Ga State Income Tax Refund

Welcome to our comprehensive guide on the Georgia State Income Tax Refund, a topic that can provide valuable insights into the financial landscape of the Peach State. Understanding the intricacies of state tax refunds is crucial for residents and businesses alike, as it directly impacts their financial planning and overall economic well-being. In this expert-led article, we will delve into the specifics of the Georgia State Income Tax Refund process, exploring the eligibility criteria, the timeline for receiving refunds, and the various factors that can influence the refund amount.

The state income tax refund is an essential aspect of the financial ecosystem in Georgia, offering a potential boost to individuals and businesses during tax season. By thoroughly examining this topic, we aim to provide an in-depth analysis that caters to the needs of a diverse audience, from tax professionals and accountants to individuals seeking clarity on their tax obligations and potential refunds.

Understanding the Georgia State Income Tax Refund

The Georgia State Income Tax Refund is a crucial component of the state's tax system, offering a financial respite to eligible taxpayers. This refund is a reimbursement of the state income taxes paid by individuals and businesses during the previous tax year. The refund amount is calculated based on various factors, including the taxpayer's income, deductions, and credits claimed on their state tax return.

Georgia's tax refund process is designed to ensure fairness and accuracy, providing taxpayers with the opportunity to receive a refund if they have overpaid their state income taxes. The refund process is a complex yet necessary procedure that requires a thorough understanding of the state's tax laws and regulations. In this section, we will explore the key aspects of the Georgia State Income Tax Refund, including the eligibility criteria, the refund calculation process, and the various factors that can impact the refund amount.

Eligibility Criteria for the State Income Tax Refund

To be eligible for the Georgia State Income Tax Refund, taxpayers must meet specific criteria outlined by the Georgia Department of Revenue. The eligibility requirements are designed to ensure that only those entitled to a refund receive one. Here are the key eligibility criteria:

- Residency: Taxpayers must be legal residents of Georgia during the tax year for which they are claiming a refund. Non-residents who worked or had income sources in Georgia may also be eligible for a refund, depending on their specific circumstances.

- Taxable Income: Taxpayers must have taxable income that exceeds the state's personal exemption amount. This amount varies annually and is determined by the Georgia General Assembly.

- Timely Filing: Taxpayers must file their state income tax return by the deadline, typically April 15th of the following year. Late filings may result in penalties and could impact the refund processing timeline.

- Accuracy: The tax return must be accurate and complete, with all required supporting documentation. Inaccurate or incomplete returns may lead to delays in processing or even rejection of the refund claim.

Meeting these eligibility criteria is the first step towards receiving a state income tax refund. However, it's important to note that fulfilling these requirements does not guarantee a refund. The actual refund amount is determined by a complex calculation process that takes into account various factors, as we will explore in the following section.

Calculating the State Income Tax Refund

The calculation of the Georgia State Income Tax Refund is a multifaceted process that involves several key steps. This process ensures that taxpayers receive the accurate refund amount they are entitled to, based on their individual tax circumstances. Here's a breakdown of the refund calculation process:

- Taxable Income Determination: The first step is to calculate the taxpayer's taxable income for the year. This involves subtracting any deductions and exemptions from the total income earned during the tax year.

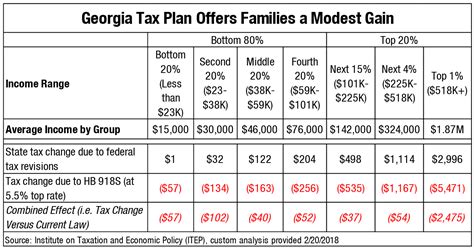

- Applying Tax Rates: Georgia uses a progressive tax system, which means that the tax rate increases as taxable income rises. The state applies different tax rates to different income brackets. The higher the taxable income, the higher the tax rate.

- Subtracting Withheld Taxes: Next, the amount of income tax withheld from the taxpayer's paychecks or estimated tax payments is subtracted from the calculated tax liability. This is the amount the taxpayer has already paid to the state.

- Applying Tax Credits: Tax credits are a crucial factor in determining the refund amount. Georgia offers various tax credits, such as the Low Income Tax Credit and the Education Expense Credit, which can reduce the tax liability or increase the refund amount.

- Final Refund Calculation: Once all the above steps are completed, the final refund amount is calculated. If the tax liability is less than the amount withheld or paid, the difference is refunded to the taxpayer. However, if the tax liability exceeds the withheld amount, the taxpayer may owe additional taxes.

The refund calculation process is designed to be fair and accurate, taking into account the taxpayer's unique financial situation. It's important to note that the refund amount can vary significantly from year to year, depending on factors such as income changes, deductions claimed, and tax law amendments.

Factors Influencing the State Income Tax Refund

Several factors can impact the Georgia State Income Tax Refund amount, making it a dynamic and often unpredictable aspect of the tax system. Understanding these factors can help taxpayers anticipate potential changes in their refund and plan their financial strategies accordingly. Here are some key factors that can influence the refund amount:

- Income Changes: Fluctuations in taxable income from one year to the next can significantly impact the refund amount. An increase in income may result in a higher tax liability, reducing the refund, while a decrease in income could lead to a larger refund.

- Deductions and Credits: Claiming eligible deductions and tax credits can reduce the taxable income and, consequently, the tax liability. This can result in a larger refund. Some common deductions include those for medical expenses, charitable contributions, and certain business expenses.

- Tax Law Amendments: Changes in Georgia's tax laws can have a direct impact on the refund amount. Amendments to tax rates, deductions, or credits can either increase or decrease the refund, depending on the specific changes implemented.

- Dependency Status: The number of dependents a taxpayer claims can affect their refund. Having eligible dependents may increase the personal exemption amount and qualify the taxpayer for additional tax credits, such as the Child Tax Credit.

- Filing Status: The taxpayer's filing status, whether single, married filing jointly, or head of household, can impact the refund amount. Each filing status has different tax rates and deductions, which can influence the final refund calculation.

These factors demonstrate the complexity and variability of the Georgia State Income Tax Refund. It's crucial for taxpayers to stay informed about these influencing factors and seek professional advice when necessary to maximize their refund potential.

The Process of Claiming the State Income Tax Refund

Claiming the Georgia State Income Tax Refund is a straightforward process, but it requires careful attention to detail to ensure a smooth and timely refund. Understanding the steps involved in claiming the refund can help taxpayers navigate the process efficiently and avoid potential pitfalls. In this section, we will guide you through the essential steps of claiming your state income tax refund.

Preparing Your Tax Return

The first step in claiming your Georgia State Income Tax Refund is to prepare your tax return accurately and thoroughly. This process involves gathering all the necessary documentation, calculating your taxable income, and claiming eligible deductions and credits. Here's a step-by-step guide to preparing your tax return:

- Gather Documents: Collect all relevant tax documents, including W-2 forms, 1099 forms, interest and dividend statements, and any other records of income or deductions. Ensure that you have all the necessary information to complete your return accurately.

- Calculate Taxable Income: Determine your taxable income by subtracting any eligible deductions and exemptions from your total income. This calculation is crucial as it forms the basis for your tax liability and potential refund.

- Claim Deductions and Credits: Review the list of eligible deductions and credits offered by the state of Georgia. These can include deductions for medical expenses, charitable contributions, and certain education-related expenses. Additionally, consider claiming any applicable tax credits, such as the Low Income Tax Credit or the Child Tax Credit.

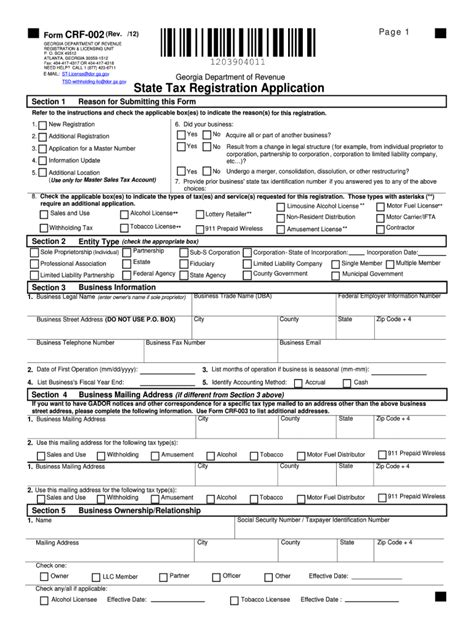

- Complete Tax Forms: Use the appropriate tax forms provided by the Georgia Department of Revenue to complete your return. Ensure that you fill out all sections accurately and provide all the required information.

- Review and Sign: Before submitting your tax return, carefully review all the information you've entered. Double-check the calculations and ensure that all the provided information is accurate and complete. Once you're satisfied, sign and date the return.

Preparing your tax return accurately is crucial to ensure you receive the correct refund amount. If you have any doubts or complexities in your tax situation, it's advisable to seek the assistance of a tax professional or use tax preparation software to ensure compliance and accuracy.

Filing Your Tax Return

Once you've prepared your Georgia State Income Tax Refund return, the next step is to file it with the Georgia Department of Revenue. The filing process can be done electronically or through traditional mail, depending on your preference and circumstances. Here's a guide to help you through the filing process:

- Electronic Filing: The most common and efficient way to file your tax return is electronically. The Georgia Department of Revenue offers an online filing system, allowing taxpayers to complete and submit their returns from the comfort of their homes. Electronic filing is faster, more secure, and often results in quicker refund processing.

- Traditional Mail Filing: If you prefer a more traditional approach or have specific reasons for not filing electronically, you can mail your completed tax return to the Georgia Department of Revenue. Ensure that you use the correct address, which can be found on the department's website or on the tax forms themselves. Include all required documentation and sign the return before mailing.

Regardless of the filing method you choose, ensure that you meet the filing deadline. The deadline for filing Georgia state income tax returns is typically aligned with the federal tax deadline, which is April 15th of the following year. Late filings may result in penalties and delays in receiving your refund.

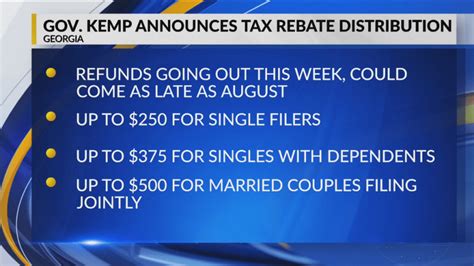

Receiving Your Refund

After filing your Georgia State Income Tax Refund return, the final step is to patiently await your refund. The Georgia Department of Revenue processes refunds as quickly as possible, but the timeline can vary depending on several factors. Here's what you need to know about receiving your refund:

- Processing Time: The time it takes for the Georgia Department of Revenue to process your refund can vary. Generally, electronic filers can expect to receive their refund within 7-14 business days, while those who file by mail may need to wait up to 4-6 weeks. However, it's important to note that this timeline can be affected by factors such as the volume of returns, system updates, or errors in the return.

- Refund Status Check: To stay informed about the status of your refund, you can utilize the refund status tool provided by the Georgia Department of Revenue. This online tool allows you to check the progress of your refund by entering your Social Security Number and the refund amount shown on your return. It provides real-time updates on the processing of your refund.

- Direct Deposit or Check: The Georgia Department of Revenue offers taxpayers the option to receive their refund via direct deposit or check. If you choose direct deposit, ensure that you provide accurate banking information when filing your return. If you opt for a check, keep an eye on your mailbox during the refund processing period.

Receiving your refund is an exciting culmination of the tax refund process. However, if you encounter any issues or delays, it's important to reach out to the Georgia Department of Revenue for assistance. They can provide guidance and help resolve any refund-related problems.

Maximizing Your State Income Tax Refund

Maximizing your Georgia State Income Tax Refund can be a strategic approach to improving your financial situation and optimizing your tax obligations. While the refund process is primarily focused on accuracy and compliance, there are several strategies and considerations that can help you get the most out of your refund. In this section, we will explore some effective strategies for maximizing your state income tax refund.

Understanding Tax Credits and Deductions

One of the most effective ways to maximize your Georgia State Income Tax Refund is by taking advantage of the various tax credits and deductions offered by the state. These incentives can significantly reduce your taxable income and, consequently, increase your refund. Here's a closer look at some key tax credits and deductions:

- Low Income Tax Credit: This credit is designed to provide relief to low-income taxpayers. It reduces the amount of tax owed, potentially resulting in a larger refund. To qualify, taxpayers must meet specific income requirements and file a return claiming the credit.

- Education Expense Credit: Georgia offers a credit for certain education-related expenses, such as tuition and fees for higher education. This credit can be claimed by taxpayers who have paid eligible expenses for themselves, their spouses, or their dependents. It can significantly reduce the tax liability and increase the refund amount.

- Child and Dependent Care Credit: If you incur expenses for the care of a qualifying child or dependent while you work or look for work, you may be eligible for this credit. The credit is based on a percentage of the expenses paid, and it can help reduce your tax burden and increase your refund.

- Medical Expense Deduction: Taxpayers can deduct certain medical and dental expenses that exceed a specified percentage of their adjusted gross income. This deduction can be particularly beneficial for those with high medical expenses, as it can reduce their taxable income and potentially increase their refund.

Understanding these tax credits and deductions and determining your eligibility can be a powerful tool for maximizing your refund. It's important to consult the Georgia Department of Revenue's guidelines and, if necessary, seek the advice of a tax professional to ensure you claim all the credits and deductions you're entitled to.

Exploring Tax Planning Strategies

Tax planning is an essential aspect of maximizing your Georgia State Income Tax Refund. By proactively managing your financial affairs throughout the year, you can position yourself to take advantage of tax-saving opportunities and potentially increase your refund. Here are some effective tax planning strategies to consider:

- Maximizing Deductions: Throughout the year, keep track of your eligible deductions, such as charitable contributions, medical expenses, and business-related expenses. The more deductions you claim, the lower your taxable income, which can lead to a larger refund. Consider implementing strategies to increase these deductions, such as donating to charities or bundling medical expenses.

- Tax-Advantaged Investments: Explore tax-advantaged investment options, such as 529 plans for education savings or Health Savings Accounts (HSAs) for medical expenses. These investments can provide tax benefits and reduce your taxable income, potentially increasing your refund.

- Retirement Contributions: Contributing to retirement accounts, such as 401(k)s or IRAs, can offer significant tax advantages. These contributions are often tax-deductible, reducing your taxable income and potentially increasing your refund. Additionally, the funds grow tax-deferred, providing long-term benefits.

- Timing of Income and Expenses: Consider the timing of your income and expenses to optimize your tax situation. For example, if you have the flexibility to receive income or make purchases at the beginning or end of the tax year, you may be able to strategically manage your taxable income and deductions to maximize your refund.

Tax planning requires a proactive and strategic approach, but the potential rewards can be significant. By implementing these strategies and staying informed about tax laws and incentives, you can make the most of your financial situation and maximize your state income tax refund.

The Future of State Income Tax Refunds in Georgia

The landscape of Georgia State Income Tax Refunds is subject to change and evolution, influenced by various economic, political, and technological factors. Understanding the potential future trends and developments in state income tax refunds can help taxpayers, businesses, and policymakers prepare for the financial landscape of tomorrow. In this section, we will explore some of the key factors that may shape the future of state income tax refunds in Georgia.

Economic Factors and Tax Policy Changes

Economic conditions and tax policy decisions can significantly impact the state income tax refund landscape in Georgia. Here are some key economic factors and potential tax policy changes to consider:

- Economic Growth and Recession: Economic growth can lead to increased tax revenues, potentially allowing for larger refunds or the introduction of new tax incentives. Conversely, a recession may result in reduced tax revenues and a tightening of refund policies to balance the state’s budget.

- Tax Reform: Changes in tax laws, such as tax rate adjustments or the introduction of new tax brackets, can directly impact the refund amounts taxpayers receive. Tax reform initiatives at the state level can bring about significant changes, affecting both