Miami Dade Taxes Property Search

Welcome to the ultimate guide to navigating the Miami-Dade County Property Search system and understanding the intricacies of property taxes in this vibrant region. In this comprehensive article, we will delve into the world of real estate taxation, offering a detailed breakdown of the process, its key players, and the critical information you need to make informed decisions regarding your property investments in Miami-Dade County.

Understanding Miami-Dade County Property Taxes

Miami-Dade County, renowned for its picturesque beaches, vibrant culture, and thriving economy, is also known for its robust property market. As an investor or homeowner, it’s essential to grasp the intricacies of property taxes, as they are an integral part of the real estate landscape.

The Role of the Miami-Dade County Property Appraiser

The Miami-Dade County Property Appraiser’s Office plays a pivotal role in the property tax ecosystem. This office, headed by the elected County Property Appraiser, is responsible for assessing the value of all taxable property within the county. The appraised value forms the basis for calculating property taxes, making this office a critical player in the local government’s revenue generation.

The Property Appraiser's team of professionals employs a range of methods to determine property values. These include physical inspections, sales analysis, cost approaches, and income capitalization for commercial properties. The office maintains a vast database of property records, ensuring transparency and accessibility for taxpayers.

Tax Assessment Process: A Step-by-Step Guide

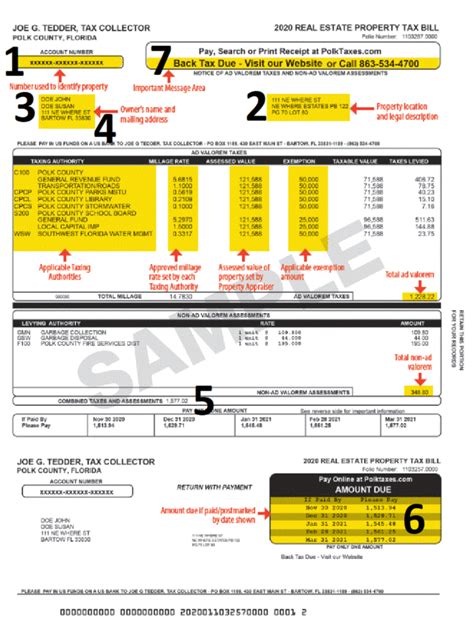

- Initial Assessment: The property appraiser’s office begins by assessing the value of each property in the county. This value is based on a multitude of factors, including the property’s location, size, improvements, and recent sales data.

- Notices of Proposed Property Taxes: Once the initial assessments are complete, the office sends out Notices of Proposed Property Taxes to all property owners. These notices detail the proposed tax amount based on the assessed value and the applicable tax rates.

- Review and Appeal: Property owners have the right to review and appeal their assessed values. The office provides a detailed breakdown of how the value was determined, allowing owners to identify any potential errors or discrepancies.

- Final Tax Roll: After the review and appeal period, the property appraiser certifies the Final Tax Roll, which contains the assessed values and tax amounts for all properties in the county. This roll is then forwarded to the Miami-Dade County Tax Collector’s Office.

- Collection of Property Taxes: The Tax Collector’s Office is responsible for collecting property taxes based on the certified tax roll. Property owners receive tax bills detailing the amount due and the payment deadline.

Tax Exemptions and Special Programs

Miami-Dade County offers a range of tax exemptions and special programs to eligible property owners. These programs are designed to provide relief to certain groups and promote specific objectives. Some of the notable exemptions and programs include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a Homestead Exemption, which provides a substantial reduction in their taxable value.

- Senior Exemption: Eligible senior citizens may qualify for an additional exemption, further reducing their taxable value.

- Veterans’ Exemption: Miami-Dade County recognizes the service of veterans by offering tax exemptions based on their military status and service-related disabilities.

- Low-Income Tax Relief: Certain low-income homeowners may be eligible for a reduction in their property taxes through the Low-Income Senior Citizen Discount program.

Navigating the Miami-Dade Property Search System

The Miami-Dade County Property Search system is a powerful tool that allows taxpayers and investors to access a wealth of information about properties in the county. This system provides detailed property data, tax information, and assessment details, empowering users to make informed decisions.

Accessing the Property Search System

To access the Miami-Dade County Property Search system, follow these steps:

- Visit the official Miami-Dade County Property Appraiser’s website: https://www.miamidade.gov/property-appraiser.

- On the homepage, you’ll find a search bar labeled Search Properties. Here, you can enter the property’s address, parcel ID, or owner’s name to initiate your search.

- Once you’ve entered your search criteria, click the Search button. The system will retrieve the property’s details, including its location, ownership information, and assessment data.

Key Features of the Property Search System

The Miami-Dade County Property Search system offers a range of features to enhance user experience and provide comprehensive property information. Some of the key features include:

- Property Details: The system provides a detailed overview of the property, including its physical attributes, such as size, number of rooms, and construction type.

- Ownership Information: You can access the property’s ownership history, including the current owner’s name, address, and contact details.

- Assessment Details: This section provides a breakdown of the property’s assessed value, including the taxable value, exemptions applied, and any special assessments.

- Tax Information: Users can view the property’s tax history, including the current tax amount, payment status, and any outstanding balances.

- Sales History: The system maintains a record of the property’s sales history, providing valuable insights into market trends and value fluctuations.

Utilizing the Property Search System for Investment Decisions

The Miami-Dade County Property Search system is an invaluable tool for investors and real estate professionals. By leveraging the system’s features, users can make informed investment decisions and conduct thorough due diligence.

For instance, investors can analyze the sales history of a property to identify trends and potential investment opportunities. They can also compare the assessed value with recent sales prices to determine if a property is fairly priced. Additionally, the system's ownership information can provide insights into potential acquisition strategies.

Conclusion: Empowering Property Owners and Investors

Understanding the intricacies of property taxes and having access to comprehensive property information is essential for both homeowners and investors in Miami-Dade County. The Miami-Dade County Property Search system, coupled with the transparent assessment process, empowers taxpayers to make informed decisions and effectively manage their property investments.

Whether you're a first-time homeowner, a seasoned investor, or a real estate professional, this guide has provided you with the tools and knowledge to navigate the complex world of Miami-Dade County property taxes. With this information, you can approach your property investments with confidence and make decisions that align with your financial goals.

Frequently Asked Questions

How often are property values assessed in Miami-Dade County?

+Property values in Miami-Dade County are typically assessed annually. The property appraiser’s office conducts a comprehensive reassessment every year to ensure that property values are up-to-date and reflect market conditions.

What happens if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Miami-Dade County Property Appraiser’s Office provides a detailed appeal process, allowing you to present evidence and argue your case. It’s important to act promptly, as there are deadlines for filing appeals.

Are there any tax incentives for investing in Miami-Dade County real estate?

+Yes, Miami-Dade County offers various tax incentives and programs to encourage investment in the local real estate market. These incentives include tax breaks for new construction, historic preservation, and affordable housing initiatives. It’s advisable to consult with a tax professional or the county’s economic development office for more details.

How can I estimate my property taxes before buying a home in Miami-Dade County?

+To estimate your property taxes before purchasing a home, you can use the Miami-Dade County Property Appraiser’s online tools. These tools allow you to input the property’s details and calculate an estimated tax amount based on the current tax rates and assessment values. However, it’s important to note that these estimates are subject to change.