Alaska Income Tax

Welcome to an in-depth exploration of Alaska's unique income tax landscape, a subject of interest for anyone curious about the financial intricacies of this remarkable state. Unlike most states in the US, Alaska stands out with its distinctive approach to taxation, particularly when it comes to personal income tax. Let's delve into the specifics of Alaska's income tax system, uncovering its intricacies and implications.

Alaska’s Income Tax: A Unique Perspective

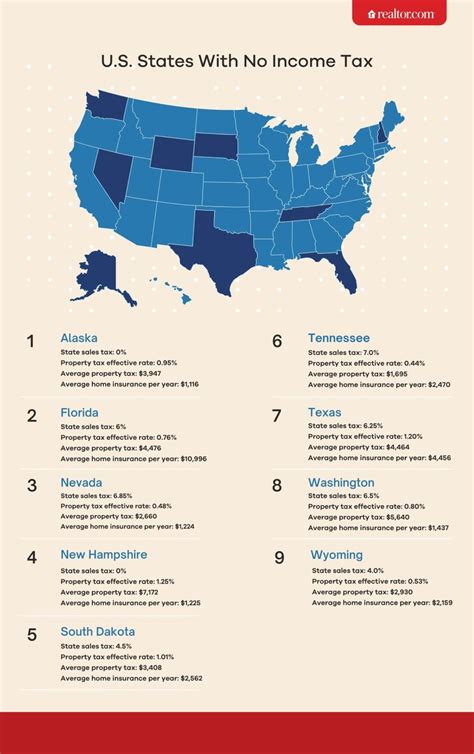

In the vast and diverse landscape of American tax systems, Alaska holds a singular position. While most US states levy a personal income tax on their residents, Alaska has taken a bold step by choosing not to impose such a tax. This decision has profound implications for both residents and businesses operating within the state’s borders.

The absence of a personal income tax in Alaska is a strategic move, one that aims to foster economic growth and attract businesses and individuals to the state. It's a testament to Alaska's commitment to providing a favorable business environment, characterized by a low tax burden and a competitive edge in the global market.

However, it's essential to recognize that Alaska's tax system is not a straightforward affair. While personal income tax may be off the table, the state has other means of generating revenue and maintaining its fiscal health. This includes a range of other taxes and unique revenue streams, each with its own impact on the state's economy and its residents.

A Closer Look at Alaska’s Tax Structure

Alaska’s tax structure is a multifaceted system, designed to balance the state’s budgetary needs with the interests of its citizens and businesses. Here’s a breakdown of the key components:

- Corporate Income Tax: Alaska does levy an income tax on corporations doing business within the state. The corporate income tax rate stands at 9.4%, making it one of the highest in the nation. This tax is a significant source of revenue for the state, contributing to infrastructure development, public services, and other essential state functions.

- Sales and Use Tax: Alaska also imposes a sales and use tax on the sale of goods and certain services within the state. The base sales tax rate is 1%, but it can vary depending on the municipality. For instance, the sales tax rate in Anchorage is 2%, while it's 3% in Juneau. These rates can further increase when combined with local option taxes, which are used to fund specific projects or services.

- Property Tax: Property taxes in Alaska are levied by local governments, including boroughs, cities, and school districts. The tax rates vary across the state, and the assessed value of the property plays a significant role in determining the tax liability. Property taxes are a crucial revenue source for local governments, supporting public education, road maintenance, and other essential services.

- Severance Tax: Alaska's abundant natural resources, particularly its oil and gas reserves, are subject to a severance tax. This tax is imposed on the extraction of these resources, and it's a significant contributor to the state's revenue. The severance tax is a crucial component of Alaska's fiscal health, especially given the state's reliance on its natural resources for economic growth and stability.

- Other Taxes: In addition to the above, Alaska also collects various other taxes, including motor fuel taxes, tobacco taxes, and fishing and hunting license fees. These taxes, while relatively small in comparison to the major revenue streams, still play a vital role in funding specific state programs and initiatives.

| Tax Category | Rate |

|---|---|

| Corporate Income Tax | 9.4% |

| Sales and Use Tax (Base Rate) | 1% |

| Property Tax (Varies by Location) | Dependent on Assessed Value |

| Severance Tax (Oil and Gas) | Varies based on Production |

The Impact on Residents and Businesses

The absence of a personal income tax in Alaska has both positive and negative implications for its residents and businesses. On the positive side, it means that individuals can keep more of their earnings, which can stimulate economic activity and boost purchasing power. For businesses, it translates to a lower tax burden, potentially making it more attractive to operate in Alaska compared to other states.

However, the lack of a personal income tax also means that the state relies heavily on other sources of revenue. This can result in higher taxes in other areas, such as sales tax and property tax, which can be a burden for residents, especially those with lower incomes. For businesses, it may mean that they have to navigate a more complex tax system, with various taxes and fees to consider.

Furthermore, the state's reliance on severance tax and natural resource extraction can make its economy vulnerable to fluctuations in global commodity prices. When prices are high, the state can generate substantial revenue, but in times of low prices, it can face budgetary challenges.

Future Implications and Considerations

Looking ahead, Alaska’s unique tax system presents both opportunities and challenges. The state’s fiscal health is closely tied to its natural resources, and as such, it is vulnerable to global market forces. Diversifying its revenue streams and exploring new economic opportunities can help mitigate this risk and ensure long-term sustainability.

For residents and businesses, understanding Alaska's tax system is crucial for financial planning and decision-making. While the absence of a personal income tax may be an attractive feature, it's essential to consider the overall tax burden and how it may impact one's financial situation. Staying informed about tax laws and potential changes is vital for both individuals and businesses operating in Alaska.

Frequently Asked Questions

Does Alaska Have an Income Tax?

+No, Alaska does not have a personal income tax. This means that individuals do not pay a state tax on their earnings. However, it’s important to note that Alaska residents are still subject to federal income tax.

How Does Alaska Fund Its Government Services Without a Personal Income Tax?

+Alaska generates revenue through various other taxes, including corporate income tax, sales tax, property tax, and severance tax on natural resource extraction. These taxes, along with other fees and revenue streams, fund the state’s operations and services.

Are There Any Benefits for Residents Due to the Absence of a Personal Income Tax?

+The absence of a personal income tax can result in more disposable income for residents, which can stimulate the local economy. Additionally, it can make Alaska more attractive for businesses, potentially leading to more job opportunities and economic growth.

What Are the Potential Downsides of Alaska’s Tax System for Residents and Businesses?

+The lack of a personal income tax means that other taxes, such as sales tax and property tax, may be higher to make up for the lost revenue. This can be a burden for residents, especially those with lower incomes. For businesses, it may mean a more complex tax system to navigate.

How Does Alaska’s Tax System Compare to Other States?

+Alaska is one of seven states that do not levy a personal income tax. However, its corporate income tax rate is one of the highest in the nation. The state’s reliance on natural resource extraction and its unique tax structure set it apart from most other states.