has a combined state and local sales tax rate of 9.25%, one of the highest in the state. In contrast, Worcester County has a lower combined rate of 6%, the same as the state rate.

Sales Tax Exemptions

While sales tax is a broad-based tax, Maryland does offer certain exemptions. These include purchases made by government entities, charitable organizations, and educational institutions, which are exempt from sales tax under specific conditions. Additionally, certain goods, such as prescription medications and select food items, are also exempt from sales tax.

Understanding these exemptions is crucial for businesses, as misclassification of products or services can lead to significant tax liabilities. It is advised that businesses stay updated with the latest exemptions to ensure compliance and avoid penalties.

Sales Tax Collection and Remittance

Businesses with a physical presence in Maryland, known as nexus, are required to collect and remit sales tax on taxable sales made within the state. This includes brick-and-mortar stores, warehouses, and even remote-seller businesses with sufficient connections to the state.

The frequency of sales tax filing and remittance varies based on the business's sales volume. Most businesses file and remit sales tax on a quarterly basis, but high-volume sellers may be required to file more frequently, such as monthly.

| Filing Frequency | Sales Volume |

|---|---|

| Quarterly | Less than $50,000 in taxable sales |

| Monthly | Greater than $50,000 in taxable sales |

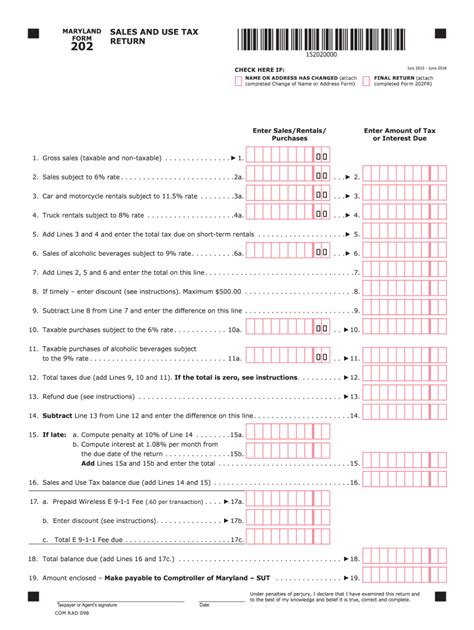

Businesses are responsible for accurately calculating the sales tax due, including both the state and local jurisdiction taxes, and submitting the collected tax to the Maryland Comptroller of Maryland within the designated timeframe.

Sales Tax Compliance and Penalties

Sales tax compliance is a critical aspect of doing business in Maryland. Non-compliance can lead to serious consequences, including penalties, interest charges, and even criminal prosecution in extreme cases.

The Maryland Comptroller of Maryland has the authority to audit businesses to ensure they are properly collecting and remitting sales tax. Audits can be random or triggered by suspicious activities, such as a sudden drop in sales tax revenue.

If an audit reveals that a business has underreported its taxable sales or has failed to collect and remit sales tax, the business may be subject to the following penalties:

- Underpayment Penalties: A penalty of 5% of the underpayment amount is imposed for each month or part of a month the underpayment remains uncorrected, up to a maximum of 25%.

- Late Payment Penalties: A penalty of 5% of the unpaid tax amount is charged for each month or part of a month the tax remains unpaid, up to a maximum of 25%.

- Interest Charges: Interest accrues on the unpaid tax and penalties at a rate of 1.5% per month or fraction thereof from the due date until the date of payment.

In addition to these penalties, the Comptroller may also pursue civil or criminal actions against businesses that intentionally evade sales tax. Civil actions can result in the business being held liable for the unpaid tax, penalties, interest, and costs of the action. Criminal actions, on the other hand, can lead to fines and even imprisonment.

Sales Tax Registration and Filing

To register for sales tax in Maryland, businesses must complete the Business Tax Registration Application (Form BDR) provided by the Maryland Comptroller of Maryland. This form collects information about the business, including its legal name, address, and contact details. Once registered, businesses will receive a unique Account Number and instructions on how to file and remit sales tax.

Sales tax returns in Maryland are due on the 20th day of the month following the end of the reporting period. For example, if a business files quarterly, its return for the quarter ending March 31st would be due on April 20th. Returns can be filed electronically through the Maryland Taxpayer Access Point (MTAP) or by mailing a paper return to the Comptroller's office.

Sales Tax Rates and Local Jurisdictions

As mentioned earlier, Maryland’s sales tax rates vary depending on the local jurisdiction where the sale occurs. Here is a breakdown of the sales tax rates in some of the major cities and counties in Maryland:

| Location | State Tax Rate | Local Tax Rate | Total Tax Rate |

|---|---|---|---|

| Baltimore City | 6% | 3.25% | 9.25% |

| Montgomery County | 6% | 1% | 7% |

| Anne Arundel County | 6% | 1% | 7% |

| Howard County | 6% | 1% | 7% |

| Frederick County | 6% | 1% | 7% |

| Prince George's County | 6% | 1% | 7% |

It's important to note that these rates are subject to change, and businesses should always refer to the official Maryland Comptroller of Maryland website for the most up-to-date information on sales tax rates and regulations.

Sales Tax Holidays

Maryland occasionally offers sales tax holidays, during which certain purchases are exempt from sales tax. These holidays are typically held around major shopping events, such as back-to-school season or the holiday season. During these periods, consumers can save money on specific items, such as clothing, school supplies, or energy-efficient appliances.

Sales tax holidays are a great way for businesses to boost sales and for consumers to save money. However, it's important for businesses to be aware of these periods and properly educate their staff on the applicable tax exemptions to ensure compliance.

Sales Tax for Online Sellers

With the rise of e-commerce, the rules for sales tax collection and remittance have become more complex, especially for online sellers. In Maryland, online sellers with a significant economic presence, or nexus, are required to collect and remit sales tax on their online sales.

The definition of nexus in Maryland includes having a physical presence in the state, such as a warehouse or office, or meeting certain economic thresholds, such as a minimum number of transactions or sales volume. Online sellers who meet these criteria must register with the Maryland Comptroller of Maryland and collect sales tax on their Maryland sales.

To simplify compliance for online sellers, Maryland offers a Voluntary Collection Agreement (VCA), which allows eligible sellers to voluntarily collect and remit sales tax on their Maryland sales, even if they do not meet the state's nexus requirements. This agreement provides a level of certainty and can help sellers avoid potential penalties and interest charges.

Sales Tax for Remote Sellers

For remote sellers, Maryland has specific rules regarding sales tax collection. Remote sellers who do not have a physical presence in Maryland but make sales into the state may be required to collect and remit sales tax if they exceed certain economic thresholds. These thresholds are based on the number of transactions or the total sales volume into the state.

Remote sellers who meet these thresholds are considered to have economic nexus in Maryland and must register with the Maryland Comptroller of Maryland and collect sales tax on their Maryland sales. Failure to comply with these rules can result in significant penalties and interest charges.

Sales Tax for Special Cases

Maryland’s sales tax system has provisions for special cases, such as sales to exempt organizations, out-of-state sellers, and drop shipments. Understanding these special cases is crucial for businesses to ensure proper tax compliance.

Sales to Exempt Organizations

Sales to certain exempt organizations, such as government entities, charitable organizations, and educational institutions, are exempt from sales tax in Maryland. However, it’s important for businesses to verify the exempt status of the organization and obtain the necessary documentation to support the exemption. Failure to properly document these sales can lead to tax liabilities.

Out-of-State Sellers

Out-of-state sellers who make sales into Maryland may be required to collect and remit sales tax if they have a significant economic presence in the state. This includes sellers who make sales through affiliates, drop shippers, or other intermediaries located in Maryland. These sellers should consult with tax professionals to ensure they are in compliance with Maryland’s sales tax laws.

Drop Shipments

Drop shipments, where a seller accepts an order from a customer but has the goods shipped directly from a third-party supplier to the customer, can have sales tax implications in Maryland. If the drop shipper is located in Maryland, the seller may be responsible for collecting and remitting sales tax on the sale. Businesses should carefully consider their drop shipping arrangements and consult with tax professionals to ensure compliance.

Future Implications and Trends

The sales tax landscape in Maryland is constantly evolving, and businesses must stay informed to ensure they are in compliance with the latest regulations. Here are some key trends and future implications to watch for:

- Online Sales Tax Collection: With the continued growth of e-commerce, the collection of sales tax on online sales is likely to become even more stringent. Businesses should expect more scrutiny and potential audits related to online sales tax collection.

- Economic Nexus Expansion: As more states adopt economic nexus rules, it is likely that Maryland will follow suit and lower its economic nexus thresholds. This means that more remote sellers may be required to collect and remit sales tax in the state.

- Remote Seller Registration: Maryland may implement more streamlined registration processes for remote sellers, making it easier for these businesses to comply with sales tax regulations.

- Sales Tax Simplification: While Maryland's sales tax system is already complex, there may be efforts to simplify and streamline the process, potentially through the use of technology and digital tools.

- Sales Tax Holidays: Maryland may continue to offer sales tax holidays to boost consumer spending and support local businesses. These periods can provide significant savings for consumers and can be a boon for businesses.

By staying informed about these trends and future implications, businesses can better navigate the complex world of sales tax in Maryland and ensure they are in compliance with the latest regulations.

How often do I need to file sales tax returns in Maryland?

+The frequency of sales tax filing in Maryland depends on your business’s sales volume. Most businesses file quarterly, but high-volume sellers may be required to file monthly. It’s important to check with the Maryland Comptroller’s office for specific guidelines based on your business’s circumstances.

What happens if I don’t collect and remit sales tax in Maryland?

+Failure to collect and remit sales tax in Maryland can result in significant penalties and interest charges. The Comptroller may also pursue civil or criminal actions against businesses that intentionally evade sales tax. It’s crucial to stay compliant to avoid these consequences.

Are there any sales tax holidays in Maryland, and how can I take advantage of them?

+Maryland occasionally offers sales tax holidays, typically around major shopping events. During these periods, certain purchases are exempt from sales tax. To take advantage of these holidays, businesses should stay informed about the dates and eligible items and properly educate their staff on the applicable tax exemptions.

What are the economic nexus thresholds for remote sellers in Maryland?

+Maryland has not yet adopted economic nexus rules for remote sellers. However, it’s important to monitor this situation, as the state may implement such rules in the future. Remote sellers should stay informed about any changes to ensure they are in compliance with Maryland’s sales tax laws.