Sales Tax On Cars In Texas

When purchasing a vehicle in Texas, understanding the sales tax implications is crucial. Texas has a unique sales tax system, and being well-informed can help you navigate the process seamlessly. This comprehensive guide will delve into the specifics of sales tax on cars in Texas, covering everything from the tax rates to the various exemptions and how to calculate and pay these taxes.

Understanding Texas Sales Tax on Vehicles

Sales tax in Texas is a state-level tax applied to the sale of goods and certain services. For vehicles, this tax is levied on the purchase price, including any additional fees and costs associated with the transaction. Texas sales tax is not a flat rate but rather a combination of state and local taxes, resulting in varying rates across the state.

State and Local Sales Tax Rates

The state of Texas imposes a base sales tax rate of 6.25%, which is applicable to most tangible personal property, including vehicles. However, it’s important to note that this base rate is just the starting point. Local governments, including counties, cities, and special districts, have the authority to impose additional sales taxes, which can significantly increase the overall tax rate.

These local taxes can vary widely. For instance, in a major city like Houston, the total sales tax rate for vehicles can reach 8.25%, with the additional 2% coming from local taxes. On the other hand, in smaller towns or rural areas, the total sales tax rate might be closer to the state's base rate.

| Location | Total Sales Tax Rate |

|---|---|

| Houston | 8.25% |

| Dallas | 8.25% |

| San Antonio | 8.125% |

| Austin | 8.25% |

| El Paso | 8.125% |

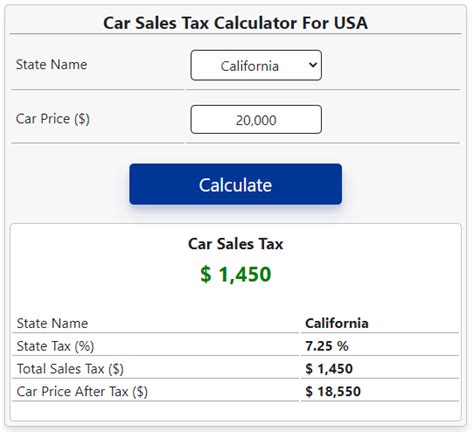

Calculating Sales Tax on Vehicles

To calculate the sales tax on a vehicle purchase in Texas, you’ll need to know the total purchase price, including any additional fees, such as dealer preparation fees or extended warranties. Here’s a simple formula to determine the sales tax:

Sales Tax = (Purchase Price x Total Sales Tax Rate) / 100

Let's consider an example. If you're purchasing a car in Dallas, where the total sales tax rate is 8.25%, and the purchase price, including all fees, is $30,000, the sales tax calculation would be as follows:

Sales Tax = ($30,000 x 8.25%) / 100 = $2,475

Exemptions and Special Considerations

While the general rule of sales tax on vehicle purchases applies to most transactions, there are certain exemptions and special cases to be aware of:

Vehicle Trade-Ins

When trading in a vehicle as part of your purchase, the value of the trade-in is subtracted from the purchase price of the new vehicle. This reduction in the purchase price can lower the amount of sales tax you owe. However, it’s important to note that the trade-in value is subject to sales tax if it’s included in the new vehicle’s purchase price.

Exemptions for Certain Vehicles

Texas offers exemptions from sales tax for specific types of vehicles, including:

- Disabled Veteran Vehicles: Veterans with a permanent disability are exempt from paying sales tax on the purchase of a vehicle.

- Disabled Person Vehicles: Individuals with a qualifying disability can apply for a sales tax exemption when purchasing a vehicle modified for their disability.

- Motorcycles: In some cases, motorcycles may be eligible for a reduced sales tax rate.

- Electric Vehicles: Texas offers incentives for the purchase of electric vehicles, which can include a sales tax exemption or reduction.

Temporary Registration and Out-of-State Purchases

If you purchase a vehicle out-of-state and plan to register it in Texas, you must pay sales tax to the state. This is known as a temporary registration and ensures compliance with Texas tax laws. The tax is due within 20 days of the vehicle’s entry into Texas.

Payment and Registration Process

After calculating the sales tax, the next step is to pay this tax and register your vehicle. Here’s a step-by-step guide:

- Calculate the Sales Tax: Use the formula provided earlier to determine the exact amount of sales tax you owe.

- Make the Payment: You can pay the sales tax at your local county tax office or online through the Texas Comptroller of Public Accounts website. Ensure you have the necessary documentation, such as the vehicle purchase agreement and proof of insurance.

- Register Your Vehicle: Once the sales tax is paid, you can proceed with registering your vehicle at the Texas Department of Motor Vehicles (DMV). This involves providing the necessary paperwork, including the sales tax receipt, title, and proof of insurance.

- Obtain License Plates: After successful registration, you'll receive your license plates and registration certificate, allowing you to legally operate your vehicle in Texas.

Tips for a Smooth Sales Tax Experience

Navigating the sales tax process can be simpler with a few key tips:

- Understand the Tax Rates: Familiarize yourself with the sales tax rates in your area. You can find this information on the Texas Comptroller of Public Accounts website or by contacting your local tax office.

- Research Exemptions: If you believe you qualify for a sales tax exemption, research the specific requirements and application process. This can save you a significant amount on your vehicle purchase.

- Negotiate the Price: When purchasing a vehicle, consider negotiating the price. A lower purchase price can result in a reduced sales tax amount.

- Consider Trade-Ins: Trading in your old vehicle can reduce the purchase price of your new vehicle, which in turn lowers the sales tax. Ensure you understand the value of your trade-in and negotiate a fair deal.

- Keep Records: Maintain a record of all vehicle-related transactions, including purchase agreements, sales tax receipts, and registration documents. These records can be invaluable for future reference.

Sales Tax and Vehicle Ownership in Texas: A Summary

Understanding the sales tax landscape in Texas is essential for anyone purchasing a vehicle in the state. From the varying tax rates to the specific exemptions, being informed can save you time and money. By following the steps outlined in this guide, you can navigate the sales tax process with confidence and ensure compliance with Texas tax laws.

Whether you're a resident purchasing a new car or an out-of-state buyer registering your vehicle, the key is to stay informed, ask questions, and keep your records organized. With this knowledge, you can make informed decisions and enjoy the benefits of vehicle ownership in Texas.

Can I negotiate the sales tax on my vehicle purchase?

+No, sales tax is a mandatory tax imposed by the state and local governments, and it cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which directly impacts the amount of sales tax you owe.

What happens if I don’t pay the sales tax on my vehicle purchase?

+Failing to pay sales tax on a vehicle purchase can result in penalties and interest charges. It’s important to pay the tax within the designated timeframe to avoid these additional costs and potential legal consequences.

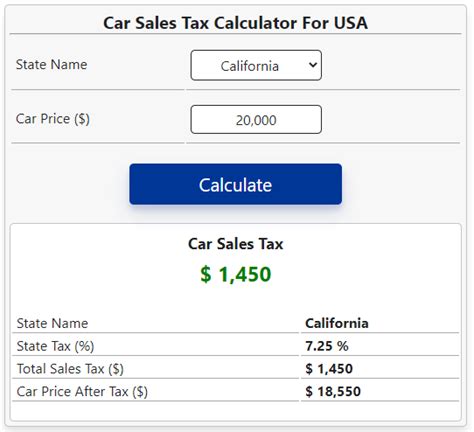

Are there any online resources to help me calculate sales tax on my vehicle purchase?

+Yes, the Texas Comptroller of Public Accounts provides an online sales tax calculator. This tool can help you estimate the sales tax on your vehicle purchase based on your location and purchase price. You can access it on their website.

How long do I have to pay sales tax on a vehicle purchased out-of-state and brought into Texas for registration?

+You have 20 days from the date the vehicle enters Texas to pay the sales tax and register it. After this period, you may be subject to penalties and additional fees.