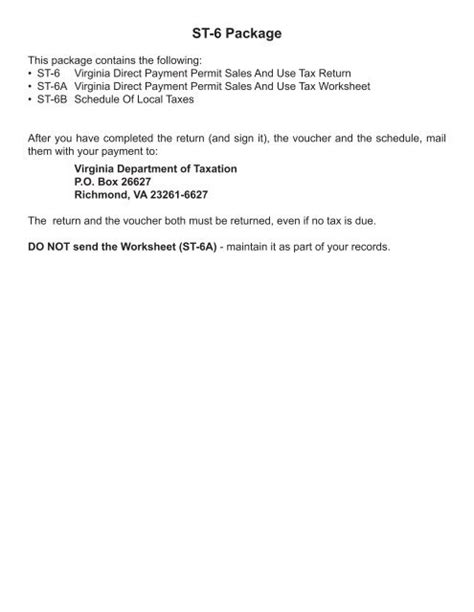

Va Tax Payment

Making tax payments is an essential part of fulfilling one's financial obligations as a citizen or business entity. In the state of Virginia, the process of making tax payments, known as Va Tax Payment, is designed to be straightforward and accessible. This article aims to provide a comprehensive guide to Va Tax Payment, covering various aspects, from the different payment methods available to the benefits and considerations for taxpayers.

Understanding Va Tax Payment

The Commonwealth of Virginia offers a user-friendly online platform for taxpayers to manage their tax obligations efficiently. Va Tax Payment refers to the process of making payments for various taxes, including income tax, sales and use tax, corporate income tax, and more. This system ensures a streamlined approach to tax management, benefiting both individuals and businesses operating within the state.

The Virginia Department of Taxation (VADOT) has implemented an advanced digital system to facilitate Va Tax Payment, allowing taxpayers to access their accounts, view their tax liabilities, and make secure payments from the comfort of their homes or offices. This modern approach to tax management has significantly improved taxpayer experiences, offering convenience, efficiency, and transparency.

Key Features of Va Tax Payment

The Va Tax Payment system boasts several features that enhance the taxpayer’s journey. Firstly, the platform provides a personalized dashboard where taxpayers can monitor their tax obligations, payment history, and any outstanding liabilities. This feature ensures that taxpayers have a clear overview of their tax situation at any given time.

Secondly, the system offers a wide range of payment options to cater to different preferences and needs. Taxpayers can choose to pay their taxes through direct debit, credit card, electronic funds transfer (EFT), or traditional check payment methods. This flexibility ensures that individuals and businesses can select the payment option that aligns with their financial practices and preferences.

| Payment Method | Description |

|---|---|

| Direct Debit | Automatic withdrawal from a specified bank account on the due date. |

| Credit Card | Secure online payment using major credit cards. |

| Electronic Funds Transfer (EFT) | Direct transfer of funds from the taxpayer's account to the VADOT's account. |

| Check Payment | Traditional method of sending a check by mail or dropping it off at a designated location. |

Benefits of Va Tax Payment

Implementing the Va Tax Payment system has brought about numerous advantages for taxpayers and the state’s revenue collection process.

Convenience and Accessibility

The online platform allows taxpayers to make payments at their convenience, eliminating the need for long queues at government offices or the uncertainty of postal services. This accessibility is particularly beneficial for busy individuals and businesses, enabling them to manage their tax obligations around their schedules.

Secure Transactions

The VADOT prioritizes the security of taxpayer information and transactions. The Va Tax Payment system employs advanced encryption technologies to safeguard personal and financial data, ensuring that taxpayers can make payments without compromising their sensitive information.

Real-Time Updates

With the online system, taxpayers receive real-time updates on their payment status. This feature provides transparency and peace of mind, allowing taxpayers to track their payments and ensure timely remittance.

Flexibility in Payment Options

As mentioned earlier, the variety of payment methods offered by Va Tax Payment caters to different financial situations. This flexibility ensures that taxpayers can choose the method that suits their financial capabilities and preferences, making the tax payment process more manageable.

Considerations for Taxpayers

While Va Tax Payment provides a seamless experience, there are a few considerations that taxpayers should keep in mind to ensure a smooth process.

Payment Deadlines

It is crucial for taxpayers to be aware of the payment deadlines for their respective taxes. Late payments may incur penalties and interest, impacting the taxpayer’s financial situation and compliance record. The VADOT provides clear guidelines on payment due dates, and taxpayers are encouraged to mark these dates in their calendars to avoid any penalties.

Secure Payment Practices

Although the Va Tax Payment system is highly secure, taxpayers should still exercise caution when making online payments. It is essential to ensure that the payment portal is legitimate and secure, especially when making payments via credit card or EFT. Taxpayers should also regularly monitor their bank statements to detect any unauthorized transactions promptly.

Record Keeping

Maintaining proper records of tax payments is vital for future reference and compliance purposes. Taxpayers should retain confirmation emails, payment receipts, and any other relevant documentation related to their Va Tax Payment transactions. These records can be crucial in resolving any discrepancies or disputes that may arise.

Future Implications and Innovations

The Va Tax Payment system is continually evolving to meet the changing needs of taxpayers and to stay abreast of technological advancements. The VADOT is exploring innovative solutions to further enhance the taxpayer experience, improve efficiency, and streamline the tax payment process.

Potential Future Developments

One potential development is the integration of mobile payment options, allowing taxpayers to make payments using their smartphones or mobile devices. This would provide an additional layer of convenience, especially for those who prefer mobile banking solutions.

Furthermore, the VADOT may explore the implementation of blockchain technology to enhance security and transparency in the tax payment process. Blockchain's immutable ledger system could provide an added layer of protection against fraud and ensure the integrity of tax transactions.

Enhanced Taxpayer Support

The department is also considering expanding its taxpayer support services. This may include the introduction of a dedicated helpline for Va Tax Payment queries, providing real-time assistance to taxpayers who encounter issues or have questions about the payment process.

Data Analytics for Improved Tax Collection

By leveraging advanced data analytics, the VADOT aims to optimize tax collection processes. Analyzing taxpayer behavior and trends can help identify potential issues and implement targeted solutions, ensuring a more efficient and effective tax collection system.

Conclusion

The Va Tax Payment system in Virginia exemplifies a modern and efficient approach to tax management. By offering a user-friendly online platform with various payment options, the state provides taxpayers with a convenient and secure way to fulfill their financial obligations. With continuous innovation and a focus on taxpayer experience, the VADOT is committed to making tax payments a seamless and transparent process for all Virginians.

What are the accepted payment methods for Va Tax Payment?

+

The Va Tax Payment system accepts a variety of payment methods, including direct debit, credit card, electronic funds transfer (EFT), and traditional check payments. Taxpayers can choose the method that best suits their financial practices and preferences.

How secure is the Va Tax Payment platform?

+

The Va Tax Payment platform employs advanced encryption technologies to ensure the security of taxpayer information and transactions. The VADOT prioritizes data protection, making the platform a secure environment for making tax payments.

Are there any penalties for late payments in Va Tax Payment?

+

Yes, late payments in Va Tax Payment may incur penalties and interest. Taxpayers are encouraged to mark their payment deadlines and make timely payments to avoid any additional financial burdens.

How can I track my Va Tax Payment status?

+

Taxpayers can log in to their personalized dashboard on the Va Tax Payment platform to track their payment status in real time. This feature provides transparency and allows taxpayers to monitor their tax obligations effectively.

Is there a payment plan option for Va Tax Payment?

+

Yes, Va Tax Payment offers a payment plan option for eligible taxpayers who may struggle to pay their tax liabilities in full. This plan allows taxpayers to make smaller, more manageable payments over an extended period.