Nj Car Sales Tax

When it comes to purchasing a new or used vehicle, one of the key considerations for buyers in New Jersey is the sales tax associated with the transaction. The New Jersey car sales tax is an important aspect of the automotive purchasing process, as it impacts the overall cost of the vehicle and the financial planning required by prospective buyers. In this comprehensive guide, we will delve into the intricacies of the NJ car sales tax, exploring its rates, exemptions, and the impact it has on the state's automotive market.

Understanding the NJ Car Sales Tax

The New Jersey car sales tax is a levy imposed on the purchase of motor vehicles within the state. It is a percentage-based tax, calculated as a proportion of the vehicle’s total purchase price. The tax is collected by the New Jersey Division of Taxation and contributes to the state’s revenue, funding various public services and infrastructure projects.

Sales Tax Rate in New Jersey

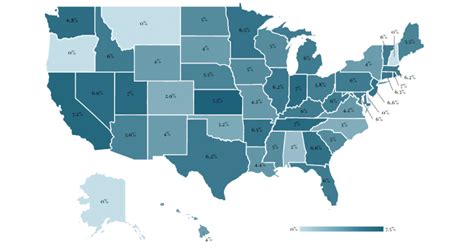

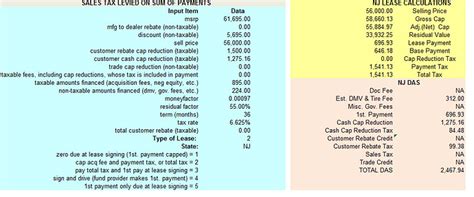

As of my last update in January 2023, the general sales tax rate in New Jersey stands at 6.625%. However, it is important to note that this rate can vary depending on the county and municipality where the vehicle is purchased. Some counties and localities may have additional sales tax surcharges, increasing the overall tax burden.

| County | Sales Tax Rate |

|---|---|

| Atlantic | 7.00% |

| Bergen | 6.875% |

| Burlington | 6.625% |

| Camden | 7.00% |

| Cape May | 7.00% |

| Cumberland | 7.00% |

| Essex | 6.875% |

| Gloucester | 7.00% |

| Hudson | 6.875% |

| Hunterdon | 6.625% |

| Mercer | 6.625% |

| Middlesex | 6.875% |

| Monmouth | 6.625% |

| Morris | 6.875% |

| Ocean | 6.625% |

| Passaic | 6.875% |

| Salem | 7.00% |

| Somerset | 6.875% |

| Sussex | 6.625% |

| Union | 6.875% |

| Warren | 6.625% |

It is crucial for car buyers to be aware of the specific sales tax rate applicable to their county, as this will directly impact the final cost of the vehicle. The additional county and municipal surcharges can add a significant amount to the overall sales tax, making it essential to consider these factors when budgeting for a vehicle purchase.

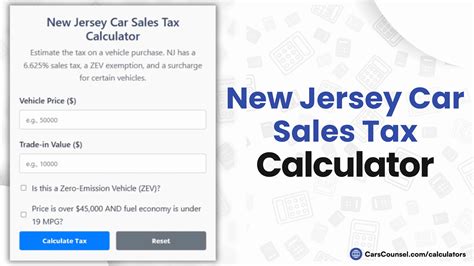

Calculating the NJ Car Sales Tax

To calculate the sales tax on a vehicle purchase in New Jersey, one can use the following formula:

Sales Tax Amount = Purchase Price x Sales Tax Rate

For example, if a vehicle is purchased for $25,000 in a county with a 6.625% sales tax rate, the sales tax amount would be:

Sales Tax Amount = $25,000 x 0.06625 = $1,656.25

Therefore, the total cost of the vehicle, including sales tax, would be $26,656.25.

Exemptions and Special Considerations

While the NJ car sales tax applies to most vehicle purchases, there are certain exemptions and special considerations that buyers should be aware of. These exemptions can significantly reduce the tax burden for eligible individuals or vehicles.

Vehicle Types and Exemptions

- Electric Vehicles (EVs): New Jersey offers a Clean Vehicle Tax Exemption for the purchase of qualified electric and plug-in hybrid vehicles. This exemption waives the sales tax for eligible vehicles, making them a more affordable and environmentally friendly option.

- Disabled Individuals: Certain modifications made to vehicles for individuals with disabilities are exempt from sales tax. This includes the purchase of adaptive equipment and vehicles specifically adapted for disabled use.

- Military Personnel: Active-duty military personnel stationed in New Jersey may be eligible for a sales tax exemption on the purchase of a vehicle. This exemption is designed to support and honor the service of military members.

- First Responders: Similar to military personnel, first responders such as police officers, firefighters, and emergency medical technicians may also be eligible for sales tax exemptions when purchasing a vehicle.

Special Considerations

- Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that buyers are not taxed on the full purchase price of the new vehicle.

- Lease Transfers: In the case of a lease transfer, the sales tax is typically calculated based on the remaining value of the lease. This approach ensures fairness for both the buyer and the seller.

- Vehicle Age: The age of the vehicle can impact the sales tax calculation. In some cases, older vehicles may be subject to a lower sales tax rate or even be exempt from sales tax entirely. This is especially relevant when purchasing classic or vintage cars.

Impact on the Automotive Market

The NJ car sales tax plays a significant role in shaping the automotive market within the state. It influences consumer behavior, vehicle pricing strategies, and the overall competitiveness of the market.

Consumer Behavior and Purchasing Decisions

The sales tax has a direct impact on the affordability of vehicles for consumers. Higher sales tax rates can deter buyers, especially those on a tight budget, from making large purchases. As a result, buyers may opt for more affordable vehicles or consider purchasing used cars, which often have a lower sales tax burden.

Additionally, the varying sales tax rates across counties can influence buyer behavior. Individuals may choose to purchase vehicles in counties with lower sales tax rates to save money. This can lead to a concentration of automotive dealerships and sales in certain counties, impacting the distribution of vehicle sales and dealership networks.

Vehicle Pricing Strategies

Automotive dealerships and manufacturers must consider the impact of the sales tax when setting vehicle prices. To remain competitive, dealerships may offer incentives, discounts, or special financing options to offset the tax burden for buyers. This can result in more aggressive pricing strategies and promotions, particularly during sales events or holiday periods.

Competitiveness of the Market

The NJ car sales tax also affects the overall competitiveness of the automotive market within the state. Higher sales tax rates can make it more challenging for dealerships to attract buyers, especially when competing with neighboring states that may have lower tax rates. This can lead to increased marketing efforts, innovative sales strategies, and a focus on providing exceptional customer service to retain market share.

Future Implications and Potential Changes

The New Jersey car sales tax, like any tax policy, is subject to potential changes and revisions over time. These changes can be driven by various factors, including economic conditions, political agendas, and the need to adapt to evolving market dynamics.

Economic Considerations

Economic factors can significantly influence tax policies. During economic downturns or recessions, there may be calls for tax relief or incentives to stimulate the automotive market. Conversely, during periods of economic growth, there may be a push to increase tax rates to generate additional revenue for the state.

Political Agenda

Political leaders and policymakers play a crucial role in shaping tax policies. Changes in government or shifts in political ideologies can lead to revisions in the sales tax structure. For example, a new administration may introduce tax reforms aimed at supporting specific industries or addressing budgetary concerns.

Market Dynamics and Technological Advancements

The automotive market is constantly evolving, with technological advancements and changing consumer preferences. As electric vehicles (EVs) gain popularity, there may be discussions about adjusting tax policies to encourage the adoption of cleaner transportation options. Additionally, the rise of ride-sharing and car-sharing services may also influence future tax considerations.

Potential Changes and Reforms

Potential changes to the NJ car sales tax could include:

- Uniform Sales Tax Rate: Currently, sales tax rates vary across counties in New Jersey. A potential reform could involve implementing a uniform sales tax rate statewide, simplifying the tax structure and making it more predictable for buyers.

- Tax Incentives for Clean Vehicles: To promote the adoption of electric and hybrid vehicles, the state could introduce additional tax incentives or expand the existing Clean Vehicle Tax Exemption program.

- Sales Tax Holidays: Some states implement sales tax holidays during specific periods, typically around major holidays. New Jersey could consider implementing such holidays to boost vehicle sales and provide temporary tax relief for buyers.

- Tax Reforms for Online Sales: With the rise of online vehicle sales, there may be discussions about updating tax policies to address the unique challenges and opportunities presented by this sales channel.

Conclusion

The New Jersey car sales tax is a critical component of the automotive purchasing process within the state. It influences buyer behavior, vehicle pricing, and the overall competitiveness of the market. By understanding the tax rates, exemptions, and potential future changes, buyers and automotive professionals can make more informed decisions and adapt to the evolving landscape of the automotive industry in New Jersey.

FAQ

What is the current sales tax rate in New Jersey for vehicle purchases?

+

The general sales tax rate in New Jersey for vehicle purchases is 6.625% as of January 2023. However, it is important to note that this rate can vary depending on the county and municipality where the vehicle is purchased, as some counties have additional sales tax surcharges.

Are there any exemptions or special considerations for certain types of vehicles or individuals?

+

Yes, New Jersey offers exemptions and special considerations for certain vehicle types and individuals. This includes a Clean Vehicle Tax Exemption for electric and plug-in hybrid vehicles, tax exemptions for modifications made to vehicles for individuals with disabilities, and potential sales tax exemptions for active-duty military personnel and first responders.

How is the sales tax calculated on a vehicle purchase in New Jersey?

+

The sales tax on a vehicle purchase in New Jersey is calculated by multiplying the purchase price of the vehicle by the applicable sales tax rate. For example, if the purchase price is 25,000 and the sales tax rate is 6.625%, the sales tax amount would be 1,656.25.

Can I negotiate the sales tax on my vehicle purchase?

+

The sales tax is a mandatory tax imposed by the state, and it cannot be directly negotiated with the dealership. However, dealerships may offer incentives or discounts on the vehicle price itself, which can indirectly reduce the overall tax burden.

Are there any online resources or tools to help calculate the sales tax on a vehicle purchase in New Jersey?

+

Yes, there are several online sales tax calculators available that can assist with estimating the sales tax on a vehicle purchase in New Jersey. These calculators consider the purchase price, applicable sales tax rate, and any additional surcharges based on the county and municipality. Using such tools can provide a quick and accurate estimate of the sales tax amount.