Ventura County Sales Tax

In the realm of financial planning and management, understanding the intricacies of local taxes is crucial for both businesses and individuals. Among the myriad of taxes, sales tax stands out as a significant contributor to local economies, shaping the financial landscape and influencing consumer behavior. In this comprehensive guide, we delve into the world of Ventura County Sales Tax, exploring its nuances, rates, and implications for the community.

Unraveling the Complexities of Ventura County Sales Tax

Ventura County, nestled in the picturesque landscapes of Southern California, boasts a thriving economy with a diverse range of industries. From agriculture and tourism to high-tech businesses, the county’s economic landscape is vibrant and ever-evolving. Amidst this dynamic setting, sales tax emerges as a pivotal revenue stream for the local government, impacting businesses and consumers alike.

The sales tax system in Ventura County operates within the broader framework of California's tax regulations. However, the county adds its unique layer of rates and exemptions, creating a complex yet fascinating tax landscape. Let's embark on a journey to decipher the key aspects of Ventura County Sales Tax, exploring its rates, collection processes, and the role it plays in shaping the local economy.

Understanding the Sales Tax Structure in Ventura County

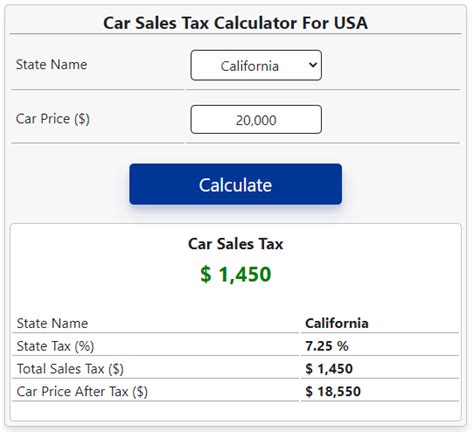

Ventura County’s sales tax system is a combination of state and local taxes, resulting in a combined rate that applies to various goods and services. As of the latest available information, the county’s sales tax rate stands at 7.25%, comprising the state base rate of 6% and an additional 1.25% levied by the county.

This seemingly simple percentage, however, belies a complex web of regulations and exemptions. Certain items, such as groceries, prescription medications, and select clothing items, are exempt from sales tax, creating a nuanced landscape for consumers and businesses to navigate.

| Sales Tax Rate Breakdown | Percentage |

|---|---|

| State Base Rate | 6% |

| Ventura County Add-On | 1.25% |

| Total Sales Tax Rate | 7.25% |

It's worth noting that while the county-wide sales tax rate is consistent, there may be variations within specific cities or districts within Ventura County. These localized rates can impact businesses and consumers differently, depending on their geographical location.

The Impact on Local Businesses and Consumers

Ventura County Sales Tax has a dual impact on both local businesses and consumers. For businesses, it represents a significant revenue stream, contributing to the county’s financial health and enabling the provision of essential services to the community. However, it also adds complexity to pricing strategies and financial planning, especially for small and medium-sized enterprises.

Consumers, on the other hand, bear the direct brunt of sales tax. While it may seem like a minor addition to the final bill, the cumulative effect of sales tax can significantly influence purchasing decisions, especially for high-value items. Understanding the sales tax landscape becomes crucial for consumers to make informed choices and budget effectively.

Sales Tax Collection and Compliance

The collection and compliance process for Ventura County Sales Tax involves a series of intricate steps. Businesses are responsible for collecting the applicable sales tax from customers at the point of sale and remitting it to the appropriate tax authorities. This process requires meticulous record-keeping and compliance with state and local regulations.

The California Department of Tax and Fee Administration (CDTFA) oversees the collection and enforcement of sales tax in the state. Businesses must register with the CDTFA, obtain a seller's permit, and file regular tax returns. Non-compliance can result in penalties and legal repercussions, underscoring the importance of a thorough understanding of the sales tax system.

Exemptions and Special Considerations

Ventura County Sales Tax, like many other sales tax systems, is not a blanket tax applied to all goods and services. It features a range of exemptions and special considerations that can significantly impact the tax burden on consumers and businesses.

As mentioned earlier, certain items such as groceries, medications, and clothing are exempt from sales tax. Additionally, there are specific exemptions for charitable organizations, educational institutions, and government entities. These exemptions are designed to support specific sectors and alleviate the tax burden on vulnerable communities.

Furthermore, Ventura County has implemented a special sales tax district for transportation purposes. This district, known as the Ventura County Transportation Sales and Use Tax, adds an additional 0.5% tax to certain transactions. The revenue generated from this district is earmarked for transportation infrastructure improvements, enhancing the county's overall mobility and connectivity.

Sales Tax and Economic Development

Ventura County Sales Tax plays a pivotal role in the county’s economic development strategy. The revenue generated from sales tax is a significant source of funding for essential public services, including education, healthcare, public safety, and infrastructure development.

By investing in these key sectors, Ventura County creates an environment conducive to economic growth and attracts businesses and talent. The sales tax system, therefore, becomes a critical tool for shaping the county's economic landscape and ensuring its long-term prosperity.

Moreover, the sales tax revenue can also be utilized for targeted economic development initiatives. For instance, the county could allocate funds for business incubation programs, entrepreneurship support, or industry-specific incentives. Such strategies can foster innovation, create jobs, and enhance the county's competitive advantage in the global market.

Future Implications and Potential Reforms

As with any tax system, Ventura County Sales Tax is subject to ongoing scrutiny and potential reforms. The evolving economic landscape, technological advancements, and changing consumer behaviors can prompt a reevaluation of the existing sales tax structure.

One potential area of reform is the expansion of sales tax base to include certain currently exempt services. This could generate additional revenue for the county, enabling further investments in critical sectors. However, such reforms must be carefully considered to ensure they do not disproportionately impact specific industries or consumer segments.

Additionally, the rise of e-commerce and online transactions presents a unique challenge for sales tax collection. Ventura County, along with other jurisdictions, may need to adapt its sales tax system to effectively capture revenue from these digital transactions, ensuring a level playing field for both online and brick-and-mortar businesses.

Lastly, the concept of a "simplified" sales tax system, with fewer exemptions and a more uniform rate, has been proposed as a potential reform. While such a system could streamline compliance and reduce administrative burdens, it may also impact certain sectors and consumer segments differently, necessitating a careful analysis of its potential effects.

Conclusion

Ventura County Sales Tax is a multifaceted system, shaping the economic landscape of the county and influencing the lives of businesses and consumers. Its intricate rates, exemptions, and collection processes require a thorough understanding to navigate effectively.

As we've explored, the sales tax system is not merely a revenue stream but a tool for economic development, infrastructure improvement, and social welfare. Its impact extends beyond the financial realm, influencing the very fabric of the community it serves.

In the ever-evolving world of taxation, staying informed and proactive is key. Whether you're a business owner, consumer, or policy advocate, a deep understanding of Ventura County Sales Tax can empower you to make informed decisions, contribute to the community's well-being, and shape a sustainable economic future.

How often are sales tax rates updated in Ventura County?

+

Sales tax rates in Ventura County are typically updated annually or when significant changes are proposed. The county board of supervisors can initiate rate changes, but these are subject to public hearings and approval processes.

Are there any special sales tax holidays in Ventura County?

+

Ventura County does not currently have specific sales tax holidays. However, the state of California occasionally offers sales tax holidays for certain items, such as back-to-school supplies.

How can businesses stay compliant with sales tax regulations in Ventura County?

+

Businesses can ensure compliance by registering with the California Department of Tax and Fee Administration (CDTFA), obtaining a seller’s permit, and staying updated on any changes in sales tax rates and regulations. Regular tax return filings and accurate record-keeping are also essential.