Alabama Income Tax Refund

For residents of the state of Alabama, understanding the process of income tax refunds is crucial. Alabama's income tax system, like that of many other states, can be complex, and staying informed about the refund process ensures that you receive your rightful tax return efficiently. This comprehensive guide will walk you through the intricacies of Alabama's income tax refund process, from the initial filing to the eventual receipt of your refund.

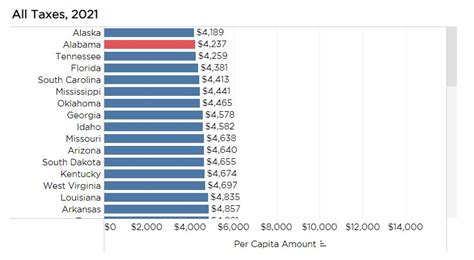

Understanding Alabama’s Income Tax Structure

Alabama operates under a progressive income tax system, which means that higher income levels are taxed at a higher rate. The state’s income tax rates range from 2% to 5%, depending on the taxpayer’s income bracket. This structure aims to ensure fairness and adequacy in the tax system, as those with higher incomes contribute a greater share of their income.

The state's tax year follows the federal tax year, running from January 1st to December 31st. This means that all tax-related activities, including filing, payment, and refund processing, are aligned with the federal government's tax calendar.

Alabama offers a range of tax credits and deductions to help reduce the tax burden on individuals and businesses. These include credits for education expenses, energy-efficient home improvements, and even a credit for taxpayers who donate to certain nonprofit organizations.

| Tax Credit/Deduction | Description |

|---|---|

| Individual Income Tax Credit | A credit against income tax for individuals. |

| Earned Income Tax Credit | A refundable federal tax credit for low to moderate-income earners. |

| Child and Dependent Care Tax Credit | A credit for childcare expenses to help working families. |

| Home Improvement Tax Credit | Encourages energy-efficient home improvements. |

| Historic Preservation Tax Credit | A credit for rehabilitating historic structures. |

The Income Tax Refund Process in Alabama

The process of obtaining an income tax refund in Alabama involves several key steps, which we will outline in detail below. Whether you are a first-time filer or a seasoned taxpayer, understanding this process will help you navigate the system with confidence.

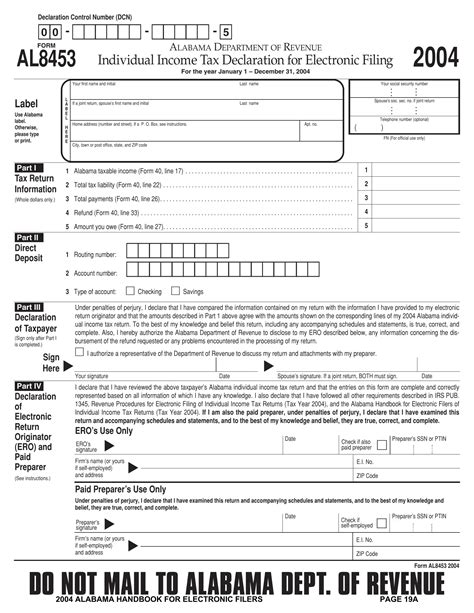

Step 1: Filing Your Alabama Income Tax Return

The first step in obtaining a refund is to accurately file your Alabama income tax return. This can be done through various methods, including online filing, mail-in paper returns, or in-person assistance at designated tax centers.

Alabama offers a user-friendly online filing system, ALFile, which allows taxpayers to file their returns securely and conveniently. This system guides users through the filing process, providing clear instructions and the necessary forms. For those who prefer paper returns, the Alabama Department of Revenue provides downloadable forms on its website.

Key Tax Forms for Alabama Residents:

- Form 40 - Individual Income Tax Return

- Form 40A - Long Form for Individuals

- Form 40 Schedule A - Itemized Deductions

- Form 40 Schedule EIC - Earned Income Credit

Step 2: Processing Your Return

Once your return is filed, it enters the processing stage. This is where the Alabama Department of Revenue reviews your return for accuracy and compliance with state tax laws. The processing time can vary depending on the complexity of your return and the volume of returns being handled by the department.

During this stage, the department may request additional information or documentation to support certain deductions or credits claimed on your return. It's important to respond promptly to any such requests to avoid delays in processing.

Step 3: Calculating Your Refund

After your return has been processed and found to be accurate, the Department of Revenue will calculate your refund. This calculation involves subtracting the total tax you owe (based on your income and applicable deductions/credits) from the total tax you’ve already paid throughout the year. The difference is your refund amount.

Alabama offers a refund calculator on its website, which allows taxpayers to estimate their refund amount based on their income, deductions, and credits. This tool can provide a helpful preview of what to expect, although the actual refund amount may vary slightly due to factors like processing fees or interest.

Step 4: Receiving Your Refund

The final step in the refund process is receiving your refund. Alabama offers several refund delivery options, including direct deposit, check by mail, and even prepaid debit cards.

Direct deposit is the fastest and most secure method, as it ensures your refund is deposited directly into your bank account within a few business days of processing. Check by mail, while slightly slower, is a traditional method that allows taxpayers to receive a physical check from the state.

For those who prefer a more flexible option, Alabama offers the Alabama Refund Card, which is a prepaid debit card. This card can be used to make purchases or withdraw cash at ATMs, providing taxpayers with immediate access to their refund funds.

Maximizing Your Alabama Tax Refund

Maximizing your tax refund involves understanding the various deductions and credits available to you as an Alabama resident. By claiming all applicable deductions and credits, you can reduce your taxable income and increase your refund amount.

Common Deductions and Credits in Alabama

Alabama offers a range of deductions and credits that can significantly impact your tax liability. Some of the most common deductions and credits include:

- Standard Deduction: A standard deduction is available to all taxpayers, regardless of whether they itemize their deductions. The standard deduction amount varies based on filing status.

- Personal Exemptions: Alabama allows a personal exemption deduction for each taxpayer, spouse, and dependent claimed on the return.

- Itemized Deductions: Taxpayers who choose to itemize their deductions can claim expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Education Credits: Alabama offers a credit for education expenses, including tuition, books, and supplies for eligible taxpayers.

- Child and Dependent Care Credit: This credit helps offset the cost of childcare expenses for working families.

- Energy Tax Credit: Alabama provides a credit for energy-efficient home improvements, such as installing solar panels or energy-efficient appliances.

Tips for Maximizing Your Refund

To ensure you’re claiming all the deductions and credits you’re eligible for, consider the following tips:

- Keep detailed records of all your expenses throughout the year. This includes receipts for eligible deductions and credits.

- Familiarize yourself with the eligibility criteria for each deduction and credit. Not all taxpayers will qualify for every deduction or credit.

- Consider using tax preparation software or seeking professional assistance to ensure you're maximizing your refund.

- If you're eligible for the Earned Income Tax Credit (EITC), be sure to claim it. The EITC can provide a significant refund for low to moderate-income earners.

- Review your withholding throughout the year to ensure you're not overpaying or underpaying your taxes.

Special Considerations for Alabama Taxpayers

Alabama’s tax system, like any other, has certain unique considerations that taxpayers should be aware of. Understanding these considerations can help you navigate the system more effectively and avoid potential pitfalls.

Sales Tax Refunds

Alabama, like many states, imposes a sales tax on various goods and services. While sales tax is typically paid at the point of purchase, there are certain situations where you may be eligible for a refund. For instance, if you purchase an item that is later found to be defective or you receive a duplicate billing, you may be entitled to a sales tax refund.

To claim a sales tax refund, you'll need to provide documentation, such as receipts and proof of the issue (e.g., a manufacturer's defect report). The refund amount will be based on the sales tax paid on the item in question.

Property Tax Refunds

Property taxes are a significant expense for many Alabama residents. If you overpay your property taxes, you may be eligible for a refund. This can occur if there is an error in the assessment of your property value or if you receive an exemption that was not previously applied.

To claim a property tax refund, you'll need to contact your local tax assessor's office. They will guide you through the process, which typically involves providing documentation to support your claim.

Estate and Inheritance Tax Refunds

Alabama imposes an estate tax and an inheritance tax. The estate tax is levied on the value of the deceased person’s estate, while the inheritance tax is paid by the beneficiaries of the estate. In certain situations, you may be eligible for a refund on these taxes.

For instance, if the estate or inheritance is found to be valued incorrectly, you may be entitled to a refund. To claim this refund, you'll need to provide evidence of the error and work with the Alabama Department of Revenue to resolve the issue.

Conclusion: Navigating Alabama’s Income Tax Refund Process

Understanding and navigating Alabama’s income tax refund process is an important part of financial planning for residents of the state. By following the steps outlined in this guide, you can ensure that you receive your refund in a timely and efficient manner.

Remember to stay organized, keep accurate records, and take advantage of the various deductions and credits available to you. With careful planning and attention to detail, you can maximize your refund and make the most of your hard-earned money.

FAQ

How long does it take to receive my Alabama income tax refund?

+The processing time for Alabama income tax refunds can vary. On average, it takes around 4-6 weeks for refunds to be issued. However, this timeline can be influenced by factors such as the complexity of your return, the volume of returns being processed, and whether additional information is required.

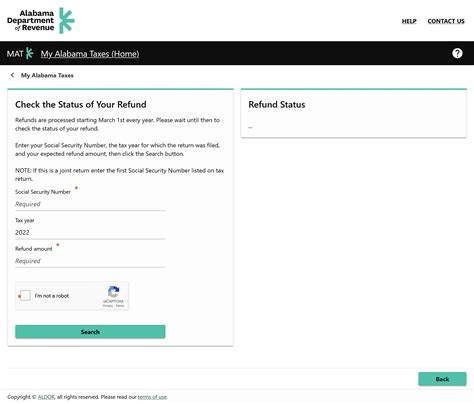

Can I check the status of my Alabama income tax refund online?

+Yes, you can check the status of your Alabama income tax refund online through the Alabama Department of Revenue’s website. You’ll need to provide your Social Security Number and either your e-File Number or your Adjusted Gross Income from the previous year to access your refund status.

What should I do if my Alabama income tax refund is delayed or incorrect?

+If you believe your refund is delayed or incorrect, the first step is to review your return carefully to ensure there are no errors. If you find an error, amend your return as soon as possible. If you’re unable to identify an error, contact the Alabama Department of Revenue’s Refund Inquiries unit for assistance.

Are there any special considerations for military personnel regarding Alabama income tax refunds?

+Yes, military personnel stationed in Alabama may be eligible for certain tax benefits and deductions. Additionally, the Alabama Department of Revenue offers a Military Tax Guide to assist service members with their tax obligations and refunds.

Can I claim a refund for overpaid sales tax in Alabama?

+Yes, if you have overpaid sales tax due to a defective item, duplicate billing, or other valid reasons, you may be eligible for a refund. You’ll need to provide documentation and work with the Alabama Department of Revenue to process your claim.