Pa 40 State Tax Form

Welcome to our comprehensive guide on the Pa 40 State Tax Form, an essential tool for Pennsylvania residents to navigate their state tax obligations. In this article, we will delve into the intricacies of this form, providing you with a detailed understanding of its purpose, completion requirements, and the process of filing it accurately. Whether you're a seasoned taxpayer or new to the world of state taxes, this guide will equip you with the knowledge to tackle the Pa 40 State Tax Form with confidence.

Understanding the Pa 40 State Tax Form

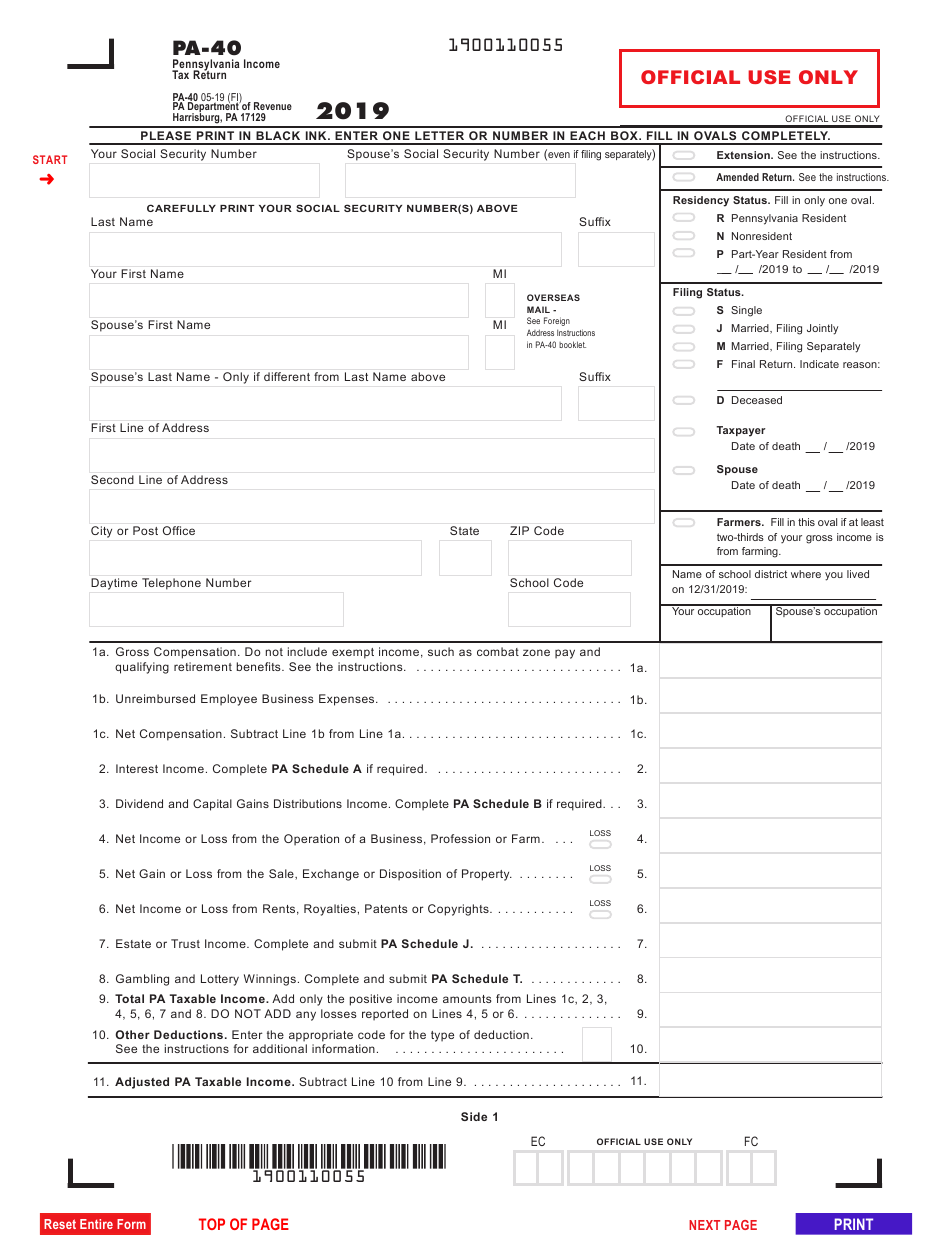

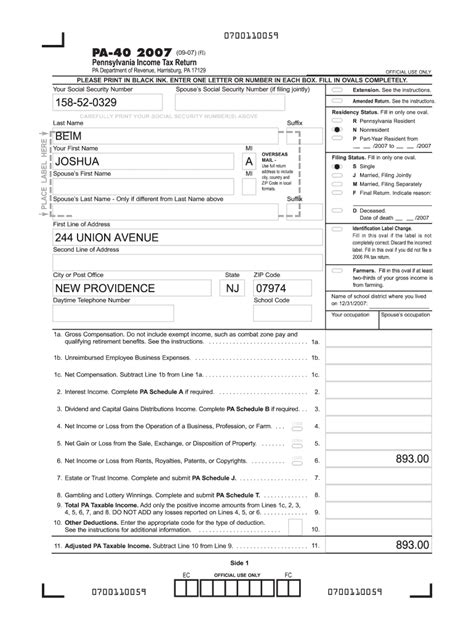

The Pa 40 State Tax Form, officially known as the Pennsylvania Individual Income Tax Return, is a critical document issued by the Pennsylvania Department of Revenue. It serves as the primary means for Pennsylvania residents to report their income, claim deductions, and calculate their state tax liability. This form is a cornerstone of the state's tax system, ensuring that individuals contribute their fair share to the Commonwealth's revenue while also taking advantage of the various tax benefits available.

The Pa 40 State Tax Form is designed to accommodate a wide range of income sources and tax situations. It provides spaces for reporting wages, salaries, tips, and other forms of taxable income. Additionally, the form allows taxpayers to claim deductions for expenses such as medical costs, charitable donations, and certain business-related outlays. By completing this form accurately, residents can ensure they meet their tax obligations and potentially receive refunds or credits if they overpaid during the year.

Key Features and Benefits

The Pa 40 State Tax Form offers several key features and benefits that make it an essential part of the Pennsylvania tax landscape:

- Comprehensive Income Reporting: The form allows taxpayers to report various income sources, including wages, interest, dividends, capital gains, and rental income. This comprehensive approach ensures that all taxable income is accounted for.

- Deduction Options: Taxpayers can benefit from a range of deductions, such as the standard deduction or itemized deductions for specific expenses. This flexibility helps reduce taxable income and can lead to significant savings.

- Credit Opportunities: The form includes sections for claiming various tax credits, including the Earned Income Tax Credit, Child and Dependent Care Credit, and credits for education expenses. These credits can provide substantial relief for eligible taxpayers.

- Easy-to-Use Format: The Pa 40 State Tax Form is designed with simplicity in mind. Its clear layout and straightforward instructions make it accessible to taxpayers, even those who are not tax experts.

- Online Filing: Pennsylvania offers the convenience of e-filing for those who prefer a digital approach. This option is secure, efficient, and often results in faster processing times.

Completing the Pa 40 State Tax Form

Completing the Pa 40 State Tax Form accurately is crucial to ensure you fulfill your tax obligations and receive any refunds or credits you're entitled to. Here's a step-by-step guide to help you through the process:

Step 1: Gather Necessary Documents

Before you begin, ensure you have all the required documents and information. This includes your previous year's tax return, W-2 forms, 1099 forms, and any other relevant income statements. You'll also need records of your deductions and credits, such as receipts for charitable donations or medical expenses.

Step 2: Calculate Your Income

Start by adding up all your taxable income sources. This includes wages, salaries, tips, interest, dividends, and any other income you received during the tax year. Be sure to report all income accurately to avoid potential penalties.

Step 3: Claim Deductions and Credits

Review the various deduction options available on the Pa 40 State Tax Form. Decide whether you want to claim the standard deduction or itemize your deductions based on your specific expenses. Additionally, explore the credits you may be eligible for, such as the Earned Income Tax Credit or education-related credits. These deductions and credits can significantly reduce your taxable income and save you money.

Step 4: Calculate Your Tax Liability

Once you've determined your income and applied your deductions and credits, it's time to calculate your tax liability. The Pa 40 State Tax Form provides a straightforward process for this calculation. Follow the instructions carefully to ensure accuracy.

Step 5: Review and Sign

Before submitting your tax return, thoroughly review your completed Pa 40 State Tax Form for any errors or omissions. Double-check your calculations and ensure all required information is included. Once you're satisfied, sign and date the form to make it official.

Filing Options and Deadlines

Pennsylvania offers several filing options to accommodate different taxpayer preferences and circumstances. Understanding these options and their deadlines is essential to ensure a smooth filing process:

Online Filing

Pennsylvania's e-filing system, eFilePA, is a secure and convenient way to file your Pa 40 State Tax Form. It offers real-time error checking, ensuring your return is accurate before submission. The deadline for online filing is typically the same as the regular filing deadline.

Paper Filing

If you prefer a traditional approach, you can print and mail your completed Pa 40 State Tax Form. Ensure you use the correct mailing address, which may vary depending on your county of residence. The deadline for paper filing is also aligned with the regular filing deadline.

Filing Deadlines

The standard deadline for filing the Pa 40 State Tax Form is typically April 15th of the year following the tax year. However, it's essential to note that this deadline may be adjusted in certain circumstances, such as during a state of emergency or if the federal tax deadline is extended.

Extension Requests

If you're unable to meet the filing deadline, you can request an extension. To do this, you'll need to complete and submit Form PA-4868, Application for Automatic Extension of Time to File Pennsylvania Individual Income Tax Return. The extension provides an additional six months to file your return, but it's important to note that it only extends the filing deadline; it does not extend the deadline for paying any taxes owed.

Pennsylvania Tax Benefits and Credits

The Pa 40 State Tax Form is not just about meeting your tax obligations; it's also an opportunity to take advantage of various tax benefits and credits offered by the Commonwealth. Understanding these incentives can help you maximize your tax savings and potentially reduce your overall tax liability.

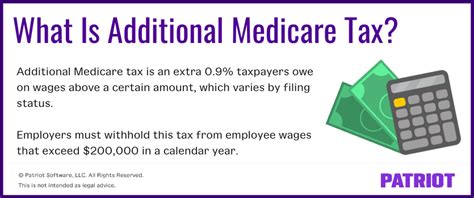

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is a significant benefit for low- to moderate-income taxpayers. It provides a refundable tax credit, meaning you can receive a refund even if you have no tax liability. The amount of the credit depends on your income and the number of qualifying children you have. To claim the EITC, you'll need to complete Schedule 40-EITC, which is part of the Pa 40 State Tax Form.

Child and Dependent Care Credit

If you incurred expenses for child or dependent care to allow you to work or attend school, you may be eligible for the Child and Dependent Care Credit. This credit can offset a portion of your care expenses, providing financial relief for working families. To claim this credit, you'll need to complete Schedule 40-CDC, which details your care expenses and qualifying dependents.

Education-Related Credits

Pennsylvania offers several tax credits related to education expenses. These include the Pennsylvania Tuition Account Program (PTAP) Credit, which provides a tax credit for contributions to a qualified tuition program, and the College Loan Repayment Assistance Program (CLRP), which offers a tax credit for eligible student loan repayments. These credits can help offset the cost of higher education and make it more accessible.

Other Credits and Deductions

In addition to the credits mentioned above, Pennsylvania offers a range of other deductions and credits, such as the Property Tax/Rent Rebate Program for eligible homeowners and renters, and the Child Care and Dependent Care Tax Credit for qualifying child care expenses. Exploring these options can further reduce your tax liability and provide additional financial benefits.

Performance Analysis and Future Implications

The Pa 40 State Tax Form is not only a tool for individual taxpayers; it also plays a crucial role in the broader context of Pennsylvania's tax system and revenue generation. Analyzing the performance and trends associated with this form can provide valuable insights into the state's economic landscape and future tax policies.

Tax Revenue Trends

By examining the data collected through the Pa 40 State Tax Form, the Pennsylvania Department of Revenue can identify trends in tax revenue. This information is vital for budgeting and planning purposes, as it helps the state allocate resources effectively. For example, if the data shows a consistent increase in tax revenue from a particular industry or sector, it may indicate a need for targeted investment or policy adjustments to support continued growth.

Compliance and Enforcement

The data gathered from the Pa 40 State Tax Form also plays a role in compliance and enforcement efforts. By analyzing tax returns, the Department of Revenue can identify potential cases of non-compliance or tax evasion. This information allows the state to enforce tax laws effectively and ensure fair taxation for all residents. Additionally, it can lead to the development of targeted education campaigns to improve taxpayer awareness and compliance.

Economic Impact Analysis

The Pa 40 State Tax Form provides a wealth of data that can be used for economic impact analysis. By studying the income levels, deductions claimed, and tax liabilities of Pennsylvania residents, economists and policymakers can assess the overall health of the state's economy. This analysis can inform decisions on tax policy, economic development initiatives, and the allocation of resources to support growth and prosperity.

Future Tax Policy Considerations

The insights gained from analyzing the Pa 40 State Tax Form data can shape future tax policy decisions. For instance, if certain deductions or credits are found to be particularly beneficial for specific industries or demographic groups, policymakers may consider expanding or enhancing these incentives. Conversely, if certain provisions are not achieving their intended goals, they may be revised or eliminated to streamline the tax system and improve efficiency.

Conclusion

The Pa 40 State Tax Form is a critical component of Pennsylvania's tax system, providing a means for residents to fulfill their tax obligations while also accessing a range of tax benefits and credits. By understanding the form's purpose, completion requirements, and the various filing options, taxpayers can navigate the process with confidence. Additionally, the data collected through this form plays a vital role in shaping tax policy, economic development, and revenue generation for the Commonwealth.

Frequently Asked Questions (FAQ)

What is the difference between the Pa 40 State Tax Form and the federal tax forms?

+The Pa 40 State Tax Form is specific to Pennsylvania’s tax system, while federal tax forms are used to calculate and file federal income taxes. While both sets of forms share some similarities, they have different rates, deductions, and credits, reflecting the unique tax policies of each jurisdiction.

Can I file my Pa 40 State Tax Form online if I don’t have a computer or internet access?

+Yes, you can file your Pa 40 State Tax Form online even if you don’t have a computer or internet access. You can visit a local library or community center that offers public computers and internet access. Additionally, some tax preparation services offer assistance with online filing for those without home internet access.

Are there any penalties for filing my Pa 40 State Tax Form late?

+Yes, Pennsylvania imposes penalties for late filing of the Pa 40 State Tax Form. The penalty is typically a percentage of the unpaid tax amount, and it can accumulate over time. It’s important to file your return by the deadline to avoid these penalties.

Can I file my Pa 40 State Tax Form jointly with my spouse even if we have different last names?

+Yes, you can file your Pa 40 State Tax Form jointly with your spouse, even if you have different last names. When filing jointly, both spouses’ incomes and deductions are combined, and you will receive the benefit of any credits or deductions that apply to your household.