Medicare Employee Tax

In the realm of healthcare and taxation, the Medicare Employee Tax stands as a crucial component, shaping the financial landscape for both employers and employees in the United States. This tax, an integral part of the nation's healthcare system, plays a pivotal role in funding Medicare, a federal program providing health insurance coverage for Americans aged 65 and older, as well as younger individuals with certain disabilities and conditions.

The Medicare Employee Tax, often simply referred to as the Medicare tax, is a payroll tax levied on earned income. It is distinct from other taxes, such as income tax or Social Security tax, and is specifically dedicated to supporting the Medicare program. This tax, while mandatory for employers and employees alike, can be a complex aspect of the American tax system, with its own set of rules and regulations.

Understanding the intricacies of the Medicare Employee Tax is vital for businesses and individuals, as it impacts their financial obligations and planning. This comprehensive guide aims to demystify this tax, offering a deep dive into its workings, implications, and relevance in the broader context of healthcare and tax policies.

The Origins and Purpose of Medicare Employee Tax

The Medicare Employee Tax traces its roots back to the Social Security Amendments of 1965, which introduced Medicare as a federal health insurance program. This tax was instituted to provide a stable and sustainable funding source for Medicare, ensuring its long-term viability and accessibility for eligible Americans.

The purpose of the Medicare Employee Tax is twofold: first, to collect revenue for the Medicare Trust Funds, which finance the healthcare services provided by the program. Secondly, it serves as a mechanism to ensure that individuals who benefit from Medicare contribute to its financial stability. This tax is a fundamental part of the social safety net in the United States, helping to ensure the availability of quality healthcare for seniors and those with specific health needs.

Over the years, the Medicare Employee Tax has undergone adjustments to align with changing healthcare costs and demographics. These adjustments are crucial to maintaining the solvency of the Medicare program, ensuring that it can meet the growing healthcare demands of an aging population.

Understanding the Tax Structure

The Medicare Employee Tax is a flat tax, meaning it is levied at a fixed rate on all taxable earnings. This tax is distinct from the progressive income tax system, where tax rates increase with higher income levels. Instead, the Medicare tax rate remains constant, regardless of an individual’s income bracket.

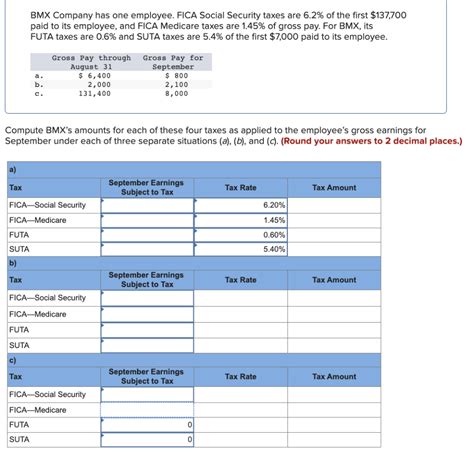

The current Medicare tax rate for employees is 1.45% of their taxable earnings. This tax is withheld from an employee's wages or salary by their employer and is then remitted to the Internal Revenue Service (IRS) on a periodic basis. The employer also contributes an equal amount, bringing the total Medicare tax rate to 2.9% of taxable earnings.

It's important to note that the Medicare tax is applicable to all forms of earned income, including wages, salaries, tips, and other compensation for services performed. However, it's not levied on investment income, such as interest, dividends, or capital gains.

The Medicare tax is a critical component of the payroll tax system, alongside the Social Security tax. Together, these taxes provide the primary funding sources for two of the largest social insurance programs in the United States, ensuring the financial stability and accessibility of essential social safety nets.

Medicare Tax Rate Changes Over Time

The Medicare tax rate has experienced fluctuations since its inception. Historically, the tax rate has been adjusted periodically to address changing healthcare costs and demographic shifts. These adjustments are made through legislative actions, often as part of broader tax reform initiatives or as stand-alone legislation.

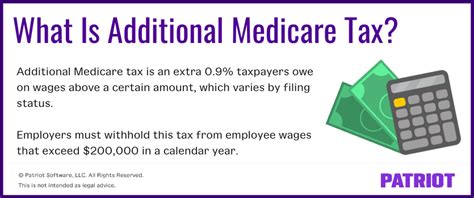

For instance, in 2013, the Affordable Care Act introduced a 0.9% additional Medicare tax on high-income earners. This additional tax applies to individuals with earnings exceeding $200,000 ($250,000 for married couples filing jointly) and is intended to further bolster the financial stability of the Medicare program.

| Year | Employee Medicare Tax Rate |

|---|---|

| 2023 | 1.45% |

| 2013-2022 | 1.45% (with an additional 0.9% tax for high-income earners) |

| 1990-2012 | 1.45% |

| 1986-1989 | 1.55% |

| 1976-1985 | 1.45% |

| 1966-1975 | 0.75% |

These rate changes reflect the dynamic nature of healthcare costs and the ongoing efforts to ensure the sustainability of Medicare. As healthcare expenses rise and the population ages, adjustments to the tax rate become necessary to maintain the program's viability and ensure its continued ability to provide comprehensive healthcare coverage.

Who Pays the Medicare Employee Tax

The obligation to pay the Medicare Employee Tax falls on two primary groups: employers and employees. Both parties are responsible for contributing to the Medicare Trust Funds through this tax.

Employer Responsibilities

Employers have a statutory duty to withhold the Medicare tax from their employees’ wages. This involves calculating the tax based on the employee’s earnings and deducting it from their paychecks. The employer then remits this withheld amount to the IRS, typically on a quarterly basis.

In addition to withholding the employee's share of the Medicare tax, employers are also required to contribute an equal amount. This means that for every dollar withheld from an employee's wages for Medicare tax, the employer matches that amount, effectively doubling the contribution to the Medicare Trust Funds.

Employers must also comply with reporting requirements, providing detailed information to the IRS about the Medicare tax withheld and paid. This ensures transparency and accountability in the tax system, allowing for effective monitoring and enforcement of tax obligations.

Employee Contributions

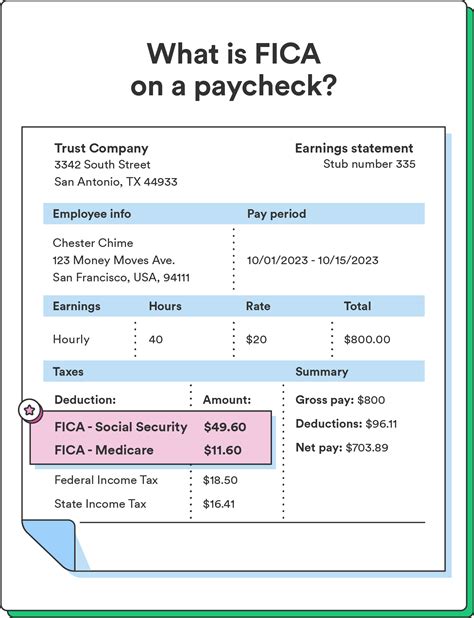

Employees are responsible for paying their share of the Medicare tax through payroll deductions. This tax is automatically withheld from their wages by their employer and remitted to the IRS. Employees do not typically see this deduction separately on their pay stubs, as it is typically grouped with other payroll taxes like Social Security tax.

It's important for employees to understand that the Medicare tax is an automatic deduction from their earnings. While they may not see it explicitly listed on their paychecks, it's a vital contribution to their future healthcare coverage under Medicare. This tax ensures that when they become eligible for Medicare, they have already contributed to the program's funding.

Exemptions and Special Cases

While the Medicare Employee Tax is a universal obligation for most employers and employees, there are certain exemptions and special cases to consider. These exemptions are designed to accommodate specific circumstances and ensure fairness in the tax system.

Exempt Employers

Certain employers are exempt from paying the employer’s share of the Medicare tax. These exemptions are typically granted to organizations that are not considered “employers” under the Internal Revenue Code, such as religious organizations or certain governmental entities.

For instance, churches and qualified church-controlled organizations are generally exempt from paying the employer's share of Medicare tax. This exemption is based on the principle of religious freedom and the separation of church and state. Similarly, certain governmental entities, like state and local governments, may also be exempt, depending on their specific legal status and tax obligations.

Self-Employment and Medicare Tax

Self-employed individuals have a different tax obligation compared to traditional employees. Instead of having taxes withheld from their earnings, self-employed individuals are responsible for paying both the employer and employee shares of the Medicare tax. This is known as the self-employment tax and is calculated as a percentage of their net earnings from self-employment.

The self-employment tax rate for Medicare is currently 2.9% of net earnings, which is double the employee Medicare tax rate. However, self-employed individuals can deduct half of this amount as a business expense when calculating their income tax liability. This helps offset some of the tax burden for self-employed individuals, who often lack the benefits and protections of traditional employment.

High-Income Earners and Additional Medicare Tax

As mentioned earlier, high-income earners are subject to an additional 0.9% Medicare tax on their earnings. This additional tax applies to individuals with earnings exceeding the threshold set by the IRS, which is currently 200,000 for individuals and 250,000 for married couples filing jointly.

The additional Medicare tax is designed to ensure that high-income earners contribute a greater share to the Medicare program, reflecting their ability to pay. This tax helps maintain the financial stability of Medicare, especially as healthcare costs continue to rise.

Compliance and Reporting

Ensuring compliance with the Medicare Employee Tax is a critical aspect of the tax system. Both employers and employees have specific reporting obligations to fulfill, which help maintain the integrity of the tax system and ensure that the Medicare program receives the necessary funding.

Employer Reporting

Employers are required to report the Medicare tax they withhold from their employees’ wages and the employer’s share of the tax. This reporting is typically done through the filing of Form 941, the Employer’s Quarterly Federal Tax Return. This form provides detailed information to the IRS about the Medicare tax and other payroll taxes withheld and paid during the quarter.

Employers must also issue Form W-2, Wage and Tax Statement, to each employee at the end of the tax year. This form details the employee's earnings and the taxes withheld, including the Medicare tax. The W-2 form is a crucial document for employees when filing their personal income tax returns, as it verifies the taxes they have paid throughout the year.

Employee Reporting

Employees are responsible for reporting their earnings and the taxes withheld, including the Medicare tax, when filing their personal income tax returns. This is typically done through Form 1040, the U.S. Individual Income Tax Return. The employee’s W-2 form, provided by their employer, is a key source of information for completing this form accurately.

Employees must ensure that their reported earnings and taxes align with the information provided by their employer. Any discrepancies can lead to tax issues and potential penalties, so accurate reporting is essential. The Medicare tax is a significant component of an employee's tax obligations, and it's important to understand its implications when filing tax returns.

Implications for Employers and Employees

The Medicare Employee Tax has significant implications for both employers and employees. Understanding these implications is crucial for effective financial planning and compliance with tax obligations.

Employer Considerations

For employers, the Medicare Employee Tax represents a substantial financial obligation. The need to match the employee’s contribution and remit the tax to the IRS can impact cash flow and financial planning. Employers must ensure that they have sufficient funds to meet these obligations, which can be especially challenging for small businesses with limited resources.

Furthermore, employers are responsible for correctly calculating and withholding the Medicare tax. Any errors in withholding or reporting can result in penalties and interest charges. It's essential for employers to have robust payroll systems and accounting practices to ensure accuracy and compliance with tax regulations.

Employee Impact

Employees also face significant implications from the Medicare Employee Tax. While the tax is automatically withheld from their wages, it reduces their take-home pay. This reduction can impact an employee’s financial planning, especially for those with limited earnings or those who are already struggling to make ends meet.

However, it's important for employees to understand that the Medicare tax is an investment in their future healthcare coverage. When they become eligible for Medicare, they will have already contributed to the program through their payroll deductions. This ensures that they have access to quality healthcare services when they need them.

For employees, understanding the Medicare Employee Tax is crucial for making informed decisions about their financial planning and retirement strategies. It's essential to consider the long-term benefits of contributing to Medicare, even if it means a reduction in take-home pay in the short term.

Future Outlook and Potential Changes

The Medicare Employee Tax is subject to ongoing scrutiny and potential changes as healthcare costs evolve and demographic trends shift. The tax system must adapt to ensure the financial stability of the Medicare program and meet the changing needs of the population.

Potential Rate Adjustments

One of the most significant changes that could impact the Medicare Employee Tax is a potential adjustment to the tax rate. As healthcare costs continue to rise, there may be a need to increase the tax rate to ensure the program’s long-term viability. While this could provide additional funding for Medicare, it would also increase the financial burden on employers and employees.

Conversely, if healthcare costs stabilize or decrease, there may be an opportunity to lower the tax rate, providing some relief to taxpayers. However, this would require careful consideration to ensure that the Medicare program remains adequately funded.

Alternative Funding Mechanisms

Beyond rate adjustments, there is ongoing discussion about alternative funding mechanisms for Medicare. These discussions often center around exploring new sources of revenue or shifting the tax burden to different segments of the population. For instance, there have been proposals to tax certain financial transactions or to adjust the tax structure for high-income earners.

While these alternative funding mechanisms could provide additional revenue for Medicare, they also present complex policy and implementation challenges. Any changes to the funding structure of Medicare must carefully consider the impact on taxpayers, healthcare providers, and the overall stability of the healthcare system.

Legislative and Policy Changes

The Medicare Employee Tax is inherently tied to broader legislative and policy changes in the healthcare sector. As the healthcare landscape evolves, so too will the tax system. Potential changes could include adjustments to eligibility criteria for Medicare, alterations to the benefits package, or reforms to the healthcare delivery system.

These changes can have a significant impact on the Medicare Employee Tax. For instance, if the eligibility age for Medicare is adjusted, it could affect the number of individuals contributing to the program through the Medicare tax. Similarly, changes to the benefits package could impact the program's costs and, consequently, the tax rate.

Conclusion: Navigating the Complexities

The Medicare Employee Tax is a critical component of the American healthcare system, providing essential funding for Medicare. While it can be complex and often carries significant financial implications, understanding its workings is vital for employers, employees, and individuals alike.

As the healthcare landscape continues to evolve, the Medicare Employee Tax will remain a key focus for policymakers, healthcare providers, and taxpayers. By staying informed about the tax's structure, implications, and potential changes, individuals and businesses can effectively navigate the complexities of this vital component of the tax system.

The Medicare Employee Tax stands as a testament to the interconnectedness of healthcare and taxation in the United States. It is a reminder that healthcare is not just a matter of personal well-being but also a collective responsibility, supported by the contributions of individuals and employers through the Medicare tax.

What is the current Medicare tax rate for employees in 2023?

+The current Medicare tax rate for employees in 2023 is 1.45% of taxable earnings. This rate has remained consistent since 2013, except for high-income earners who are subject to an additional 0.9% Medicare tax.

Are there any exemptions from the Medicare Employee Tax for certain employers or employees?

+Yes, there are certain exemptions. Churches and qualified church-controlled organizations are generally exempt from paying the employer’s share of Medicare tax. Additionally, self-employed individuals have different tax obligations, paying both the employer and employee shares of the Medicare tax through the self-employment tax.

How does the Medicare Employee Tax impact financial planning for employers and employees?

+For employers, the Medicare Employee Tax represents a substantial financial obligation, impacting cash flow and financial planning. For employees, the tax reduces take-home pay, affecting financial planning and retirement strategies. However, it’s important to view the tax as an investment in future healthcare coverage through Medicare.